METHODS OF OPERATION OF THE CENTRAL BANK INCLUDING PRUDENT REGULATION OF THE FINANCIAL SYSTEM.

Functions of central bank-Money and banking handout.

The rationale for regulation

Financial systems are prone to periods of instability. In recent years, a number of financial crises around the world (South-east Asia, Latin America and Russia, Global financial crisis) have brought about a large number of bank failures. Some argue that this suggests a case for more effective regulation and supervision. Others attribute many of these crises to the failure of regulation. Advocates of the so-called ‘free banking’ argue that the financial sector would work better without regulation, supervision and central banking.

In the absence of government regulation, they argue, banks would have greater incentives to prevent failures. However, the financial services industry is a politically sensitive one and largely relies on public confidence. Because of the nature of their activities(illiquid assets and short term liabilities), banks are more prone to troubles than other firms. Further, because of the interconnectedness of banks, the failure of one institution can immediately affect others. This is known as bank contagion and may lead to bank runs.

Banking systems are vulnerable to systemic risk, which is the risk that problems in one bank will spread through the whole sector. Bank runs occur when a large number of depositors, fearing that their bank is unsound and about to fail, try to withdraw their savings within a short period of time. A bank run starts when the public begins to suspect that a bank may become insolvent. This creates a problem because banks want to keep only a small fraction of deposits in cash; they lend out the majority of deposits to borrowers or use the funds to purchase other interest-bearing assets. When a bank is faced with a sudden increase in withdrawals, it needs to increase its liquidity to meet depositors’ demands. Bank reserves may not be sufficient to cover the withdrawals and banks may be forced to sell their assets. Banks assets (loans) are highly illiquid in the absence of a secondary market and if banks have financial difficulties they may be forced to sell loans at a loss (known as ‘fire-sale’ prices in the United States) in order to obtain liquidity. However, excessive losses made on such loan sales can make the bank insolvent and bring about bank failure.

Bank loans are highly illiquid because of information asymmetries. The very nature of banks’ contracts can turn an illiquidity problem (lack of short-term cash) into insolvency (where a bank is unable to meet its obligations or to put this differently when the value of its assets is less than its liabilities).

Regulation is needed to ensure consumers’ confidence in the financial sector. According to Llewellyn (1999) the main reasons for financial sector regulation are:

- To ensure systemic stability;

- To provide smaller, retail clients with protection; and

- To protect consumers against monopolistic exploitation.

Systemic stability is one of the main reasons for regulation, as the social costs of bank failure are greater than the private costs.

The second concern is with consumer protection. In financial markets ‘caveat emptor’ (‘Let the buyer beware’) is not considered adequate, as financial contracts are often complex and opaque. The costs of acquiring information are high, particularly for small, retail customers. Consumer protection is a particularly sensitive issue if customers face the loss of their lifetime savings. Finally, regulation serves the purpose of protecting consumers against the abuse of monopoly power in product pricing.

The most common objectives of financial sector regulation are:

- Prudential: To reduce the level of risk bank creditors are exposed to (i.e. to protect depositors)

- Systemic risk reduction: to reduce the risk of disruption resulting from adverse trading conditions for banks causing multiple or major bank failures

- Avoid misuse of banks: to reduce the risk of banks being used for criminal purposes, e.g. laundering the proceeds of crime

- To protect banking confidentiality

- Credit allocation: to direct credit to favoured sectors

Existing financial sector regulatory framework in Kenya

The existing regulatory framework for the financial sector in Kenya consists of a number of independent regulators each charged with the supervision of their particular sub sectors. The creation of the Insurance Regulatory Authority completed the shift from having departments under the Ministry of Finance to having independent regulators for each sub-sector.

The current regulatory structure is characterized by regulatory gaps, regulatory overlaps, multiplicity of regulators, inconsistency of regulations and differences in operational standards. For example, some of the regulators have at least partial exemption from the State Corporations Act while others do not, some have tax exemption, and others do not. Some regulators have powers to issue regulations while in other cases the power is retained by the Minister for Finance. This regulatory framework is clearly captured by the figure below.

DEPOSIT AND NON DEPOSIT TAKING FINANCIAL INSTITUTIONS.

Financial Markets

Financial markets are places where financial instruments are bought and sold. The markets relay information, shift risk, set prices, and help move resource to their most valued use. Smooth financial markets are key to an efficient economy. This section studies general aspects of financial markets.

The Role of Financial Markets

Even though there are hundreds of financial markets. The roles of each market Will be at least one of three basic things with regards to the buying and/or selling of financial instruments:

- Liquidity: Markets help to ensure that buyer and sellers have quick and cheap access to financial instruments. Agents will have the ability to quickly move in and out a financial instrument.

- Information: Markets will pool and communicate information about the buy- ers and sellers of a financial instrument. This is one of the basics of supplyand demand.

- Risk Sharing: Markets allow individuals to share or pool risk across the entire market. Agents prefer stability and sharing risk is one way to help increasestability.

The Structure of Financial Markets

There are hundreds of financial markets that govern the supply and demand of financial instruments. Luckily there are some common ways to group markets according to certain properties: where instruments are traded, the way which instruments are traded, and the type of instrument.

Primary versus Secondary Markets

Primary Markets: Financial markets where newly-issued assets are sold. IPOs and issuing of new debt.

Secondary Markets: Financial markets where existing securities are traded. Most transactions on NSE and other markets.

Centralized Exchanges versus Over-The-Counter Markets

Centralized Exchanges: A secondary financial market where buyers and sellers of assets must meet in a central physical location to make trades.

Over-The Counter (OTC) Markets: A secondary financial market where buyers and sellers can meet electronically to make trades in several places.

Debt and Equity versus Derivative Markets

Debt and Equity Markets: Trades are made and result in immediate cash payments.

Stocks and bonds of this type. Derivative Markets: Claims are made for transactions that will lead to future cash payments. Futures and options are examples of this.

Characteristics of a Well-Run Financial Market Well-Run financial markets have three characteristics:

- Low Transactions Cost: The trading of financial instruments is done quickly and cheaply. Today’s efficient markets perform millions if not billions of transactions in a single day.

- Full Information: The markets must pool and provide correct information. Accurate information is key to an efficient market. If information is incorrect, agents may make incorrect decisions.

- Protection: Any promises of payments or collection of debts must have legal backing. Without parties could simply walkout of arrangements. This is and information is why the stock market uses the SEC.

Financial Institutions

Financial Institutions are the firms which provide access to financial markets. These institutions serve as a middle man between savers and borrowers and are thus some times called financial intermediaries. This sections briefly discusses the role and structure of financial institutions.

10.2.1. The Role of Financial Institutions

The main purpose of a financial institution is to reduce transactions costs by special-ization in some particular financial instrument. These firms also reduce information costs by having efficient methods of monitoring and screening potential borrowers. Financial institutions streamline many things which individual would find costly or impossible to do. Think about investing in the stock market without a brokerage firm.

The Structure of the Financial Industry

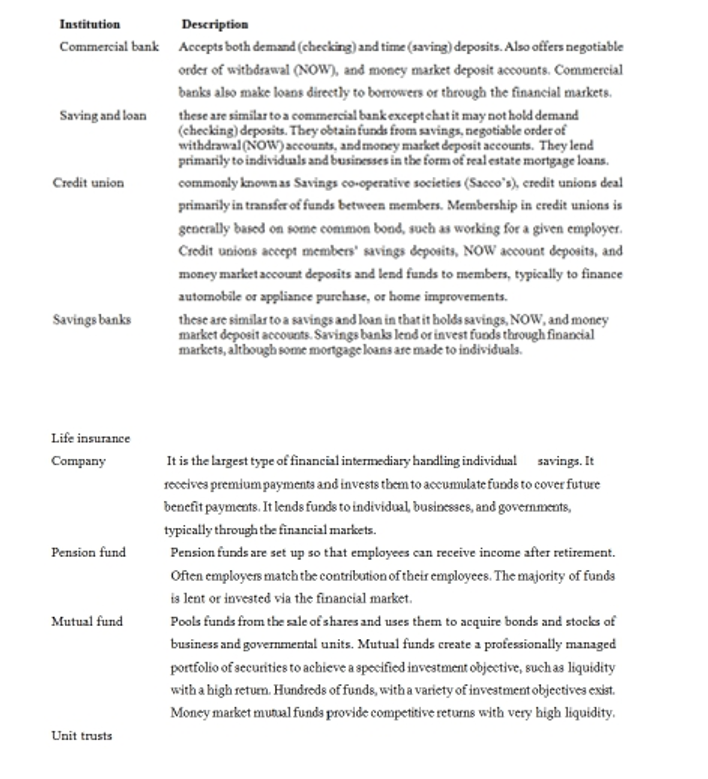

The structure of financial industry is summarized by breaking firms into two categories: depository and non-depository institutions. A depository institution takes in deposits and makes loans. These are more typically called banks. Non-depository institutions trade other financial instruments. These include insurance companies, securities firms, pension funds, and others. We can generally classify financial firms into six categories:

- Depository Institutions: These firms take in deposits and make loans. These include commercial banks, credit unions, and savings banks among others.

- Insurance Companies: These firms accept premiums which are typically invested. In return, they promise to pay compensation to policyholders should a certain event occur. You name an event and you can probably buy insurance for it.

- Pension Funds: These firms invest individual or group contributions into the financial market in order to provide retirement payments.

- Securities Firms: These firms include brokers, investment banks, and mutual fund companies. These firms act like middle men. They give individuals access to financial markets. The individual faced the risk of the investment.

Finance Companies: Use a pool of assets to make loans to customers. Unlikebanks, these firms use financial debts to make loans not deposits.

- Government-Sponsored Enterprises: Federal agencies which provide loans directly to farmers and home mortgagors.

There are other financial institutions that exist as sources and users of funds besides commercial banks. The U.S. financial system is categorized into two broad groups: deposit institutions and non-deposit institutions

Deposit Institution

Savings and loan associations, savings banks, and credit unions, in addition to commercial banks, are considered deposit institutions because they accept deposits from customers and provide some form of checking account. While each of these institutions has traditionally served specific financial needs of individuals and businesses, deregulation has blurred the distinctions among them. For example, at one time only commercial banks offered checking accounts. However, savings and loan associations and savings banks currently offer interest-paying NOW accounts. Credit unions offer their own variant in the form of share draft accounts. Although thrifts, as savings and loan associations and savings banks are commonly called, have traditionally served as sources of home mortgages, many commercial banks now compete in the home mortgage market. All of these institutions compete by offering passbook accounts, time deposits, traveler’s checks, and a variety of other banking services with competitive rates.

Thrifts: Savings and Loan Associations and Savings Banks.

A savings and loan association (S&L) is a financial institution offering both savings and checking accounts and using most of its funds to make home mortgage loans. Their original purpose was to encourage family thrift and home ownership, and for years, S&Ls were permitted to pay slightly higher interest rates to savers than could commercial banks. Deposited funds were then used to make long-term, fixed-rate mortgages at prevailing mortgage rates.

Savings banks, also known as mutual savings banks, are virtually identical to S&Ls. Their origins can be traced to the early 1800s in Boston and Philadelphia, where they were established to provide interest on savings accounts. The early U.S.banks did not provide such accounts, and the first savings banks were designed to meet the savings and borrowing needs of individual households. They oper- ate much like S&Ls in offering NOW accounts and other savings accounts and in making home mortgage loans, and they have faced similar competitive pressures.

Like the S&Ls, they are now permitted to make consumer and some business loans.

To gain competitive advantages in loan production, Great American First Savings Bank, headquartered

SPECIAL FINANCIAL INSTITUTIONS IN THE BANKING SECTOR.

The major financial institutions in Kenya economy are commercial banks, savings and loans, credit unions, savings banks, life insurance companies, pension funds, and mutual funds. These institutions attract funds from individuals, businesses, and governments, combine them, and make loans available to individuals and businesses. A brief description of the major financial institutions follows.

Other specialized financial institutions

- Industrial and commercial Development Corporation (LC.D.C) I. C.D.C was established in 1954 by the government. Its main objective was to promote industrial & commercial development in Kenya. Its specifically provides financial or technical assistance to small enterprises. Financial assistance may be in the form of working capital financing or purchase of fixed assets. This may take the form of equity or debt financing. Equity is provided by large- scale enterprises with more than 50 employees. Loans are given to both small and medium sized enterprise. Long-term loans repayment period is 6 years for industrial and up to 10 years for commercial loans

- Agricultural finance corporation (AFC) it was established by the government in 1963. The main objective is to provide support for the agricultural sector. This is through provision of short term and long-term loans. The loans must be for a defined project by a farmer. Loans may be short term or long term and there exist flexibility to allow its repayment.

- Kenya Industrial Estate (KIE) It was established in 1967 At inception it was a wholly owned subsidiary of ICDC. However in 1978 it was separated from ICDC and become an independent body as a parastatal under the ministry of industry. The main objective of K1E is to assist in the development of new projects and the expansion and modernization of new business enterprise. This is through the provision of finds and technical assistance. They provide both debt and equity finance.

- Kenya Tourist Development Corporations: (KTDC) The KTDC was established in 1960’s. Its main responsibility was carrying out Investigations, formulation and study of projects development of the tourism industry KTDC Provides financial assistance in forms of loan, for tourism related enterprises. It has substantial share —holdings in local hotels, which includes Hilton, Serena, and Pan Africa etc.

- Industrial Development Bank (IDB) Was established in 1963 as a limited company. The main objective of setting this Institution was to promote industrial development in Kenya through the establishment promotion and expansion of small or large-scale enterprises. This is through financial assistance in the form of loans, provision of guarantee and securities and underwriting

- Hire — purchase financial companies These are institutions, which provides assets on credit with an arrangement to pay the principal and interest in installment basis. However, the legal ownership of the assets remains with the hire-purchase company. The title is transferred when the last installment is made. Hire Purchase Company’s in Kenya include- Kenya finance corporation (KFC), Pan-Afric credit finance Ltd, Investment and mortgage Ltd. etc.

- Insurance Companies The main role of insurance companies is to assist individuals and corporate bodies safeguard against future risks. May also engage in other activities. The main capital for insurance companies is the premium paid by the policy holders. Forms of Insurance Company’s in Kenya includes: – Life Insurance, Third party insurance etc. Examples of Insurance company’s in Kenya include: jubilee insurance company, pan African insurance company, Blue shield insurance Co. Ltd. etc.

- Building societies/Housing finance Co: These ale financial institution, which provide finance to the public so as to purchase or construct houses. The individual or corporate bodies make deposit upon which they later receive loan for acquiring or constructing house. Some buildings societies in Kenya include: Housing finance corporation (HFC), East African building society and Pioneer building society.

- Pension and provident scheme institution These institutions obtain funds from both employees and employers of contribution. They manage and invest thesefunds so as to meet the current and future obligations of the pension scheme to its members.

- Merchant Banks It originated and also derives its name from the activities of wealth merchants who provided credit for the trading ventures. The ventures were for small-scale merchants. Before the establishment of banking systems in the 19th century, the merchants changed their role of merchants and started offering financial service. Today merchant banks performs the role of under- writing and assisting companies to raise capital in the financial markets They underwrite the security issues, buy and sell securities and provide advice inInvestment in securities.

Example Discuss non deposit taking financial institution in Kenya

Solution:

Hire — purchase financial companies These are institutions, which provides assetson credit with an arrangement to pay the principal and interest in installment basis.

However, the legal ownership of the assets remains with the hire-purchase company.

Insurance Companies The main role of insurance companies is to assist individuals and corporate bodies safeguard against future risks. May also engage in other activities. The main capital for insurance companies is the premium paid by the policyholders.

Building societies/Housing finance Co: These are financial institution, which pro vide finance to the public so as to purchase or construct houses. The individual or corporate bodies make deposit upon which they later receive loan for acquiring or constructing house.

Pension and provident scheme institution These institutions obtain funds from both employees and employers of contribution. They manage and invest these funds so as to meet the current and future obligations of the pension scheme to its members.

Mutual fund Pools funds from the sale of shares and uses them to acquire bonds and stocks of business and governmental units. Mutual funds create a professionally managed portfolio of securities to achieve a specified investment objective, such as liquidity with a high return.