MONDAY: 21 May 2018, Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

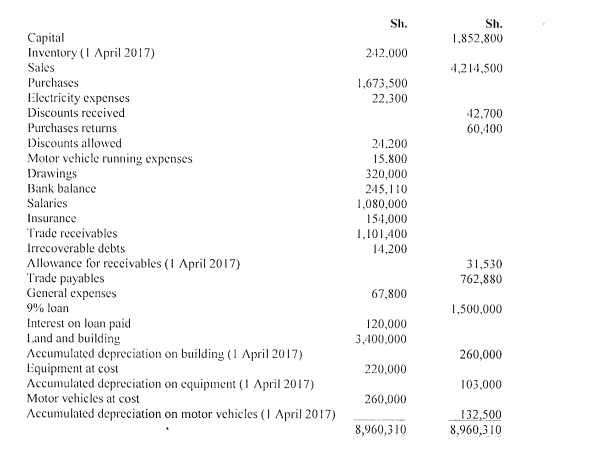

Asuba Enterprises is a business run by a sole trader. The following trial balance was extracted from the accounts of the business as at 31 March 2018:

Additional information:

- Only 10 months’ salaries are shown in the trial balance. An equal amount is paid for salaries for each month of the year.

- As at 31 March 2018, Sh.32,000 had been prepaid for insurance, whilst Sh.4,100 was owing for general expenses.

- Sh.46,000 had been charged to general expenses for the owner’s private holiday.

- As at 31 March 2018, inventory was valued at Sh.225,000.

- A customer owing Sh.50,400 has been declared bankrupt. This amount is to be written off in full. An allowance for receivables is to be maintained at 3% of the remaining trade receivables.

- As at 31 March 2018, land was valued at Sh. ,000,000. [and is not to be depreciated.

- Depreciation is to be provided as follows:

Building – 4% per annum on cost.

Equipment – 25% per annum on cost.

Motor vehicles – 40% per annum on reducing balance.

- There were no additions or disposals of non-current assets during the financial year.

Required:

The income statement for the year ended 31 March 2018. (8 marks)

The statement of financial position as at 3 I March 2018. (6 marks)

Explain the accounting concepts involved in each of the additional information notes 1, 3 and 5 above. (6 marks)

(Total: 20 marks)

QUESTION TWO

1. Highlight six uses of the general journal.

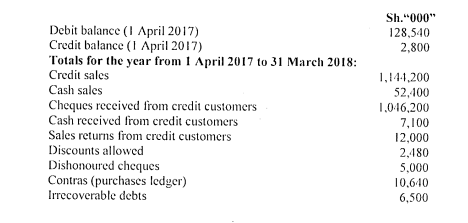

2. The sales ledger control account of Pie Ltd. for the year ended 31 March information:

The sales ledger control account balance, which is part of the double entry system, failed to agree with the total receivables of Sh.189,380,000 as shown by the schedule of receivables. The following errors were subsequently discovered:

- A customer had returned goods to Pie Ltd. at the selling price of Sh.2,100,000. The goods had been bought on credit. No entries had been made to record the return of the goods in the records of Pie Ltd.

- The discounts allowed column in the cash book had been overcast by Sh.1,080,000.

- No contra entry had been made in the receivables account in the sales ledger in respect of purchases by Pie Ltd. of goods at a list price of Sh.2,000,000. Pie Ltd. received a trade discount of 10% on these goods. This transaction had been correctly dealt with in the sales ledger control account.

- A credit sale of Sh.3,520,000 to Joto Ltd. was correctly recorded in the sales ledger control account, but no other entry had been made.

- A cheque received from a customer for Sh.6,900,000 which had been correctly processed through the books, had subsequently been dishonoured. No entries were made to record this dishonoured cheque.

- Dot Ltd., a customer, has recently been declared bankrupt and the amount owed of Sh.3,500,000 is to be written off but no entries have yet been made.

Required:

Revised sales ledger control account for the year ended 31 March 2018. (8 marks)

Revised statement showing the correct total of the schedule of receivables for the year ended 3I March 2018. (6 marks)

(Total: 20 marks)

QUESTION THREE

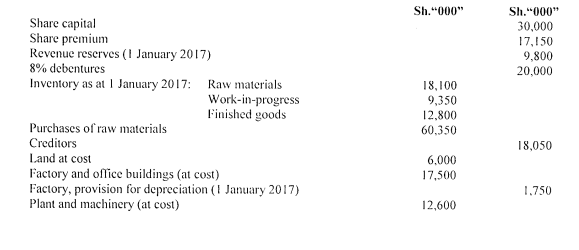

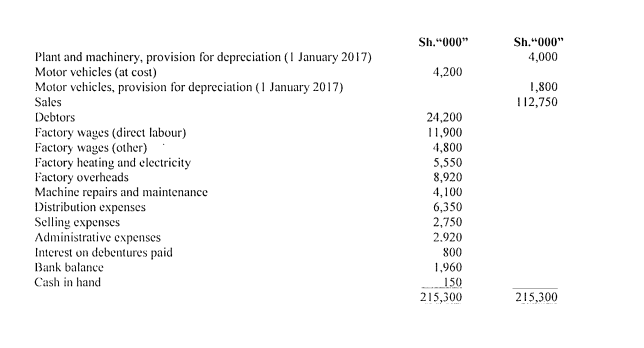

ABC Ltd. is a manufacturer of motor vehicle spare parts. The company’s trial balance as at 31 December 2017 was as follows:

Additional information:

Inventory as at 31 December 2017 was valued at:

Sh.

Raw materials 17,200,000

Work-in-progress 9,950,000

Finished goods 11,650,000

- Depreciation is to be provided as follows:

- Factory and office buildings – 2% per annum on cost.

- Plant and machinery 10% per annum on cost.

- Motor vehicles – 25% per annum on reducing balance.

Factory and office buildings are regarded as 6/7 for Factory and 1/7 for office; motor vehicles at 75% for distribution and 25% for sales.

- Although no provision for bad and doubtful debts had been made previously, it is considered necessary now to write off a debt 01Si-1.200,000 and to make a provision for doubtful debts of I% on the balance of debtors.

- No entries have been made in the books of account of the company in respect of the following items accrued as at 31 December 2017:

Sh.

- Factory electricity 320,000

- Repairs to machines 80,000

- Salesmen’s travelling expenses 60,000

- Transport expenses (for delivery of finished goods) 70,000

- Directors’ remuneration 250,000

- A consignment of raw materials was received between Christmas and new year, and due to the factory being closed, was stored in the gatekeeper’s store. The invoice fbr Sh.170,000 for the consignment has not been recorded and the goods were not counted durir2, the stock take as at 31 December 2017.

- Rates of Sh.960,000 had been paid in respect of the half-year from 1 October 2017. In the accounts, these should be divided between factory overheads and administrative expenses in the ratio of 5: 1 .

- Annual insurance premiums of Sh.900,000 were paid for the year commencing I May 2017. These were apportioned between factory overheads, distribution expenses and administrative expenses in the ratio oil 1:1.

- A commission on net profit is payable to certain management staff of the company. A provision of 10% of the company’s net profit after charging this commission is to be made.

- Tax for the year is provisionally estimated at Sh.500,000.

- The directors have proposed a dividend of 4% on the ordinary shares.

Required:

Manufacturing account for the year ended 31 December 20 1 7. (8 marks)

Income statement for the year ended 31 December 2017. (6 marks)

Statement of financial position as at 31 December 2017. (6 marks)

(Total: 20 marks)

QUESTION FOUR

1. Explain three reasons why an entity’s statement of cash flows might be more useful and reliable than its statement of comprehensive income. (6 marks)

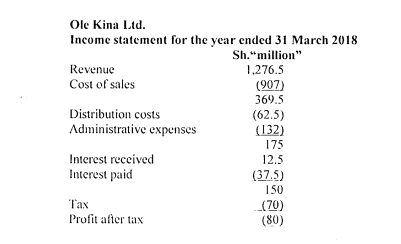

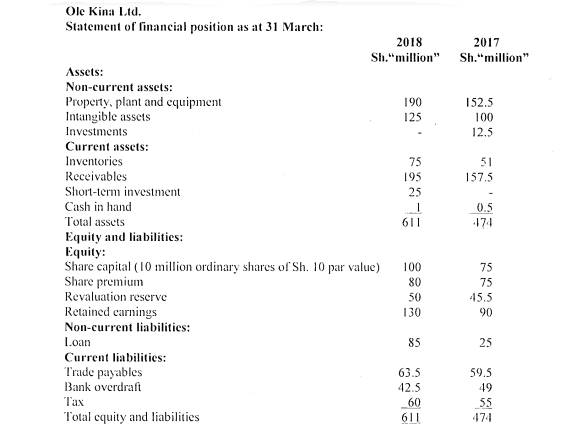

2. The following are the financial statements of Ole Kina Ltd. for the year ended 31 March 2018:

Additional information:

- During the year, the investments classified as non-current assets were sold. The proceeds of the sale of these investments amounted to Sh. 15 million.

- Fixtures and fittings, with an original cost of Sh.42.5 million and a carrying amount of Sh.22.5 million were sold for Sh.16 million during the year.

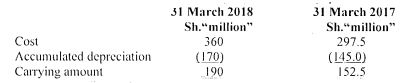

- The following information 1-elates to property, plant and equipment:

- 2.5 million ordinary shares of Sh.10 par value were issued during the year at a premium of Sh.2.0 per ordinary share.

- Dividends totalling Sh.40 million were paid during the year.

Required:

Statement of cash flows in accordance with international accounting standard (1AS) 7 “Statement of Cash Flows” for the year ended 31 March 2018. (14 marks)

(Total: 20 marks)

QUESTION FIVE

1. Faithful representation is the requirement that financial statements should be produced that accurately reflect the condition of a business. The faithful representation concept should extend to all parts of the financial statements including the results of operations, financial position and cash flows of the reporting entity.

Required:

Describe two attributes that financial statements should possess in order to meet the faithful representation criterion. (4 marks)

2. In the context of public sector accounting, explain the meaning of the following terms:

Fund accounting. (2 marks)

Commitment accounting. (2 marks)

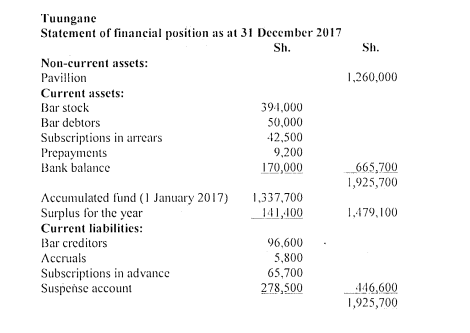

3. Tuungane is a welfare club with an annual membership fee of Sh.200. The club’s statement of financial position as at 31 December 2017, which is presented below, failed to balance and the difference was posted in the suspense account:

On further investigation, the following matters were revealed:

- Bar takings had been overcast by Sh.15,000.

- 600 members had not paid their subscriptions as at 31 December 2017.

- Depreciation for the pavillion amounting to Sh.56,000 had not been provided.

- A loan of Sh.450,000 obtained from the bank was only recorded in the receipts and payments account.

- Repairs on the pavillion amounting to Sh.135,000 had been capitalised.

- Bar creditors of Sh.45,000 had been omitted from the creditors list.

- A receipt of Sh.50,750 had been entered as a payment in the receipts and payments account.

Required:

Journal entries to correct the above errors (narrations not required). (6 marks)

Suspense account duly balanced. (2 marks)

Statement of adjusted surplus (or deficit) for the year ended 31 December 2017. (4 marks)

(Total: 20 marks)