MONDAY: 1 August 2022. Morning paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

Do NOT write anything on this paper.

QUESTION ONE

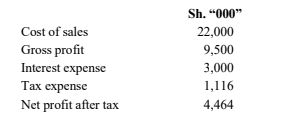

1. The finance manager of Wali Traders has provided you with the following information:

Required:

Interest coverage ratio. (3 marks)

Gross profit margin ratio. (2 marks)

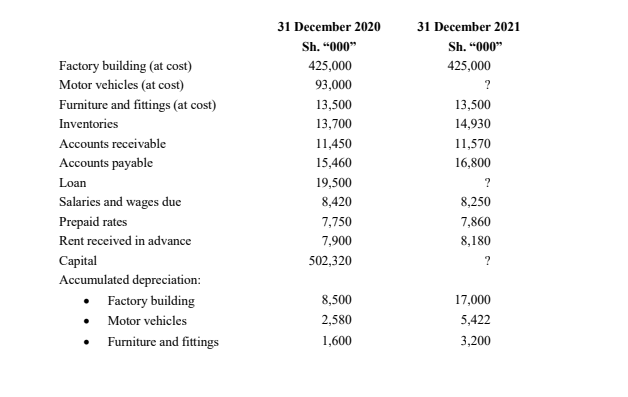

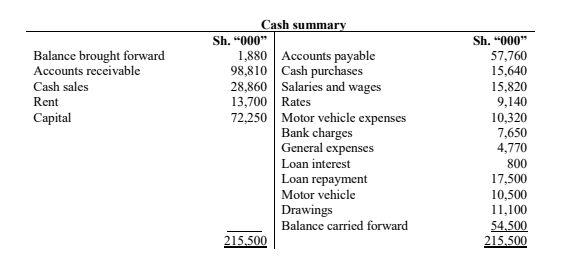

2. Grace Solo is a sole trader who runs a commercial bakery. She does not maintain proper records, but has provided you with the following information.

Additional information:

1. Grace Solo’s cash summary is provided as follows:

2. During the year ended 31 December 2021, discounts allowed amounted to Sh.873,000 while discounts received amounted to Sh.886,000.

2. During the year ended 31 December 2021, discounts allowed amounted to Sh.873,000 while discounts received amounted to Sh.886,000.

3. During the year ended 31 December 2021, Grace Solo took goods valued at Sh.800,000 for her personal use.

Required:

Statement of profit or loss for the year ended 31 December 2021. (10 marks)

Statement of financial position as at 31 December 2021. (5 marks)

(Total: 20 marks)

QUESTION TWO

1. Outline four objectives of accounting regulatory bodies. (4 marks)

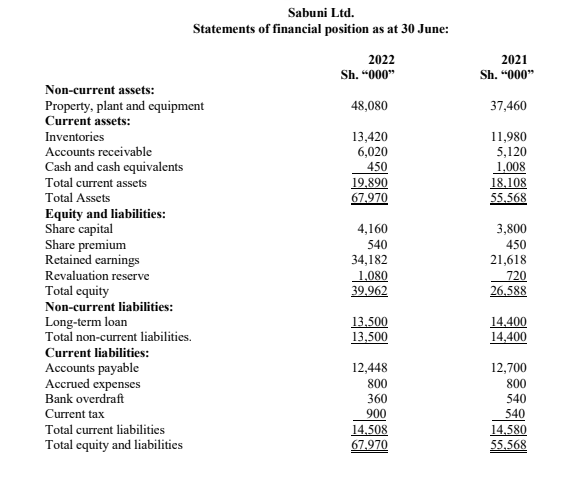

2. The following are the statements of financial position of Sabuni Ltd., a soap manufacturing company for year ended 30 June 2022 and 30 June 2021:

Additional information:

1. The cost of property, plant and equipment was Sh.45,740,000 on 1 July 2021.

2. The company disposed of a plant with a carrying value of Sh.3,120,000 on 1 April 2022. The original cost of this plant was Sh.4,800,000 and the company made a loss of Sh.120,000.

3. It is the policy of the company to depreciate all assets at the rate of 10% per annum on cost from date of purchase to date of sale.

4. The finance cost incurred and paid in the year ended 30 June 2022 was Sh.288,000, while a dividend of Sh.516,000 was paid for the same period.

5. Sabuni Ltd. made a profit before tax of Sh.13,458,000 during the year ended 30 June 2022.

6. The income tax expense for the year ended 30 June 2022 was Sh.378,000.

Required:

Statement of cash flows in accordance with the requirement of “International Accounting Standard (IAS)7”, statement of cash flows, for the year ended 30 June 2022. . (16 marks)

(Total: 20 marks)

QUESTION THREE

Maji Matamu Ltd. is company that manufacturers Tamu juice. On 1 January 2021, 100,000 litres of Tamu juice were in stock. During the year ended 31 December 2021, the company manufactured 366,000 litres of juice. The company sold 400,000 litres of juice at a price of Sh.600 per litre.

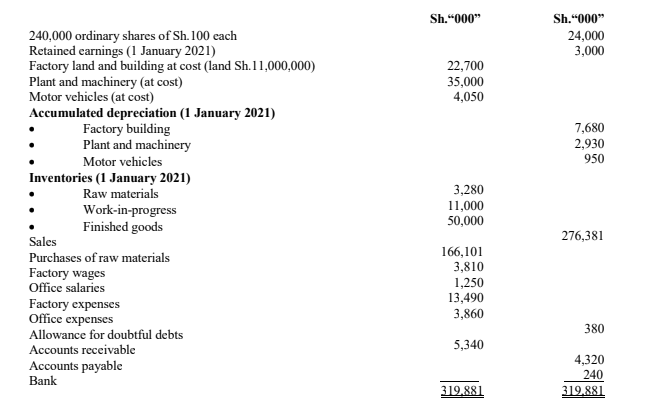

The following trial balance was extracted from the books of the company for year ended 31 December 2021:

Additional information:

1. Inventories as at 31 December 2021 were valued as follows:

Sh. “000”

Raw materials 3,560

Work-in progress 18,400

Finished goods 33,000

2. The allowance for doubtful debts is to be maintained at 5% of the accounts receivable.

3. As at 31 December 2021, accrued factory expenses amounted to Sh.125,000 (including office expenses of Sh75,000) and prepaid factory expenses amounted to Sh.12,000 (including office rent and rates of Sh.7,000).

4. Depreciation is provided on cost as follows:

Rate per annum

Factory buildings 2%

Factory plant 20%

Motor vehicles 25%

5. The inventory of finished goods of Tamu juice on 1 January 2021 was valued at factory cost.

6. The directors of Maji Matamu decided to transfer all the Tamu juice manufactured to the warehouse at a mark-up of 10% from 1 January 2021.

7. The directors proposed a dividend of Sh.10 per share issued.

Required:

1. Manufacturing and statement of profit or loss for the year ended 31 December 2021. (12 marks)

2. Statement of financial position as at 31 December 2021. (8 marks)

(Total: 20 marks)

QUESTION FOUR

The authorised share capital of MLO Ltd. consists of one million ordinary shares of Sh.10 each and 500,000 6% preference shares of Sh.10.

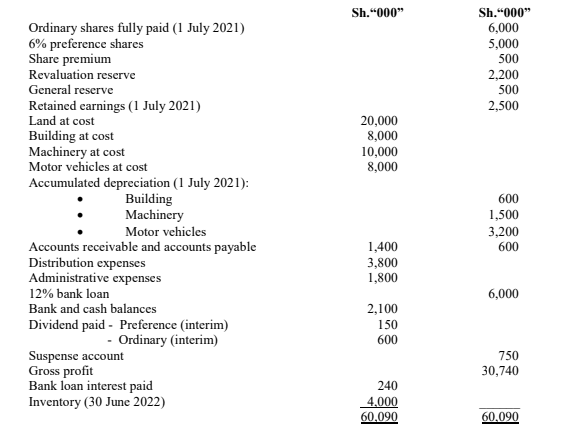

The following trial balance was extracted from the books of MLO Ltd. as at 30 June 2022:

Additional information:

1. The suspense account relates to 50,000 new ordinary shares which were issued at a premium of 50% each on 31 January 2022.

2. On 30 November 2021, the directors made a bonus issue of one share for every five shares held at par fully paid from the revenue reserves.

3. Depreciation is provided per annum on straight line basis as follows:

4. Corporate tax expenses for the year amounted to Sh.3,100,000.

5. The directors proposed the following:

• A transfer of Sh.2,500,000 to general reserve.

• Payment of final dividends for preference shares.

• A dividend of Sh.5 per share for ordinary shares. The additional ordinary shares also qualified for the final dividend.

6. Land was revalued upwards to Sh.22 million on 1 July 2021.

Required:

1. Statement of profit or loss for the year ended 30 June 2022. (12 marks)

2. Statement of financial position as at 30 June 2022. (8 marks)

(Total: 20 marks)

QUESTION FIVE

1. Outline the information required by each of the following users of accounting information:

Owners. (2 marks)

Customers. (2 marks)

Suppliers. (2 marks)

Lenders. (2 marks)

Management. (2 marks)

2. Discuss two benefits of using the double entry system of bookkeeping to an organisation. (4 marks)

3. Explain three objectives of the International Public Sector Accounting Standards Board (IPSASB). (6 marks)

(Total: 20 marks)