WEDNESDAY: 15 December 2021 Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Evaluate four objectives of financial statements. (8 marks)

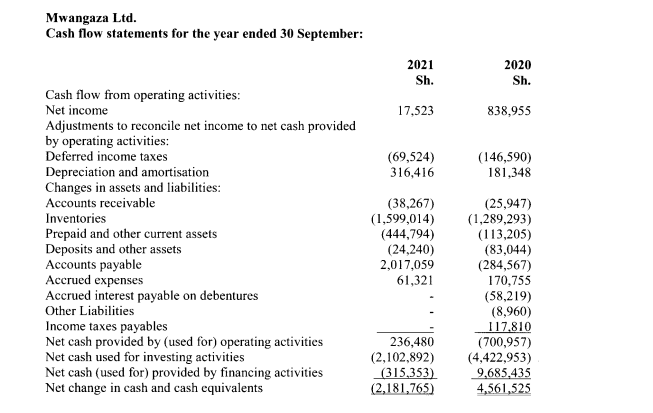

2. Mwangaza Ltd. manufactures solar panels for home use. Over the past few years, the company’s sales have greatly increased. Such dramatic growth has significant implications for cash flows.

Provided below are the cash flows for the year ended 30 September 2020 and 30 September 2021.

Additional information:

- The liabilities and net sales were as follows: September 2021 September 2020

Current liabilities 4,055,465 1,995,600

Total liabilities 4,620,085 2,184,386

Net sales 20,560,566 17,025,856

- Included in net cash used for investing activities is machinery purchase of Sh.50,000 for the year ended 30 September 2020 and Sh.60,000 for the year ended 30 September 2021.

- No dividends were paid in the year ended 30 September 2020, but Sh.20,000 was paid in the year ended 30 September 2021.

- An analyst observes that net income in the year ended 30 September 2021 was only Sh.17,253 compared to the previous year ended 30 September 2020 of Sh.838,955, but net cash flow from operating activities was Sh.236,480 in the current year ended 30 September 2021 and a negative Sh.700,957 in the year ended 30 September 2020.

Required:

Discuss two causes of the situation that the analyst observed. (4 marks)

Analyse Mwangaza Ltd.’s liquidity, solvency and profitability for the year ended 30 September 2021 using cash flow based ratios. (6 marks)

Calculate the firm’s free cash flow. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. On 17 January 2020, Daudi Ltd. invested Sh.11 million in Barua’s debt securities, with a 5% stated coupon on par value and interest payable each 31 December. The par value of the securities is Sh.10 million, and the market interest rate in effect when the bonds were purchased was 4%. Daudi Ltd. designates the investment as held to maturity. As of 31 December 2020, the fair value of Barua’s debt securities was Sh.12 million.

Required:

The amortised cost of Barua’s debt securities in the financial statements of Daudi Ltd. as at 31 December 2020(4 marks)

2. Discuss four factors that might stimulate the use of creative accounting techniques in an organisation.(8 marks)

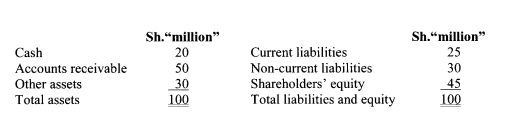

3. Roxy Ltd. wants to raise Sh.40 million in capital by borrowing against its financial receivables. Roxy Ltd. wants to create a special purpose entity (SPE), invest Sh.10 million in the SPE, have the SPE borrow Sh.40 million and then use the funds to purchase Sh.50 million of receivables from Roxy Ltd. Roxy Ltd. meets the definition of control and plans to consolidate the SPE. Roxy Ltd.’s summarised financial statement is presented below:

Roxy Ltd. plans to borrow against its financial receivables.

Required:

Calculate the following ratios, before and after consolidation of the SPE:

The current ratio. (4 marks)

The debt equity ratio. (4 marks)

(Total: 20 marks)

QUESTION THREE

1. Explain the following qualitative characteristics of financial reports:

Reliance. (2 marks)

Faithful representation. (2 marks)

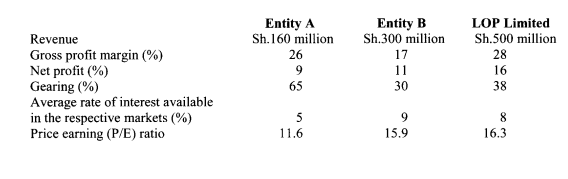

2. LOP Limited operates in the construction industry and prepares its financial statements in accordance with the International Financial Reporting Standards (IFRS). It is listed on its local exchange, LOP Limited is considering expanding its overseas operations by acquiring a new subsidiary. Two geographical areas have been targeted, Frontland and Sideland. Entity A operates in Frontland and entity B operates in Sideland. Both entities are listed on their local exchange.

The financial highlights for entity A, entity B and LOP Limited are provided below for the last trading period:

Required:

Analyse the information provided by the key financial indicators above and explain the impact that each entity would have on the financial indicators of LOP Limited. (8 marks)

Explain two limitations of using ratio analysis on a potential takeover target. (2 marks)

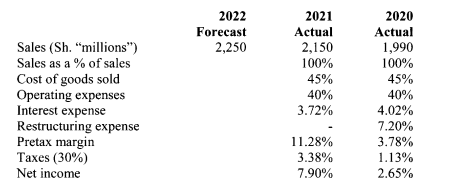

3. A financial analyst is forecasting earnings per share (EPS) for a company. He prepares the following common sized data from its recent annual report and estimates sales for the year 2022.

The capital structure of the company has not changed and the company has no short-term interest bearing debt outstanding.

Required:

The net projected income for the year 2022. (6 marks)

(Total: 20 marks)

QUESTION FOUR

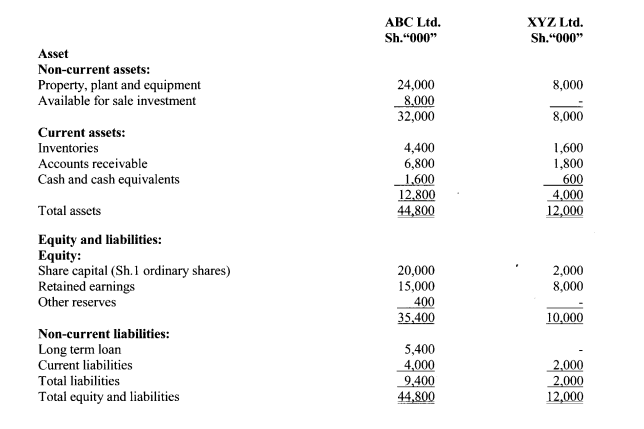

1. The statements of financial position for ABC Ltd. and XYZ Ltd. as at 31 December 2020 are provided below:

Additional information:

- ABC Ltd. acquired a 75% investment in XYZ Ltd. on 1 May 2020 for Sh.7,600,000. The investment has been classified as available for sale in the books of ABC Ltd. The gain on its subsequent measurement as at 31 December 2020 has been recorded within other reserves in ABC’s individual financial statements. At the date of acquisition, XYZ Ltd. had retained earnings of Sh.6,400,000.

- It is the group policy to value non-controlling interest at fair value at the date of acquisition. The fair value of the non-controlling interest at 1 May 2020 was Sh.3,200,000.

- As at 1 May 2020, the fair value of the net assets acquired was the same as the book value with the following exceptions:

- The fair value of property, plant and equipment was Sh.3,600,000 higher than the book value.

These assets were assessed to have an estimated useful life of 36 years from the date of acquisition.

- A full year’s depreciation is charged in the year of acquisition and none in the year of sale.

- The fair value of inventories was estimated to be Sh.400,000 higher than the book value. All of these inventories were sold by 31 December 2020.

- On acquisition, ABC Ltd. identified an intangible asset that XYZ Ltd. developed internally which met the recognition criteria of International Accounting Standards (IAS) 38 “Intangible Assets”. This intangible asset is expected to generate economic benefit from the date of acquisition until 31 December 2021. This asset was valued at Sh.300,000 at the date of acquisition.

- A contingent liability, which had a fair value of Sh.420,000 at the date of acquisition, had a fair value of Sh.168,000 at 31 December 2020.

- An impairment review was conducted at 31 December 2020 and it was decided that the goodwill on the acquisition of XYZ Ltd. was impaired by 20%.

- During the year ended 31 December 2020, ABC Ltd. sold goods to XYZ Ltd. for Sh.600,000. Half of these goods remained in inventories at 31 December 2020, ABC Ltd. makes 20% margin on all sales.

- No dividends were paid by either entity in the year ended 31 December 2020.

- During the year ended 31 December 2020, ABC Ltd. disposed of equipment with a net book value of Sh.2,000,000.

Required:

The consolidated statement of financial position as at 31 December 2020 for ABC group. (14 marks)

2. Summarise six items that could be included in the notes to financial statements. (6 marks)

(Total: 20 marks)

QUESTION FIVE

1. The authorised share capital of Zimtex Limited is made up of 10 million ordinary shares with a paid up share capital of Sh.6,750,000 represented by 6 million ordinary shares of Sh.1.125 each.

Additional information:

- Earnings after tax for the year ended 30 June 2021 were Sh.5,400,000. The company has no debt capital.

- The price earnings (P/E) ratio of the company is 22.5.

- The company plans to make a large investment at a cost of Sh.15,750,000. This is to be raised through a rights issue with a price of Sh.12 per share.

Required:

The current market price per share. (2 marks)

The theoretical ex-right price per share. (3 marks)

2. On 28 February 2020, Red Group purchased a machine for Sh.1,500,000 for the purpose of leasing it. The machine is expected to have a 10 year life, no residual value and will be depreCiated on a straight-line basis. The machine was leased to Blue Ltd. on 1 March 2020 for a four year period at a monthly rental of Sh.19,500. There is no provision for the renewal of the lease or purchase of the machine by the lessee at the expiration of the lease term. Red Group paid Sh.30,000 commission associated with negotiating the lease in February 2020.

Required:

The expense that Blue Ltd. should record in its books as a result of the lease agreement for the year ended 31 December 2020. (1 marks)

The profit or loss before income taxes that Red Group should record in its books as result of the lease agreement for the year ended 31 December 2020. (3 marks)

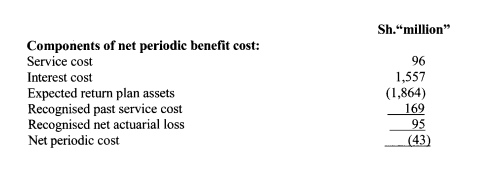

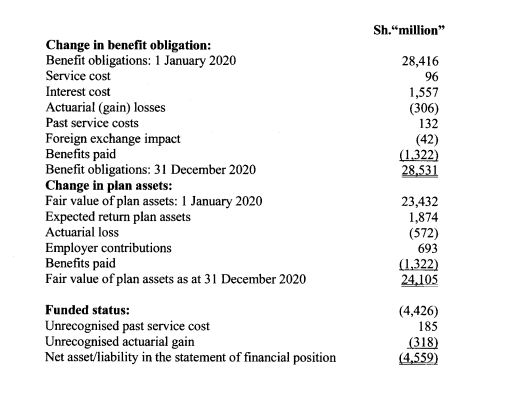

3. Pitkam Limited operates a defined benefit pension plan for its employees and complies with the requirements of International Accounting Standard (IAS 19) “Employee Benefits”. The following is an extract of the financial statement for the year ended 31 December 2020

The corporation tax rate is 30% per annum.

Required:

The economic pension expense for Pitkam Ltd.’s defined plan for the year ended 31 December 2020. (5 marks)

Adjust the reported net income to reflect the company’s underlying economic benefit expense. (3 marks)

Adjust Pitkam Ltd.’s 2020 statement of financial position to reflect the funded status of the company’s defined benefit pension plan. (3 marks)

(Total: 20 marks)