MONDAY: 24 April 2023. Morning Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

Neno Moja commenced his business on 1 April 2022. Due to his limited accounting knowledge, he did not maintain a complete set of accounts. He engaged a financial accounting consultant to prepare his financial statements at the end of the year.

The consultant’s examination revealed the following:

- On the commencement date he deposited Sh.1,200,000 into the bank account, converted his pick-up valued at Sh.660,000 into business use and purchased equipment worth Sh.960,000 using a cheque from the business bank account. As at 1 April 2022, the pick up was estimated to have a remaining useful life of 3 years while equipment has a useful life of 5 years.

- On 1 April he employed an office assistant at a monthly salary of 60,000 paid from his bank account.

- On 1 July 2022, he borrowed Sh.400,000 at 15% per annum from the bank. No interest had been paid as at 31 March

- Land rates for 15 months up to 30 June 2023 amounted to 360,000, but had not been paid.

- The financial accountant’s consultancy fee was agreed at 55,000.

- Cash withdrawal for office use per week amounted to Sh.18,000. Cash withdrawals were all used for administrative

- Neno Moja provided the following bank payments summary:

8. Purchases for the period amounted to 1,960,000 all paid from the bank.

9. Credit sales of Sh.6,178,000 were made during the year, out of which Sh.5,080,000 was paid directly by the customers into the bank account. As at 31 March 2023, debts amounting to Sh.17,000 were written off.

10. During the year, cash sales amounted to Sh.726,000, out of which Sh.560,000 was banked, Sh.99,000 was taken for personal use, the rest was used on general expenses except 30,100 which was left in the office cabinet as at 31 March 2023.

11. Closing inventory as at 31 March 2023 was valued at 158,000.

12. As at 31 March 2023, electricity outstanding and insurance expense pre-paid amounted to Sh.48,000 and Sh.40,000

Assume a year has 52 weeks.

Required:

- Statement of profit or loss for the year ended 31 March (12 marks)

- Statement of financial position as at 31 March (8 marks)

(Total: 20 marks)

QUESTION TWO

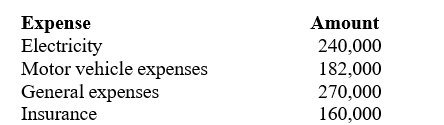

The following trial balance was extracted from the books of Kulah Manufacturers Ltd. as at 31 December 2022:

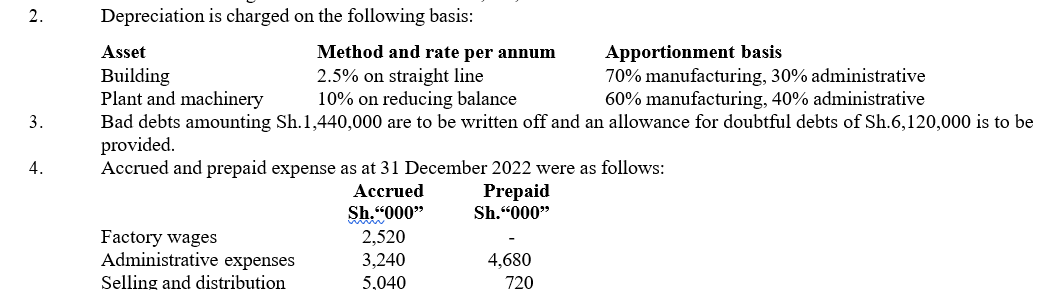

Additional information:

- Inventory as at 31 December 2022 was valued as follows:

5. The following were agreed and provided for by the management and the board:

-

- Corporate tax for the year 28,800,000

- Proposed an ordinary share dividend of 21,600,000.

- Transfer of 3,600,000 to general reserve.

6. Manufactured goods are transferred to the warehouse at cost plus 50% mark-up

Required:

Prepare the following:

- Manufacturing statement and statement of profit or loss for the year ended 31 December (12 marks)

- Statement of financial position as at 31 December (8 marks)

(Total: 20 marks)

QUESTION THREE

1. Describe THREE functions of the International Public Sector Accounting Standards (IPSAS). (6 marks)

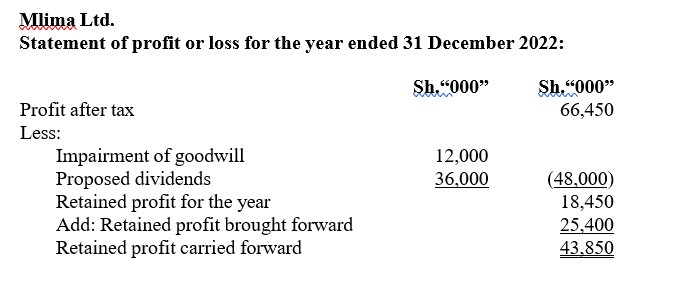

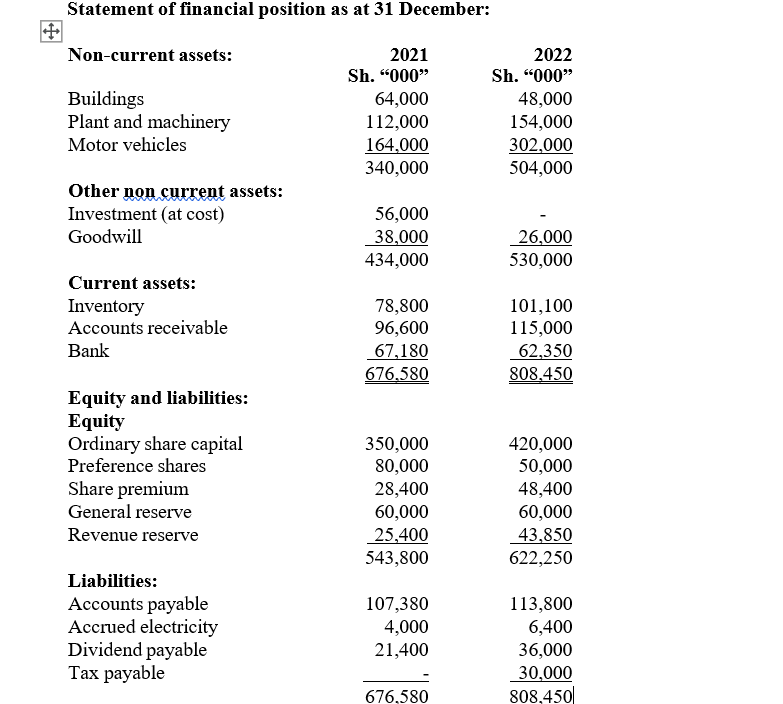

2. The following financial statements were extracted from the books of Mlima for the year ended 31 December 2022:

Additional information:

- Investments were sold at a gain of 6,000,000.

- During the year ended 31 December 2022, depreciation charged on building amounted to Sh.1,600,000. No other buildings were acquired or constructed during the year.

- During the year ended 31 December 2022, an item of plant and machinery worth Sh.60,000,000 was

- Motor vehicles which had cost Sh.80,000,000 and with accumulated depreciation of Sh.54,000,000 were disposed of during the year ended 31 December 2022 at 30,000,000. The total depreciation charge for the year for all motor vehicles was Sh.30,000,000.

Required:

Statement of cash flows in accordance with the requirement of International Accounting Standard (IAS) 7 “Statement of Cash Flows” for the year ended 31 December 2022. (14 marks)

(Total: 20 marks)

QUESTION FOUR

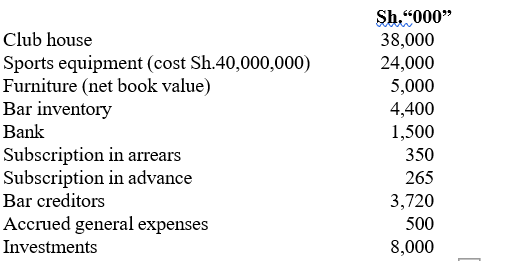

The following balances were extracted from the books of Mchezo Sports Club as at 1 January 2022:

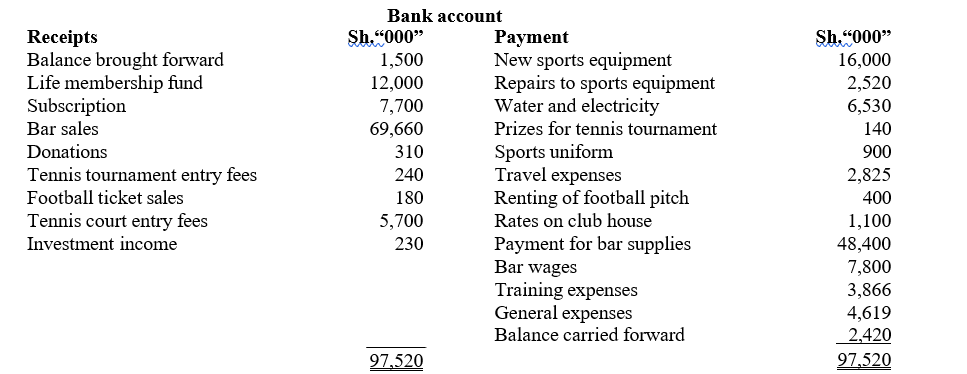

All cash received was paid into the club bank account and all payments were made by cheque. The bank statements for the year ended 31 December 2022 have been analysed and the following summary prepared:

Additional information:

- During the year, the club introduced a life membership The contributions to the fund were set at Sh.400 per member. A tenth of the fund fee will be recognised in the income and expenditure account every year.

- As at 31 December 2022, creditors for bar purchases and general expenses outstanding amounted to Sh.4,300,000 and Sh.640,000 respectively.

- It is the club’s policy to write off the cost of sports equipment over a ten year A full year’s depreciation is recognised in the year of purchase and no depreciation in the year of disposal.

- Furniture is depreciated at a rate of 10% per annum based on the balance at the year

- Subscription in arrears as at 31 December 2022 amounted to 230,000 and subscription received in advance amounted to Sh.543,000.

- As at 31 December 2022, bar inventory was valued at 3,850,000.

Required:

- Bar statement of profit or loss for the year ended 31 December (4 marks)

- Income and expenditure account for the year ended 31 December (8 marks)

- Statement of financial position as at 31 December (8 marks)

(Total: 20 marks)

QUESTION FIVE

1. Highlight SIX objectives of public sector (6 marks)

2. Explain the following terms as used in public sector accounting:

- Commitment (2 marks)

- Budgetary (2 marks)

3. In relation to intangible assets:

- Define the term “intangible asset”. (2 marks)

- Cite TWO examples of intangible (2 marks)

4. Discuss THREE limitations of ratios as financial analysis (6 marks)

(Total: 20 marks)