WEDNESDAY: 1 September 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. The concept of time value of money lays a solid foundation upon which other finance concepts are developed.

In light of the above statement, explain three applications of the concept of time value of money. (6 marks)

2. Highlight four advantages of the wealth maximisation objective of a firm. (4 marks)

3. Belta Limited issued a 16% corporate bond with a par value of Sh.1,000. The bond will either be redeemed at 20% premium after 5 years or convertible into equity at a conversion rate of Sh.100 per 2 ordinary shares. Each ordinary share is currently trading at the Securities Exchange for Sh.50. It is expected that the share price will increase at a constant rate of 5% each year.

The minimum required rate of return by investors is 12%.

Required:

The current value of the redeemable bond. (3 marks)

The current value of the convertible bond. (3 marks)

Propose four advantages that would accrue to Belta Limited by using commercial papers as a source of finance. (4 marks)

(Total: 20 marks)

QUESTION TWO

1. Maridadi Ltd. is a firm that operates in the textile industry. The firm’s operating profit, that is, earnings before interest and tax (EBIT) over the next five years are forecasted as follows:

Year 2021 2022 2023 2024 2025

Operating profit (EBIT) Sh. “000” 10,000 12,000 15,000 16,000 18,000

Additional information:

- The firm expects to incur a fixed financing cost of Sh.20,000,000 in the year 2021. This is expected to rise at a constant rate of 10% each year.

- The firm’s acceptable investments to be financed each year are given as follows:

Year 2021 2022 2023 2024 2025

Acceptable projects Sh. “000” 3,000 4,500 5,000 6,500 7,000

- Corporation tax rate is 30%.

- The number of issued ordinary shares are 10,000,000. These are expected to remain constant each year.

Required:

Dividend per share (DPS) payable in each year assuming the firm adopts 40% payout ratio as its dividend policy. (4 marks)

Dividend per share (DPS) payable in each year assuming the firm adopts a residual dividend policy. (4 marks)

2. Jahazi Limited is considering investing in the purchase of a machine for its manufacturing process at a cost of Sh.5,000,000. Installation cost of the machine is expected to be Sh.500,000. The machine is expected to have a useful life of five years, at the end of which, salvage value is estimated at Sh.800,000. This investment shall lead to increase in sales. In order to support increased sales, the firm requires an extra investment in working capital at the start of the machine’s useful life. Inventory balances will increase by Sh.1,200,000, debtors balances will rise by Sh.1,500,000 and creditors balance will increase by Sh.1,700,000. The additional investment in working capital will be recovered at the end of the machine’s useful life.

The quantity of the product to be manufactured and sold in each year are estimated as follows:

Year Quantity (Units)

1 20,000

2 25,000

3 30,000

4 35,000

5 40,000

Additional information:

- The unit selling price and unit variable costs incurred are estimated at Sh.45 and Sh.15 respectively. These are expected to remain constant each year.

- The firm’s estimated fixed operating costs excluding depreciation are Sh.100,000 per annum.

- The machine will require an overhaul at the end of the second year. This overhaul cost will amount to Sh.240,000.

The overhaul cost will be ammortised separately on a straight line basis over the remaining useful life of the asset.

- The firm provides for depreciation on a reducing balance basis at the rate of 32% per annum.

- The cost of capital is 13%.

- The corporation tax rate is 30%.

Required:

Using the net present value (NPV) technique, advise on the suitability or otherwise of the project. (12 marks)

(Total: 20 marks)

QUESTION THREE

1. An efficient and sound financial system of a country plays an important role in the economic development of that country.

In relation to the above statement, explain five functions of a financial system. (5 marks)

2. Hakika Ltd. is a newly listed company in the local Securities Exchange. The company has 1 million ordinary shares trading at Sh.49.50 per share. To finance a restructuring exercise, the company requires Sh.7,855,000. To raise the amount, the company intends to issue a one for five rights issue at a subscription price of Sh.39 per share. The finance manager has projected that upon restructuring, the company’s annual cash inflows would increase by Sh.965,000.

In the previous financial year, the company paid a dividend of Sh.5 per share. The dividend and the company’s earnings are expected to grow by 5% annually upon restructuring.

Required:

The price of the shares after the rights issue but before they start selling ex-rights. (4 marks)

The theoretical ex-rights price of the shares. (3 marks)

The theoretical value of the rights when the shares are selling cum-rights. (2 marks)

3. Theophilus Akumu has a capital of Sh.1,000,000 which she intends to invest in two securities; namely Security A and Security B.

She plans to invest Sh.200,000 in Security A, and Sh.800,000 in Security B.

The returns of the two securities have the following characteristics depending on the state of the economy:

State of the Returns (%)

economy Probability Security

A B

Recession 0.40 18 24

Stable 0.50 14 22

Expansion 0.10 12 21

Required:

Expected return for the portfolio comprising of Security A and Security B. (3 marks)

Correlation coefficient between Securities A and B. (3 marks)

(Total: 20 marks)

QUESTION FOUR

1. Summarise five features of the efficient markets hypothesis. (5 marks)

2. Examine four challenges of Islamic banking in your country. (4 marks)

3. Upesi. Wholesalers Ltd. deals in sale of foodstuffs to retailers. Owing to economic depression, the firm intends to relax its credit policy to boost productivity and sales.

The firm’s current credit policy is “net 30” and the average debt collection period is 45 days.

The current annual credit in amount to Sh.60 million. The firm intends to change to “net 60” where sales are expected to increase by 25%. Credit and debt analysis costs will increase from the current 2% to 2.5% of credit sales. Bad debts will also increase from the current 1.5% to 2% of credit sales, variable costs account for 75% of sales and return on assets is 12%. Assume a 360 day year.

Required:

Advise the company on whether to adopt the new credit policy. (6 marks)

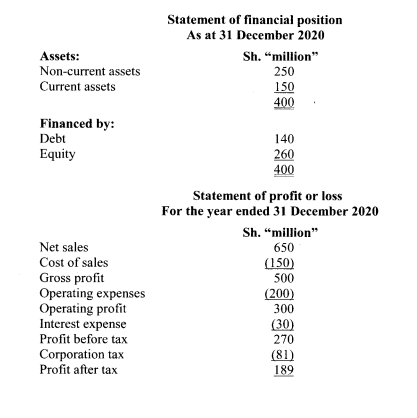

4. The following financial data relates to Penguine Limited for the year ended 31 December 2020:

Additional information:

- The firm’s cost of equity is 12%.

- Corporation tax rate is 30%.

- Interest rate on debt is 10%.

Required:

Compute the Economic Value Added (EVA) of the company. (5 marks)

(Total: 20 marks)

QUESTION FIVE

1. Differentiate between the following terms as used in capital budgeting decisions:

“Hard capital” and “Soft capital” (2 marks)

“Sunk costs” and “Opportunity costs”. (2 marks)

“Independent projects” and “Mutually exclusive projects”. (2 marks)

2. The management of Biashara Ltd. are in the process of determining the optimal capital budget of the company for the year ending 31 December 2021.

The following information is available:

- The profit after tax for the year ending 31 December 2021 is estimated to be Sh.22,500,000.

- The retention ratio is 60%.

- The ordinary shares of the company are currently trading on the securities exchange at Sh.80 per share.

- Ordinary shareholders expect a dividend of Sh.6 per share for the year ending 31 December 2021.

- The annual growth rate in dividend is 6% per annum.

- Floatation costs amounts to Sh.8 per share issued.

- The company could issue an unlimited number of 11% preference shares at Sh.96 per share. The par value is Sh.100.

- The company could obtain a bank loan of upto Sh.24,000,000 at a pre-tax interest rate of 10% per annum.

Thereafter, an unlimited amount of bonds could be issued under the following terms:

- Coupon interest rate of 12% per annum.

- Par value at Sh.1,000 per bond.

- Discount of Sh.30 per bond.

- Floatation cost of Sh.20 per bond.

- Maturity period of ten years.

- The optimal capital structure of the company comprises 15% debt, 40% preference shares capital and 45% equity.

- Corporate tax rate is 30%.

Required:

The cost of capital for each source of finance available to Biashara Ltd. (6 marks)

The break-point(s) in the marginal cost of capital (MCC) schedule with respect to retained earnings and debt. (4 marks)

The marginal cost of capital (MCC) at each break-point identified in (ii) above. (4 marks)

(Total: 20 marks)