In order to succeed in this paper, candidates must be very well versed with the relevant International Financial Reporting Standards (IFRSs) and International Accounting Standards (IASs) and their application in different circumstances. As with all Accounting papers, marks are earned based on the correct application of the requirements of IFRSs/IASs, accuracy of figures, neatness, presentation as well as interpretation.

Some candidates did not perform well in the following questions:

Question 1 (a) and (b)

Majority of the candidates had difficulties in tackling question one (a)(i) and (ii) which required candidates to answer the following questions which are reproduced here for ease of reference:

The expected responses were as follows:

1 (i) What comprises a “financial asset” and a “financial liability”:

Financial asset – The term financial asset has been defined in the following manner:

A financial asset is any asset that is:

- Cash.

- An equity instrument of another entity.

- A contractual right:

- To receive cash or another financial asset from another entity; or

- To exchange financial assets or financial liabilities with another entity under conditions that are potentially favourable to the entity

or

- A contract that will or may be settled in the entity’s own equity instruments.

Examples of financial assets can be investments in equity instruments, investments in debt instruments, trade receivables, cash and cash equivalents, derivative financial assets and so on.

Financial liability – The term financial liability has been defined in the following manner:

A financial liability is any liability that is:

- A contractual obligation:

- To deliver cash or another financial asset to another entity; or

- To exchange financial assets or financial liabilities with another entity under conditions that are potentially unfavourable to the entity; or

- A contract that will or may be settled in the entity’s own equity instruments.

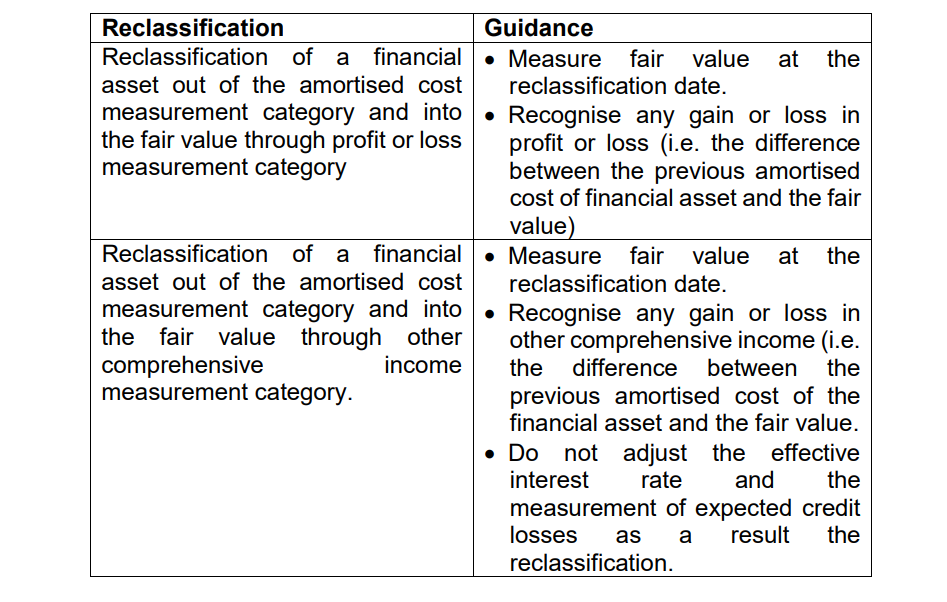

(ii) Guidance to preparers of financial statements on reclassification of financial assets:

2. Most of the candidates had difficulties in tackling question one (b) (i), (ii) and (iii) which are reproduced as follows:

Candidates were required to respond as follows:

3. (i) Characteristics of a joint arrangement:

A joint arrangement has the following characteristics: [IFRS 11:5]

- The parties are bound by a contractual arrangement and

- The contractual arrangement gives two or more of those parties joint control of the arrangement.

(ii) Types of joint arrangements:

Joint arrangements are either joint operations or joint ventures:

- A joint operation is a joint arrangement whereby the parties that have joint control of the arrangement have rights to the assets and obligations for the liabilities, relating to the arrangement. Those parties are called joint operators. [IFRS 11:15].

- A joint venture is a joint arrangement whereby the parties that have joint control of the arrangement have rights to the net assets of the arrangement. Those parties are called joint venturers.

(iii) A joint operator recognises the following in relation to its interest in a joint operation:

- Its assets, including its share of any assets held jointly;

- Its liabilities, including its share of any liabilities incurred jointly;

- Its revenue from the sale of its share of the output of the joint operation;

- Its share of the revenue from the sale of the output by the joint operation;

and - Its expenses, including its share of any expenses incurred jointly.

A joint operator accounts for the assets, liabilities, revenues and expenses relating to its involvement in a joint operation in accordance with the relevant IFRSs.

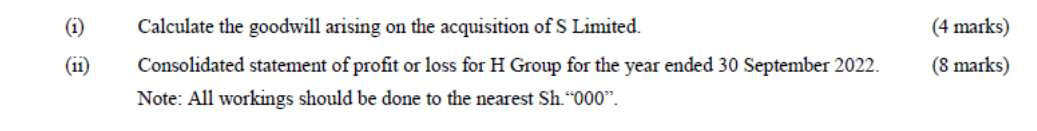

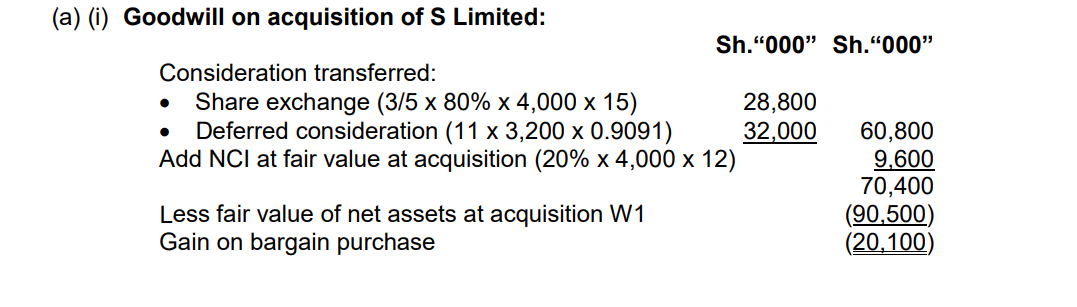

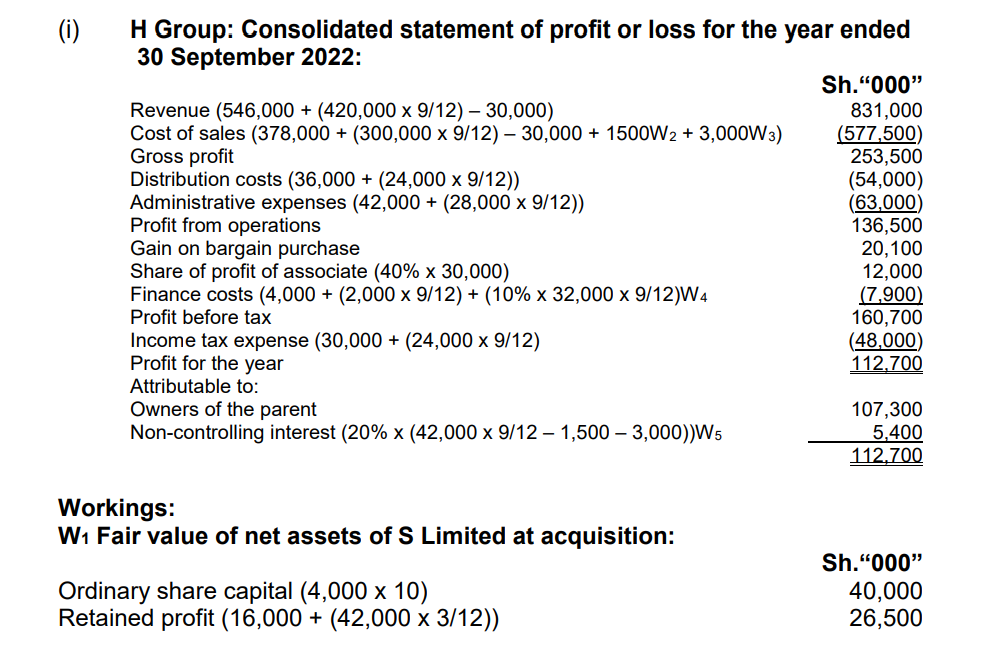

Question 3 (a)

Candidates were provided with details relating to a company (H Limited) acquiring control of another company (S Limited). Majority of the candidates had difficulties in answering the following questions:

The expected solutions were as follows:

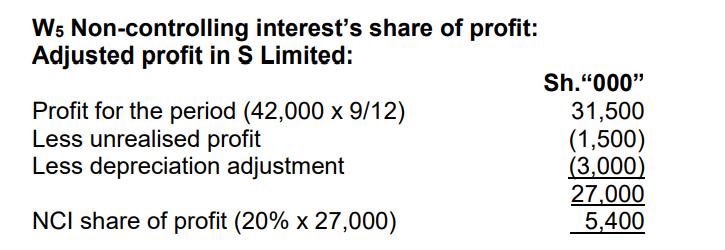

Key issues to note in this question were as follows:

- Other than a cash payment, consideration for the acquisition of shares can also be done through a share exchange.

- The results of the subsidiary company are consolidated for nine months only during the current year (that is 1.1.2022 to 30.9.2022)

- Part of the consideration may be paid at a certain date in the future (hence deferred consideration). Where this is the case, the time value of money has to be considered hence the present value of the consideration is the one that is booked to the cost of control account. As the discount unwinds (Sh 2.4 m), it is regarded as a finance cost and charged to the holding company’s SPLOCI.

- In cases where there is negative goodwill (also called gain on acquisition or bargain purchase gain) such as in this question, IFRS 3 (Business Combinations) allows this figure to be treated as a realised gain hence booked

in its entirety to the credit of the SPLOCI.

Question 3 (b)

Candidates had challenges in utilising the provided details in explaining with support of suitable calculations the accounting treatment of interest on costs on the loan note in the financial statements of the company (Sayari Limited) in

accordance with International Accounting Standard (IAS) 23 “Borrowing Costs”.

The expected solutions were as follows:

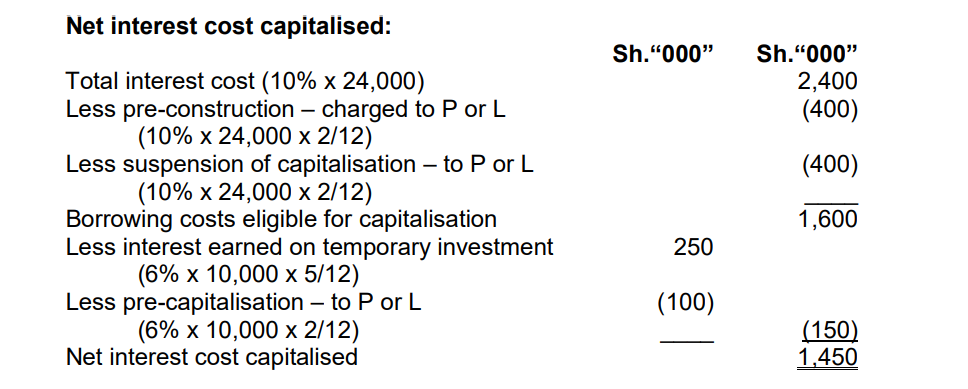

(b) IAS 23 – Borrowing costs

- Interest cost will only be capitalised as part of the cost of a qualifying asset during the period of active construction during the year.

- Interest cost incurred before the commencement of capitalisation period and during the suspension of capitalisation, should be charged to profit or loss.

- Interest income earned from temporary investment of surplus funds should be deducted from the borrowing costs eligible for capitalisation, to the extent that the interest income was earned during the capitalisation period.

- Therefore, interest income earned during the pre-construction period should be excluded from the determination of borrowing costs to be capitalised.