MONDAY: 4 April 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Describe four ways of encouraging managers to achieve stakeholders‘ objectives. (4 marks)

2. State five arguments against Modigliani and Miller’s (MM’s) view that dividend policy is irrelevant as a means of affecting shareholders’ wealth. (5 marks)

3. Explain three forms of market information efficiency as stipulated by Eugene Fama’s efficient market hypothesis (EMH). (6 marks)

4. You are on attachment in an investment firm and the following information regarding investments has been provided to you by a company whose earnings per share (EPS) in the current financial year was Sh.8. The company adopts a 60% payout ratio as its dividend policy.

The company is considering two investment options as follows:

Option 1:

The firm has an investment opportunity which, if undertaken, the growth rate in dividends will be 10% per annum for the next 3 years. The growth rate will fall to 8% per annum for the next 2 years after the first 3 years and then stabilise at 6% per annum thereafter.

Option2:

The firm can continue with the current investments and the growth in dividends will continue at the rate of 10% per annum in perpetuity.

Required:

Assuming the required rate of return is 18%, advise the company on the option to take. (5 marks)

(Total: 20 marks)

QUESTION TWO

1. James Chege intends to accumulate Sh.10,000,000 in his bank account 15 years from now.

Required:

The amount he should deposit now assuming that the bank is offering a 5% interest rate per annum compounded semi annually. (4 marks)

2. The following information relates to Triplex Ltd:

- The company has annual sales revenue of Sh.6,000,000 and all sales are on 30 _days credit, although customers on average take 10 days more than the recommended 30 days to pay.

- Contribution represents 60% of sales and the company currently has no bad debts. Accounts receivable are financed by an overdraft at an annual interest rate of 7%.

- Triplex Ltd. plans to offer an early settlements discount of 1.5% for payment within 15 days and to extend the maximum credit offered to 60 days.

- The company expects that these changes will increase annual credit sales by 5% while also leading to additional incremental costs equal to 0.5% of sales revenue.

- The discount is expected to be taken by 30% of customers, while the remaining customers would take an average of 60 days to pay.

Required:

Evaluate whether the proposed changes in credit policy will increase the profitability of Triplex Ltd. (8 marks)

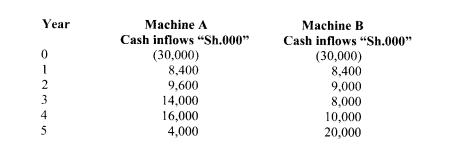

3. Tuli Ltd. intends to invest in one of two machines; A or B.

The following data is available:

Additional information:

- Both machines have a useful life of 5 years.

- Depreciation is on a straight line basis.

- The corporate tax rate is 30%.

Required:

Using pay back period as the criterion for project selection, advise the management of Tuli Ltd. on which machine to invest in. (8 marks)

(Total: 20 marks)

QUESTION THREE

1. Explain the term “cross border listing”. (2 marks)

Explain four benefits that would accrue to a firm that undertakes cross border listing of its shares. (4 marks)

2. Outline four reasons behind investors’ preference for current income as opposed to future income. (4 marks)

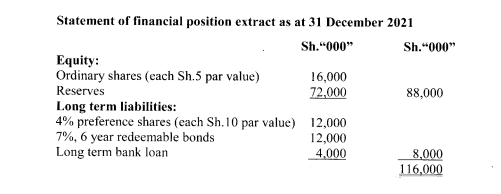

3. The following financial information relates to Panda Ltd.:

Additional information:

- The ordinary shares of Panda Ltd. have an ex-dividend market value of Sh.47 per share and an ordinary dividend of Sh.3.63 per share has just been paid.

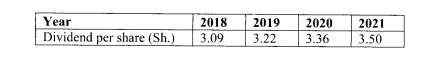

Historic dividend payments have been as follows:

- The preference shares of Panda Ltd. are not redeemable and have an ex-dividend market value of Sh.4 per share.

- The 7% bonds are redeemable at a 5% premium to their nominal value of Sh.100 per bond and have an ex-interest market value of Sh.104.50 per bond.

- The bank loan has a variable interest rate that has averaged 4% per year in recent years.

- The corporate tax rate applicable to Panda Ltd. is 30% per year.

Required:

The market value weighted average cost of capital (WACC) of Panda Ltd. (10 marks)

(Total: 20 marks)

QUESTION FOUR

1. Explain four methods that a company could use to issue ordinary shares. (4 marks)

2. Highlight five functions of the Central Depository System (CDS). (5 marks)

3. Fredrick Onyango, a prospective investor, is considering buying shares of Company A and Company B which are currently selling at Sh.40 and Sh.50 respectively at the securities exchange. He wishes to invest Sh.1,000,000 in both companies’ shares in the ratio of 6:4 for share A and share B respectively.

The forecasted end of year market prices and the probabilities of their occurrence in different economic conditions are given as follows:

Economic End of year market price (Sh.)

condition Probability Share A Share B

Best 0.40 50 60

Fair 0.30 42 50

Poor 0.30 35 40

Required:

Expected rate of return for each investment. (3 marks)

Portfolio expected return. (2 marks)

Assuming that the returns of share A and share B are perfectly positively correlated, compute the portfolio risk. (6 marks)

(Total: 20 marks)

QUESTION FIVE

1. Big data finance refers to large diverse (structured and unstructured) and complex sets of data that can be used to provide solutions to long standing business challenges for financial services and banking companies around the world.

Required:

In relation to the above statement, discuss two big data challenges facing the banking and finance indust (4 marks)

Explain two differences between “conventional finance” and “islamic finance”. (4 mark

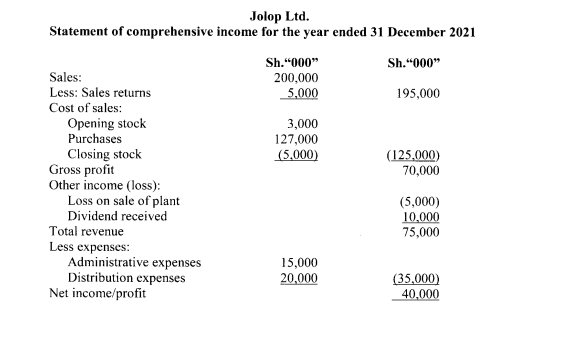

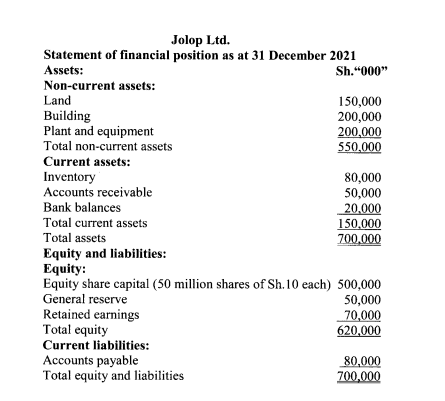

The following information relates to Jolop Ltd. for the financial year ended 31 December 2021:

Required:

Compute and interpret the following for Jolop Ltd.:

Operating profit ratio. (2 marks)

Net profit to capital employed ratio. (2 marks)

Stock turnover ratio. (2 marks)

Debt collection period. (2 marks)

Gross profit ratio. (2 marks)

Quick/acid test ratio. (2 marks)

(Total: 20 marks)