WEDNESDAY: 15 December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Outline four red flags that a credit analyst might detect in financial statements. (4 marks)

2. Discuss three differences between “horizontal analysis” and “vertical analysis” of financial statements. (6 marks)

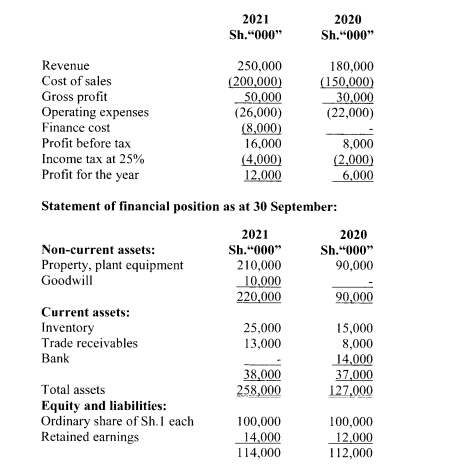

3. The following are the financial statements for Zainab Ltd., a listed company, for the years ended 30 September 2020 and 30 September 2021:

Income statement for the year ended 30 September:

Additional information:

- The directors of Zainab Ltd. commented on the performance for the year ended 30 September 2021 as follows:

- An increase in sales revenue by 39%.

- Gross profit margin up from 16.7% to 20%.

- A doubling of the profit for the period.

- On 1 October 2020, Zainab Ltd. purchased the whole of net assets of Mia Ltd., a private limited company for Sh.100,000. The contribution of Mia Ltd. towards the purchase by Zainab Ltd. result for the year ended 30 September 2021 was as follows:

Sh.”000″

Revenue 70,000

Cost of sales (40,000)

Gross profit 30,000

Operating expenses (8,000)

Profit before tax 22,000

- There were no disposals of non-current assets during the year.

- All sales and purchases were made on credit terms.

- Assume 365-days a year.

Required:

Net assets turnover. (2 marks)

Closing inventory holding period. (2 marks)

Trade receivables collection period. (2 marks)

Payables payment period. (2 marks)

Gearing. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain the following types of business risks:

Solvency risk. (2 marks)

Inventory risk. (2 marks)

Cash flow risk. (2 marks)

Market risk. (2 marks)

2. Enumerate four skills that a credit analyst might be required to possess. (4 marks)

3. A credit analyst has various sources of information. These sources of information are either financial or non- financial.

Identify four sources of:

Financial information. (4 marks)

Non-financial information. (4 marks)

(Total: 20 marks)

QUESTION THREE

1. Outline four cash flow strategies that a credit manager might apply in order to stabilise the cash flow of a small or medium size enterprise. (4 marks)

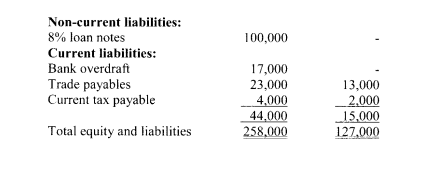

2. Mwenze Ltd. is listed at the securities exchange. The following financial statement were extracted from the books of the company for the year ended 30 September 2021:

Additional information:

- Investment purchased during the year ended 30 September 2021 includes Sh.3.2 million in government bonds, redeemable in 20 years. The remaining investments were treasury bills redeemable in 3 months’ time.

- Interest on finance leases of Sh.120,000 was included in the interest payable charged to income statement.

- During the year ended 30 September 2021, the company issued 200,000 (Sh.2 par value) ordinary shares at Sh.3.8 each.

- During the year ended 30 September 2021, some items of property, plant and equipment were purchased under finance lease amounting to Sh.1,120,000. Disposal of equipment having a net book value of Sh.760,000 realised Sh.840,000.

- During the year ended 30 September 2021 depreciation charge was Sh.1,480,000 and some items were revalued upwards by Sh.280,000.

Required:

Cash flow statement for the year ended 30 September 2021 in accordance with International Accounting Standard (IAS) 7 (Statement of Cash Flows). (16 marks)

(Total: 20 marks)

QUESTION FOUR

1. Distinguish between “conservative” and “aggressive” accounting techniques. (4 marks)

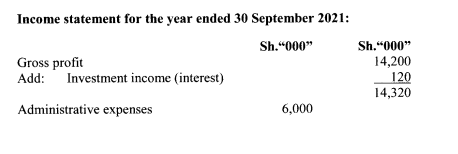

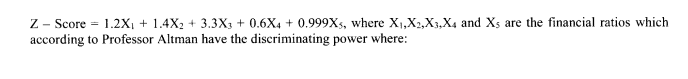

2. Professor Edward Altman’s model for prediction of bankruptcy is given as follows:

X1 = Working capital/Total assets

X2 = Retained earnings/Total assets

X3 = Operating profit (EBIT)/Total assets

X4 = Market value of equity shares/Book value of debt including preference share capital

X5 = Sales/Total assets

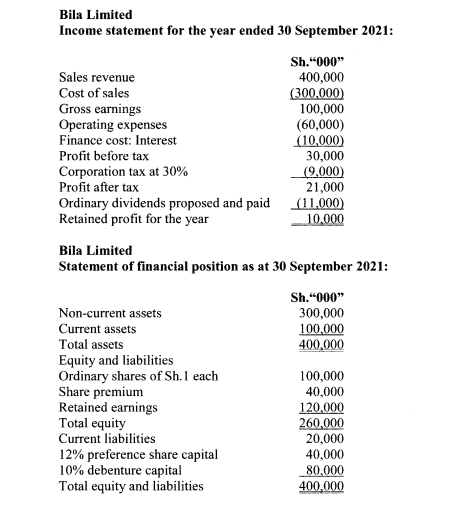

Given below are summarised financial statements of Bila Limited for the year ended 30 September 2021:

Required:

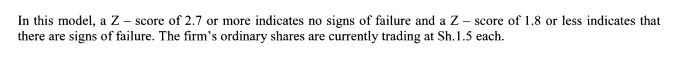

The Z — score for Bila Limited. (7 marks)

Comment on the results obtained in above. ( I mark)

3. JK Ltd. presented the following information for the year ended 30 June 2021:

Sh.”000″

Sales 5,600

Average receivables 506

Average inventories – Finished goods 350

– Work-in-progress 550

– Raw materials 220

Average payables 210

Gross profit margin 25%

Raw material purchases represent 50% of the total cost of sales.

Required;

The company’s cash operating cycle for the year ended 30 June 2021. (8 marks)

(Total: 20 marks)

QUESTION FIVE

1. Evaluate four groups of quantitative factors that may be used in credit analysis. (8 marks)

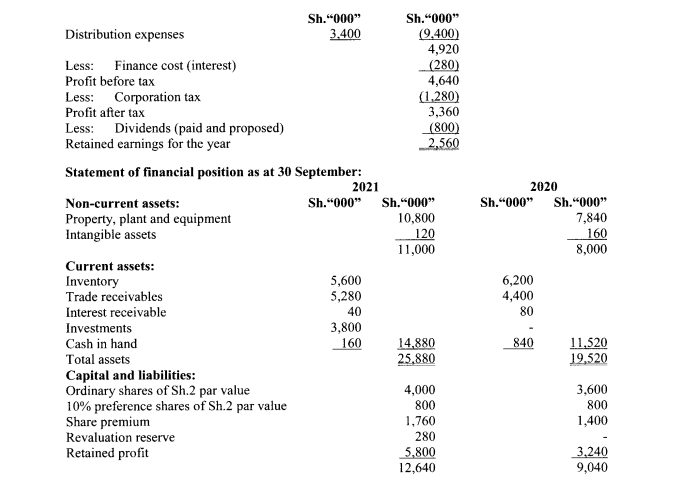

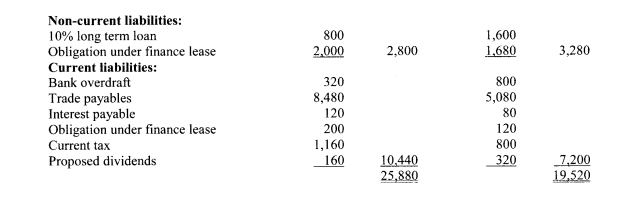

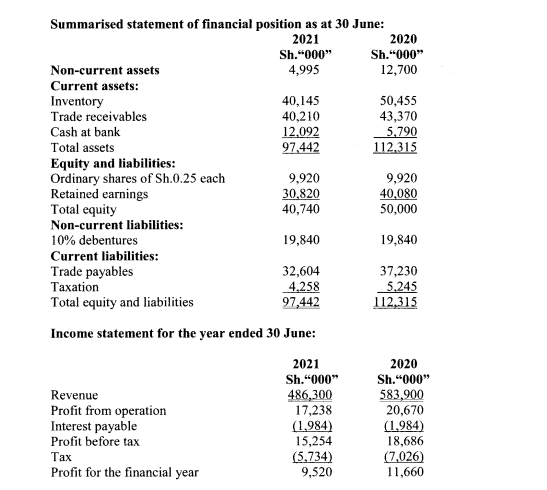

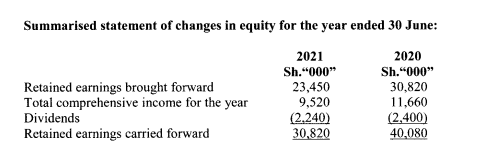

2. The following are the summarised accounts for Nyota Limited for the year ended 30 June 2020 and 30 June 2021:

Required:

Compute the following ratios for the years ended 30 June 2020 and 30 June 2021:

Earnings per share. (2 marks)

Dividend coverage ratio. (2 marks)

Current ratio. (2 marks)

Quick ratio. (2 marks)

Return on capital employed. (2 marks)

Non-current assets turnover. (2 marks)

(Total: 20 marks)