THURSDAY: 24 August 2023. Afternoon Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Outline FOUR limitations of profit maximisation as a financial goal of a firm. (4 marks)

2. Evaluate FOUR features of preference shares as a source of capital to a firm. (4 marks)

3. Maca Ltd. is considering raising funds for an expansion programme through a rights issue. The expansion programme is expected to cost Sh.20 million. The company has currently issued 2,400,000 ordinary shares which are currently selling for Sh.30 each. The board of directors have proposed an offer price of Sh.25 per share.

The funds to be raised will be invested in a project which is expected to generate net operating cash flow of Sh.6,000,000 each year over the project’s useful life of five years. The salvage value of the project after five years is estimated at Sh.5,000,000. The cost of capital for the firm is 12% per annum.

Required:

Cum-right market price per share (MPS). (2 marks)

Number of rights required to buy one new ordinary share. (1 mark)

Theoretical ex-right market price per share. (2 marks)

Theoretical value of each right. (2 marks)

Evaluate the impact of the rights issue on the value of wealth of an existing shareholder who owns 1,200

ordinary shares in the company and Sh.15,000 in his savings account under the various options available

to him. (5 marks)

(Total: 20 marks)

QUESTION TWO

1. Distinguish between “temporary working capital” and “permanent working capital” in relation to

working capital management. (2 marks)

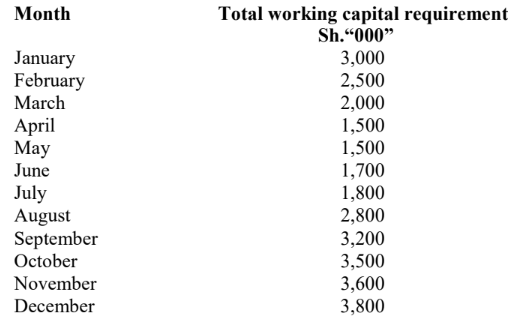

The monthly working capital requirement for Mbuni Ltd. are given as follows:

The short term cost of financing working capital is 15% per annum whereas the long-term financing cost is 20% per annum.

The firm adopts an aggressive policy in financing its working capital needs. 80% of the firm’s permanent working capital are financed using short term funds and the balance is financed using long term funds.

Required:

Determine the total cost of financing the working capital needs of the firm. (6 marks)

2. Fila Ltd. is considering to purchase a new machine so as to improve its production process which is currently being undertaken manually. The machine costs Sh.13,950,000. The firm will incur installation cost of Sh.450,000.

The machine will have an economic life of 6 years but will require an overhaul at the end of the fourth year. The overhaul will cost Sh.1,125,000. After six years, the machine could be disposed of for Sh.900,000.

The company estimates that that it will cost Sh.2,100,000 per year to operate the new machine. The current manual production method costs Sh.5,250,000 per annum. In addition to reducing annual operating costs, the new machine will allow the company to increase production capacity by 120,000 units per annum. The company realises a contribution margin of Sh.45 per unit.

Additional information:

1. The company applies straight-line method of depreciation.

2. Corporate tax rate is 30%.

3. Fila Ltd. requires 20% return an all investment.

Required:

Using the Net Present Value (NPV) project evaluation method, advise Fila Ltd. on whether or not to purchase the machine. (12 marks)

(Total: 20 marks)

QUESTION THREE

1. By aid of a diagram, differentiate between “systematic risk” and “unsystematic risk” in relation to portfolio analysis. (4 marks)

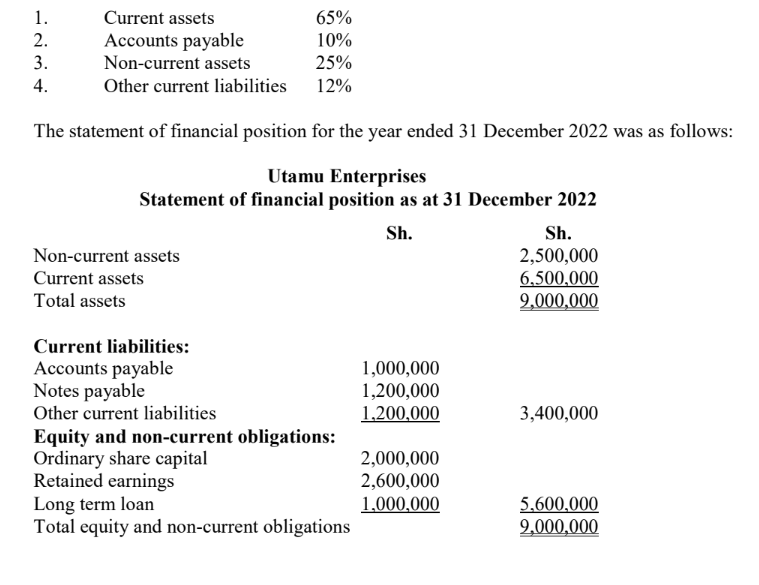

2. Utamu Enterprises operates a fruit juice processing business. The financial manager has realised a consistent relationship among the following items as a percentage of sales:

Additional information:

1. The profit after tax margin is 5% and the company sales for the year ended 31 December 2022 were

Sh.10 million.

2. Sales are expected to grow by 10% every year for the next 5 years.

3. The notes payable were paid off.

Required:

Using the percentage of sales method of financial forecasting:

Determine the external financial requirement for the business for the year ending 31 December 2027.

(8 marks)

Prepare a program statement of financial position for the year ending 31 December 2027. (8 marks)

(Total: 20 marks)

QUESTION FOUR

1. Financial planning is one of the most crucial steps for any person, regardless of whether they earn any income or not. While many people understand the importance of financial planning, it is still one of the steps that are postponed or skipped:

With regards to the above statement, summarise FOUR benefits of financial planning to an individual. (4 marks)

2. Describe FOUR forms of dividend payments that a company could use while making dividend decisions. (4 marks)

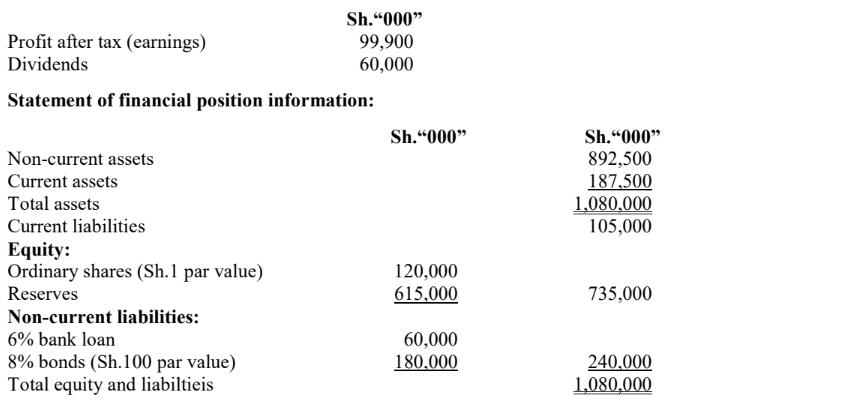

3. Zora Ltd., a securities market listed company has the following recent financial information:

Additional information:

1. Financial analysts have forecast that the dividend of the company will grow in the future at a rate of 4% per year. This is slightly less than the forecast growth rate of the profit after tax (earnings) of the

company, which is 5% per year.

2. Considering the risk associated with expected earnings growth, earnings yield of 11% per annum can be used for valuation purposes.

3. Zora Ltd. has a cost of equity of 10% per annum and a before tax cost of debt of 7% per annum.

4. The 8% bonds will be redeemed at par value in six years’ time and the company pays tax at an annual

rate of 30% per annum.

5. The ex-dividend market share price of Zora Ltd. is Sh.8.50 per share.

Required:

Calculate the value of Zora Ltd. using the following valuation methods:

Net asset value method. (2 marks)

Dividend growth model. (2 marks)

Earnings yield method. (2 marks)

4. Using the information in (c) above, calculate the weighted average after tax cost of capital (WACC) of Zora Ltd. using market values. (6 marks)

(Total: 20 marks)

QUESTION FIVE

1. Outline FIVE factors driving financial innovation in the recent past. (5 marks)

2. Joel Ouma needs Sh.9,000,000 in five years’ time to purchase a house. He is determined to deposit a given amount of money each quarter in a sinking fund that earns interest at the rate of 12% compounded quarterly for five years.

Required:

Compute the amount of money that Joel Ouma should deposit in each quarter in a sinking fund so as to enable him realise Sh.9,000,000 in five years time. (5 marks)

3. Penda Ltd. deals with laboratory accessories. A dropper sells for Sh.500 per piece and has a variable cost equivalent to 50% of the selling price per piece of the dropper. The firm has a fixed operating cost of Sh.500,000 and fixed financing cost of Sh.750,000.

Further analysis of the firm reveals that if the firm sales increase by 10%, the firm’s earnings before interest and taxes (EBIT) increase by 15% and if the firm’s EBIT increase by 10%, the firm’s earnings per share (EPS) increases by 12%.

Required:

Calculate the following measures of leverage for the firm:

Break-even quantity of sales in units. (2 marks)

Operating break-even quantity of sales in units. (2 marks)

Degree of operating leverage (DOL). (2 marks)

Degree of financial leverage (DFL). (2 marks)

Degree of total leverage (DTL). (2 marks)

(Total: 20 marks)