Financial statement analysis is the process of identifying the strength and weaknesses of the firm by establishing and analyzing the relationships between various items in the financial statement.

This relationship is expressed by the use of ratios.

Basic Financial Statement

- Balance sheet: This indicates the financial position of a firm at a given point, in time. It shows the assets/resources of the firm and the respective liabilities that were incurred to finance these assets.

- Income Statement: This indicates the financial performance of a firm during a given financial year. This performance is indicated by profitability of the firm. Financial statements also includes cash flow statement which shows changes in cash position of the entity, value added statement and employee statement.

Classification of Financial Ratios Financial ratios are broadly classified into five categories:

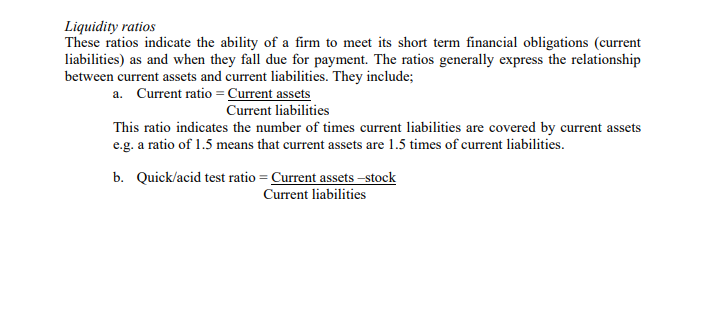

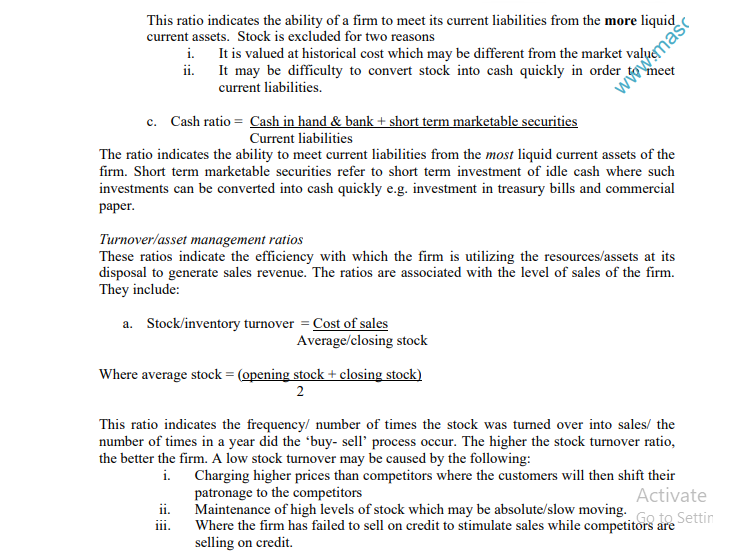

- Liquidity ratios

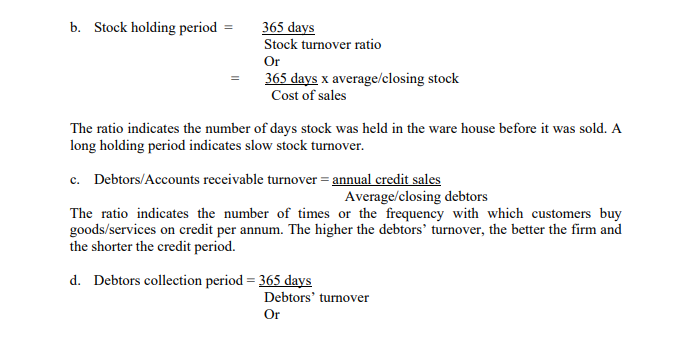

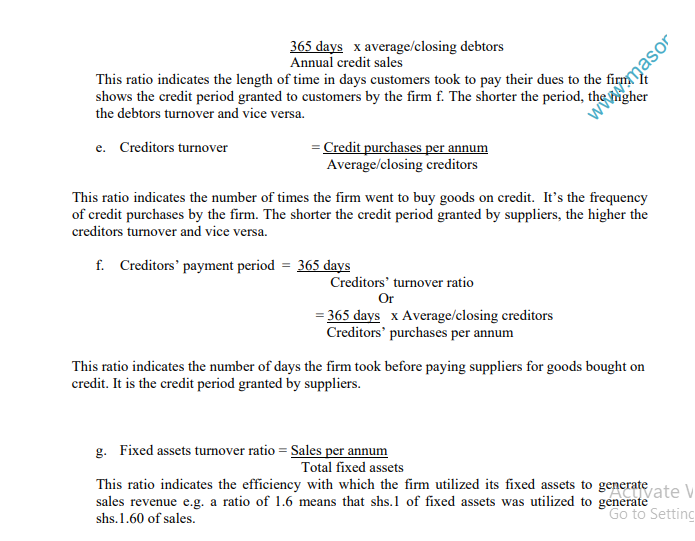

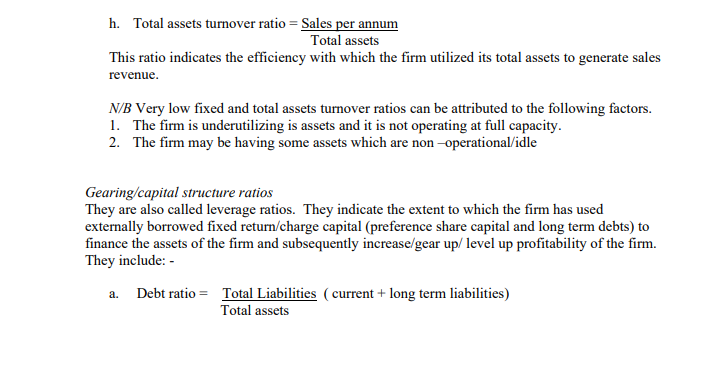

- Turnover/asset management ratios

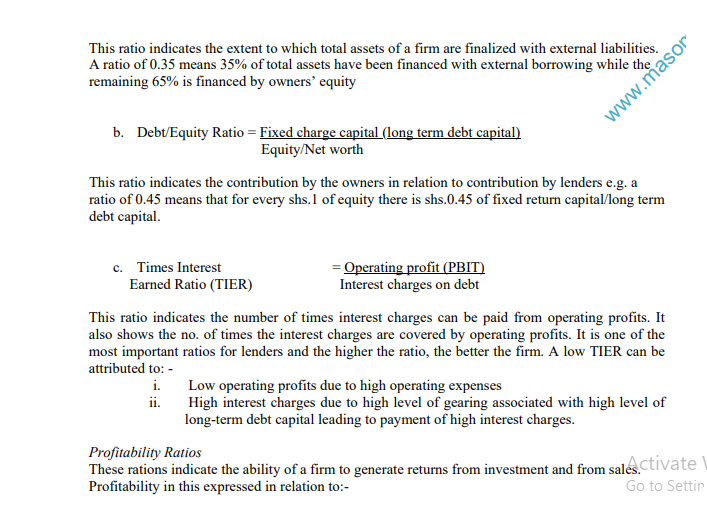

- Gearing/capital structure ratios

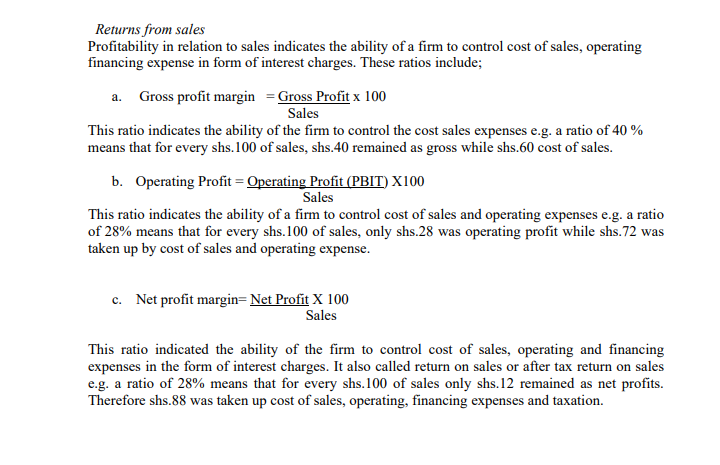

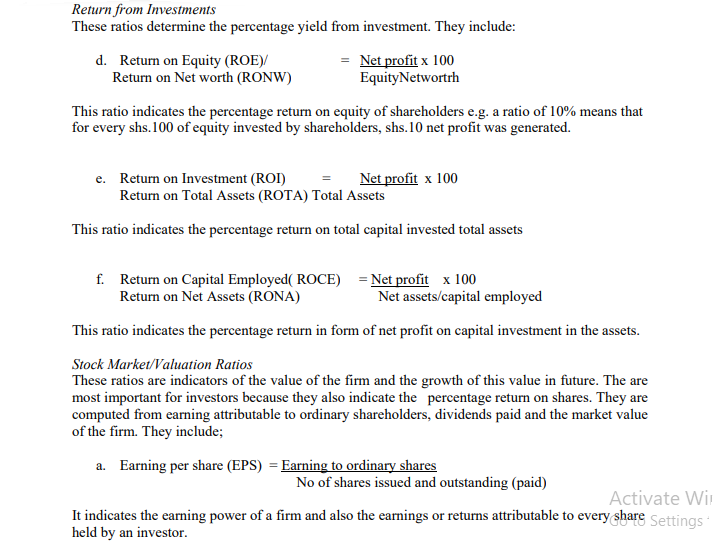

- Profitability ratios

- Valuation/stock market ratios

Important Definitions

- Net working capital= Current assets – Current Liabilities

- Equity/networth = Ordinary share capital +retained earnings + other reserves

- Operating profits =Profits/earnings before interest and tax (EBIT)

- Net assets/capital employed = Total assets –Current liabilities

(Equity +Long term liabilities) - Earnings attributable to ordinary shareholders = Profit after tax and preference dividends

- Net profits =Profit after tax

- Fixed return/charge capital = Long term liabilities with a fixed/constant rate of return (debentures (long term debt) + preference share capital.

Share this: