The financial plan is an important part of the business plan because it is here that the profitability of the intended business is demonstrated to the entrepreneur and to the potential financiers. It provides a tool for monitoring the financial performance of the

business. In this section of the module, an analysis of financial requirements of a business is presented. The financial plans development is also illustrated.

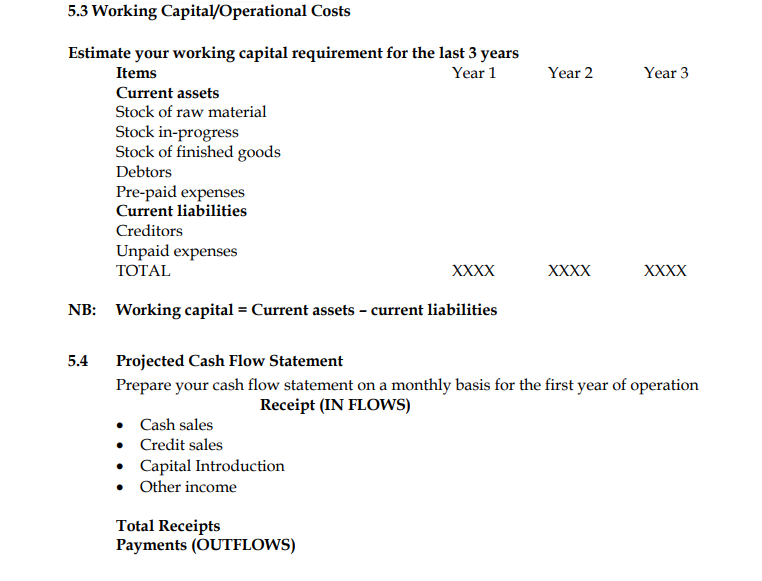

5.1 Financial assumptions

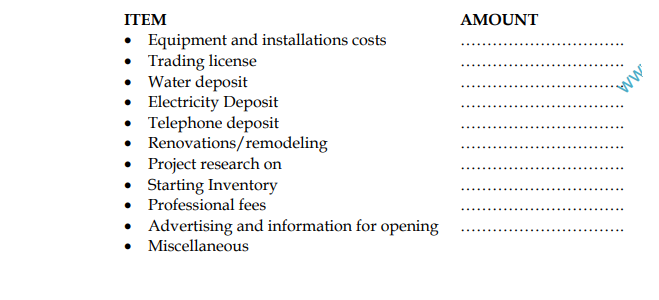

5.2 Pre-Operational costs

- Cash purchase

- Payments to creditors

- Salaries wages

- Rent

- Electricity

- Water

- Advertising

- Maintenance

- Repair

- Postage

- Stationery

- Transport

- Taxes

- Interest

Total Cash Outflow

Net Cash

Accumulative Cash

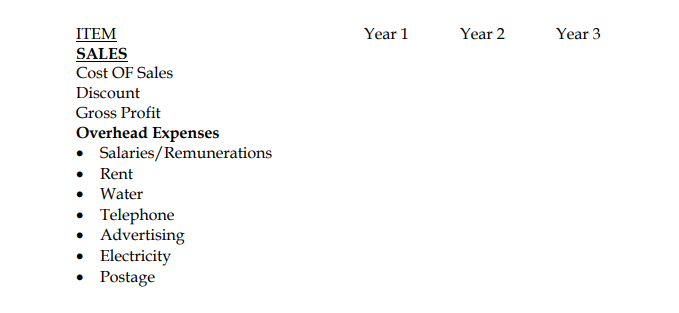

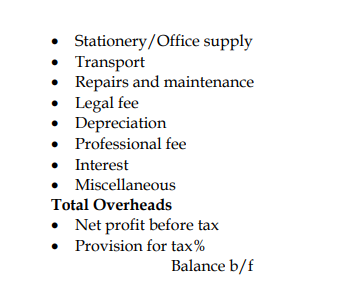

5.5. Pro-Forma Profit And Loss Account (Income Statement)

This is to summarize all the incomes and expenses incurred during that accounting period and show the net profit or loss incurred.

Prepare your Pro-forma Income Statements/Income Statement for the first years 3 years of operation.

Use the format below

5.6. Pro-Forma Balance Sheet

This financial statement depicts the financial structure of a business at the end of an accounting period. It has three major components: assets, liabilities, and stockholders’ equity. They show what the business owns or controls, how much is owed to creditors, and the residue net worth of the enterprise after asset value has debt subtracted from it. Put another way, a balance sheet shows how assets are financed: either by debt (shown in the liabilities section) or by its owners’ capital (shown in shareholders’ equity).

Therefore: assets = liabilities + owner’s equity.

At the end of each accounting period, profit after taxes is added to the retained earnings accounts in the balance sheet.

Outline your proforma balance sheet at the start of business and at the end of the first two years.

Year 1 Year 2 Year 3

Fixed

Current

LIABILITIES

CAPITAL

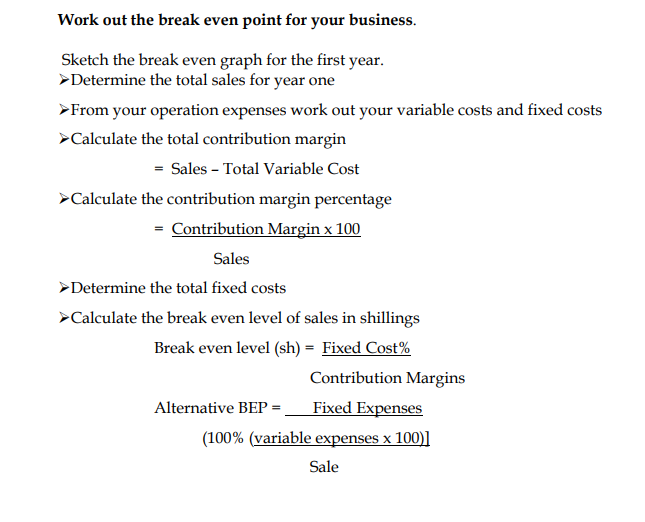

5.7 Break Even Analysis

The break-even analysis is used to analyze the effect on profits of different costs, volumes, and prices. This analysis shows the level of sales required to support the overhead of the business. The break-even point is that point at which the business will cover all its costs

but will make me profit.

The figures that we will use in the analysis can all be taken from your profit and losses. The first step is to break down all expenses, including cost f goods sold, into three categories: fixed, variable, and semi-variable. Fixed costs are those which remain the same

regardless of the amount of sales. Some examples that are commonly fixed are: rent, management salaries, depreciation, interest, and professional services. Variable expenses are those expenses that vary directly with sales volume. Variable costs are direct material,

sales commissions, and shipping costs. Semi-variable costs are those costs which vary with sales, but not indirect proportion. For example, if you double your sales, your utility expenses may increase but it probably will not double; on the other hand, it your sales drop to 0, utility expenses may fall, but it will not fall to

5.11 The Implementation Schedule

Include a time line chart showing significant milestones and their priority for completion. Demonstrate that you know what must be done and how you will pursue these goals in a realistic way within a reasonable time frame. Identify the critical milestones. Summarize

the implications of not reaching them and your alternative action plans.

5.12 Critical Risks And Possible Solutions

The aim of this last component of the business plan is to demonstrate your knowledge of inheritable or potential problems and risks and to show your willingness and ability to face them and deal with them.

Relevant questions

- What are the inherent and potential problems , risk and other negatives your business may or will be faced with

- Will your intended business face any stringent regulatory requirements

- What potential legal liability or insurance problems might you face

- How can you avoid this problem, manage them or minimize their impact

- Can any problem be turned into opportunities?

Types of critical risks and problem

The are three types of critical risks and problems that you may wish to consider

- Inevitable risks and risks and problems

Describe the nature of the problem and risks that your venture will be faced with, discuss how you will avoid or minimize their impacts - Potential risks and problems

Discuss the circumstances and situations that would prompt this risks and problems and how you will deal with them if they did - Worst case scenario

Give a worst case scenario of all inherent and potential risks that your intended business may suffer. summarize the consequences and what, if anything could be salvaged or recovered if these risks materialize .