THURSDAY: 16 December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Accounting in general and financial reporting in particular are undergoing a dynamic transformation both in function and practice. Global forces are continuously reshaping accountancy as a profession.

Required:

In the context of the above statement, describe how the following forces are transforming the future of accounting:

Cloud based accounting solutions. (2 marks)

Automation of the accounting function. (2 marks)

Outsourcing of accounting services. (2 marks)

Data analytics. (2 marks)

2. In the context of International Public Sector Accounting Standard (IPSAS) 24 — Presentation of Budget Information in Financial Statements:

Explain the salient feature that differentiates an “original budget” from a “final budget”. (2 marks)

Summarise the key provisions of the IPSAS with regard to presentation of a comparison of budget and actual amounts. (4 marks)

3. Describe two methods for translating foreign currencies into the local currency. (6 marks)

(Total: 20 marks)

QUESTION TWO

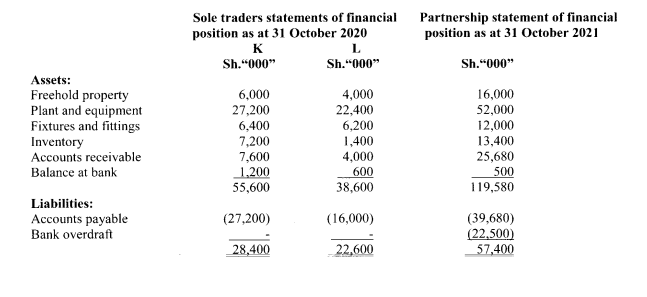

K and L were sole traders manufacturing solar equipment. On 31 October 2020, they amalgamated and traded as partners sharing profits and losses in the ratio of 3:2 respectively. One year later, on 31 October 2021, they converted the partnership into a limited liability company called Kilo Ltd.

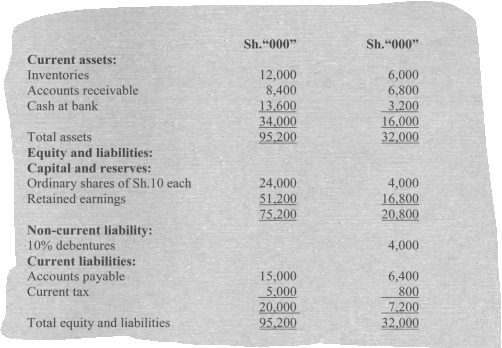

No adjustments have been made to record the amalgamation and conversion but the summarised statements of financial position for the sole traders as at 31 October 2020 and the partnership as at 31 October 2021 were as follows:

Additional Information:

- On 1 April 2020, the partners agreed to take up the assets and liabilities of the individual traders at book values except for freehold property, plant and equipment and fixtures and fittings which were to be revalued as follows:

K L

Sh.”000″ Sh.”000″

Freehold property 8,000 6,000

Plant and equipment 26,000 22,000

Fixtures and fittings 6,000 6,000

- During the year ended 31 October 2021, K made drawings of Sh.9,560,000 while L withdrew Sh.2,440,000.

- The partnership was converted into a limited company on the following terms:

- The freehold property and accounts receivable were revalued to Sh.24,000,000 and Sh.22,680,000 respectively.

- K and L were to receive 15% unsecured debentures at par so as to provide each partner with income equivalent to a 6% return on capital employed based on capital balances as at 31 October 2021 (that is after accounting for the profit, drawings and revaluation in bullet (i) above).

- Kilo Ltd’s. authorised share capital was made up of 600,000 ordinary shares of Sh.50 each, out of which 520,000 shares were to be issued to the partners in their profit sharing ratio.

- Any balances in the partners’ capital accounts were to be settled in cash.

Required:

A computation showing the value of debentures and ordinary shares to be issued to the partners. (10 marks)

Partners capital accounts as at 31 October 2021. (4 marks)

Statement of financial position of Kilo Ltd. as at 31 October 2021 after completing the above transactions on conversion. (6 marks)

(Total: 20 marks)

QUESTION THREE

1. Various analytical tools are today utilised in financial statements analysis. Some of these tools include:

- Ratio analysis.

- Trend analysis.

- Common size financial statements.

Required:

In the context of the statement above, describe how each of the above tools is utilised in practice. (6 marks)

2. Summarise four attributes of good financial statement analysis. (4 marks)

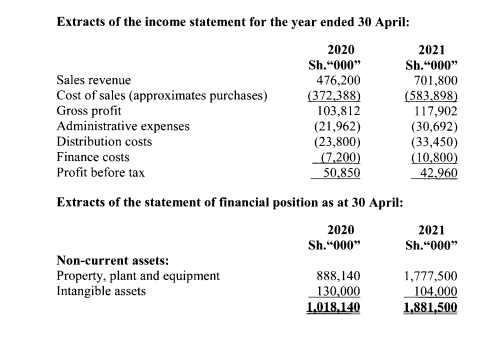

3. The following are extracts of financial statements from the books of Zawadi Ltd.:

Required:

Analyse and interpret the performance and efficiency of the company for the two years ended 30 April 2020 and 2021 using:

Gross profit margin. (2 marks)

Return on capital employed. (2 marks)

Inventory turnover period. (2 marks)

Trade receivables collection period. (2 marks)

Trade payables payment period. (2 marks)

(Total: 20 marks)

QUESTION FOUR

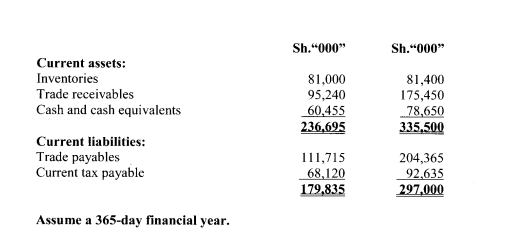

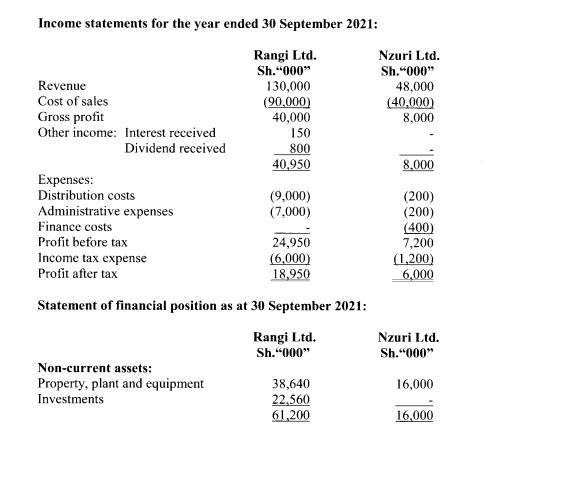

On 1 January 2021, Rangi Ltd. acquired the following in Nzuri Ltd.:

- 80% of the ordinary share capital of Nzuri Ltd. for Sh.20,560,000

- Half of the 10% debentures in Nzuri Ltd.

The summarised financial statements of Rangi Ltd. and Nzuri Ltd. for the year ended 30 September 2021 were as follows: Income statements for the year ended 30 September 2021:

Additional information:

- The fair value of the assets of Nzuri Ltd. at the date of acquisition were the same as their book values except for an item of plant whose fair value was more by Sh.6.4 million. As at 1 January 2021, the plant had a remaining useful life of four years. Nzuri Ltd. depreciates plant on straight line basis on cost.

- During the post acquisition period, inter-company trading that occurred included:

- Rangi Ltd. sold goods to Nzuri Ltd. for Sh.12 million. These goods had cost Rangi Ltd. Sh.18 million.

- Nzuri Ltd. sold some of the goods purchased from Rangi Ltd. at Sh.20 million for Sh.30 million.

- On 30 June 2021, Rangi Ltd. and Nzuri Ltd. paid dividends of Sh.2 million and Sh.1 million respectively.

- Included in the accounts receivable and account payable is Sh.1.5 million being the amount Nzuri Ltd. owed Rangi Ltd.

- Goodwill is considered to be impaired by 25% as at 30 September 2021. Goodwill impaired is classified as an administrative expense by the group companies.

Required:

Group income statement for the year ended 30 September 2021. (10 marks)

Group statement of financial position as at 30 September 2021. (10 marks)

(Total 20 marks)

QUESTION FIVE

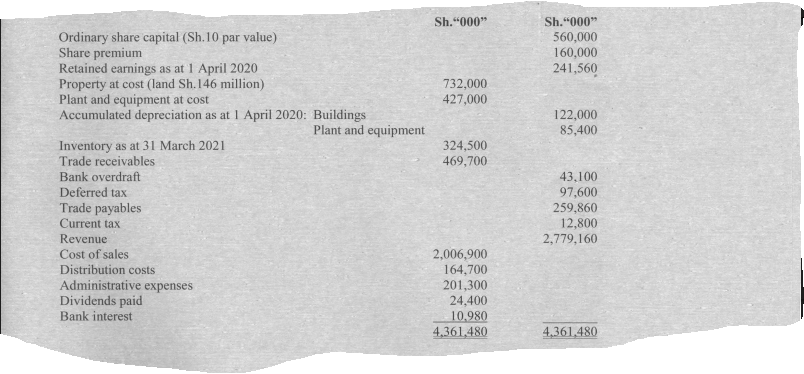

The following trial balance relates to Bawabu Limited as at 31 March 2021:

Additional information:

- On 1 April 2020, the directors of Bawabu Limited resolved that the financial statements would show an improved position if the property was revalued to market value. At that date, an independent valuer valued the land at Sh.160 million and the buildings at Sh. 485 million. The remaining life of the buildings as at that date was 25 years. Bawabu Limited does not make a transfer to retained earnings for excess depreciation. Ignore deferred tax on the revaluation surplus.

- Plant and equipment is depreciated at a rate of 15% per annum using the reducing balance method. All depreciation is charged to cost of sales, but none has yet been charged on any non-current assets for the year ended 31 March 2021.

- Bawabu Limited estimated that an income tax provision of Sh.113.8 million is required for the year ended 31 March 2021. The balance on the current tax in the trial balance represents the under/over provision of the tax liability for the year ended 31 March 2020. As at 31 March 2021, the tax base of Bawabu Limited’s net assets was Sh.292 million less than the carrying amounts. The income tax rate of Bawabu Limited is 30%.

- Bawabu Limited made a 1 for 5 bonus issue on 31 March 2021, which has not yet been recorded in the books of account. The company intends to utilise the share premium as far as possible in providing for the bonus issue.

Required:

Statement of profit or loss for the year ended 31 March 2021. (8 marks)

Statement of financial position as at 31 March 2021. (12 marks)

(Total: 20 marks)