MONDAY: 5 December 2022. Morning Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

Do NOT write anything on this paper.

QUESTION ONE

1. Citing FOUR reasons, justify why not-for-profit entities should be subject to regulation. (8 marks)

2. Vipi Traders’ financial year ends on 31 March. On 1 April 2021, Vipi Traders had a balance on plant account of

Sh.334,800,000 and on accumulated depreciation of plant account of Sh.184,860,000.

Vipi Traders’ policy is to provide depreciation using the reducing balance method applied to the non-current assets

held at the end of the financial year at the rate of 20% per annum. Depreciation charge is not pro-rated.

On 1 September 2021, the company sold for Sh.12,330,000 a plant which it had acquired on 31 October 2018 at a

cost of Sh.32,400,000. Additionally, installation costs totalled Sh.3,600,000. During the year ended 31 March 2020,

major repairs costing Sh.5,670,000 had been carried out on this plant.

A new motor was fitted on the plant on 12 December 2020 at a cost of Sh.3,960,000. Further repairs costing Sh.2,430,000 were carried out during the year ended 31 March 2021. The company acquired a new replacement plant on 30 November 2021 at a cost of Sh.8,640,000 inclusive of installation charges of Sh.6,300,000.

Required:

- Plant account. (4 marks)

- Accumulated depreciation on plant account. (6 marks)

- Profit or loss on disposal of plant. (2 marks)

(Total: 20 marks)

QUESTION TWO

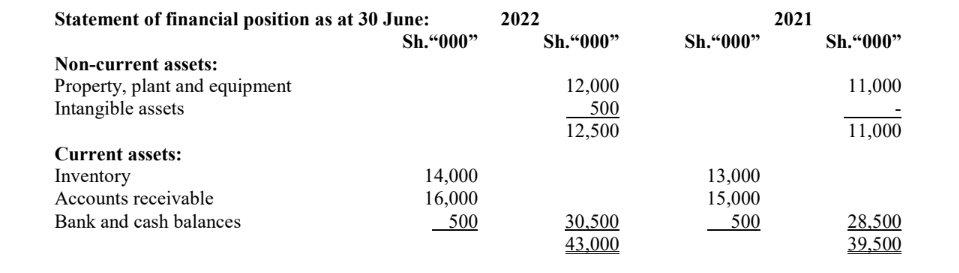

1. The following are summarised financial statements of Tazama Ltd. for the years ended 30 June 2021 and 30 June

2022.

Additional information:

1. As at 1 July 2020, opening inventory was valued at Sh.11,000,000.

2. As at 1 July 2020, accounts receivable and accounts payable were valued at Sh.18,000,000 and Sh.17,600,000 respectively.

3. During the years ended 30 June 2021 and 30 June 2022, 80% of sales were on credit while 10% of purchases were on a cash basis.

Assume a 365-day year.

Required:

Compute each of the following ratios for the years ended 30 June 2021 and 30 June 2022:

- Quick ratio. (2 marks)

- Inventory turnover. (2 marks)

- Accounts receivable turnover in days. (4 marks)

- Accounts payable turnover in days. (4 marks)

- Times interest earned ratio. (2 marks)

Highlight THREE risks that might arise due to each of the following situations:

Low inventory turnover. (3 marks)

High debtors turnover. (3 marks)

(Total: 20 marks)

QUESTION THREE

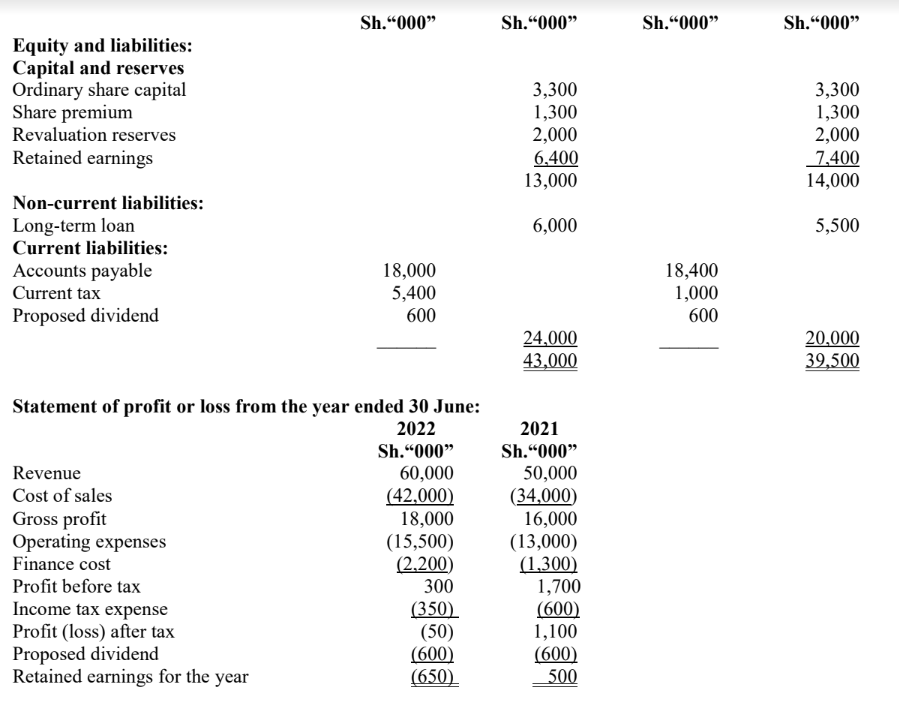

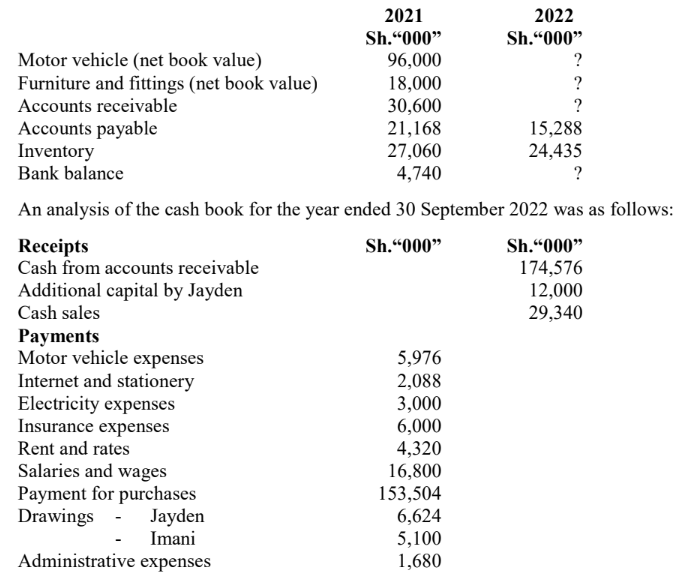

Jayden and Imani are in a business partnership trading under the name Jayman Partnership. Jayden and Imani share profits and losses equally. They do not maintain proper books of accounts. They have provided you with the following information for the year ended 30 September:

Additional information:

1. Credit sales during the year amounted to Sh.163,116. All purchases made during the year ended 30 September 2022

were on credit.

2. On 1 October 2021, Jayden’s capital was Sh.10,000,000 less than that of Imani. Imani’s capital amounted to

Sh.80,000,000.

3. The current accounts for Jayden and Imani each had a balance of Sh.2,616,000 as at 1 October 2021.

4. The capital accounts earn an interest of 1% per annum.

5. During the year ended 30 September 2022, some motor vehicles were disposed of on credit for Sh.32,000,000. Jayden

also sold other partnership’s motor vehicles for Sh.12,500,000 and withdrew the cash for personal use.

The combined net book value of all these motor vehicles was Sh.33,000,000. These transactions have not been

recorded in the books of account.

6. Depreciation is to be provided on a reducing balance method as follows:

Asset Rate per annum

Motor vehicles 12.5%

Furniture and fittings 10%

No depreciation is charged in the year of disposal.

7. As at 30 September 2022, pre-paid insurance amounted to Sh.3,000,000.

8. As at 30 September 2022, the outstanding expenses were as follows:

Sh.“000”

Administrative expenses 180

Electricity expenses 624

Internet and stationery 312

Required:

1. Statement of profit or loss and appropriation account for the year ended 30 September 2022. (10 marks)

2. Partners’ current accounts. (4 marks)

3. Statement of financial position as at 30 September 2022. (6 marks)

(Total: 20 marks)

QUESTION FOUR

The following balances were extracted from the books of Sukari Ltd. as at 31 October 2022:

The following additional information is available:

1. Depreciation is provided annually on cost of the assets as follows:

• Building – 20%

• Fixtures and fittings – 10%

2. A customer who owed Sukari Ltd. Sh.10,000,000 has been declared bankrupt.

3. The allowance for doubtful debts as at 31 October 2022 is to be adjusted to 5% of outstanding accounts receivable.

4. Additional provision for corporate tax of Sh.25,000,000 is to be made.

5. As at 31 October 2022, administrative expenses accrued amounted to Sh.7,000,000.

6. The company paid the interest on debentures for the year ended 31 October 2022 on 30 November 2022.

7. As at 31 October 2022, closing inventory was valued at Sh.560,000,000 at cost and Sh.480,000,000 on realisable

value.

8. The suspense account relates to issue of additional 100,000 ordinary shares at Sh.400.

9. The company’s directors propose the following:

• Preference shares dividend be paid.

• A dividend of 10% on the ordinary share be paid.

• Sh.13,000,000 to be transferred to general reserves.

Required:

1. Statement of profit or loss for the year ended 31 October 2022. (12 marks)

2. Statement of financial position as at 31 October 2022. (8 marks)

(Total: 20 marks)

QUESTION FIVE

1. State FOUR elements of financial statements. (4 marks)

2. Explain FOUR reasons why an organisation’s statement of cash flows might be useful and reliable than its statement

of profit or loss. (8 marks)

3. Argue TWO cases for and TWO cases against the use of accrual method of accounting in the public sector. (8 marks)

(Total: 20 marks)