WEDNESDAY: 7 December 2022. Morning Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. In the context of financial assets and financial liabilities:

Provide an overview of what comprises a “financial asset” and a “financial liability”. (2 marks)

With reference to the measurement and recognition of financial assets, recommend guidance to preparers of financial statements who reclassify financial assets under the following categories:

• Reclassification of a financial asset out of the amortised cost measurement category and into the face value through profit or loss measurement category. (2 marks)

• Reclassification of a financial asset out of the amortised cost measurement category and into the fair value through other comprehensive income measurement category. (4 marks)

2. With reference to International Financial Reporting Standard (IFRS) 11 – Joint Arrangements:

Summarise TWO characteristics of a joint arrangement. (2 marks)

Describe the TWO types of joint arrangements. (2 marks)

Explain the salient provisions on what a joint operator recognises in relation to its interest in a joint operation. (2 marks)

3. With reference to International Public Sector Accounting Standard (IPSAS) 19 – Provisions, Contingent Liabilities and Contingent Assets:

Distinguish between “provisions” and “contingent liabilities”. (2 marks)

Summarise the circumstances for recognition of a provision. (2 marks)

Indicate the accounting treatment for “contingent liabilities” and “contingent assets”. (2 marks)

(Total: 20 marks)

QUESTION TWO

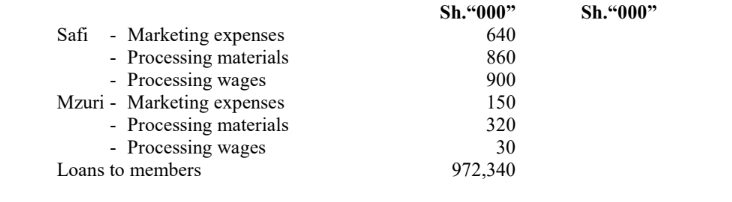

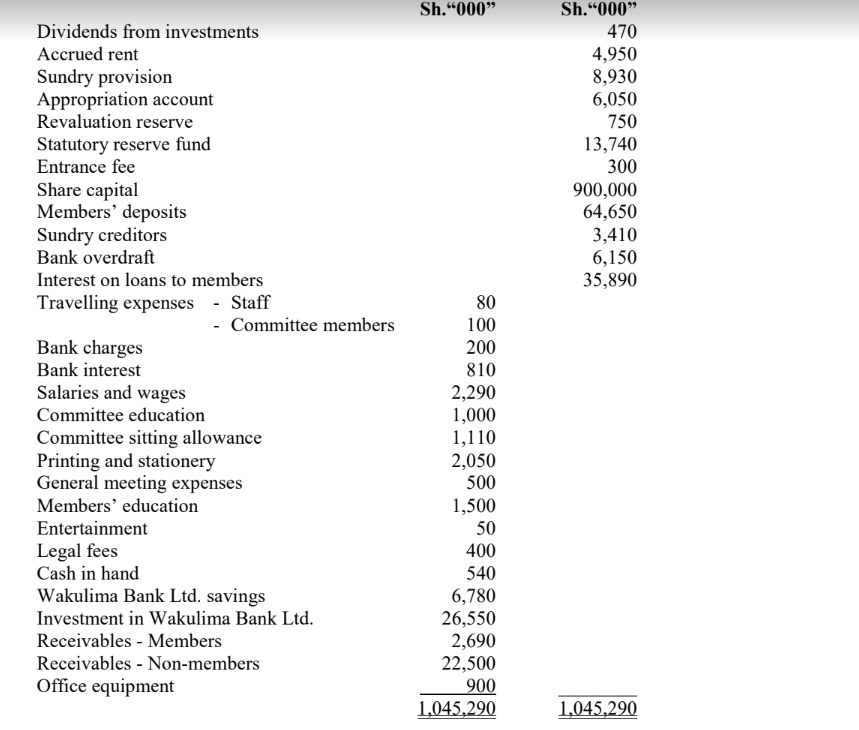

Marula Farmers Cooperative Society Ltd. deals in the marketing of two brands of coffee; Safi and Mzuri on behalf of the

members. As per the society’s bylaws, the society is allowed to retain 20% of sales from Safi and Mzuri for operations and

pay the balance to the members.

The following trial balance was extracted from the books of the society as at 31 December 2021:

Additional information:

1. Bora Limited markets Safi and Mzuri brands for Marula Society. On 31 December 2021, Bora Limited sold Safi and

Mzuri brands for 175,000 United States (US) dollars and 115,300 US dollars respectively. Bora Limited remitted the

above amounts to Marula Farmers’ Wakulima Bank account on 15 January 2022. Marula Farmers Cooperative

Society does not maintain a US dollar account in Wakulima Bank.

2. The exchange rates for the two currencies were as shown below on the respective dates:

Sh./1 US dollar

31 December 2021 105

15 January 2022 100

3. Audit fee of Sh.6,000,000 is to be provided for.

4. Staff salaries and wages amounting to Sh.3,200,000 had not been paid as at 31 December 2021.

5. Interest on members deposits is to be provided at Sh.6,086,000.

6. As per the relevant Ministry regulations, cooperative societies are required to transfer 20% of their net earnings to a

statutory reserve.

Required:

Prepare the following financial statements for Marula Cooperative Society Ltd. for the year ended 31 December 2021:

1. Safi brand marketing account, showing the profit or loss. (3 marks)

2. Mzuri brand marketing account, showing the profit or loss. (3 marks)

3. Statement of profit or loss for the year ended 31 December 2021. (6 marks)

4. Statement of financial position as at 31 December 2021. (8 marks)

(Total: 20 marks)

QUESTION THREE

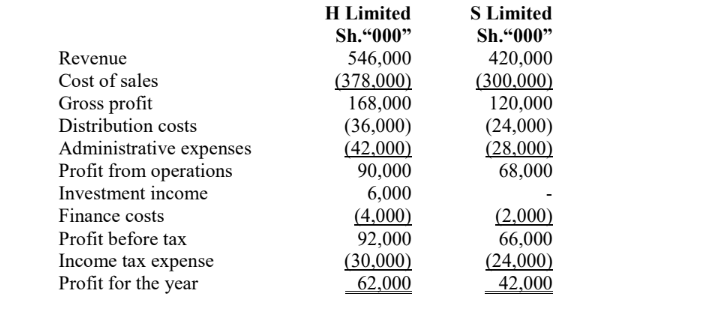

1. On 1 January 2022, H Limited acquired 80% of the 4 million, Sh.10 ordinary shares of S Limited issued at par

value.

The acquisition consideration comprised of three new ordinary shares issued by H Limited in exchange for every

five shares acquired in S Limited.

Additionally, H Limited will pay further consideration on 31 December 2022 of Sh.11 per share acquired. H

Limited’s cost of capital is 10% per annum and the discount factor at 10% for one year is 0.9091.

At the date of acquisition, the fair values of ordinary shares in H Limited and S Limited were Sh.15 and Sh.12

respectively.

The following statements of profit or loss for the year ended 30 September 2022, relate to the two companies:

Additional information:

1. At the date of acquisition, the fair value of S Limited’s net assets approximated their carrying values with the exception of an item of plant and equipment which had a fair value of Sh.24 million above its carrying amount. The remaining economic useful life of the plant and equipment at the date of acquisition was six years. Depreciation is charged to cost of sales.

2. Sales from S Limited to H Limited in the post-acquisition period amounted to Sh.30 million. S Limited reported a gross profit margin of 25% on these sales. H Limited’s inventory includes one fifth (1⁄5) of these goods as at 30 September 2022.

3. H Limited’s policy is to value the non-controlling interests at fair value at the date of acquisition. For this purpose, S Limited’s share price at acquisition date can be deemed to be representative of the fair value of the shares held by the non-controlling interest.

4. H Limited’s investment income is dividend received from its investment in a 40% owned associate which it has held for several years. The associate reported a profit after tax of Sh.30 million for the year ended 30 September 2022.

5. As at 30 September 2022, no impairment of goodwill was considered necessary.

6. Assume that profits and losses accrued evenly throughout the year.

7. As at 1 October 2021, the retained earnings of S Limited were Sh.16 million.

Required:

Calculate the goodwill arising on the acquisition of S Limited. (4 marks)

Consolidated statement of profit or loss for H Group for the year ended 30 September 2022. (8 marks)

Note: All workings should be done to the nearest Sh.“000”.

2. Sayari Limited obtained a 10% loan note amounting to Sh.24 million on 1 January 2021 to finance the construction

of a new factory.

As the funds were not all required immediately, Sayari Limited invested Sh.10 million in 6% bonds until 31 May 2021. Construction of the factory began on 1 March 2021. However, due to an unexpected shortage of skilled labour, the project ceased during the months of July and August 2021.

By 31 December 2021, the project was not complete.

Required:

Explain, with suitable calculations, the accounting treatment of interest on costs on the loan note in the financial statements of Sayari Limited for the year ended 31 December 2021 in accordance with International Accounting Standard (IAS) 23 “Borrowing Costs”. (8 marks)

(Total: 20 marks)

QUESTION FOUR

1. Ratio analysis has over time proven to be a useful financial tool for decision making. However, reliance on ratios for decision making has inherent limitations.

Required:

Citing SIX limitations, justify the above statement. (6 marks)

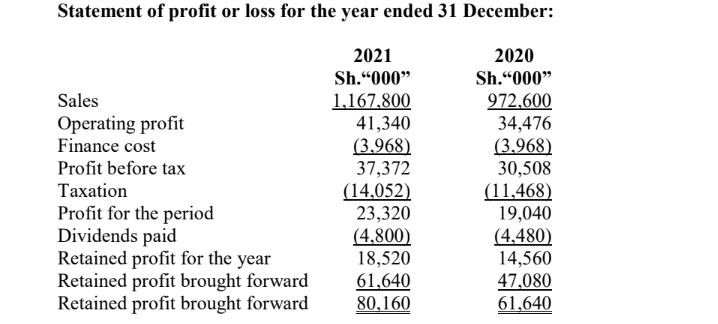

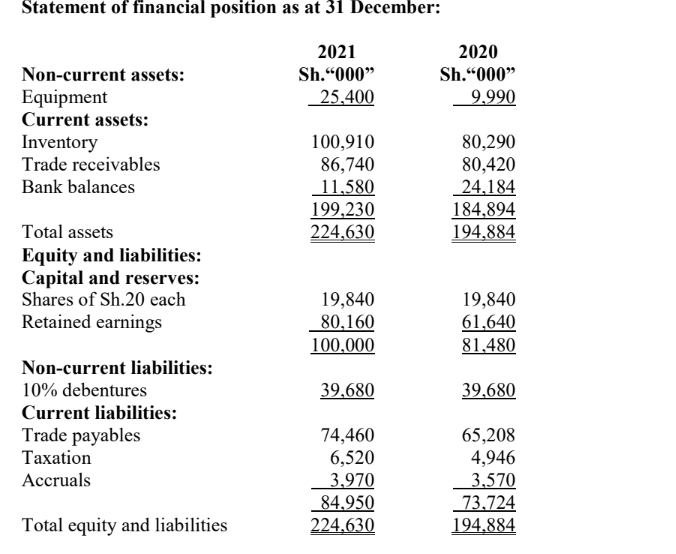

2. The following draft financial statements were extracted from the books of Mrima Limited as at 31 December:

Required:

Calculate for each year, TWO ratios for each of the following user groups, which are of particular significance to them:

Shareholders. (4 marks)

Trade payables. (2 marks)

Internal management. (2 marks)

3. Comment on the changes between the two years as reflected in the ratios calculated in 2 above. (6 marks)

(Total: 20 marks)

QUESTION FIVE

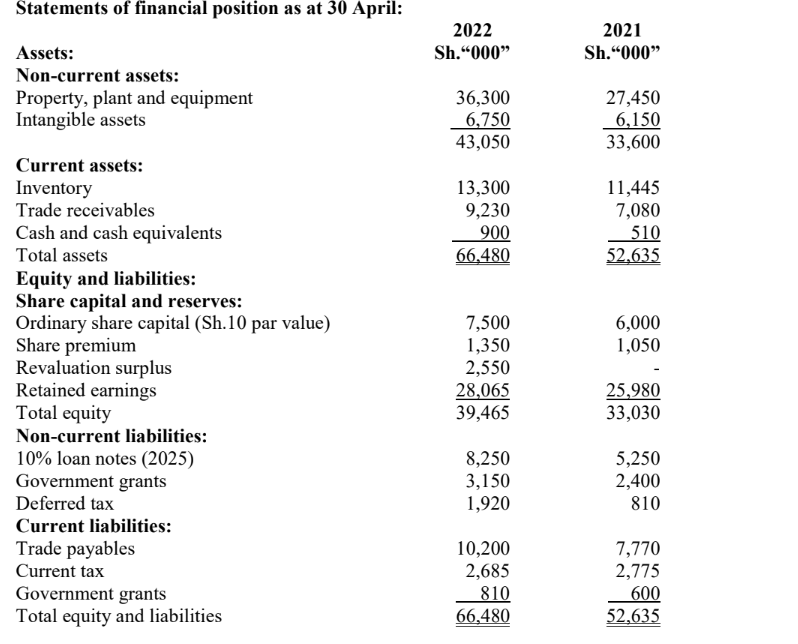

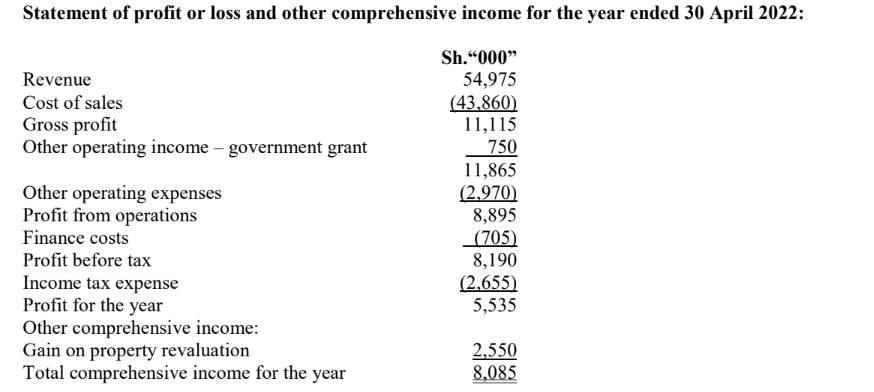

The following draft financial statements were extracted from the financial records of Maalum Limited, a public limited entity, as at 30 April 2022 with comparatives for the year ended 30 April 2021.

Additional information:

1. Maalum Limited acquired some new plant during the year to 30 April 2022 at a cost of Sh.1,800,000 from a finance

company. An arrangement was made at the date of acquisition for the liability for the plant to be settled by Maalum Limited issuing at par a 10% loan note dated 2025 to the finance company. The value by which the loan note exceeded the liability for the plant was received from the finance company in cash.

2. The company’s motor vehicle haulage fleet with a cost of Sh.2,630,000 and accumulated depreciation of Sh.1,165,000 was disposed of during the year for cash proceeds of Sh.1,810,000. The profit on disposal has been included in the other operating expenses.

3. Depreciation charged on property, plant and equipment during the year was Sh.5,490,000 and was included in the cost of sales.

4. Intangible assets were amortised during the year and amortisation charged to profit or loss amounted to Sh.540,000.

5. During the year ended 30 April 2022, Maalum Limited made a bonus issue of ordinary shares of one new share for

every ten shares held utilising the share premium account.

Required:

A statement of cash flows for Maalum Limited for the year ended 30 April 2022 using the indirect method in accordance with International Accounting Standard (IAS) 7 “Statement of Cash Flows”. (Total: 20 marks)