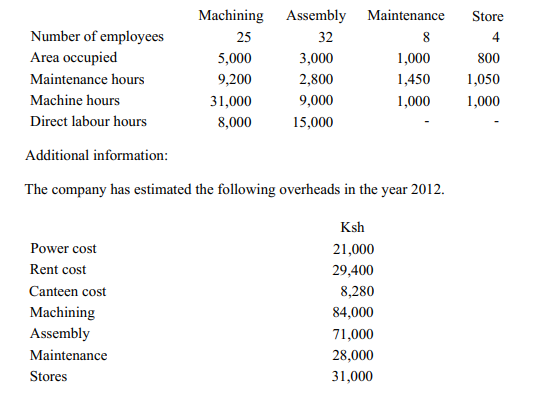

I – (a) The Chief Accountant of Royal company is to prepare the overhead analysis for the forthcoming year, 2012. The company has two production cost centres, machining and assembly and two service cost centres maintenance and stores.

The following information concerns the cost centres.

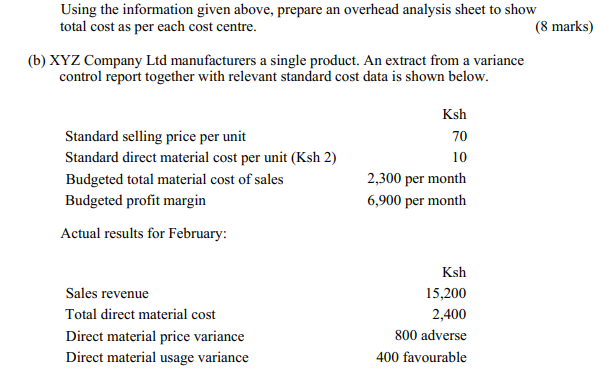

There was no change in inventory levels during the month. Calculate:

(i) Actual production;

(ii) Actual usage of direct material;

(iii) The selling price variance;

(iv) Sales volume variance.

2. (a) Explain five objectives of budgetary control. (10 marks)

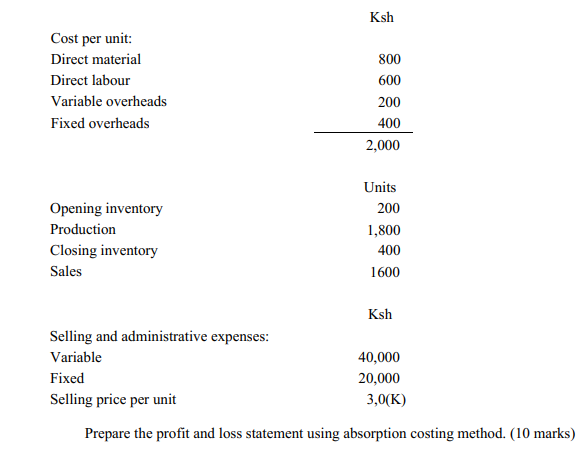

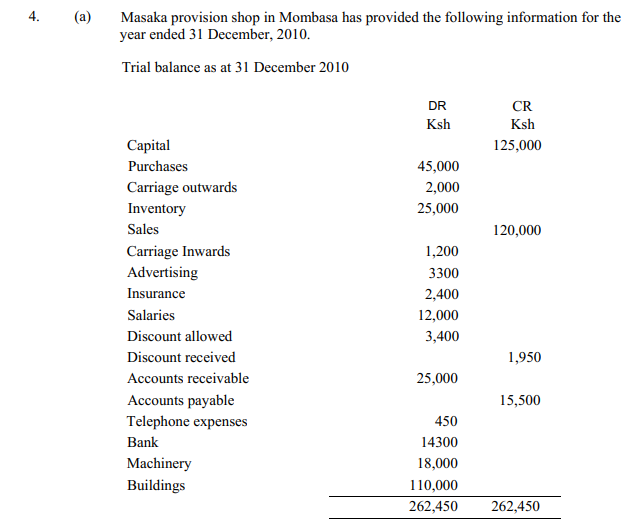

(b) Keiti Manufacturing company provided the following data for its operation for the year 2010.

• Closing inventory Ksh 25,000;

• Telephone bill Ksh 50 is due;

• Insurance Ksh 600 has been paid in advance.

Prepare:

(i) Trading, profit and loss account for the year ended 31 December, 2010;

(ii) The balance sheet as at 31 December, 2010. (12 marks)

Highlight four factors that are considered when determining a wage payment system

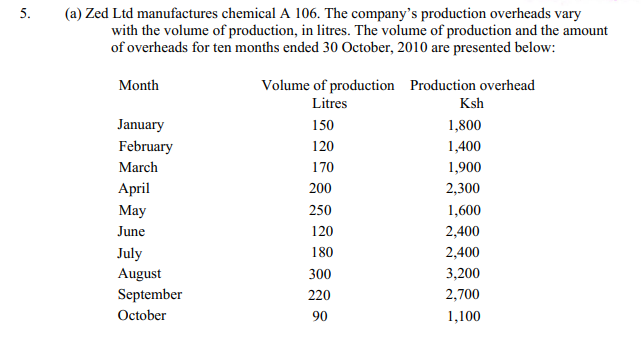

Required:

(i) Use the High-Low method to determine an equation in the form of. y = a + hx\

(ii) Using the equation in (i) above, determine the overhead for the production of

350 units;

(iii) Determine the production units if production overhead cost is Ksh 4,000.

(12 marks)

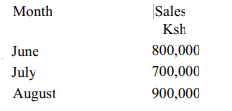

(b) The following information was extracted from the sales budget of F.xe Ltd.

Sales are made in both credit and cash terms. Cash sales constitute 50% of the total sales and attracts a cash discount of 2%. Generally, 30% of debtors pay after one month and then 19% within 2 moths. The remainder are considered irrecoverable. Prepare the cash budget extract for the three months, showing the sales receipts.

6. (a) A company manufactures a single product with a selling price of Ksh 200 per unit and a variable cost of Ksh 140 per unit. Fixed costs amount to Ksh 1,800,000. The annual demand for the product is estimated at 50,000 units.

(i) Determine:

I Break-even point in units and value;

II The level of sales in units and value that is required to earn a profit of Ksh 900,000;

HI Margin of safety in units and shillings;

(ii) Explain three assumptions of break-even concept. (12 marks)

(b) Explain the following terms as used in cost accounting:

(i) Profit centre;

(n) Cost centre;

(iii) Cost unit;

(iv) Opportunity cost.

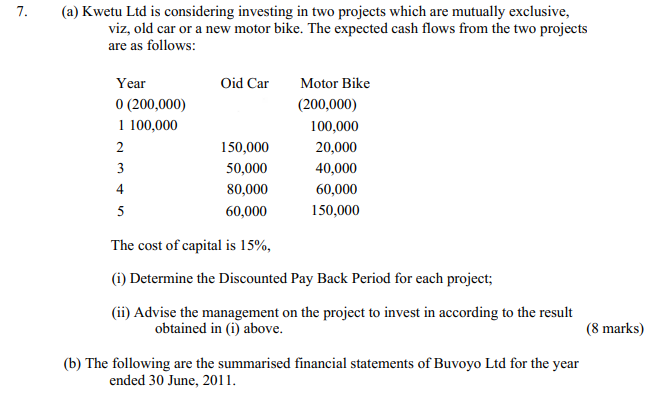

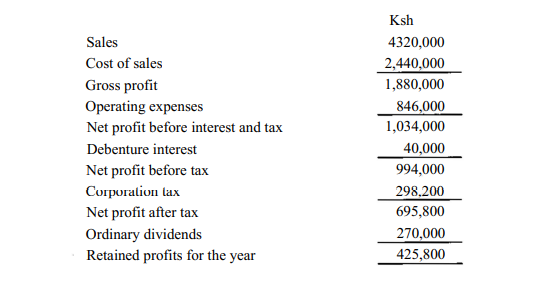

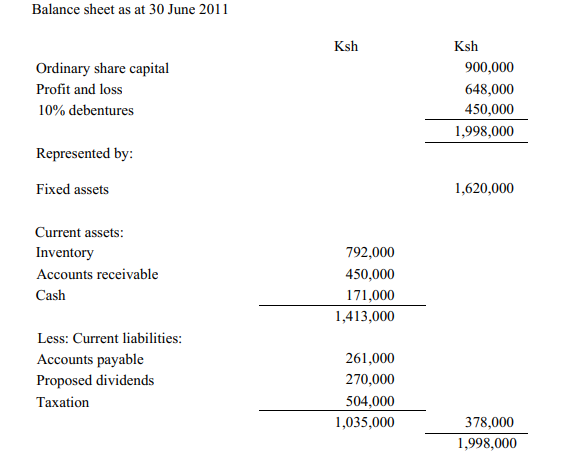

(i) Calculate the following ratios:

I Current ratio;

II Acid test ratio;

III Rate of stock turnover;

IV Total assets turnover;

V Gross profit margin;

VI Net profit margin.

(ii) Comment on the liquidity and profitability positions of the company from the ratios ascertained in (i) above.