THURSDAY: 24 May 2018. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. In the context of International Public Sector Accounting Standard (IPSAS) 19 — Provisions, Contingent Liabilities and Contingent Assets:

Distinguish between a “provision” and a “contingent liability”. (4 marks)

Summarise the recognition requirements for provisions, contingent liabilities and contingent assets. (6 marks)

2. With reference to International Accounting Standard (IAS) 12 — Income Taxes:

Differentiate between a “deferred tax liability” and a “deferred tax asset”. (2 marks)

Explain the two types of temporary differences. (4 marks)

Describe the basis of measurement for current tax liabilities and deferred tax liabilities. (4 marks)

(Total: 20 marks)

QUESTION TWO

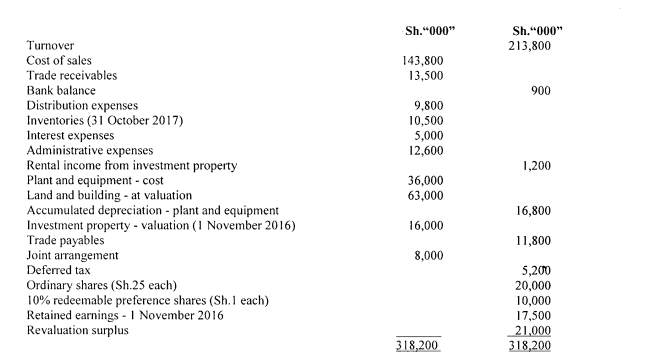

The following trial balance relates to Zambezi Ltd. as at 31 October 2017:

Additional information:

1. An inventory count on 31 October 2017 listed goods with a cost of Sh.10.5 million. These included some damaged goods that had cost Sh.800,000. These goods would require repair works costing Sh.450,000 after which they could be sold for an estimated price of Sh.950,000.

2. Non-current assets:

Plant

All plant, including that of the joint operation is depreciated at the rate of 12.5% per annum on reducing balance basis.

Land and building

The land and building were revalued at Sh.15 million and Sh.48 million respectively on LiNovember 2016 creating a Sh.21 million revaluation surplus. At this date, the building had a remaining useful life of 15 years.

Depreciation is on a straight line basis. Zambezi Ltd. does not make a transfer to realised profits in respect of excess depreciation.

Depreciation on both the building and the plant should be charged to the cost of sales.

Investment property

On 31 October 2017, a qualified surveyor valued the investment property at Sh.13.5 million. The company uses the fair value model as per lAS 40 — Investment Property, to value its investment property.

- Interest expenses include overdraft charges, the full year’s preference dividend and an ordinary dividend of Sh.4 per share that was paid in April 2017.

- The directors have estimated the provision for income tax for the year ended 31 October 2017 at Sh.8 million. The deferred tax provision as at 31 October 2017 is to be adjusted (through the profit and loss statement) to reflect that the tax base of the company’s net assets is Sh.12 million less than their carrying amounts. The tax rate is 30%.

- On 1 November 2016, Zambezi Ltd. entered into a joint arrangement with two other entities. Each venturer contributes their own assets and is responsible for their own expenses including depreciation on assets of the joint arrangement. Zambezi Ltd. is entitled to 40% of the joint venture’s total turnover. The joint arrangement is not a separate entity and is regarded as a joint operation.

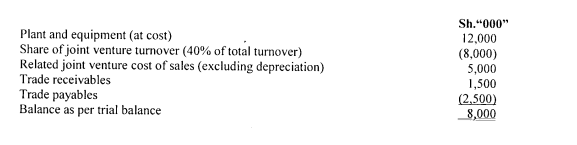

Details of Zambezi Ltd.’s joint venture transactions are as follows:

Required:

1. Statement of comprehensive income for the year ended 31 October 2017. (10 marks)

2. Statement of financial position as at 31 October 2017. (10 marks)

(Total: 20 marks)

QUESTION THREE

1. Outline three circumstances under which a partnership might be dissolved by operation of law. (3 marks)

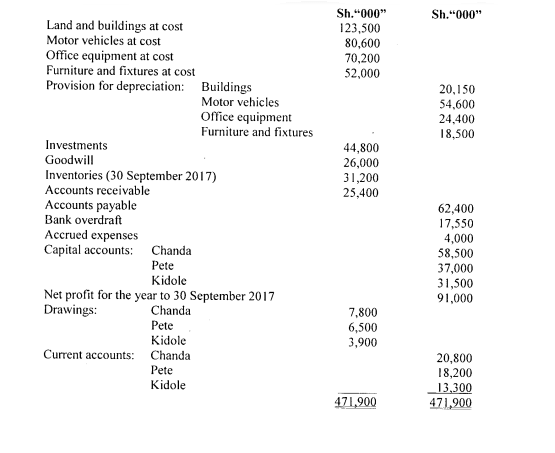

2. Chanda, Pete and Kidole are partners in a partnership business sharing profits and losses in the ratio of 2:2:1 respectively

after allowing for a 10% per annum interest on fixed capital balances and commission entitled to a partner.

The trial balance extracted from the financial records of the partnership as at 30 September 2017 is as set out below:

Additional information:

- Kidole was the only active partner and was entitled to a commission of 15% based on the annual sales revenue which averaged Sh.20 million.

- The partners resolved to convert their business into that of a company to be named Chapeki Limited with effect from I October 2017 under the following terms:

Investments comprised equity investments which partners had acquired jointly. Each partner was to take over a portion of the investments equivalent to the profit share. The investments had a market value of Sh.50 million on 30 September 2017.

Other assets and liabilities were transferred to the new company at the following agreed values:

Sh.”000″

Land and buildings 115,000

Motor vehicles 25,500

Office equipment 43,500

Furniture and fixtures 29,550

Inventories at book value less 5%

Accounts receivable at book value less 2Y2% Current liabilities at book values

Goodwill was considered valueless and therefore was written off.

The purchase consideration on business purchase was agreed at Sh.250 million.

The partners were to become shareholders. The company issued ordinary shares at a par value of Sh.10 each to the partners to satisfy the balances due to them as at 30 September 2017.

- Upon incorporation, the new company issued new debentures at par, carrying interest at 14% per annum. The cash proceeds from the issue amounting to Sh.50 million were used to purchase additional stock of raw materials worth Sh.15 million. Accrued expenses were settled in full.

Required:

A realisation account, partners’ capital accounts and Chapeki Limited’s account to close off the partnership’s books. (10 marks)

Opening statement of financial position of Chapeki Limited. (7 marks)

(Total: 20 marks)

QUESTION FOUR

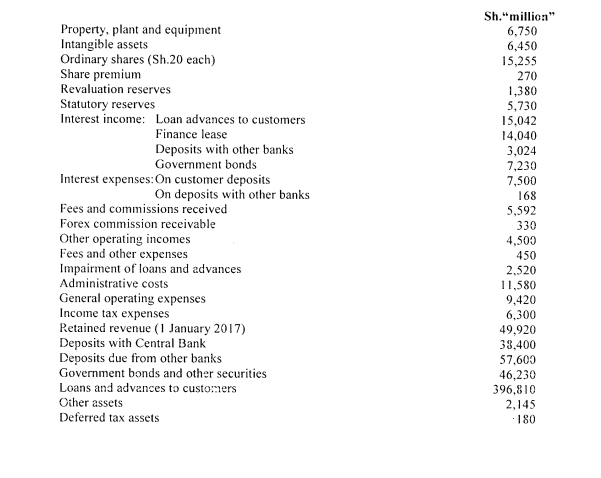

1. The following information was extracted from the books of Maendeleo Commercial Bank Ltd. as at 31 December 2017:

Additional information:

- Intangible assets were impaired by 20% as at the end of the year.

- Property, plant and equipment is to be revalued to Sh.12,750 million.

- An allowance for unserviced loans is to be created at 2% of the outstanding loans and advances to customers.

Required:

Income statement for the year ended 31 December 2017. (6 marks)

Statement of financial position as at 31 December 2017. (6 marks)

2. Royal Contractors Ltd. owns an item of plant used for construction with a carrying value of Sh.14 million as at 31 December 2015. The firm won a construction contract and decided to sell and lease back the machine on that date under the following conditions.

Selling price Sh.40 million. This was also the fair value of the plant.

- Lease rentals payable annually in arrears amaunted to Sh.15,521,200.

- Lease duration for the machine was to be 3 years. The economic life of the machine was also 3 years.

- The implicit interest rate was 8% per annum.

Required:

The journal entries to record the necessary transactions in the books of Royal Contractors Ltd. for the three years, including the expected entries at the end of year 2018. (8 marks)

(Total: 20 marks)

QUESTION FIVE

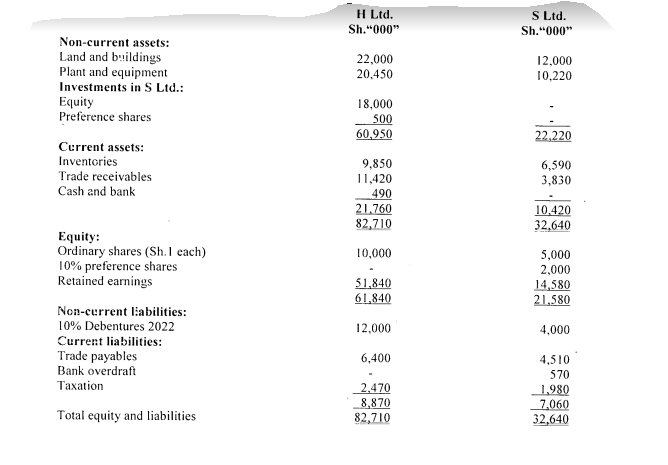

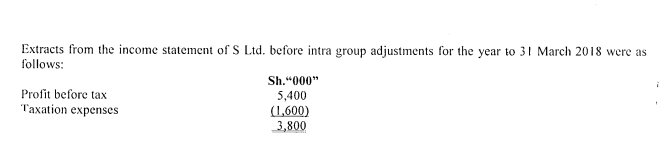

1. On 1April 2017, H Ltd. acquired four million of the ordinary shares of S Ltd., paying Sh.4.50 per share. At the same time, H Ltd. purchased Sh.500,000 of S Ltd.’s 10% redeemable preference shares. At the acquisition date, the retained earnings of S Ltd. were Sh.400,000.

The following are the draft statements of financial position of the two companies as at 31 March 2018:

Additional information:

- Included in the land and buildings of S Ltd. is a large piece of development land at a cost of Sh.5 million. The fair value of the land on the date S Ltd. was acquired was Sh.7 million and by 3 I March 2018, this value had risen to Sh.8.5 million. The group’s valuation policy for development land is that it should be carried at fair value and not depreciated.

- On the date of acquisition of S Ltd., the company’s plant and equipment included plant that had a fair value of Sh.4 million in excess of its carrying value. This plant had a remaining useful life of 5 years. The group calculates depreciation on a straight-line basis. The fair value of the other net assets of S Ltd. approximated their carrying values.

- During the year, S Ltd. sold goods to H Ltd. for Sh.1.8 million. S Ltd. adds a 20% mark up on cost to all its sales. Goods with a transfer price of Sh.450,000 were included in the inventory of H Ltd. as at 31 March 2018. The balance of the current accounts of H Ltd: and S Ltd. was Sh.240,000 on 31 March 2018.

- An impairment test carried out on 31 March 2018 showed that the consolidated goodwill was impaired by Sh. L4.88,000.

- S Ltd. had paid its preference dividend in full and ordinary dividends of Sh.500,000.

Required:

Consolidated statement of financial position of 1-1 Ltd. and its subsidiary S Ltd. as at 3 I March 2018. (14 marks)

2. Discuss the impact of International Financial Reporting Standard (IFRS) 9 on the tax expenses of commercial banks. (6 marks)

(Total: 20 marks)