TUESDAY: 6 December 2022. Morning Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Explain the following sources of non-financial information for credit analysts:

Memorandum of association. (2 marks)

Sustainability reports. (2 marks)

Integrated reports. (2 marks)

2. Outline FOUR accounting ratios that a credit manager could apply in analysing the debt position of a company and

its ability to meet its debt obligations as and when they fall due. (4 marks)

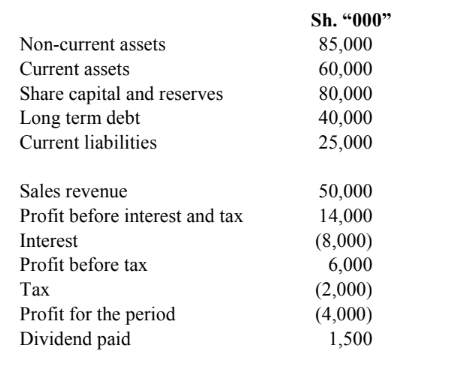

3. The results of Mkopo Ltd. for the year ended 30 September 2022 were as follows:

Additional information:

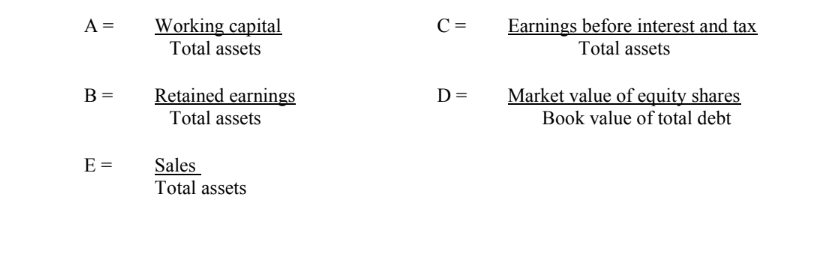

1. The following five ratios are used to produce a Z-score, where Z-score = 1.2A +1.4B + 3.3C + 0.6D + 1.0E and where,

2. In Altman’s model, a Z-score of 2.7 or more indicates non-failure and a Z-score of 1.8 or less indicates a high risk of financial failure. Assume that all liabilities are treated as debt.

3. The market value of Mkopo Ltd.’s equity shares is Sh.90 million.

Required:

1. The Z-score of the firm. (6 marks)

2. Comment on the result of (c) (i) above. (2 marks)

3. Explain the significance of the Altman’s mathematical model. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Outline FOUR disadvantages of financing a company through a bank overdraft. (4 marks)

2. State FOUR elements of credit risk management. (4 marks)

3. Explain the following terms as used in the analysis of risk attitude:

Risk aversion. (2 marks)

Risk seeking. (2 marks)

Risk neutral. (2 marks)

4. Explain the following approaches as used in the analysis of financial statements:

Top-down approach. (2 marks)

Bottom-up approach. (2 marks)

Valuation analysis approach. (2 marks)

(Total: 20 marks)

QUESTION THREE

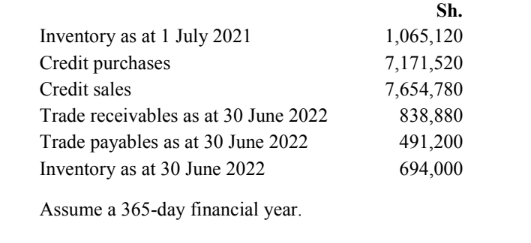

1. The following balances were obtained from the financial records of Axio Limited:

Required:

Determine the following for the year ended 30 June 2022:

1. Inventory holding period. (2 marks)

2. Trade receivables collection period. (2 marks)

3. Trade payables payment period. (2 marks)

4. Cash conversion cycle. (2 marks)

Distinguish between “conservative accounting” and “aggressive accounting”. (6 marks)

Identify THREE users of a credit analyst’s report and their respective information needs. (6 marks)

(Total: 20 marks)

QUESTION FOUR

1. Highlight FOUR reasons why accounting profit might not be the best measure of a company’s achievement in view

of credit management. (4 marks)

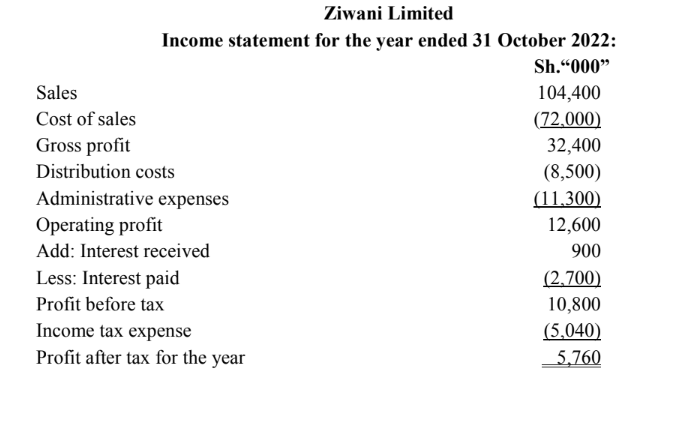

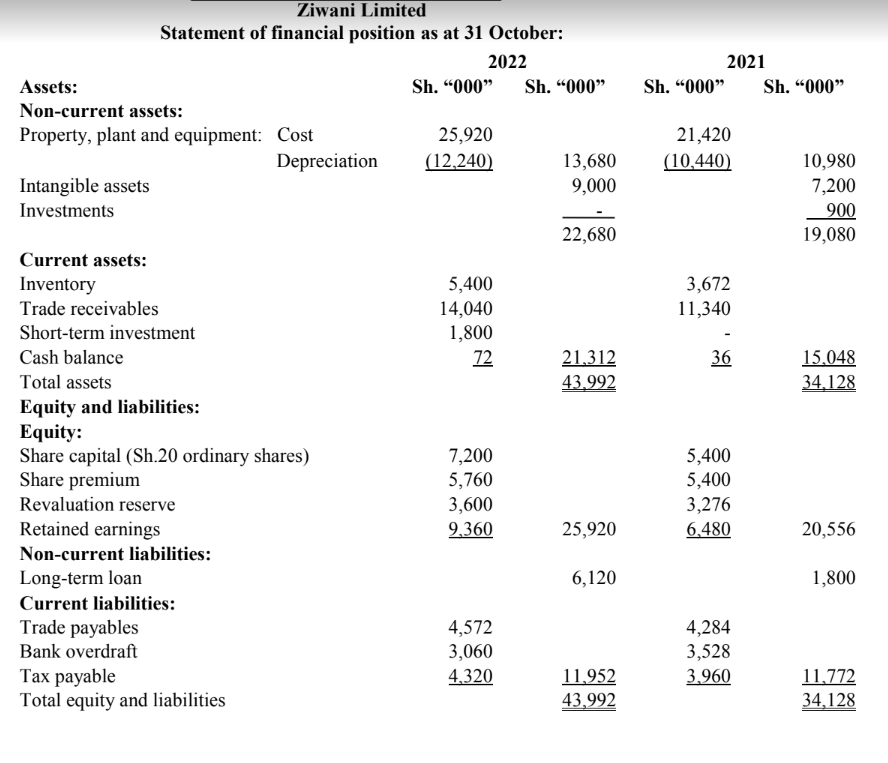

2. The financial statements of Ziwani Ltd. for the year ended 31 October 2022 were as follows:

Additional information:

1. During the year ended 31 October 2022, 90,000 ordinary shares of Sh.20 each were issued at a premium of Sh.4 per share.

2. During the year, ended 31 October 2022, dividends amounting to Sh.2,880,000 were paid.

3. The proceeds from the sale of investments amounted to Sh.1,080,000.

4. During the year ended 31 October 2022, equipment with an original cost of Sh.3,060,000 and a net book value of Sh.1,620,000 was sold for Sh.1,152,000.

Required:

Statement of cash flow for the year ended 31 October 2022 in accordance with the requirements of International Accounting Standard (IAS), 7 “Statement of Cash Flows”. (16 marks)

(Total: 20 marks)

QUESTION FIVE

1. Financial distress is one of the fundamental areas of interest by credit analysts in the critical analysis of entities.

Required:

In view of the above statement, highlight FIVE causes of financial distress. (5 marks)

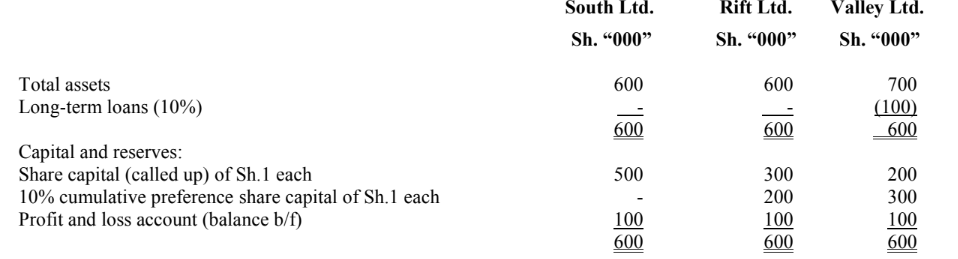

2. The following information relates to three separate and independent companies, South Ltd., Rift Ltd., and Valley

Ltd. as at 30 September 2022.

Summarised financial position as at 30 September 2022:

Additional information:

1. The operating profit before interest and tax for the year ended 30 September 2022 earned by each of the three companies was Sh.300,000.

2. The corporation tax rate for all the three companies for the year ended 30 September 2022 was 30%. This rate is to be used in calculating each company’s tax payable on ordinary profit.

3. An ordinary dividend of Sh.0.20 per share for the year ended 30 September 2022 was paid by all the three companies as was the preference dividend.

4. The market price of ordinary shares as at 30 September 2022 was Sh.8.40, Sh.8.50 and Sh.10.38 for South Ltd., Rift Ltd. and Valley Ltd. respectively.

5. There were no changes in the share capital structure or in long term loans of any of the companies during the year ended 30 September 2022.

Required:

1. Statement of profit or loss for each of the THREE companies (in columnar format) for the year ended 30 September 2022. (3 marks)

2. The change in profit or loss for each company over the year. (3 marks)

3. Compute the earnings per share (EPS), price earnings (P/E) ratio and gearing ratio for each company. (9 marks)

(Total: 20 marks)