TUESDAY: 2 August 2022. Morning paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

Do NOT write anything on this paper.

QUESTION ONE

1. An organisation must estimate its working capital very accurately because excessive working capital results in unnecessary accumulation of inventory and wastage of capital whereas shortage of working capital affects the smooth flow of operating cycle and a business may fail to meet its financial obligations as they fall due. As the newly employed credit analyst at Mwamuku Mpya Ltd., explain four factors that could affect the working capital needs of your organisation. (8 marks)

2. With reference to evaluation of financial data of a corporate borrower:

Analyse the process of credit analysis of a company. (2 marks)

3. Explain the following credit risk assessment drivers:

Probability of default. (2 marks)

Loss given default. (2 marks)

Exposure default. (2 marks)

4. List four business cash flow drivers. (4 marks)

(Total: 20 marks)

QUESTION TWO

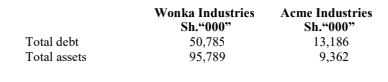

1. The following information relates to two of your corporate customers:

The above customers have applied for a loan facility in your bank.

Required:

Compute the total debt-to-assets ratio. (1 mark)

As the credit analyst of Jisort Bank, advise on whether you will approve or decline the loan application from your customers based on the information provided above. (4 marks)

Explain one reason why debt-to-total assets ratio could change over time. (1 mark)

2. Examine three areas of an organisation which can assist a credit analyst to authoritatively conclude that an organisation is facing financial distress and as such no additional loan should be granted. (6 marks)

3. An audit report is an appraisal of a business’s complete financial status. The report presents the auditors objective assessment of the firm’s financial position as a going concern.

With reference to the above statement, discuss four audit reports that would be of interest to a credit analyst when undertaking credit assessment for a publicly listed company. (8 marks)

(Total: 20 marks)

QUESTION THREE

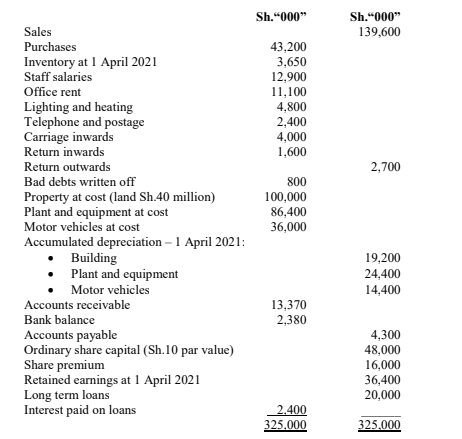

The following trial balance was extracted from the financial records of Mwenza Limited, a public limited entity as at 31 March 2022:

Additional information:

1. Inventory as at 31 March 2022 was valued at a cost of Sh.3,050,000.

2. Depreciation for the year to 31 March 2022 is to be charged as follows:

• Building 2% on cost

• Plant and equipment 15% on net book value

• Motor vehicles 20% on cost

3. Accrued rent as at 31 March 2022 amounted to Sh.1,200,000.

4. The marketing manager of the company is entitled to a 10% bonus on profit before tax, after charging such bonus.

5. The income tax for the year to 31 March 2022 is estimated at Sh.12,500,000.

Required:

1. Statement of profit or loss for the year ended 31 March 2022. (10 marks)

2. Statement of financial position as at 31 March 2022. (10 marks)

(Total: 20 marks)

QUESTION FOUR

1. Explain the role of a financial analyst in an organisation. (2 marks)

2. Describe four cash flow measures that are important to a credit analyst in making sound lending decisions. (4 marks)

List four items that a credit analyst should pay attention to while assessing a corporate lender. (4 marks)

3. Explain the term “credit score”. (2 marks)

In the context of a hypothetical credit rating model ranging between 1 – 1,000, differentiate between the following credit scores “800 to 1,000” and “300 to 579”. (4 marks)

When information is updated on a borrower’s credit score, their credit score changes. It can rise or fall based on the new information.

With reference to the above statement, describe two ways in which a consumer could improve their credit score. (4 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain the accounting cycle in a business entity. (6 marks)

2. Explain five types of non-financial information that a credit analyst would be interested in the Articles of Association (AOA) of a company. (10 marks)

3. Describe four roles of a credit committee in an organisation. (4 marks)

(Total: 20 marks)