It is difficult believe that a firm should have 100% debt because of tax advantage. Why don’t firm in practice borrow 100% or what is the offsetting disadvantage of debt? The offsetting disadvantage is grouped under the term financial distress. Financial distress occurs when the firm finds it difficult to honor the obligation of creditors.

The extreme form of financial distress is insolvency. Insolvency could be very expensive. It involves legal costs. The firm may have to sell its needed assets at distress prices. More important the consideration is the inflexibility of raising funds if the firm has already

used heavy amount of debt. Non availability of funds on acceptable terms could adversely affect the operating performance of the firm. Creditors lose patience when a firm is financially distressed they force the firm in to liquidation to realize their claims.

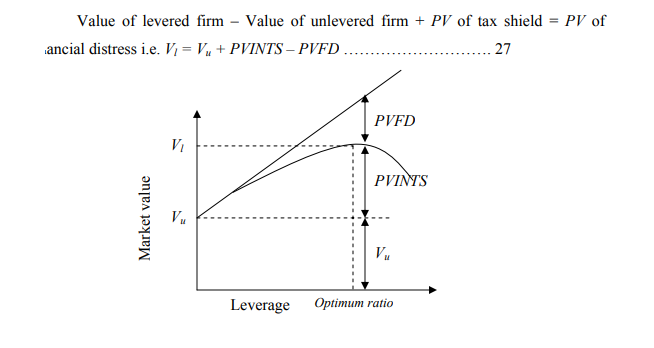

They the value of levered firms is given as follows:

The figure above shows how the capital structure of the firm is determined as a result of the tax benefits and the costs of financial distress. The present value of the interest tax shield increase with borrowing but so does the present value of the cost of financial distress. However, the cost of financial distress are quite insignificant with moderate level of debt and therefore the value of eh firm increase with debt. With more and more debt and the cost of financial distress increases and therefore the tax benefit shrinks. The optimum point reached when the present value of the tax benefits equal to the present value of the costs of financial distress. The value of the firm is maximum at this point.