TUESDAY: 5 April 2022. Morning paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. International Public Sector Accounting Standards (IPSAS) 23 – Revenue from Non-Exchange Transactions (Taxes and Transfers) prescribes requirements for the financial reporting of revenue arising from non-exchange transactions other than non-exchange transactions that give rise to an entity combination.

Required:

In the context of the IPSAS 23, describe the following:

(1) The measurement and recognition of revenue from non-exchange transactions. (4 marks)

The measurement of assets on initial recognition. (2 marks)

Conditions for recognition of a present obligation as a liability. (2 marks)

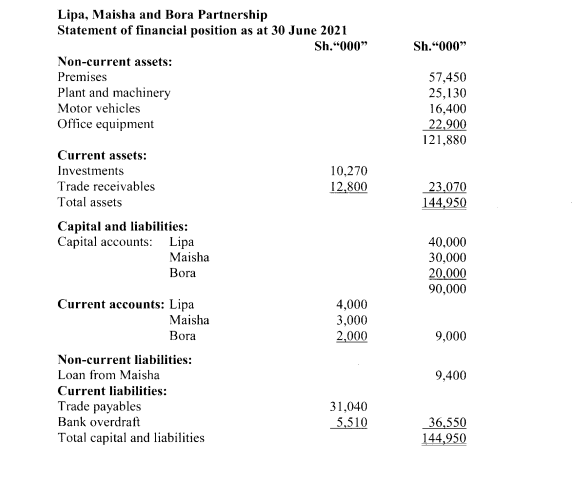

2. Lipa, Maisha and Bora have been in partnership business sharing profits and losses in the ratio of 2:2:1 respectively.

The draft statement of financial position of the partnership extracted as at 30 June 2021 revealed the following:

Due to irreconcilable differences, the partners dissolved their business with effect from 1 July 2021, under the following terms:

- , Partner Maisha took over the loan he had advanced to the partnership while Lipa took over one of the motor vehicles at a valuation of Sh.5 million.

- The rest of the assets were realised in three stages of piecemeal realisation as follows:

Sh.”000″

First realisation 42,310

Second realisation 24,890

Third realisation 71,000

- Realisation expenses amounting to Sh.1,140,000 were settled in cash.

- The trade payables accepted Sh.28 million in full settlement of their claims.

- The rule in Garner Vs. Murray applies where applicable.

Required:

A schedule of cash distribution to the partners. (6 marks)

Realisation account. (3 marks)

Partners’ capital accounts. (3 marks)

(Total: 20 marks)

QUESTION TWO

Super Cars Limited deals in car accessories. Roughly 75% of sales are on credit while the balance are on cash sales.

Super Cars Limited engaged an analyst who extracted the following summary of industry ratios:

Return on year end capital employed 28.1%

Net asset (equal to capital employed) turnover 4 times

Gross profit margin 17%

Net profit (before tax) margin 6.30%

Current ratio 1.6:1

Closing inventory holding period 46 days

Trade receivables collection period 45 days

Trade payables’ payment period 55 days

Dividend yield 3.75%

Dividend cover 2 times

Super Cars Limited summarised financial statements for the year ended 31 December 2021 are as provided below:

Statement of profit or loss for the year ended 31 December 2021

Sh.”000″ Sh.”000″

Revenue 20,000

Cost of sales 17,250)

Gross profit 2,750

Operating expenses (1,850)

900

Profit on disposal of plant 200

Finance cost (100)

Profit before tax 1,000

Income tax expense (250)

Profit for the period 750

Statement of financial position as at 30 December 2021

Sh.”000″ Sh.”000″

Non-current assets:

Property, plant and equipment 2,750

Current assets:

Inventory 1,250

Trade receivables 1,800 3,050

Total assets

Sh.”000″ Sh.”000″

Equity and liabilities:

Capital and reserves:

Ordinary shares of Sh.100 each 500

Retained earnings 1,900

=2,400

Non-current liabilities:

8% debentures 1,000

Current liabilities:

Trade payables 2,150

Current tax 200

Bank overdraft 50 2,400

Total equity and liabilities 5,800

Additional information:

- Super Cars Limited received Sh.600,000 from the sale of plant that had a carrying amount of Sh.400,000 at the date of its sale.

- The market price of Super Cars Limited’s shares throughout the year averaged Sh.375 each.

- There were no issues or redemption of shares or loans during the year.

- Dividends paid during the year ended 31 December 2021 amounted to Sh.450,000, maintaining the same dividend paid in the year ended 31 December 2020.

Required:

With reference to the industry ratios, compute the equivalent ratios for Super Cars Limited for the year ended 31 December 2021. (12 marks)

Using the ratios computed in (a) above, analyse the financial performance and position of Super Cars Limited for the year ended 31 December 2021 compared to the industry. (8 marks)

(Total: 20 marks)

QUESTION THREE

The following trial balance was prepared by Millennium Ltd. as at 30 June 2021:

Sh.”000″ Sh.”000″

Ordinary share capital (Sh.10 each) 40,000

8% Redeemable preference shares 12,000

6% Debentures 10,000

Revaluation surplus 3,400

Retained earnings (1 July 2020) 14,100

Revenue 283,460

Inventory (1 July 2020) 12,400

Purchases 147,200

Distribution costs 22,300

Administrative expenses 34,440

Interest on debentures 300

Interim dividends – Preference 480

– Ordinary 2,000

Investment income 1,500

Land and building (land Sh.16 million) 56,000

Plant and equipment (cost) 55,000

Furniture and fittings (cost) 35,000

Investments at fair value 34,500

Accumulated depreciation:

– Building 8,000

– Plant and equipment 12,800

– Furniture and fittings 9,600

Accounts receivable 35,950

Bank 10,740

Accounts payable 17,770

Deferred tax 5,200

Share premium 7, 000

= 435,570 = 435,570

Additional Information:

- The sales proceeds include customers’ deposits of Sh.4,200,000 which Millennium Ltd. accounted for by debiting bank and crediting sales.

- The cost of inventory as at 30 June 2021 was valued at Sh.16,000,000. This included goods whose cost was Sh.450,000, replacement value Sh.400,000, fair value of Sh.500,000 with a selling cost of Sh.80,000.

- The 6% debentures were issued on I October 2020 at par. Interest on debenture is payable semi-annually.

- Land and building are carried under the revaluation model as permitted by IFRSs. The most recent valuation took place on 30 June 2019 resulting in the value included in the trial balance above. The revaluation surplus of Sh.3,400,000 resulted solely from the land and building. The building was estimated to have a useful economic life of 50 years as at that date. On 30 June 2021, land was revalued at Sh.18,500,000 and the building at Sh.34,000,000.

There was no change in the useful life estimates of the building. Depreciation on building is recognised on a straight line basis.

- Other assets are being depreciated as follows:

- Plant and equipment at 20% per annum on straight line basis.

- Furniture and fittings at 25% per annum on reducing balance method.

Depreciation is classified as cost of sales except for depreciation on furniture and fittings which is classified as administrative expense.

- A provision for corporation tax of Sh.24,500,000 for the year ended 30 June 2021 is required.

- The taxable timing differences for the year amounted to Sh.45,000,000 while the deductible timing differences were Sh.24,000,000.

- The directors proposed to pay a final ordinary dividend of 10% on 28 June 2021.

Required:

Statement of comprehensive income for the year ended 30 June 2021. (8 marks)

Statement of financial position as at 30 June 2021. (12 marks)

(Total: 20 marks)

QUESTION FOUR

1. With reference to International Accounting Standard (lAS) 21 – The Effects of Changes in Foreign Exchange Rates:

Explain the accounting treatment of exchange differences arising on monetary items. (3 marks)

Describe the disclosures required in the financial statements of the reporting entity. (3 marks)

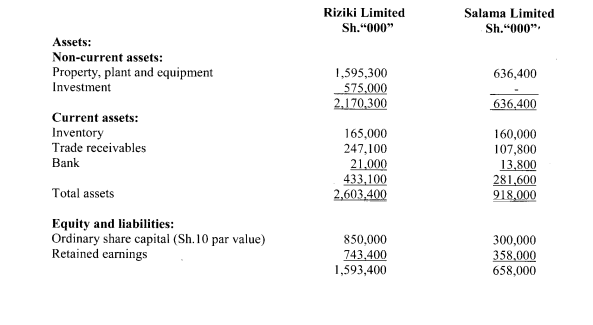

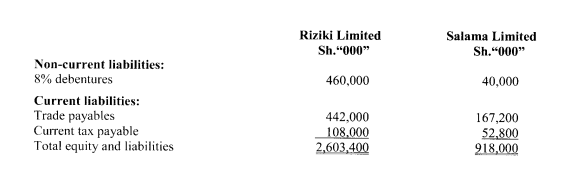

2. On 1 April 2021, Riziki Limited acquired 75% of the equity shares of Salama Limited when the retained earnings of Salama Limited stood at Sh.234 million. The acquisition consideration consisted of cash amounting to Sh.510 million and share exchange on the basis of 2 ordinary shares of Riziki Limited for every 3 ordinary shares acquired in Salama Limited. The market value of Riziki Limited’s shares as at 1 April 2021 was Sh.16 per share. No accounting entries have been made in respect of the share exchange consideration.

The draft statements of financial position of the two companies as at 31 March 2022 are as presented below:

Additional Information:

- The fair values of Salama Limited’s net assets approximated their carrying amounts with the exception of a specialised piece of equipment which had a fair value of Sh.120 million in excess of its carrying amount. This equipment had a ten-year remaining useful life on 1 April 2021.

- It is the group’s policy to value the non-controlling interest at fair value at the date of acquisition. The fair value of the non-controlling interest in Salama Limited on 1 April 2021 was estimated at Sh.144 million.

- During the year to 31 March 2022, Salama Limited sold goods to Riziki Limited for Sh.64 million earning a gross margin of 25% on the sale. Riziki Limited still held Sh.48 million worth of these goods in the inventory at 31 March 2022. Salama Limited still had the full invoice value of Sh.64 million in its trade receivables at 31 March 2022, however, Riziki Limited’s trade payables only showed Sh.34 million as it made a payment of Sh.30 million on 31 March 2022.

- On 1 April 2021, Riziki Limited also acquired a 30% equity interest in Amua Ltd. for Sh.65 million in cash. Amua Limited sustained heavy losses over the last few years and Riziki Limited hoped it would turn it around through its significant influence over Amua Limited. In the year ended 31 March 2022, Amua Limited made a loss of Sh.150 million.

- Impairment tests performed on 31 March 2022, revealed that the investment in Amua Limited had been impaired by Sh.5 million due to sustained trading losses. However, no impairment was required in respect of goodwill arising on acquisition of Salama Limited.

Required:

Determine the value of investment in Amua Limited as at 31 March 2022. (3 marks

Calculate the value of goodwill arising on acquisition of Salama Limited. (3 marks)

Consolidated statement of financial position for Riziki Group as at 31 March 2022. (8 marks)

(Total: 20 marks)

QUESTION FIVE

1. With reference to International Accounting Standards (IAS) 41 – Agriculture:

Describe the key provisions on measurement of agricultural produce. (5 marks)

Highlight six disclosure requirements where fair value of the farm produce cannot be measured reliably. (6 marks)

2. Zeon Limited, a public limited entity is in the process of finalising its financial statements for the year ended 31 October 2021.

The following information has been extracted from its accounting records for the purpose of estimating the deferred tax balance:

- inventory is stated in the financial statements at the lower of cost and net realisable value. The company wrote down its inventory by Sh.120 million to a net realisable value of Sh.1,130 million. The reduction in value is ignored for tax purposes until the inventory is sold.

- Trade receivables had a carrying amount of Sh.450 million after making a general provision for doubtfuldebts of Sh.30 million. The provision is not allowed for tax purposes.

- Property, plant and equipment has a carrying amount of Sh.3,050 million and a tax base of Sh.2,750 million. During the year ended 31 October 2021, property was revalued upwards by Sh.150 million.

- During the year to 31 October 2021, development expenditure amounting to Sh.480 million was capitalised. Amortisation of Sh.20 million was charged to profit or loss for the year. This development expenditure was allowed for tax purposes in full during the year.

- Trade and other payables are carried at Sh.600 million. Included in the other payables are accrued expenses of Sh.100 million whose related expenses are deductible for tax purposes on cash paid basis.

- Deferred tax liability as at 1 November 2020 amounted to Sh.272 million.

- The income tax rate of 30% is applicable.

Required:

Compute the relevant temporary differences. (5 marks)

Deferred tax account as at 31 October 2021. (4 marks)

(Total: 20 marks)