WEDNESDAY: 15 December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Outline two benefits and two challenges of adopting International Public Sector Accounting Standards (IPSASs). (4 marks)

2. Explain five uses of control accounts in an organisation. (5 marks)

3. The following balances were extracted from the books of Ruth Sifa, who runs a car wash business. She has no knowledge of double entry book-keeping but records everything correctly.

The following balances relate to the year ended 30 September 2021:

Sh.”000″

Accounts payable 200

Cleaning income 35,288

Cash balance 70

Own salary 21,200

Equipment 1,500

Repair to customers’ cars due to damage 460

Miscellaneous expenses 220

Owed by customers 440

Insurance 700

License fees paid 1,050

Stationery 100

Bank balance 4,690

Cleaning materials inventory (30 September 2021) 6,800

Opening capital balance 1,332

Ruth Sifa has not included the following items in her records:

- As at 30 September 2021, bank charges amounted to Sh.90,000.

- As at 30 September 2021, insurance amounting to Sh.100,000 was pre-paid.

- Amounts owed by customers might not easily be recovered. Ruth Sifa would like to make an allowance for doubtful debts of 50% of the amount owing as at 30 September 2021.

- License fees paid amounting to Sh.500,000 relates to the year ended 30 September 2020.

- Equipment is to be depreciated over two years with no residual value.

Required:

Statement of profit or loss for the year ended 30 September 2021. (6 marks)

Statement of financial position as at 30 September 2021. (5 marks)

(Total: 20 marks)

QUESTION TWO

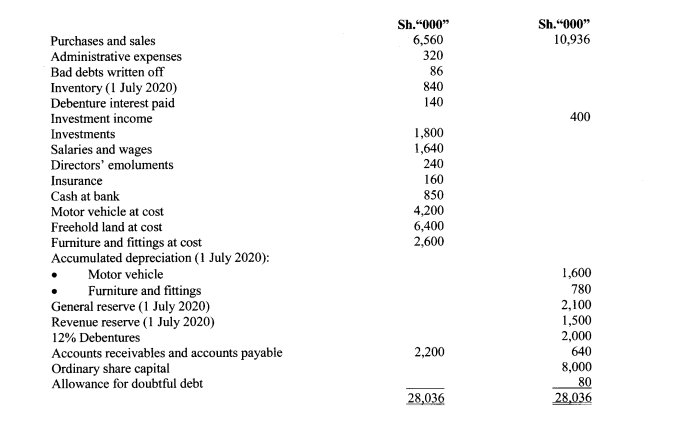

Zamu Ltd. has an authorised capital of 2,000,000 ordinary shares of Sh.20 each. The company’s trial balance as at 30 June 2021 was as follows:

Additional information:

- The inventory as at 30 June 2021 was valued at Sh.1,240,000.

- The freehold land was revalued to Sh.9,400,000. Part of the revaluation amount was used for a rights issue of 1 for every 4 shares held at a value of Sh.20 each.

- As at 30 June 2021, insurance paid in advance amounted to Sh.40,000 while salaries and wages outstanding amounted to Sh.60,000.

- The directors proposed a dividend of 10% of the issued share capital and a transfer of Sh.420,000 to the general reserve.

- The corporation tax for the year amounted to Sh.540,000.

- Depreciation is provided as follows:

Asset Rate per annum

- Motor vehicle 20% on cost

- Furniture and fittings 10% reducing balance

- Allowance for doubtful debts is to be maintained at 5% of the accounts receivable.

Required:

1. Statement of profit or loss for the year ended 30 June 2021. (10 marks)

2. Statement of financial position as at 30 June 2021. (10 marks)

(Total: 20 marks)

QUESTION THREE

1. Identify four books of original entry used in accounting. (4 marks)

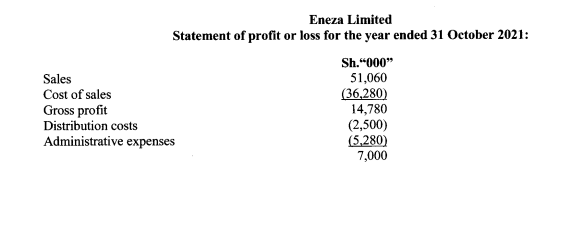

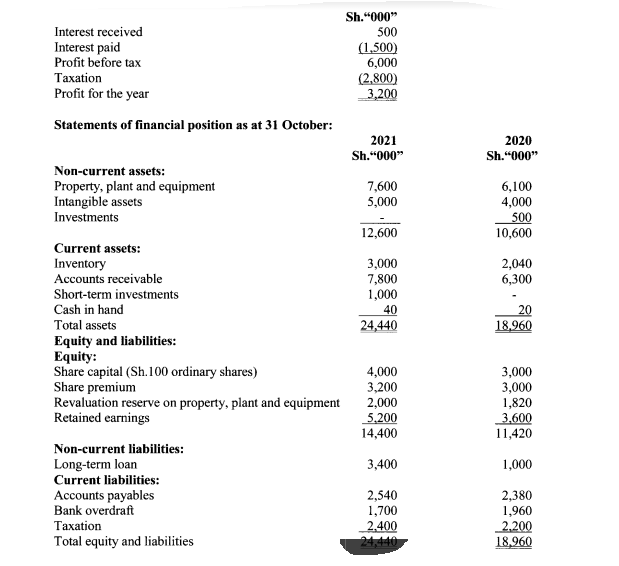

2. The following are the summarised financial statements of Eneza Limited as at 31 October 2020 and 31 October 2021:

Additional information:

- The process of the sale of non-current investments amounted to Sh.600,000.

- Equipment with an original cost of Sh.1,700,000 and a net book value of Sh.900,000 was sold for Sh.640,000 during the year ended 31 October 2021.

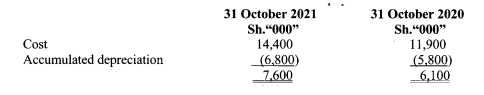

- The following information relate to property, plant and equipment:

- Dividends totalling Sh.1,600,000 were paid during the year.

Required:

Statement of cash flows in accordance with requirements of International Accounting Standard (IAS) 7,

“Statement of Cash Flows” for the year ended 31 October 2021. (16 marks)

(Total: 20 marks)

QUESTION FOUR

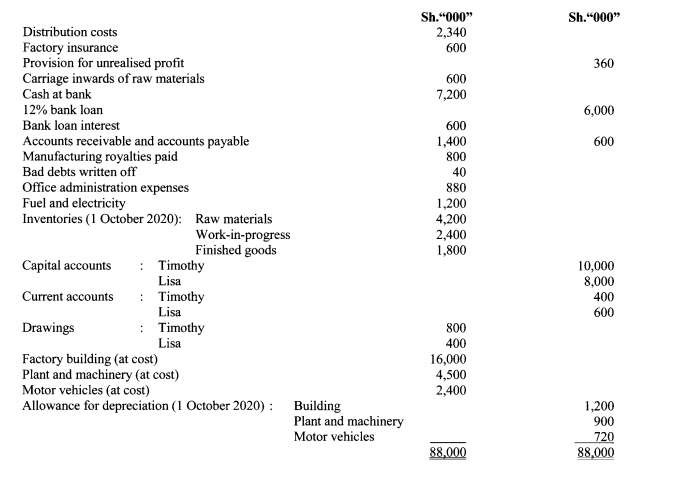

Timothy and Lisa are in partnership sharing profit and loss equally in a manufacturing venture. Timothy manages the manufacturing entity, while Lisa manages the selling and distribution of the end product.

The following trial balance was extracted from their books for the year ended 30 September 2021:

Additional information:

- Inventories as at 30 September 2021 were valued as follows:

Sh.

Raw materials 5,200,000

Work-in-progress 2,000,000

Finished goods 3,600,000

- Depreciation is provided on cost as follows:

Asset Rate per annum

– Building 21/2%

– Plant and machinery 10%

– Motor vehicles 20%

- Manufactured goods are transferred to the warehouse at factory cost plus profit at 20% of the factory cost.

- The partnership agreement provided that:

Each partner is entitled to a salary of Sh.100,000 per month.

Timothy is entitled to 10% commission based on factory profit, while Lisa is entitled to a 10% commission based on the net profit.

Interest on capital is to be charged at 10% per annum.

Interest on drawings is to be charged at 15% per annum.

- Fuel and electricity are to be apportioned at 80% to the factory and 20% to the office.

Required:

Manufacturing and statement of profit or loss for the year ended 30 September 2021. (12 marks)

Statement of financial position as at 30 September 2021. (8 marks)

(Total: 20 marks)

QUESTION FIVE

1. Highlight four types of errors that might not affect the trial balance. (4 marks)

2. Discuss four sources of revenue for not-for-profit entities. (8 marks)

3. Evaluate four qualities of useful financial information. (8 marks)

(Total: 20 marks)