MONDAY: 1 August 2022. Morning paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

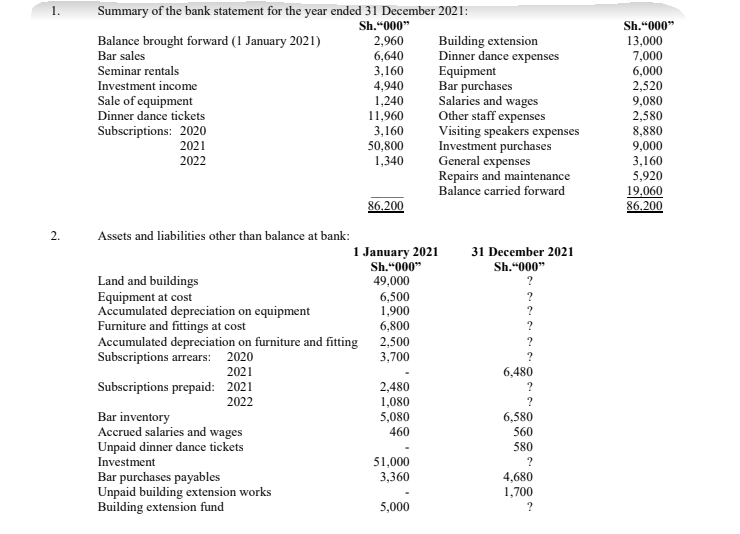

The treasurer of Union Club does not keep a complete set of accounting records. However, the following balances have been extracted from Union Club’s records:

Additional information:

- Equipment with original cost of Sh.1,200,000 was sold during the year for Sh.1,240,000 in cash. The accumulated depreciation on this equipment at 1 January 2021 amounted to Sh.380,000. Another equipment with an original cost of Sh.500,000 was sold for Sh.280,000 to a club member. He had not paid the club this money as at 31 December 2021. The accumulated depreciation on this equipment amounted to Sh.140,000.

- Depreciation for the year ended 31 December 2021 is to be provided as follows:

Asset Sh.“000”

Equipment 1,620

Furniture and fittings 680

- Subscriptions in arrears are written off after 12 months.

- The building extension fund was not utilised during the year ended 31 December 2021.

Required:

1. Bar income statement for the year ended 31 December 2021. (4 marks)

2. Income and expenditure account for the year ended 31 December 2021. (8 marks)

3. Statement of financial position as at 31 December 2021. (8 marks)

(Total: 20 marks)

QUESTION TWO

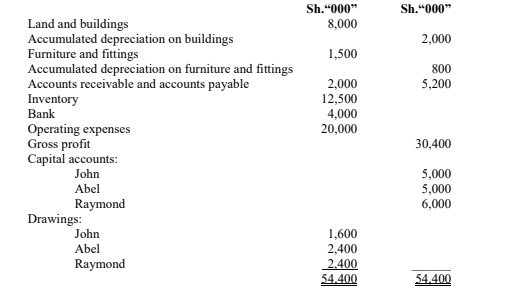

John, Abel and Raymond have been trading as partners under the name JAR Enterprises. They have been sharing profits and losses in the ratio 4:3:3 respectively.

Additional information:

- On 30 June 2021, John retired from the partnership. From that date, Abel and Raymond were to share profits and losses equally. Profits and losses accrue evenly throughout the year.

- Interest is to be credited at 5% per annum in the partner’ capital accounts. No interest is to be charged on drawings.

- On John’s retirement, goodwill was valued at Sh.11,100,000. This was to be written off immediately.

- Upon John’s retirement, revaluation of assets was carried out by a valuer. The assets were revalued as follows:

Asset Sh.“000”

Land and buildings 10,000

Furniture and fittings 1,000

- The amount due to John from his capital account is to receive interest at the rate of 6% per annum from the date of retirement until it is repaid. As at 31 December 2021, both the amount in his capital account and current account had not been repaid.

- The following trial balance was extracted from the books of JAR Enterprises as at 31 December 2021:

- The operating expenses comprised of the following:

Sh.“000”

Rent and insurance 2,000

Salaries and wages 12,400

Bad debts 800

Office expenses 1,200

Repairs and maintenance 3,600

- As at 31 December 2021, accrued rent amounted to Sh.650,000, while office expenses of Sh.135,000 and repairs and maintenance of Sh.1,080,000 had been prepaid.

- Each partner draws an annual salary of Sh.2,500,000. This is not included in the salaries and wages.

Required:

1. Statement of profit or loss and appropriation account in columnar form for the two periods ended 30 June 2021 and 31 December 2021. (10 marks)

2. Partners’ current accounts. (4 marks)

3. Statement of financial position as at 31 December 2021. (6 marks)

(Total: 20 marks)

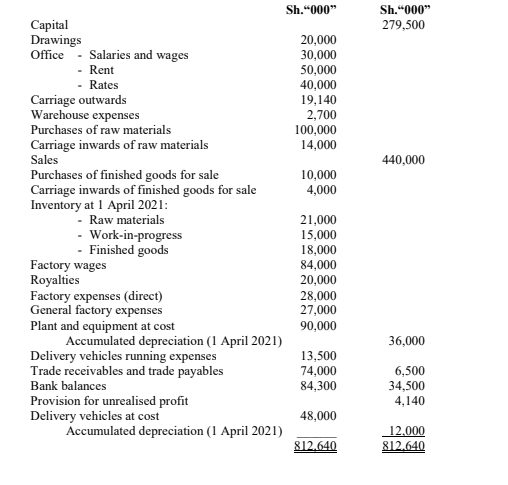

QUESTION THREE

Linkages Ltd. is a manufacturer of barbed wire. The company’s trial balance as at 31 March 2022 was as follows:

Additional information:

- Rates paid in advance as at 31 March 2022 amounted to Sh.6,000,000.

- Direct factory wages accruing as at 31 March 2022 amounted to Sh.9,000,000.

- Inventories as at 31 March 2022 were valued as follows:

Sh.“000”

Raw materials 27,000

Work-in-progress 24,000

Finished goods 31,050

- Depreciation is to be charged at 10% per annum on cost for plant and equipment and 25% per annum on cost for delivery vehicles.

- Manufactured goods are transferred to the warehouse at markup of 25% of factory cost.

Required:

1. Manufacturing account for the year ended 31 March 2022. (6 marks)

2. Statement of profit or loss for the year ended 31 March 2022. (7 marks)

3. Statement of financial position as at 31 March 2022. (7 marks)

(Total: 20 marks)

QUESTION FOUR

1. In relation to public sector accounting, explain the following terms:

Recurrent expenditure. (2 marks)

Development expenditure. (2 marks)

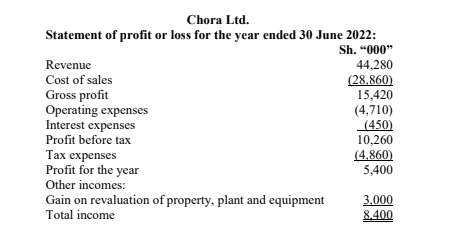

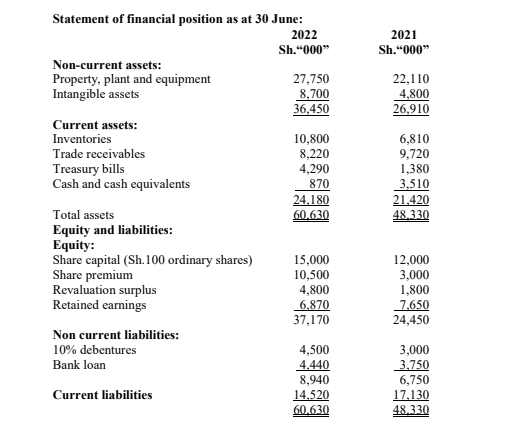

2. The following are the summarised financial statements of Chora Ltd. as at 30 June 2021 and 30 June 2022:

Additional information:

- During the year ended 30 June 2022, impairment loss of Sh.180,000 was charged on intangible assets.

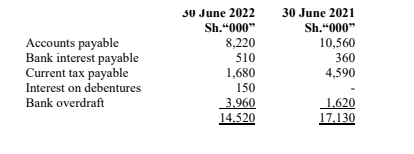

- Current liabilities comprise of the following:

- During the year ended 30 June 2022, items of property, plant and equipment with a carrying amount of Sh.3,090,000 were sold for Sh.3,300,000. Profits on these sales were offset against operating expenses.

- During the year ended 30 June 2022, depreciation charged on property, plant and equipment amounted Sh.1,710,000. Property, plant and equipment of Sh.1,680,000 was acquired through a bank loan during the year.

- During the year ended 30 June 2022, Chora Ltd. made a 1 for 8 bonus issue, capitalising its retained earnings followed by a rights issue.

Required:

Statement of cash flows in accordance with the requirement of International Accounting Standard (IAS) 7, “Statement of cash flows” for the year ended 30 June 2022. (16 marks)

(Total: 20 marks)

QUESTION FIVE

1. Outline four criteria that an asset should satisfy for it to be classified as a current asset. (4 marks)

2. Discuss three guiding ethics for professional accountants. (6 marks)

3. Explain the following terms:

Bonus issue of shares. (2 marks)

Rights issue of shares. (2 marks)

4. Explain the significance of the following:

Return on investment (ROI). (2 marks)

Gross profit to sales. (2 marks)

Price earnings ratio (P/E ratios). (2 marks)

(Total: 20 marks)