MONDAY: 17 May 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Explain four challenges one might face when using a computerised accounting system. (4 marks)

2. Identify five types of ledgers. (5 marks)

3. Highlight five professional ethics that govern the accounting profession. (5 marks)

4. Describe the following types of accounting errors:

Error of principle. (2 marks)

Error of commission. (2 marks)

Error of omission. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Highlight four source documents used in accounting transactions. (4 marks)

2. Distinguish between “discounts allowed” and “discounts received”. (4 marks)

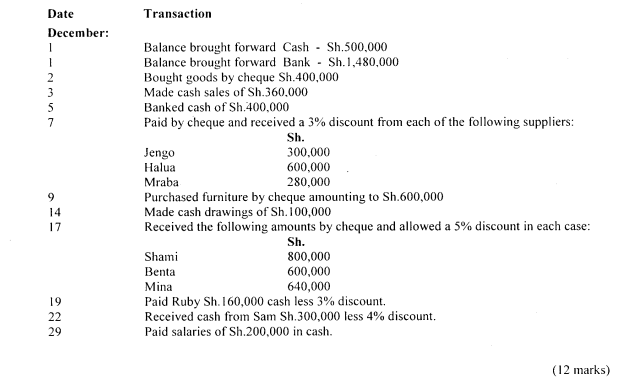

The following information relates to Mena Enterprises for the month of December 2020:

(Total: 20 marks)

QUESTION THREE

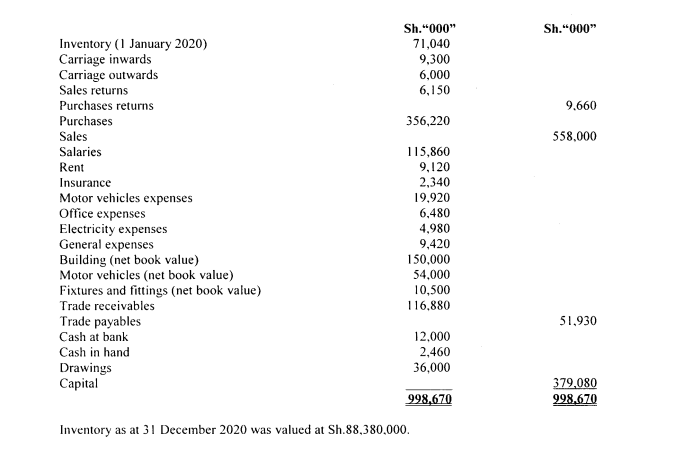

The following is the trial balance for Jembe Kazi for the year ended 31 December 2020:

Required:

1. Statement of profit or loss for the year ended 31 December 2020. (12 marks)

2. Statement of financial position as at 31 December 2020. (8 marks)

(Total: 20 marks)

QUESTION FOUR

1. Distinguish between “errors” and “fraud”. (4 marks)

2. Highlight four differences between the role of “internal audit” and “external audit”. (8 marks)

3. Propose eight internal control measures that could be used by an organisation in the credit sales procedure.

(8 marks)

(Total: 20 marks)

QUESTION FIVE

1. Discuss five challenges that an auditor might face during the process of gathering evidence. (10 marks)

2. Describe five roles played by the Office of the Auditor General (OAG). (10 marks)

(Total: 20 marks)