Financial management is that managerial activity which is concerned with planning and control of a firm’s financial resources. It used to be a branch of economics till 1890; as a separate discipline it is of recent origin. Even now it is not an independent body of knowledge, and draws heavily on economics for its theoretical concepts.

The subject of financial management is of immense interest to both academicians and practising managers. It is of great interest to academicians because the subject is still developing, and there are still certain areas where controversies exist for which no unanimous solutions have been reached as yet. Practising managers are interested in this subject because among the most crucial decisions of the firm are those which relate to finance, and an understanding of the theory of financial management provides them with conceptual and analytical insights to make those decisions skillfully.

SCOPE OF FINANCE

What is finance? What are a firm’s financial activities? How are they related to the firm’s other activities? Firms create manufacturing capacities for production of goods; some provide services to customers. They sell their goods or services to earn profit. They raise funds to acquire manufacturing and other facilities. Thus, the three most important activities of a business firm are:

production marketing finance

A firm secures whatever capital it needs and employs it (finance activity) in activities which generate returns on invested capital (production and marketing activities).

Real and Financial Assets

A firm requires real assets to carry on its business. Tangible real assets are physical assets that include plant, machinery, office, factory, furniture and building. Intangible real assets include technical know-how, technological collaborations, patents and copyrights. Financial assets, also called securities, are financial papers or instruments such as shares and bonds or debentures. Firms issue securities to investors in the primary capital markets to raise necessary funds. The securities issued by firms are traded—bought and sold—by investors in the secondary capital markets, referred to as stock exchanges. Financial assets also include lease obligations and borrowings from banks, financial institutions and other sources. In a lease, the lessee obtains a right to use the lessor’s asset for an agreed amount of rental over the period of lease. Funds applied to assets by the firm are called capital expenditures or investment. The firm expects to receive return on investment and might distribute return (or profit) as dividends to investors.

Equity and Borrowed Funds

There are two types of funds that a firm can raise: equity funds (simply called equity) and borrowed funds (called debt). A firm sells shares to acquire equity funds. Shares represent ownership rights of their holders. Buyers of shares are called shareholders (or stockholders), and they are the legal owners of the firm whose shares they hold. Shareholders invest their money in the shares of a company in the expectation of a return on their invested capital. The return consists of dividend and capital gain. Shareholders make capital gains (or losses) by selling their shares.

Shareholders can be of two types: ordinary and preference. Preference shareholders receive dividend at a fixed rate, and they have a priority over ordinary (equity)shareholders. The dividend rate for ordinary shareholders is not fixed, and it can vary from year to year depending on the decision of the board of directors. The payment of dividends to shareholders is not a legal obligation; it depends on the discretion of the board of directors. Since ordinary shareholders receive dividend (or repayment of invested capital, in case the company is wound up) after meeting the obligations of others, they are generally called owners of residue. Dividends paid by a company are not deductible expenses for calculating corporate income taxes, and they are paid out of profits after corporate taxes. As per the current laws in India, a company is required to pay 12.5 per cent tax on dividends.

A company can also obtain equity funds by retaining earnings available for shareholders. Retained earnings, which could be referred to as internal equity, are undistributed profits of equity capital. The retention of earnings can be considered as a form of raising new capital. If a company distributes all earnings to shareholders, then, it can reacquire new capital from the same sources (existing shareholders) by issuing new shares called rights shares. Also, a public issue of shares may be made to attract new (as well as the existing) shareholders to contribute to equity capital.

Finance and Management Functions Another important source of securing capital is creditors or lenders. Lenders are not the owners of the company. They make money available to the firm as loan or debt and retain title to the funds lent. Loans are generally furnished for a specified period at a fixed rate of interest. For lenders, the return on loans or debt comes in the form of interest paid by the firm. Interest is a cost of debt to the firm. Payment of interest is a legal obligation on the part of the firm. The amount of interest paid by a firm is a deductible expense for computing corporate income taxes. Thus, the interest provides tax shield to a firm. The interest tax shield is valuable to a firm. The firm may borrow funds from a large number of sources, such as banks, financial institutions and public or by issuing bonds or debentures. A bond or a debenture is a certificate acknowledging the amount of money lent by a bondholder to the company. It states the amount, the rate of interest and the maturity of the bond or debenture. Since bond or debenture is a financial instrument, it can be traded in the secondary capital markets.

There exists an inseparable relationship between finance on the one hand and production, marketing and other functions on the other. Almost all business activities, directly or indirectly, involve the acquisition and use of funds. For example, recruitment and promotion of employees in production is clearly a responsibility of the production department; but it requires payment of wages and salaries and other benefits, and thus, involves finance. Similarly, buying a new machine or replacing an old machine for the purpose of increasing productive capacity affects the flow of funds. Sales promotion policies come within the purview of marketing, but advertising and other sales promotion activities require outlays of cash and therefore, affect financial resources.

Where is the separation between production and marketing functions on the one hand and the finance function of making money available to meet the costs of production and marketing operations on the other hand? Where do the production and marketing functions end and the finance function begins? There are no clear-cut answers to these questions. The finance function of raising and using money although has a significant effect on other functions, yet it needs not necessarily limit or constrain the general running of the business. A company in a tight financial position will, of course, give more weight to financial considerations, and devise its marketing and production strategies in the light of the financial constraint. On the other hand, management of a company, which has a reservoir of funds or a regular supply of funds, will be more flexible in formulating its production and marketing policies. In fact, financial policies will be devised to fit production and marketing decisions of a firm in practice.

FINANCE FUNCTIONS

It may be difficult to separate the finance functions from production, marketing and other functions, but the functions themselves can be readily identified. The functions of raising funds, investing them in assets and distributing returns earned from assets to shareholders are respectively known as financing decisions, investment decisions and dividend decisions. A firm attempts to balance cash inflows and outflows while performing these functions. This is called liquidity decision, and we may add it to the list of important finance decisions or functions. Thus finance functions or decisions are divided into long-term and short-term decisions as below:

Long-term finance functions or decisions: Long-term asset-mix or investment decision

Capital-mix or financing decision

Profit allocation or dividend decision

Short-term finance functions or decisions: Short-term asset-mix or liquidity decision

A firm performs finance functions simultaneously and continuously in the normal course of the business. These functions do not necessarily occur in a sequence. Finance functions call for skilful planning, control and execution of a firm’s activities.

Let us note at the outset that shareholders are made better-off by a financial decision that increases the value of their shares. Thus, while performing the finance functions, the financial manager should strive to maximize the market value of shares. This point is elaborated in detail later in the chapter.

Why and how do firms raise funds? Check Your Concepts

Long-term Finance Decisions

The long-term finance functions or decisions have a longer time horizon, generally greater than a year. They may affect the firm’s performance and value in the long run. They also relate to the firm’s strategy and generally involve senior management in taking the final decision.

Investment Decisions

A firm’s investment decisions involve capital expenditures. They are, therefore, referred to as capital budgeting decisions. A capital budgeting decision involves the decision of allocation of capital or commitment of funds to long-term assets that would yield benefits (cash flows) in the future. Two important aspects of investment decisions are (a) the evaluation of the prospective profitability of new investments, and (b) the measurement of a cut-off rate against which the prospective return of new investments could be compared. Future benefits of investments are difficult to measure and cannot be predicted with certainty. Risk in investment arises because of the uncertain returns. Investment proposals should, therefore, be evaluated in terms of both expected return and risk. Besides the decision to commit funds in new investment proposals, capital budgeting also involves replacement decisions, that is, decision of recommitting funds when an asset becomes less productive or non-profitable.

There is a broad agreement that the correct cut-off rate or the required rate of return on investments is the opportunity cost of capital.1 The opportunity cost of capital is the expected rate of return that an investor could earn by investing his or her money in financial assets of equivalent risk. However, there are problems in computing the opportunity cost of capital in practice from the available data and information. A decision maker should be aware of these problems.

Financing Decisions

A financing decision is the second important function to be performed by the financial manager. Broadly, he or she must decide when, where from and how to acquire funds to meet the firm’s investment needs. The central issue before him or her is to determine the appropriate proportion of equity and debt. The mix of debt and equity is known as the firm’s capital structure. The financial manager must strive to obtain the best financing mix or the optimum capital structure for his or her firm. The firm’s capital structure is considered optimum when the market value of shares is maximized.

In the absence of debt, the shareholders’ return is equal to the firm’s return. The use of debt affects the return and risk of shareholders; it may increase the return on equity funds, but it always increases risk as well. The change in the shareholders’ return caused by the change in the profits is called the financial leverage. A proper balance will have to be struck between return and risk. When the shareholders’ return is maximized with given risk, the market value per share will be maximized and the firm’s capital structure would be considered optimum. Once the financial manager is able to determine the best combination of debt and equity, he or she must raise the appropriate amount through the best available sources. In practice, a firm considers many other factors such as control, flexibility, loan covenants, legal aspects etc. in deciding its capital structure.

Dividend Decisions

Short-term Finance Decisions

A dividend decision is the third major financial decision. The financial manager must decide whether the firm should distribute all profits, or retain them, or distribute a portion and retain the balance. The proportion of profits distributed as dividends is called the dividend payout ratio and the retained portion of profits is known as the retention ratio. Like the debt policy, the dividend policy should be determined in terms of its impact on the shareholders’ value. The optimum dividend policy is one that maximizes the market value of the firm’s shares. Thus, if shareholders are not indifferent to the firm’s dividend policy, the financial manager must determine the optimum dividend-payout ratio. Dividends are generally paid in cash. But a firm may issue bonus shares. Bonus shares are shares issued to the existing shareholders without any charge. The financial manager should consider the questions of dividend stability, bonus shares and cash dividends in practice.

Short-term finance functions or decisions involve a period of less than one year. These decisions are needed for managing the firm’s day-to-day fund requirements. Generally, they relate to the management of current assets and current liabilities, short-term borrowings and investment of surplus cash for short periods.

Liquidity Decision

Investment in current assets affects the firm’s profitability and liquidity. Management of current assets that affects a firm’s liquidity is yet another important finance function. Current assets should be managed efficiently for safeguarding the firm against the risk of illiquidity. Lack of liquidity (or illiquidity) in extreme situations can lead to the firm’s insolvency. A conflict exists between profitability and liquidity while managing current assets. If the firm does not invest sufficient funds in current assets, it may become illiquid and therefore, risky. It would lose profitability, as idle current assets would not earn anything. Thus, a proper trade-off must be achieved between profitability and liquidity. The profitability-liquidity trade-off requires that the financial manager should develop sound techniques of managing current assets. He or she should estimate the firm’s needs for current assets and make sure that funds would be made available when needed.

In sum, financial decisions directly concern the firm’s decision to acquire or dispose of assets and require commitment or recommitment of funds on a continuous basis. It is in this context that finance functions are said to influence production, marketing and other functions of the firm. Hence finance functions may affect the size, growth, profitability and risk of the firm, and ultimately, the value of the firm. To quote Ezra Solomon:2

… The function of financial management is to review and control decisions to commit or recommit funds to new or ongoing uses. Thus, in addition to raising funds, financial management is directly concerned with production, marketing and other functions, within an enterprise whenever decisions are made about the acquisition or distribution of assets.

Financial Procedures and Systems

For the effective execution of the finance functions, certain other functions have to be routinely performed. They concern procedures and systems and involve a lot of paper work and time. They do not require specialized skills of finance. Some of the important routine finance functions are:

supervision of cash receipts and payments and safeguarding of cash balances custody and safeguarding of securities, insurance policies and other valuable papers taking care of the mechanical details of new outside financing record keeping and reporting

The involvement of the financial manager in the managerial financial functions is recent. About three decades ago, the sc ope of finance functions or the role of the financial manager was limited to routine activities. How the scope of finance function has widened or the role of the finance manager has changed is discussed in the following section.The finance manager in the modern enterprises is mainly involved in the managerial finance functions; executives at lower levels carry out the routine finance functions. Financial manager’s involvement in the routine functions is confined to setting up of rules and procedures, selecting forms to be used, establishing standards for the employment of competent personnel and to check up the performance to see that the rules are observed and that the forms are properly used.

Check Your Concepts

- What is the difference between long-term and short-term finance functions or decisions?

- Name four finance functions or decisions. Briefly explain each one of them.

- What is the nature of investment decisions?

- Briefly explain the nature of financing decisions.

- How will you describe dividend decision?

- What is involved in the management of liquidity?

- What kinds of financial procedures and systems are used by a firm?

FINANCIAL MANAGER’S ROLE

Who is a financial manager?* What is his or her role? A financial manager is a person who is responsible, in a significant way, to carry out the finance functions. It should be noted that,

in a modern enterprise, the financial manager occupies a key position. He or she is one of the members of the top management team, and his or her role, day-by-day, is becoming more pervasive, intensive and significant in solving the complex funds management problems. Now his or her function is not confined to that of a scorekeeper maintaining records, preparing reports and raising funds when needed, nor is he or she a staff officer in a passive role of an adviser. The finance manager is now responsible for shaping the fortunes of the enterprise, and is involved in the most vital decision of the allocation of capital. In the new role, he or she needs to have a broader and far-sighted outlook, and must ensure that the funds of the enterprise are utilized in the most efficient manner. He or she must realize that his or her actions have far-reaching consequences for the firm because they influence the size, profitability, growth, risk and survival of the firm, and as a consequence, affect the overall value of the firm. The financial manager, therefore, must have a clear understanding and a strong grasp of the nature and scope of the finance functions.

The financial manager has not always been in the dynamic role of decision-making. About three decades ago, he or she was not considered an important person, as far as the top management decision-making was concerned. He or she became an important management person only with the advent of the modern or contemporary approach to the financial management. What are the main functions of a financial manager?

The primary functions of the financial managers are:

Funds raising Funds allocation

Other functions include:

Profit planning

Funds Raising: Traditional Finance Function Understanding capital markets

The traditional approach dominated the scope of financial management and limited the role of the financial manager simply to funds raising. It was during the major events, such as promotion, reorganization, expansion or diversification in the firm that the financial manager was called upon to raise funds. In the day-to-day activities, his or her only significant duty was to see that the firm had enough cash to meet its obligations. Because of its central emphasis on the procurement of funds, the finance textbooks, for example, in the USA, till the mid-1950s covered discussion of the instruments, institutions and practices through which funds were obtained. Further, as the problem of raising funds was more intensely felt in the special events, these books also contained detailed descriptions of the major events like mergers, consolidations, reorganizations and recapitalizations involving episodic financing.3 The finance books in India and other countries simply followed the American pattern. The notable feature of the traditional view of financial management was the assumption that the financial manager had no concern with the decision of allocating the firm’s funds. These decisions were assumed as given, and he or she was required to raise the needed funds from a combination of various sources.

The traditional approach did not go unchallenged even during the period of its dominance. But the criticism related more to the treatment of various topics rather than the basic definition of the finance function. The traditional approach has been criticized because it failed to consider the day-to-day managerial problems relating to finance of the firm. It concentrated itself to looking into the problems from management’s, i.e., the insider’s point of view.4 Thus, the traditional approach of looking at the role of the financial manager lacked a conceptual framework for making financial decisions, misplaced emphasis on raising of funds, and neglected the real issues relating to the allocation and management of funds.

Funds Allocation: Modern Finance Function

The traditional approach outlived its utility in the changed business situation, particularly after the mid-1950s. A number of economic and environmental factors, such as the increasing pace of industrialization, technological innovations and inventions, intense competition, increasing intervention of the government on account of management inefficiency and failure, population growth and widened markets, during and after mid-1950s, necessitated efficient and effective utilization of the firm’s resources, including financial resources. The development of a number of management skills and decision-making techniques facilitated the implementation of a system of optimum allocation of the firm’s resources. As a result, the approach to, and the scope of financial management, also changed. The emphasis shifted from the episodic financing to the financial management, from raising of funds to efficient and effective use of funds. The new approach is embedded in sound conceptual and analytical theories.

The new or modern approach to finance is an analytical way of looking into the financial problems of the firm. Financial management is considered a vital and an integral part of overall management. To quote Ezra Solomon:5

In this broader view the central issue of financial policy is the wise use of funds, and the central process involved is a rational matching of advantages of potential uses against the cost of alternative potential sources so as to achieve the broad financial goals which an enterprise sets for itself.

In his or her new role of using funds wisely, the financial manager must find a rationale for answering the following three questions:6Thus, in a modern enterprise, the basic finance function is to decide about the expenditure allocations and to determine the demand for capital for these expenditures. In other words, the financial manager, in his or her new role, is concerned with the efficient allocation of funds. The allocation of funds is not a new problem, however. It did exist in the past, but it was not considered important enough in achieving the firm’s long run objectives.

How large should an enterprise be, and how fast should it grow?

In what form should it hold its assets?

How should the funds required be raised?

As discussed earlier, the questions stated above relate to three broad decision-making areas of financial management: investment (including both long-term and short-term assets), financing and dividend. The ‘modern’ financial manager has to help make these decisions in the most rational way. They have to be made in such a way that the funds of the firm are used optimally. We have referred to these decisions as managerial finance functions since they require special care and extraordinary managerial ability.

As discussed earlier, the financial decisions have a great impact on all other business activities. The concern of the financial manager, besides his traditional function of raising money, will be on determining the size and technology of the firm, in setting the pace and direction of growth and in shaping the profitability and risk complexion of the firm by selecting the best asset mix and financing mix.

Profit Planning

The functions of the financial manager may be broadened to include profit-planning function. Profit planning refers to the operating decisions in the areas of pricing, costs, volume of output and the firm’s selection of product lines. Profit planning is, therefore, a prerequisite for optimising investment and financing decisions.7 The cost structure of the firm, i.e., the mix of fixed and variable costs has a significant influence on a firm’s profitability. Fixed costs remain constant while variable costs change in direct proportion to volume changes. Because of the fixed costs, profits fluctuate at a higher degree than do sales. The change in profits due to the change in sales is referred to as operating leverage. Profit planning helps to anticipate the relationships between volume, costs and profits and develop action plans to face unexpected surprises.

Understanding Capital Markets

Capital markets bring investors (lenders) and firms (borrowers) together. Hence the financial manager has to deal with capital markets. He or she should fully understand the operations of capital markets and the way in which the capital markets value securities. He or she should also know how risk is measured and how to cope with it in investment and financing decisions. For example, if a firm uses excessive debt to finance its growth, investors may perceive it as risky. The value of the firm’s share may, therefore, decline. Similarly, investors may not like the decision of a highly profitable, growing firm to distribute maximum profit as dividend. They may like the firm to reinvest maximum profits in attractive opportunities that would enhance their prospects for making high capital gains in the future. Investments also involve risk and return. It is through their operations in capital markets that investors continuously evaluate and react to the actions of the financial manager.

Check Your Concepts

- Who is a financial manager?

- What role does a financial manager play?

- What is the financial manager’s role in raising funds and allocating funds?

- What are capital markets? Why should a financial manager understand capital markets? What is profit planning?

FINANCIAL GOAL: PROFIT MAXIMIZATION vs WEALTH MAXIMIZATION

A firm’s investment and financing decisions are unavoidable and continuous. In order to make them rationally, the firm must have a goal. It is generally agreed in theory that the financial goal of the firm should be Shareholder Wealth Maximization (SWM), as reflected in the market value of the firm’s shares. In this section, we show that the Shareholder Wealth Maximization is a theoretically logical and operationally feasible normative goal for guiding the financial decision making.

Profit Maximization

Firms, producing goods and services, may function in a market or government-controlled economy. In a market economy, prices of goods and services are determined in competitive markets. Firms in the market economy are expected to produce goods and services desired by society as efficiently as possible.

Price system is the most important organ of a market economy indicating what goods and services the society wants. Goods and services in great demand command higher prices. This results in higher profit for firms; more of such goods and services are produced. Higher profit opportunities attract other firms to produce such goods and services. Ultimately, with intensifying competition, an equilibrium price is reached at which demand and supply match. In the case of goods and services, which are not required by society, their prices and profits fall. Producers drop such goods and services in favour of more profitable opportunities.8 Price system directs managerial efforts towards more profitable goods or services. Prices are determined by the demand and supply conditions as well as the competitive forces, and they guide the allocation of resources for various productive activities.9

A legitimate question may be raised: Would the price system in a free market economy serve the interests of the society? Adam Smith gave the answer many years ago. According to him:10

(The businessman), by directing…industry in such a manner as its produce may be of greater value…intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was not part of his intention…pursuing his own interest he frequently promotes that of society more effectually than he really intends to promote it.

Following Smith’s logic, it is generally held by economists that under the conditions of free competition, businessmen pursuing their own self-interests also serve the interest of society. It is also assumed that when individual firms pursue the interest of maximizing profits, society’s resources are efficiently utilized.

In the economic theory, the behaviour of a firm is analysed in terms of profit maximization. Profit maximization implies that a firm either produces maximum output for a given amount of input, or uses minimum input for producing a given output. The underlying logic of profit maximization is efficiency. It is assumed that profit maximization causes the efficient allocation of resources under the competitive market conditions, and profit is considered as the most appropriate measure of a firm’s performance.

Objections to Profit Maximization

It is also feared that profit maximization behaviour in a market economy may tend to produce goods and services that are wasteful and unnecessary from the society’s point of view. Also, it might lead to inequality of income and wealth. It is for this reason that governments tend to intervene in business. The price system and therefore, the profit maximization principle may not work due to imperfections in practice. Oligopolies and monopolies are quite common phenomena of modern economies. Firms producing same goods and services differ substantially in terms of technology, costs and capital. In view of such conditions, it is difficult to have a truly competitive price system, and thus, it is doubtful if the profit-maximizing behaviour will lead to optimum social welfare. However, it is not clear whether abandoning profit maximization, as a decision criterion, would solve the problem or not. Rather, government intervention may be sought to correct market imperfections and to promote competition among business firms. A market economy, characterized by a high degree of competition, would certainly ensure efficient production of goods and services desired by society.13The objective of profit maximization has often been criticized. It is argued that profit maximization assumes perfect competition, and in the face of imperfect modern markets, it cannot be a legitimate objective of the firm. It is also argued that profit maximization, as a business objective, developed in the early 19th century when the characteristic features of the business structure were self-financing, private property and single entrepreneurship. The only aim of the single owner then was to enhance his or her individual wealth and personal power, which could easily be satisfied by the profit maximization objective.11 The modern business environment is characterized by limited liability and a divorce between management and ownership. Shareholders and lenders today finance the business firm but it is controlled and directed by professional management. The other important stakeholders of the firm are customers, employees, government and society. In practice, the objectives of these stakeholders or constituents of a firm differ and may conflict with each other. The manager of the firm has the difficult task of reconciling and balancing these conflicting objectives. In the new business environment, profit maximization is regarded as unrealistic, difficult, inappropriate and immoral.12

Is profit maximization an operationally feasible criterion? Apart from the aforesaid objections, profit maximization fails to serve as an operational criterion for maximizing the owner’s economic welfare. It fails to provide an operationally feasible measure for ranking alternative courses of action in terms of their economic efficiency. It suffers from the following limitations:14 It is vague

It ignores the timing of returns

It ignores risk

Definition of Profit: The precise meaning of the profit maximization objective is unclear. The definition of the term profit is ambiguous. Does it mean short or long-term profit? Does it refer to profit before or after tax, or total profits or profit per share? Does it mean total operating profit or profit accruing to shareholders?

Time Value of Money: The profit maximization objective does not make an explicit distinction between returns received in different time periods. It gives no consideration to the time value of money, and it values benefits received in different periods of time as the same.

Uncertainty of Returns: The streams of benefits may possess different degrees of certainty. Two firms may have same total expected earnings, but if the earnings of one firm fluctuate considerably as compared to the other, it will be more risky. Possibly, owners of the firm would prefer smaller but surer profits to a potentially larger but less certain stream of benefits.

Maximizing Profit After Taxes

Maximizing EPS

Let us put aside the first problem mentioned above, and assume that maximizing profit means maximizing profits after taxes, in the sense of net profit, as reported in the profit and loss account (income statement) of the firm. It can easily be realized that maximizing this figure will not maximize the economic welfare of the owners. It is possible for a firm to increase profit after taxes by selling additional equity shares and investing the proceeds in low-yielding assets, such as the government bonds. Profit after taxes would increase but earnings per share (EPS) would decrease. To illustrate, let us assume that a company has 10,000 shares outstanding, profit after taxes of `50,000 and earnings per share of `5. If the company sells 10,000 additional shares at `50 per share and invests the proceeds (`500,000) at 5 per cent after taxes, then the total profits after taxes will increase to `75,000. However, the earnings per share will fall to `3.75 (i.e., `75,000/20,000). This example clearly indicates that maximizing profits after taxes does not necessarily serve the best interests of owners.

If we adopt maximizing EPS as the financial objective of the firm, this will also not ensure the maximization of owners’ economic welfare. It also suffers from the flaws already mentioned, i.e., it ignores timing and risk of the expected benefits. Apart from these problems, maximization of EPS as a financial objective has certain deficiencies. For example, note the following observation:15

… For one thing, it implies that the market value of the company’s shares is a function of earnings per share, which may not be true in many instances. If the market value is not a function of earnings per share, then maximization of the latter will not necessarily result in the highest possible price for the company’s shares. Maximization of earnings per share further implies that the firm should make no dividend payments so long as funds can be invested internally at any positive rate of return, however small. Such a dividend policy may not always be to the shareholders’ advantage.

It is, thus, clear that maximizing profits after taxes or EPS as the financial objective fails to maximize the economic welfare of owners. Neither method takes account of the timing and uncertainty of the benefits. An alternative to profit maximization, which solves these problems, is the objective of wealth maximization. This objective is also considered consistent with the survival goal and with the personal objectives of managers such as recognition, power, status and personal wealth.

Shareholder Wealth Maximization (SWM)

What is shareholder wealth or simply wealth? Here the benefits and costs occuring over a period of time are adjusted for their timing and risk. Wealth is equal to the difference between the present value of benefits and the present value of costs.

Wealth = Present value of benefits – Present value of costs

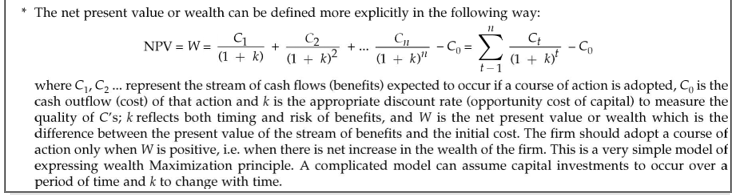

What is meant by Shareholder Wealth Maximization (SWM)? SWM means maximizing the net present value of a course of action to shareholders. Net present value (NPV) or wealth of a course of action is the difference between the present value of its benefits and the present value of its costs.16 A financial action that has a positive NPV creates wealth for shareholders and, therefore, is desirable. A financial action resulting in negative NPV should be rejected since it would destroy shareholders’ wealth. Between mutually exclusive projects the one with the highest NPV should be adopted. NPVs of a firm’s projects are additive in nature.

That is

NPV(A) + NPV(B) = NPV(A + B)

The objective of SWM takes care of the questions of the timing and risk of the expected benefits. These problems are handled by selecting an appropriate rate (the shareholders’ opportunity cost of capital) for discounting the expected flow of future benefits. It is important to emphasise that benefits are measured in terms of cash flows. In investment and financing decisions, it is the flow of cash that is important, not the accounting profits.

This is referred to as the principle of value-additivity. Therefore, the wealth will be maximized if NPV criterion is followed in making financial decisions.*

The objective of SWM is an appropriate and operationally feasible criterion to choose from among the alternative financial actions. It provides an unambiguous measure of what financial management should seek to maximize in making investment and financing decisions on behalf of shareholders.17

Maximizing the shareholders’ economic welfare is equivalent to maximizing the utility of their consumption over time. With their wealth maximized, shareholders can adjust their cash flows in such a way as to optimize their consumption. From the shareholders’ point of view, the wealth created by a company through its actions is reflected in the market value of the company’s shares. Therefore, the wealth maximization principle implies that the fundamental objective of a firm is to maximize the market value of its shares. The value of the company’s shares is represented by their market price which in turn, is a reflection of shareholders’ perception about quality of the firm’s financial decisions. The market price serves as the firm’s performance indicator. How is the market price of a firm’s share determined?

AGENCY PROBLEMS: MANAGERS vs SHAREHOLDERS GOALS

SWM.

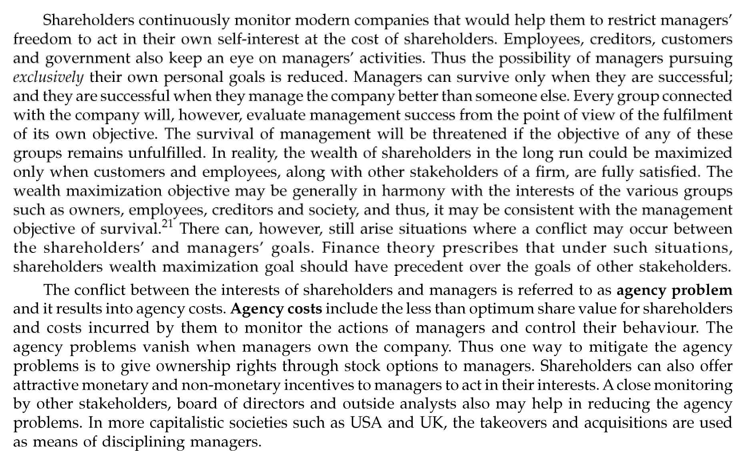

In large companies, there is a divorce between management and ownership. The decision taking authority in a company lies in the hands of managers. Shareholders as owners of a company are the principals and managers are their agents. Thus there is a principal-agent relationship between shareholders and managers. In theory, managers should act in the best interests of shareholders; that is, their actions and decisions should lead to SWM. In practice, managers may not necessarily act in the best interest of shareholders, and they may pursue their own personal goals. Managers may maximize their own wealth (in the form of high salaries and perks) at the cost of shareholders, or may play safe and create satisfactory wealth for shareholders than the maximum. They may avoid taking high investment and financing risks that may otherwise be needed to maximize shareholders’ wealth. Such “satisficing” behaviour of managers will frustrate the objective of SWM as a normative guide. It is in the interests of managers that the firm survives over the long run. Managers also wish to enjoy independence and freedom from outside interference, control and monitoring. Thus their actions are very likely to be directed towards the goals of survival and self-sufficiency20. Further, a company is a complex organization consisting of multiple stakeholders such as employees, debt-holders, consumers, suppliers, government and society. Managers in practice may, thus, perceive their role as reconciling conflicting objectives of stakeholders. This stakeholders’ view of manager role may compromise with the objective of

ORGANIZATION OF THE FINANCE FUNCTIONS

The vital importance of the financial decisions to a firm makes it imperative to set up a sound and efficient system for the finance functions. The ultimate responsibility of carrying out the finance functions lies with the top management. Thus, a department to organize financial activities may be created under the direct control of the board of directors. The board may constitute a finance committee. The executive heading the finance department is the firm’s chief finance officer (CFO), who may be known by different designations. The finance committee or CFO will decide the major financial policy matters, while the routine activities would be delegated to lower levels. For example, at BHEL a director of finance at the corporate office heads the finance function. He is a member of the board of directors and reports to the chairman and managing director (CMD). An executive director of finance (EDF) and a general manager of finance (GMF) assist the director of finance. EDF looks after funding, budgets and cost, books of accounts, financial services and cash management. GMF is responsible for internal audit and taxation.

Status and Duties of CFO, Treasurer and Controller

The reason for placing the finance functions in the hands of top management may be attributed to the following factors: First, financial decisions are crucial for the survival of the firm. The growth and development of the firm is directly influenced by the financial policies. Second, the financial actions determine solvency of the firm. At no cost can a firm afford its solvency to be threatened. Because solvency is affected by the flow of funds, which is a result of various financial activities, top management being in a position to coordinate these activities retains finance functions in its control. Third, centralization of the finance functions can result in a number of economies to the firm. For example, the firm can save in terms of interest on borrowed funds, can purchase fixed assets economically or issue shares or debentures efficiently.

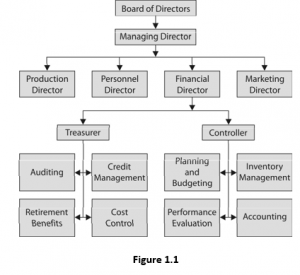

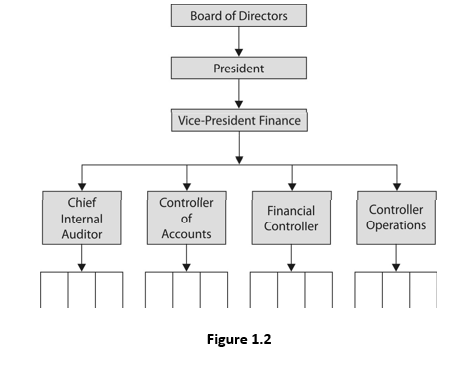

The exact organizational structure for financial management will differ across firms. It will depend on factors such as the size of the firm, nature of the business, financing operations, capabilities of the firm’s financial officers and most importantly, on the financial philosophy of the firm. The designation of the chief financial officer (CFO) would also differ within firms. In some firms, the financial officer may be known as the financial manager, while in others as the vice-president of finance or the director of finance or the financial controller. Two more officers—treasurer and controller—may be appointed under the direct supervision of CFO to assist him or her. In larger companies, with modern management, there may be vice-president or director of finance, usually with both controller and treasurer reporting to him.18

Figure 1.1 illustrates the financial organization of a large (hypothetical) business firm. It is a simple organization chart, and as stated earlier, the exact organization for a firm will depend on its circumstances. Figure 1.1 reveals that the finance function is one of the major functional areas, and the financial manager or director is under the control of the board of directors. Figure 1.2 shows the organization for the finance function of a large, multi-divisional Indian company.

The CFO has both line and staff responsibilities. He or she is directly concerned with the financial planning and control. He or she is a member of the top management, and is closely associated with the formulation of policies and making decisions for the firm. The treasurer and controller, if a company has these executives, would operate under CFO’s supervision. He or she must guide them and others in the effective working of the finance department.

The main function of the treasurer is to manage the firm’s funds. His or her major duties include forecasting the financial needs, administering the flow of cash, managing credit, floating securities, maintaining relations with financial institution and protecting funds and securities. On the other hand, the functions of the controller relate to the management and control of assets. His or her duties include providing information to formulate accounting and costing policies, preparation of financial reports, direction of internal auditing, budgeting, inventory control, taxes, etc. It may be stated that the controller’s functions concentrate on the asset side of the balance sheet, while treasurer’s functions relate to the liability side.

| Summary | |

| Finance deals with the management of the firm’s assets, liabilities and profitability.

All management functions like production, marketing, human resource management etc. have financial implication. The traditional finance function of the manager relates to raising of funds. But the modern finance function places more emphasis on efficient allocation of the firm’s funds. The finance functions can be divided into three broad categories: (i) investment decision, (ii) financing decision, and (iii) dividend decision. In other words, the firm decides how much to invest in shortterm and longterm assets and how to raise the required funds. In making financial decisions, the financial manager should aim at increasing the value of the shareholders’ stake in the firm. This is referred to as the principle of Shareholder Wealth Maximization (SWM). Wealth maximization is superior to profit maximization since wealth is precisely defined as net present value and it accounts for time value of money and risk. Managers are agents of shareholders since shareholders are the legal owners of the firm. In practice, there may arise a conflict between the interests of shareholders and managers. This is refered to as agency problems, and the asssociated costs are called agency costs. The financial manager raises capital from the capital markets. He or she should therefore know how the capital markets function to allocate capital to the competing firms and how security prices are determined in the capital markets. Most companies have only one chief financial officer (CFO). But a large company may have both a treasurer and a controller, who may or may not operate under CFO. The treasurer’s function is to raise and manage company funds while the controller oversees whether funds are correctly applied. A number of companies in India either have a finance director or a vicepresident of finance as the chief financial officer. |

|