WEDNESDAY: 23 May 2018. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. QUESTION ONE

1. Explain three working capital financing policies and their implications in an organisation (6 marks)

2. Chauringo Limited wishes to expand its business. The company is considering to issue Sh.50 million worth of redeemable bonds denominated in Sh.1,000. The bond’s rate of interest is 10% and will mature on 30 June 2028. The bonds will be issued on 1 July 2018.

The cost of capital is 18% per annum for the whole period.

Required:

The current value of the bond. (3 marks)

The par value of the bond. (2 marks)

3. Maandani Enterprises maintains a minimum cash balance of Sh.10,000. The standard deviation of the daily cash flows is Sh. 2,500. The transaction cost of each marketable security is Sh.20. The interest rate of a marketable security is 9.2% per annum. Assume 365 days in a year.

Required:

Using the Miller-Orr model of cash management, determine:

The optimal cash balance. (3 marks)

The upper cash limit. (2 marks)

The average cash balance. (2 marks)

The spread. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain three assumptions of the Gordon’s dividend model. (6 marks)

2. Kubusa Ltd. is contemplating the acquisition of a new machine to replace the one currently being used in production process. The existing machine was acquired 2 years ago at a cost of Sh.8 million. The existing machine was estimated to have a useful life of 5 years with no salvage value. However, a critical analysis of the machine now shows that the machine is usable for the next 5 years with a salvage value of Sh.1.5 million. The existing machine can be disposed of now at Sh.4 million.

The new machine is expected to cost Sh.12.56 million with a salvage value of Sh.4 million at the end of its useful life of 5 years. The new machine will also require an additional investment in working capital of Sh.2.6 million at the start of its useful life which will however be recovered at the end of its useful life.

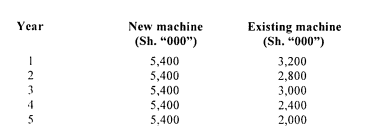

The following information relates to the estimated earnings before depreciation and tax (EBDT) over the coming five year period for the two machines:

Kubusa Ltd.’s cost of capital is 13%. The company applies straight-line method of depreciation. The corporate tax rate is 30%.

Required:

Using the net present value (NPV) technique, advise the management of Kubusa Ltd. on whether to replace the existing machine with the new machine. (14 marks)

(Total: 20 marks)

QUESTION THREE

1. Argue three cases for and three cases against the use of market values for various components of cost of capital in determining the weighted average cost of capital (WACC) of a firm. (6 marks)

2. Akiba Limited has the following capital structure:

Sh. “000”

3,000,000 fully paid ordinary shares 30,000

Retained earnings 20,000

1,000,000 10% preference shares 20,000

6% debentures (Sh.150 par value) 30,000

Additional information:

The current market price per share (MPS) is Sh.30.

- The expected dividend per share in the following year is Sh.1.20.

- The average growth rate in both earnings and dividends has been maintained at 10% over the last 10 years.

The trend is expected to remain the same into the foreseable future.

- The debentures are trading at Sh.l 10 at the securities market.

- The debentures mature in 100 years period.

- The preference shares were issued 4 years ago and they are still trading at face value.

- The corporate tax rate is 30%.

Required:

Weighted average cost of capital (WACC) for the company. (8 marks)

3. The profit after tax of Muhendato Ltd. as at 30 April 2017 was Sh.6,500,000. The company is quoted at the securities exchange and its shares are currently selling for Sh.40 each. The company’s dividend policy is to pay out 40% of its earnings for the year as dividends on its 1,000,000 issued and fully paid up shares.

The company’s profit after tax is expected to increase by 15% per year for three years and 8% per year thereafter. Dividends will grow at the same rate as profits of the company.

The shares of the company are expected to sell at Sh.64 per share at the end of five years from now. The cost of capital for the company is 12% per annum.

Required:

Determine whether the shares of Muhendato Ltd. are currently fairly valued, undervalued or overvalued for an investor expecting to sell them after 5 years. (6 marks)

(Total: 20 marks)

QUESTION FOUR

1. Explain the following terms as used in Islamic finance:

Ijara. (2 marks)

Sukuk. (2 marks)

2. Distinguish between the terms “capital market” and “money market”. (2 marks)

3. Describe two types of capital rationing in capital budgeting. (4 marks)

Amani Contractors Ltd. is intending to invest in four independent projects. The following infoemation relates to the four projects:

Additional information:

- The company has a capital limitation of Sh.90 million.

- The company’s required rate of return is 10%.

- Any surplus funds can be re-invested to generate a return of net cash flow of 14% in perpetuity.

- The projects are indivisible.

- The projects can be combined to achieve a higher return subject to the company’s capital limitation.

Required:

Advise on the optimal project combination. (5 marks)

4. Matta Ltd. is in the process of completing construction of a green house.

The finance manager has estimated that the project’s useful life is 15 years and shall generate the following cash flows:

Years Cash flows (Sh. “000”)

1 – 5 5,000

6 – 10 9,000

11 – 15 4,000

=18,000

The required rate of return for the company is 10%.

Required:

The total present value of the project. (5 marks)

(Total: 20 marks)

QUESTION FIVE

1. Distinguish between “financial planning” and “financial forecasting”. (2 marks)

2. Explain four benefits that might accrue from demutualisation of securities exchange of your country. (4 marks)

3. Furunzi Express Ltd.’s records got lost in a fire that burnt down the accounts office.

The following information was however obtained from the laptop of the accountant liar the year ended 31 December 2017:

Opening stock Sh.450,000

Stock turnover ratio 10 times

Net profit margin 15%

Gross prolit margin 20%

Current ratio 4:1

Long-term loan Sh.1,000,000

Depreciation of fixed assets (10%) Sh.100,000

Closing stock Sh.510,000

Additional information:

- Credit period allowed by suppliers is one month.

- Average debt collection period is 2 months.

- On 31 December 2017. current assets consisted of stock, debtors and cash only.

- There was no bank overdraft.

- All purchases are made on credit.

- Cash sales were 1/4 of total sales.

Required:

Cost of sales. (2 marks)

Gross profit. (2 marks)

Total sales. (2 marks)

Total purchases. (2 marks)

Net profit. (2 marks)

Debtors value. (2 marks)

Creditors value. (2 marks)

(Total: 20 marks)