WEDNESDAY: 15 December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Discuss three types of external credit enhancements. (6 marks)

2. Describe two mechanisms for placing bonds in the primary market. (4 marks)

3. Nep Limited has a Sh.60 million bond issue outstanding that has a 12% annual coupon interest rate and 20 years remaining to maturity. This issue, which was sold 5 years ago, had flotation costs of Sh.3 million that the firm has been amortising on a straight line basis over the 25 year original life of the issue. The bond has a call provision that makes it possible for the company to retire the issue at any time by calling the bonds in at a 10% call premium. Investment banks have assured the company that it could sell an additional Sh.60 million worth of new 20 year bonds at an interest rate of 9%.

To ensure that the funds required to pay off the old debt will be available, the new bonds will be sold 1 month before the old issue is called; thus for 1 month the company will have to pay interest on two issues. Current short term interest rates are 6%. Predictions are that long-term interest rates are unlikely to fall below 9%. Flotation costs on a new refunding issue will amount to Sh.2,650,000 and the marginal tax rate is 30%.

Required:

Using suitable computations, advise NEP Limited whether or not to refund the existing bond. (10 marks)

(Total: 20 marks)

QUESTION TWO

1. A financial analyst has been tasked with evaluating a floating rate security which has a quoted margin of 90 basis points and is selling for Sh.99.2510 and matures in 7 years.

Required:

The floater’s spread for life. (3 marks)

Explain two limitations of the spread for life. (2 marks)

2. A bond may include a provision that allows the issuer to retire or call all or part of the issue before maturity date.

Required:

Examine three disadvantages to an investor of a call provisions clause in a bond. (6 marks)

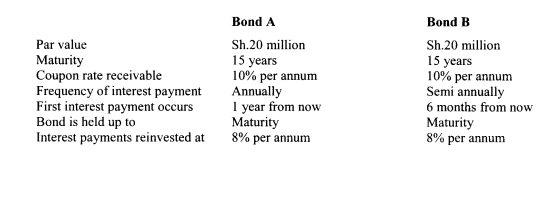

3. Zainabu Anyango is analysing two types of bonds, bond A and bond B whose information she has gathered as shown below:

Required:

The present value of annuity interest for bond A and bond B. (4 marks)

The total value of the constituent components of bonds return for bond A and bond B. (4 marks)

Based on your computations in (ii) above, advise Zinabu Anyango on the preferred bond to invest in. (1 mark)

(Total: 20 marks)

QUESTION THREE

1. Discuss how each of the following theories could account for downward sloping of the term structure of interest rates:

Pure expectations theory. (2 marks)

Liquidity preference theory. (2 marks)

Market segment theory. (2 marks)

2. The following data relates to 8.5% fully convertible debentures issued by Crescent Limited at Sh1,000:

- Market price of debenture Sh.900

- Conversion ratio 30

- Straight value of debenture Sh.700

- Market price of equity shares on the date of conversion Sh.25

Required:

Conversion value of debentures. (1 mark)

Market conversion price. (1 mark)

Conversion premium per share. (1 mark)

Premium over straight value of the debentures. (1 mark)

3. A financial analyst has obtained the following treasury spot rates:

Period Years to maturity Spot rate

(%)

1 0.5 5.0

2 1.0 5.4

3 1.5 5.8

4 2.0 6.4

5 2.5 7.0

6 3.0 7.2

7 3.5 7.4

8 4.0 7.8

Required:

Compute the following forward rates:

The 6-month forward rate six months from now. (2 marks)

The 6-month forward rate one year from now. (2 marks)

The 6-month forward rate three years from now. (2 marks)

The 2-year forward rate one year from now. (2 marks)

The 1-year forward rate two years from now. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Describe two factors that could determine the term structure of credit spreads. (4 marks)

2. Summarise six risks associated with fixed income securities. (6 marks)

3. Jack Mustaafu is an investor who plans to retire in five years’ time. As part of his retirement portfolio, Jack Mustaafu buys a 5% treasury bond that matures on 15 August 2025 priced to yield 6%. Coupons are paid semi-annually on 15 February and 15 August. The yield to maturity (YTM) is stated on a street-convention semi-annual bond basis. The settlement date is 61 days into a 184-day coupon period, using the actual/actual day-count convention. The bond has a par value of Sh.100.

Required:

The approximate Macaulay duration for this treasury bond assuming a 100 basis point change in the yield to maturity. (6 marks)

The duration gap at the time of purchase. (2 marks)

The estimated price value of a basis point (PVBP) for the bond. (2 marks)

(Total: 20 marks)

QUESTION FIVE

1. With respect to the arbitrage-free valuation framework, explain the following terms:

Value additivity. (1 mark)

Dominance. (1 mark)

Stripping. (1 mark)

Reconstitution. (1 mark)

2. A 6%, Sh.1,000, 2-year semi-annual treasury bond is priced in the market based on a 2-year treasury bond yield of 8% per annum. The prevailing treasury spot rates are provided below:

Period Spot rate (%)

1 3.04

2 3.34

3 3.62

4 3.98

Required:

The arbitrage profit generated from the trade. (6 marks)

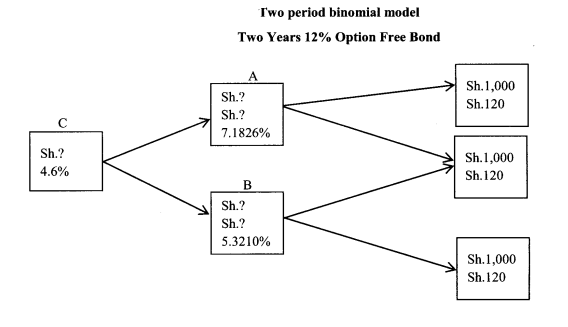

3. Ahmed Noor, a fixed income analyst, has researched and gathered the following binomial interest rate tree of an option free 12% annual coupon bond with two years to maturity:

Required:

The value of the bond. (2 marks)

The value of the bond and the value of the embedded call option, assuming the bond is callable at Sh.1,050.00 at the end of year 1. (4 marks)

The value of bond and the value of the embedded put option assuming the bond is putable at Sh.1,050.00 at the end of year 1. (4 marks)

(Total: 20 marks)