MONDAY: 4 April 2022. Morning paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your

workings. Do NOT write anything on this paper.

QUESTION ONE

1. Outline four purposes of a statement of cash flow. (4 marks)

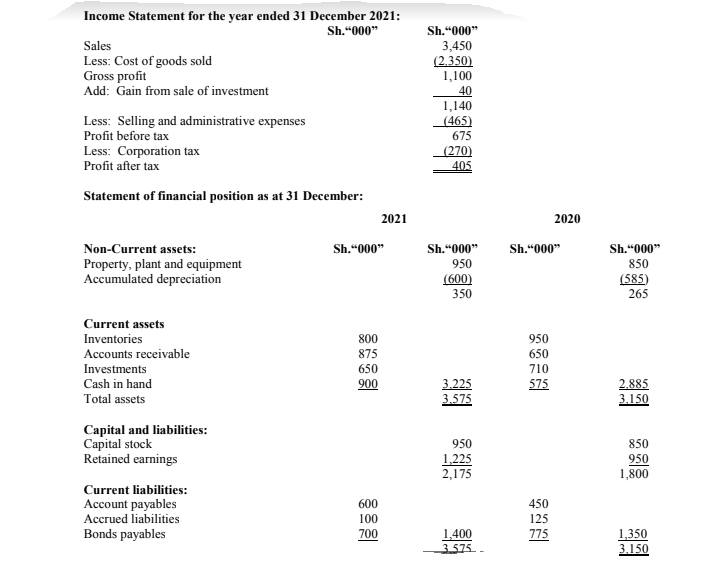

2. Imarisha Ltd. is listed at the securities exchange. The following statement were extracted from the books of the company for the year ended 31 December 2021:

Additional Information:

1. During the year 2021, a dividend of Sh.130,000 was declared and paid by the management of Imarisha Ltd.

2. Some plant assets were purchased during the year 2021 and the payment was settled by issuing common stock amounting to Sh.35,000.

Required:

Cash flow statement for the year ended 31 December 2021 in accordance with International Accounting Standard (IAS) 7 (Statement of Cash Flows). (16 marks)

(Total: 20 marks)

QUESTION TWO

1. Mfalme Equipment Company estimates its carrying cost at 15% and its ordering cost at Sh.9 per order. The estimated annual requirement is 48,000 units at a price of Sh.4 per unit.

Assumption – 1 year = 360 days

Required:

Calculate the most economical number of units to order. (2 marks)

Explain how many orders should be placed in a year. (2 marks)

Determine how often an order should be placed. (2 marks)

2. Outline two objectives of preparing financial statements. (2 marks)

3. Explain the acronym “CAMELS” as a tool used by banks in the analysis of financial statements. (12 marks)

(Total: 20 marks)

QUESTION THREE

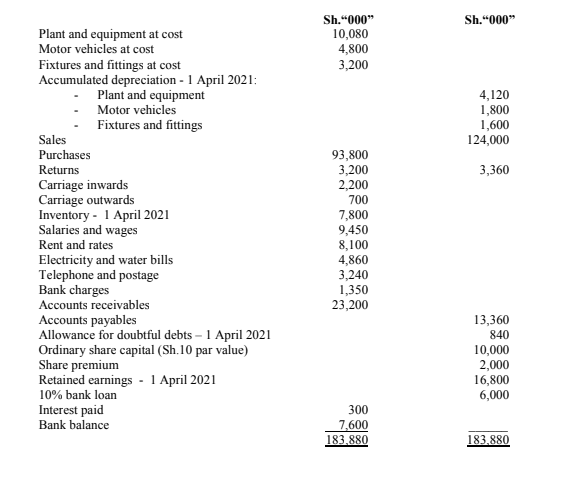

The following trial balance as at 31 March 2022 relates to Mawingu Ltd.:

Additional Information:

1. Inventory count was performed on 31 March 2022 which revealed valuation at a cost of Sh.9,300,000.

2. At 31 March 2022, outstanding electricity bills amounted to Sh.340,000 while prepaid rent was Sh.1,100,000.

3. Depreciation on property, plant and equipment is to be provided at the following rates and basis:

Assets Rate per annum Basis

Plant and equipment 12.5% Reducing balance

Motor vehicles 25% Straight line

Fixtures and fittings 10% Straight line

4. Allowance for doubtful debts is to be maintained at 5% of the accounts receivable.

5. The current tax for the year is estimated as a tax refund of Sh.95,000.

6. The 10% bank loan was obtained on 1 July 2021. Interest on the loan is payable half yearly on 31 December and 30 June each year.

Required:

Statement of profit or loss for the year ended 31 March 2022. (8 marks)

Statement of financial position as at 31 March 2022. (8 marks)

As a credit analyst comment on the liquidity position of Mawingu Ltd. by calculating:

Current ratio. (2 marks)

Quick ratio. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Explain the following terms as used in working capital management:

Cash and cash equivalents. (2 marks)

Accrued expenses. (2 marks)

Cash operating cycle. (2 marks)

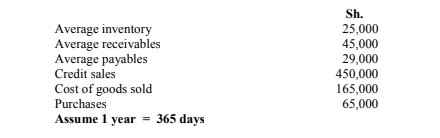

2. The following information was extracted from the books of Amuzer Ltd.:

Required:

Compute the cash conversion cycle. (8 marks)

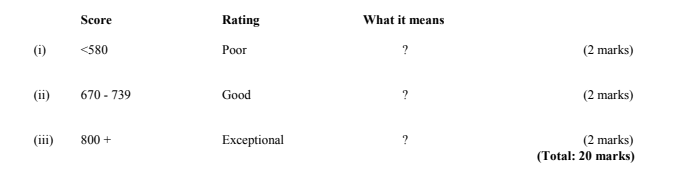

3. State what the following credit score means to a lender:

QUESTION FIVE

1. Analyse four reasons for corporate failures. (4 marks)

2. Outline four contents of a credit analysis report. (4 marks)

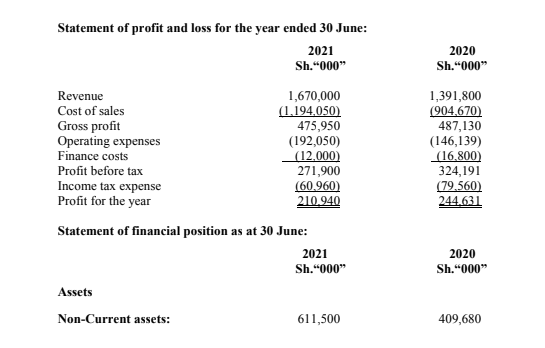

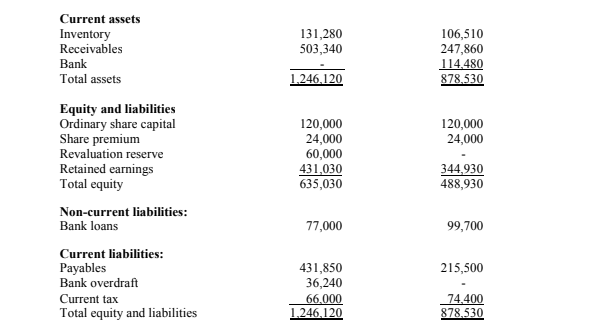

3. Protractor Limited, a private limited entity is a manufacturer and a retailer of household products. The company’s summarised financial statements for the years ended 30 June 2021 and 30 June 2020 are set out below:

The directors concluded that the revenue for the year ended 30 June 2020 fell below budget and introduced measures during the year ended 30 June 2021 to improve the situation, which included:

- Reducing the selling price.

- Extending credit facilities.

- Leasing additional machinery in order to increase production.

The directors are now reviewing the results for the year ended 30 June 2021.

Assume a 365-days financial year. Required:

Calculate the following financial ratios for Protractor Limited for the two years ended 30 June 2021 and 2020:

- Gross Profit margin. (2 marks)

- Operating profit margin. (2 marks)

- Return on Capital Employed (ROCE). (2 marks)

- Inventory holding period. (2 marks)

- Receivables collection period. (2 marks)

- Payables payment period. (2 marks)

(Total: 20 marks)