TUESDAY: 5 December 2023. Morning Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. With regard to credit risk assessment, explain TWO benefits of business environment analysis. (4 marks)

2. Highlight TWO purposes of long term solvency of an entity for credit risk analysis. (2 marks)

3. Highlight FOUR discipline mechanisms regarding poor quality financial reports. (4 marks)

4. Flight Limited is an airline company which flies to various destinations all over the world. The company experienced strong initial growth but in recent years, it has been criticised for slowing down on its performance.

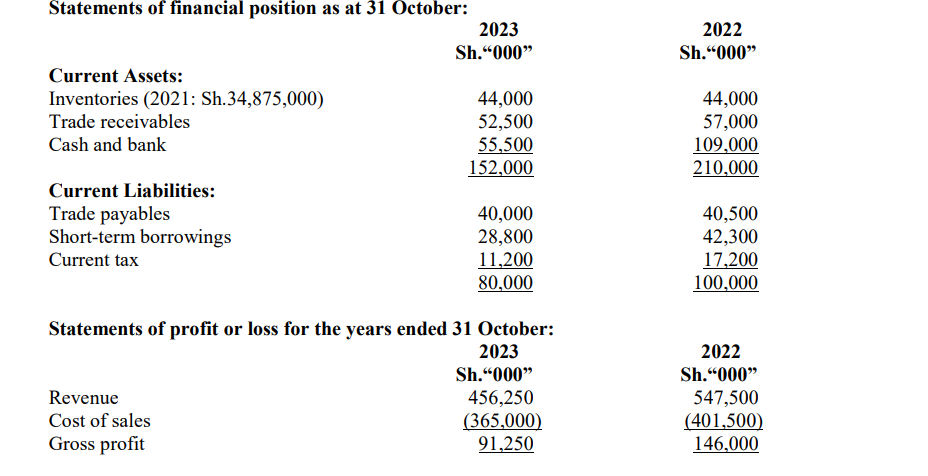

Extracts from Flight Limited’s financial statements are as set out below:

Additional information:

All sales and purchases made by the company during the reporting periods were on credit basis.

Required:

Calculate the following financial ratios for the analysis of liquidity and turnover of Flight Limited for the two years ended 31 October 2022 and 31 October 2023:

Current ratio. (2 marks)

Quick (acid test) ratio. (2 marks)

Inventory holding period. (2 marks)

Receivables collection period. (2 marks)

Payables payment period. (2 marks)

(Assume a 365-day financial year)

(Total: 20 marks)

QUESTION TWO

1. Identify FOUR qualities of a good credit report that can be used by credit managers for purposes of credit rating. (4 marks)

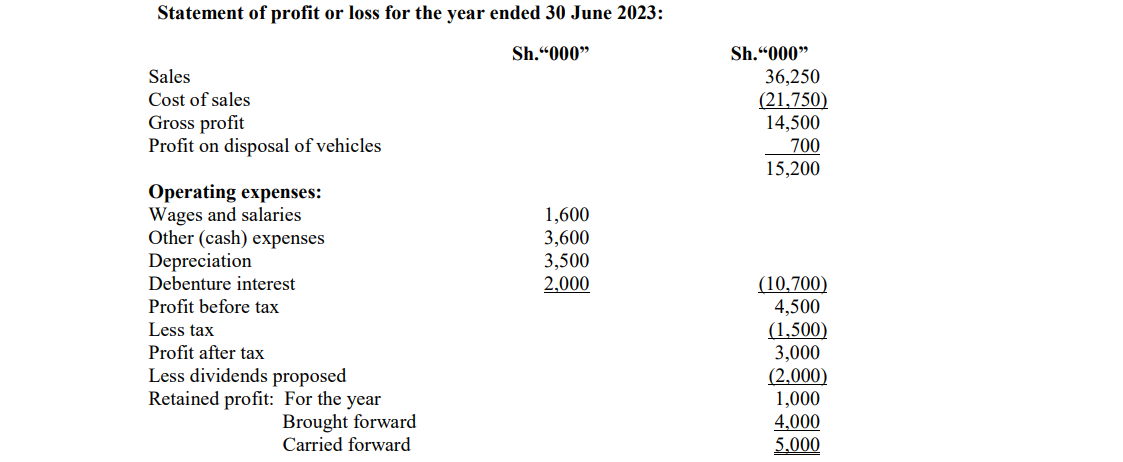

2. The following financial statements were extracted from the books of Pumwani Ltd. for the years ended 30 June 2022 and 30 June 2023:

Required:

Cash flow statement for the year ended 30 June 2023 in accordance with International Accounting Standards (IAS) 7. (16 marks)

(Total: 20 marks)

QUESTION THREE

1. Company A has a return on asset of 8% and a return on equity of 12%. Company B has a return on asset of 7% and return on equity of 15%.

Required:

Explain what this means in terms of relative level of debt financing between these two companies. (2 marks)

2. Explain how depreciation creates a difference between earnings and cash flows. (2 marks)

3. Discuss THREE benefits of CAMELS rating system as used in assessment of a bank’s management, of its operations. (6 marks)

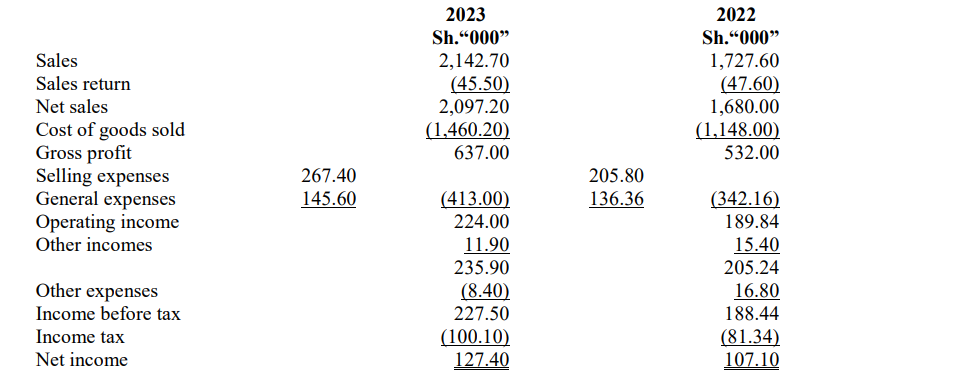

4. The following statements of profit or loss were extracted from the books of Maji Maji Ltd. for the years ended 30 September 2022 and 30 September 2023:

Required:

Vertical analysis of statements of profit or loss for the years ended 30 September 2022 and 30 September 2023. (10 marks)

(Total: 20 marks)

QUESTION FOUR

1. As a result of increased borrowing of loans and advances in Fanikisha Bank Ltd., the management is considering employing a credit analyst. You have been approached by the management of Fanikisha Bank Ltd. to recruit a credit analyst.

Required:

In reference to the above statement, highlight FOUR essential skills of a bank credit analyst. (4 marks)

2. Describe FOUR factors that inform the need to change the financial policy for lending purposes. (4 marks)

3. The data below relates to the financial performance of Winners Ltd. for the year ended 31 March 2023:

Required:

Calculate:

Degree of operating leverage. (2 marks)

Degree of financial leverage. (2 marks)

Degree of combined leverage. (2 marks)

Percentage change in earnings per share if sales increase by 5%. (2 marks)

4. Highlight FOUR differences between a financial analyst and a credit analyst. (4 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain the term “trend analysis”. (2 marks)

2. Outline FOUR signs that a business is in distress. (4 marks)

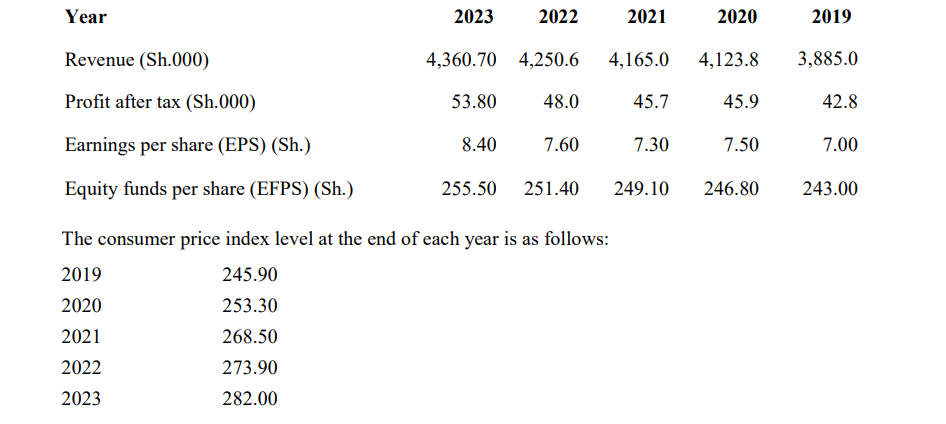

3. The following results have been obtained from the financial statements of Bitcon Ltd. as at 30 June:

Required:

Compute the adjustment factors for years 2019 to year 2022 using year 2023 as the end-of-year price

levels. (4 marks)

Adjusted annual figures to common price level of year 2023 prices using the adjustment factors obtained

in (b) (i) above. (4 marks)

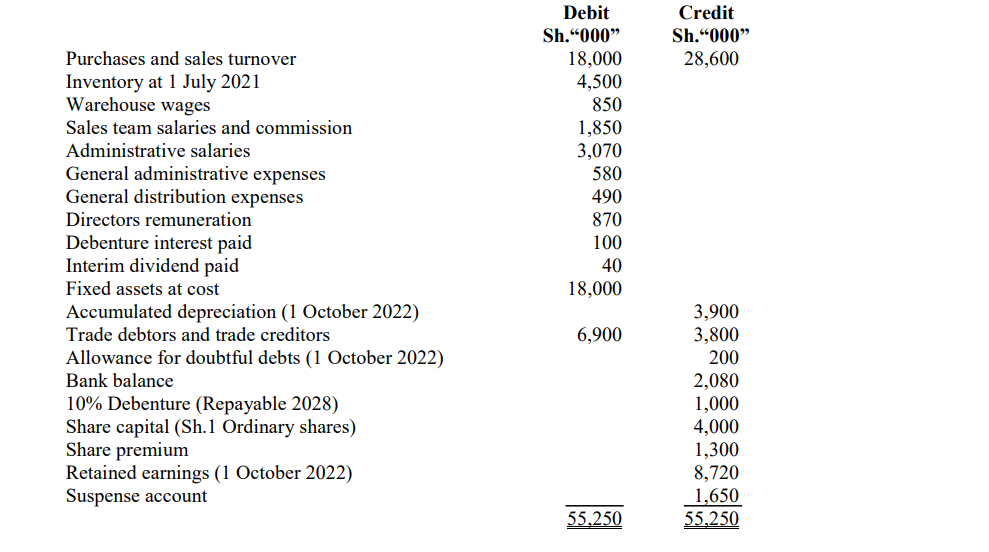

4. The following is the trial balance of Hallmark Ltd. as at 30 September 2023:

Additional information:

1. Closing inventory for the year ended 30 September 2023 was Sh.5,000,000.

2. A review of the trade debtors total of Sh.6,900,000 showed that it was necessary to write off debts

totalling to Sh.400,000, and that the allowance for credit loss should be adjusted to 2% of the remaining

trade debtors.

3. Two transactions have been entered in the company’s cash record and transferred to the suspense account as follows:

The receipt of Sh.1,500,000 from the issue of 500,000 ordinary shares of Sh.1 at a premium of

Sh.2 per share.

The sale of plant that had cost Sh.1,000,000 had a written down value of Sh.100,000 was sold

for Sh.150,000 and the amount had been credited to the suspense account but no other entries

have been made.

4. Depreciation should be charged at 10% per annum on cost at the end of the year and allocated 70% to

distribution costs and 30% to administration.

5. The directors propose a final dividend of Sh.0.4 per share on the shares in issue at the end of the year.

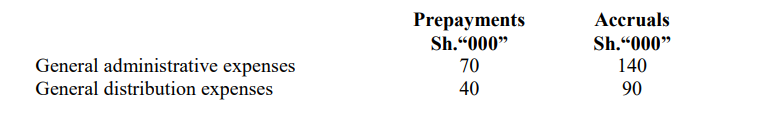

6. Accruals and prepayments still to be accounted for are as follows:

7. Directors remuneration is to be apportioned between distribution costs and administrative expenses of Sh.300,000 and Sh.570,000 respectively.

Ignore taxation.

Required:

Statement of financial position as at 30 September 2023. (6 marks)

(Total: 20 marks)