MONDAY: 4 April 2022. Morning paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Highlight five elements of financial statements. (5 marks)

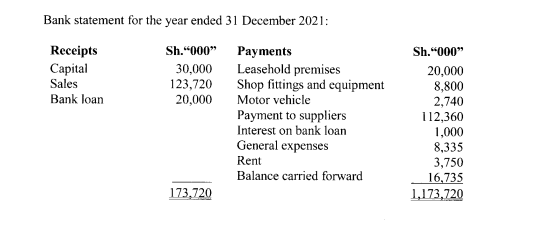

2. Fatuma Ali commenced business as a retail chemist on 1 January 2021 with an initial capital of Sh.30,000,000 which she paid into her business bank account. She hired a shop manager at an annual salary of Sh.2,000,000. In addition, the shop manager is to receive a commission of 10% of the gross profit.

During the year ended 31 December 2021, Fatuma Ali did not maintain proper books of account. After an examination of the available records the following information was extracted:

Additional information:

- All sales were for cash and sales are banked daily subject to the retention of a cash float of Sh.100,000.

The following payments were made out of the cash sales:

Sh. “000”

Manager’s salary 1,980

Drawings 4,000.

Payments to suppliers 1,390

General expenses 840

- As at 31 December 2021, cheques sent to suppliers amounting to Sh.2,500,000 had not been presented to the bank for payment.

- As at 31 December 2021, invoices from suppliers amounting to Sh.8,600,000 had not been paid.

- As at 31 December 2021, inventory was valued at Sh.36,500,000.

- Depreciation per annum is to be provided on the motor vehicle at the rate of 25% on cost and on the shop fittings and equipment at 10% on cost.

- During the year ended 31 December 2021, Fatuma Ali took goods which cost Sh.100,000 for her personal use.

Required:

Statement of profit or loss for the year ended 31 December 2021. (8 marks)

Statement of financial position as at 31 December 2021. (7 marks)

(Total: 20 marks)

QUESTION TWO

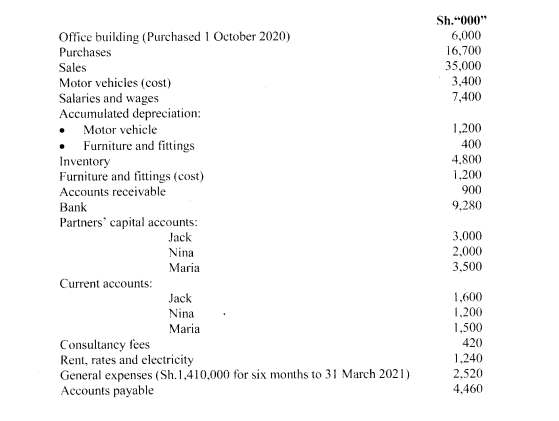

Jack and Nina were operating a shop dealing in designer bags as partners sharing profits and losses in the ratio of 2:1 respectively. On 31 March 2021 they admitted Maria to the partnership. The partnership deed provides for interest on capital at the rate of 10% per annum.

The balances as per the partnership’s book of account as at 30 September 2021 were as follows:

Additional information:

- On admission of Maria, the profit sharing ratio changed to Jack 2/5. Nina 2/5, Maria 1/5. For purpose of admission, goodwill was valued at Sh. I 2,000,000 and was written off the books immediately.

- Sales for the period to 31 March 2021 were equal to two third of sales from 1 April to year end.

- On 1 April 2021, Maria paid Sh.5,000,000 which comprised her fixed capital of Sh.3,500,000 and her current account contribution of Sh.1,500,000.

- Apportionment of gross profit was to be made on the basis of sales while for expenses is based on time, unless otherwise indicated.

- On 30 September 2021, inventory was valued at Sh.5,100,000

- Allowance for depreciation on motor vehicles, and furniture and fittings is at the rate of 20% and 5% per annum respectively, based on cost.

- Salaries included the following partner’s drawings during the year:

Sh.

Jack 600,000

Nina 480,000

Maria 250,000

- As at 30 September 2021, rates paid in advance amounted to Sh.260,000 while electricity accrued amounted to Sh.60,000.

- Doubtful debts (for which full provision was required) as at 31 March 2021 amounted to Sh.120,000 and Sh.160,000 as at 30 September 2021.

- Consultancy fees included Sh.200,000 paid in respect to the acquisition of office building. These fees are to be capitalised as part of the building. The building is estimated to have a useful life of 25 years.

Required:

Statement of profit or loss for the year ended 30 September 2021. (10 marks)

Statement of financial position as at 30 September 2021. (6 marks)

Partners’ current accounts. (4 marks)

(Total: 20 marks)

QUESTION THREE

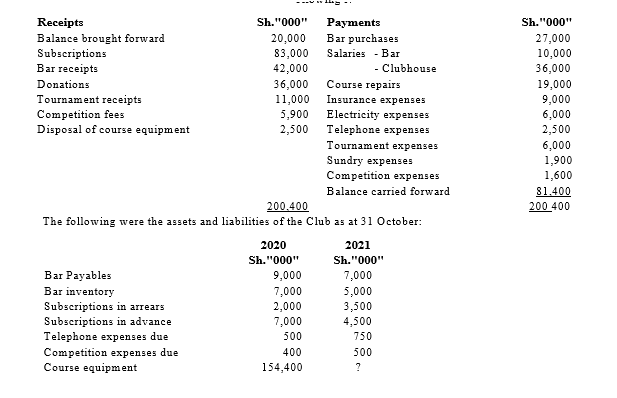

The treasurer of Kite Golf Club has provided the following receipts and payments for the year ended 31 October 2021:

Additional information:

- As at 1 November 2020, the following assets were identified at cost:

Sh. “000”

Clubhouse and course 400,000

Fixtures and fittings 70,000

Course equipment 160,000

- Depreciation rates per annum were as follows:

Asset Rate

– Fixtures and fittings 10% on cost

– Course equipment 20% on cost

- Course equipment was disposed of during the year for a scrap value of Sh.2,500,000. The equipment was purchased for Sh.7,000,000 and had an accumulated depreciation charge of Sh.5,600,000 as at 1 November 2020. No depreciation is charged in the year of disposal.

- As at 1 November 2020, insurance pre-paid amounted to Sh.4,500,000.

- The insurance expense paid for the year covers the period to 31 July 2022. The Insurance for the period to 31 July 2021 amounted to Sh.6,000,000.

Required:

Bar income statement for the year ended 31 October 2021. (4 marks)

Income and expenditure statement for the year ended 31 October 2021. (8 marks)

Statement of financial position as at 31 October 2021. (8 marks)

(Total: 20 marks)

QUESTION FOUR

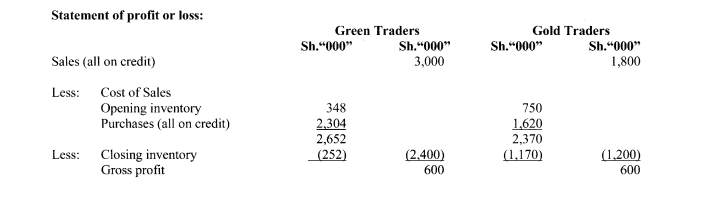

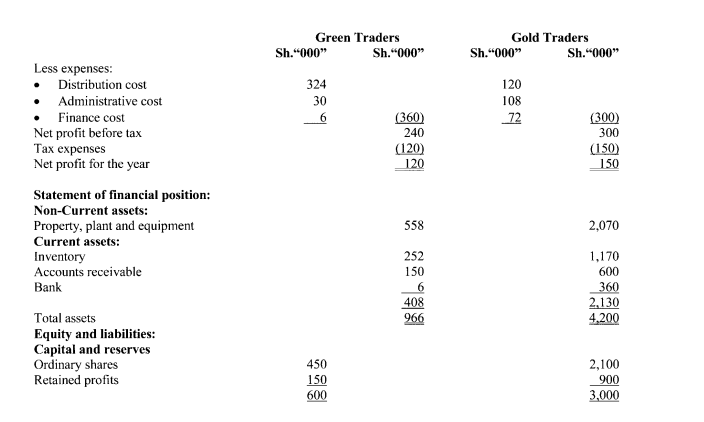

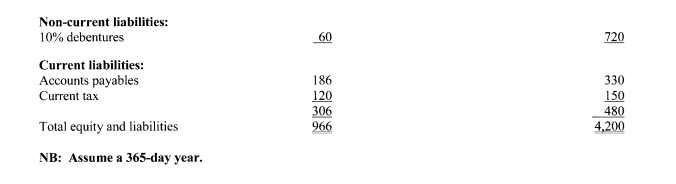

Green Traders and Gold Traders are two businesses dealing with the sale of household furniture. The following financial statements were extracted from their books for the year ended 31 December 2021:

Required:

Compute the following ratios for each company:

Gross profit margin. (2 marks)

Net profit margin. (2 marks)

Return on capital employed. (2 marks)

Return on assets. (2 marks)

Current ratio. (2 marks)

Assets turnover. (2 mark

Inventory turnover. (2 marks

Trade receivable days. (2 marks)

Trade payable days. (2 marks)

2. Comment on the profitability for each company. (2 marks)

(Total: 20 marks)

QUESTION FIVE

1. In relation to public sector accounting:

Explain the term “encumbrance (obligations)”. (2 marks)

Highlight four characteristics of a government business enterprise. (4 marks)

2. Describe the following types of preference share capital:

Cumulative preference shares. (2 marks)

Participating preference share capital. (2 marks)

Redeemable preference shares. (2 marks)

3. On 30 September 2021, the cashbook (bank column) of Legume Traders showed a debit balance of Sh.530,000 while the bank statement balance on the same date had a balance of Sh.608,500.

On investigation, the following discrepancies were discovered:

- A cheque received from a debtor for Sh.92,000 and debited in the cashbook was refunded by the bank stamped “Insufficient funds” on 28 September 2021.

- A receipt from a debtor of Sh.65,000 was entered as a payment in the cashbook.

- Bank charges amounting to Sh.9,500 were reflected in the bank statement only.

- Cheques totalling to Sh.299,000 had been issued to suppliers, but not yet been presented to the bank for payment.

- A standing order placed for rent of Sh.230,000 was effected in the bank as per the bank statement.

- Cheques amounting to Sh.206,000 were received and debited in the cash book. These cheques had not yet been credited into the bank statement.

- A customer made a direct deposit of Sh.187,000 into the business bank account.

Required:

An updated cashbook as at 30 September 2021. (4 marks)

Bank reconciliation statement as at 30 September 2021. (4 marks)

(Total: 20 marks)