Financial Accounting forms part of the core competencies that a CPA candidate should acquire. The examination mode for this paper is a mixture of theory and computational requirements.

On the computational requirements, for example, marks will be earned for accuracy, clarity, neatness, display and presentation of information. In addition, the correct format of presentation will also be key in earning the candidate extra marks.

Against this background, some candidates did not perform well in the following questions:

Question 2(b)

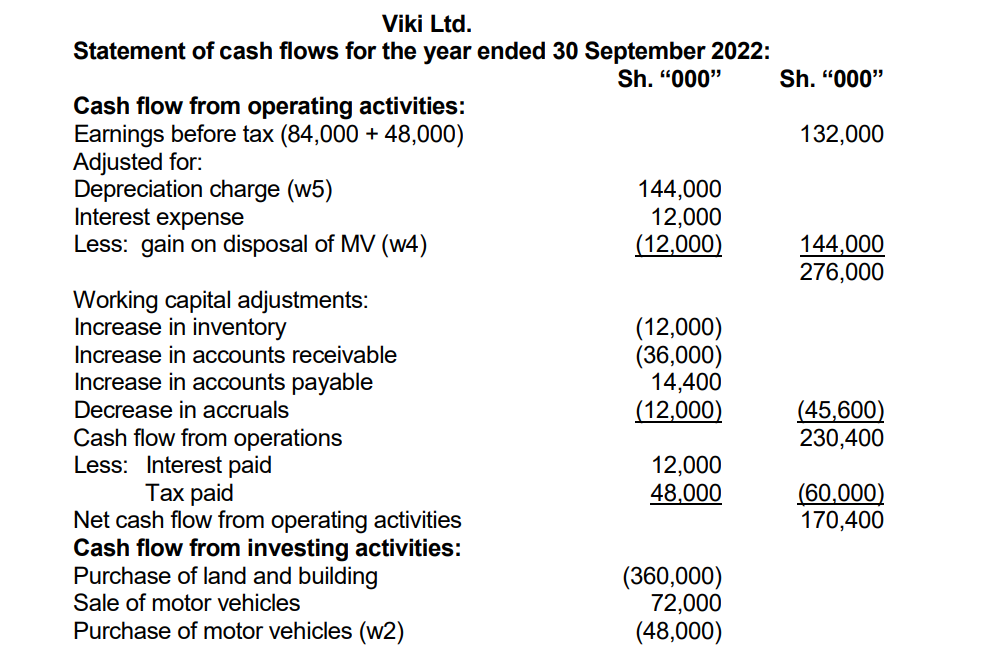

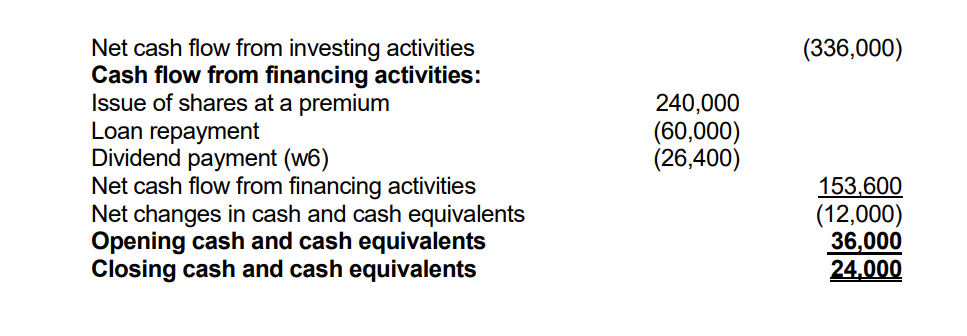

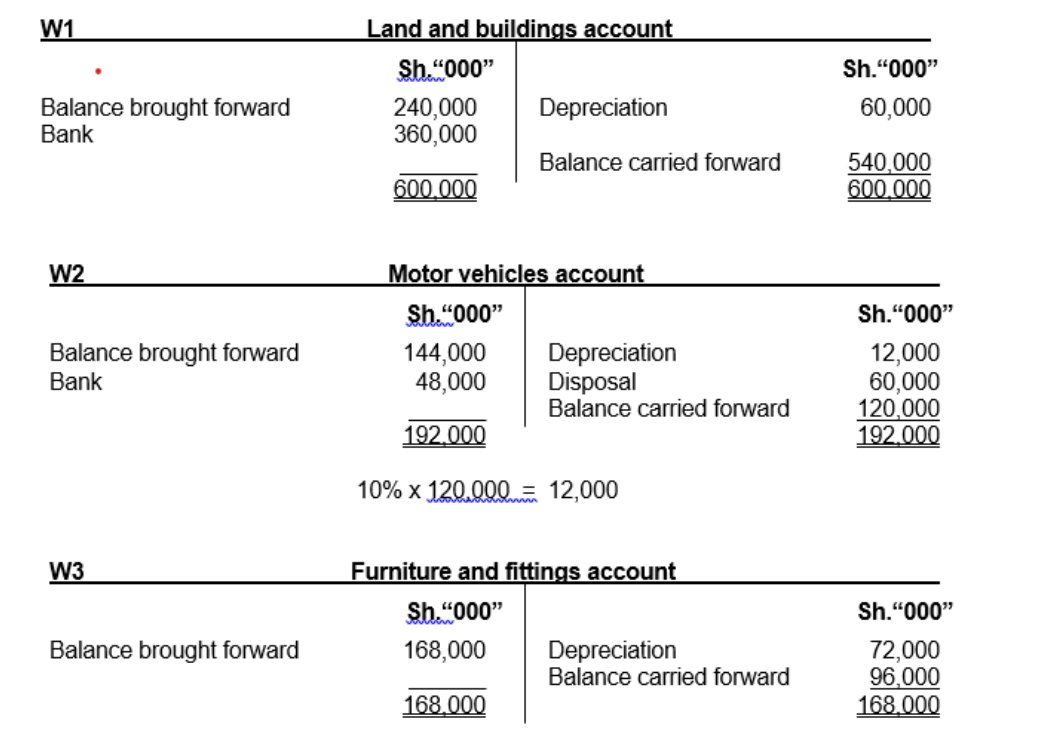

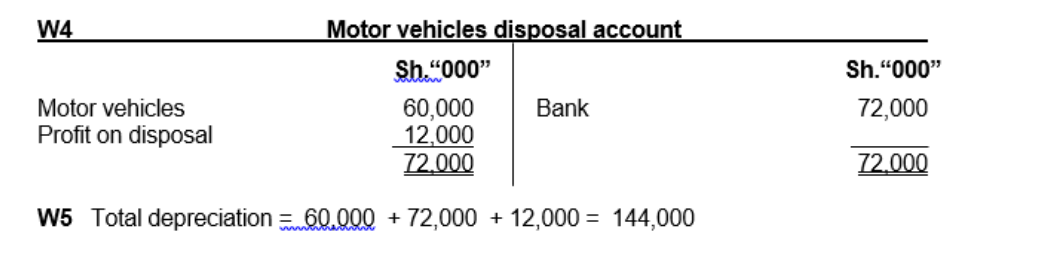

Candidates had challenges in utilizing the provided information to prepare a statement of cashflows in accordance with the requirements of International Accounting Standard (IAS) 7, Statement of Cash Flows.

In questions such as these, the correct format of presentation should be adopted.

The first part of the statement is the cashflow from operating activities. The statement should begin with the profit before tax. Adjustments should then be made for items not involving the movement of cash (for example gain on disposal

of assets) or items that require a separate line item of disclosure (for example interest paid). Next, adjustments are made for working capital items such as accounts receivable and accruals. After this, deductions should be made for payments made in respect of taxation and interest. The net figure is the cashflow from operating activities. The second part (cashflow from investing activities) and the third part (cashflow from financing activities) are quite straightforward.

In such questions, it helps to keep in mind the cash movement that is being traced. The answer should clearly show how we move from the opening balance of cash and bank (Sh 36,000,000) to the closing balance (Sh 24,000,000).

The expected response was as follows:

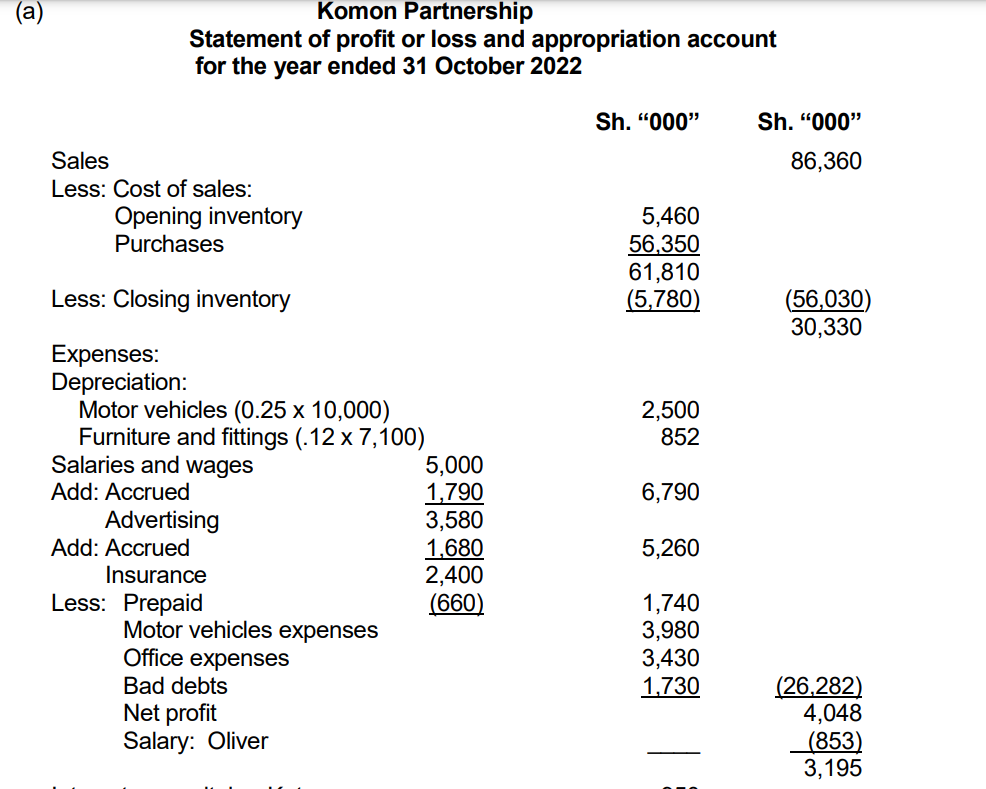

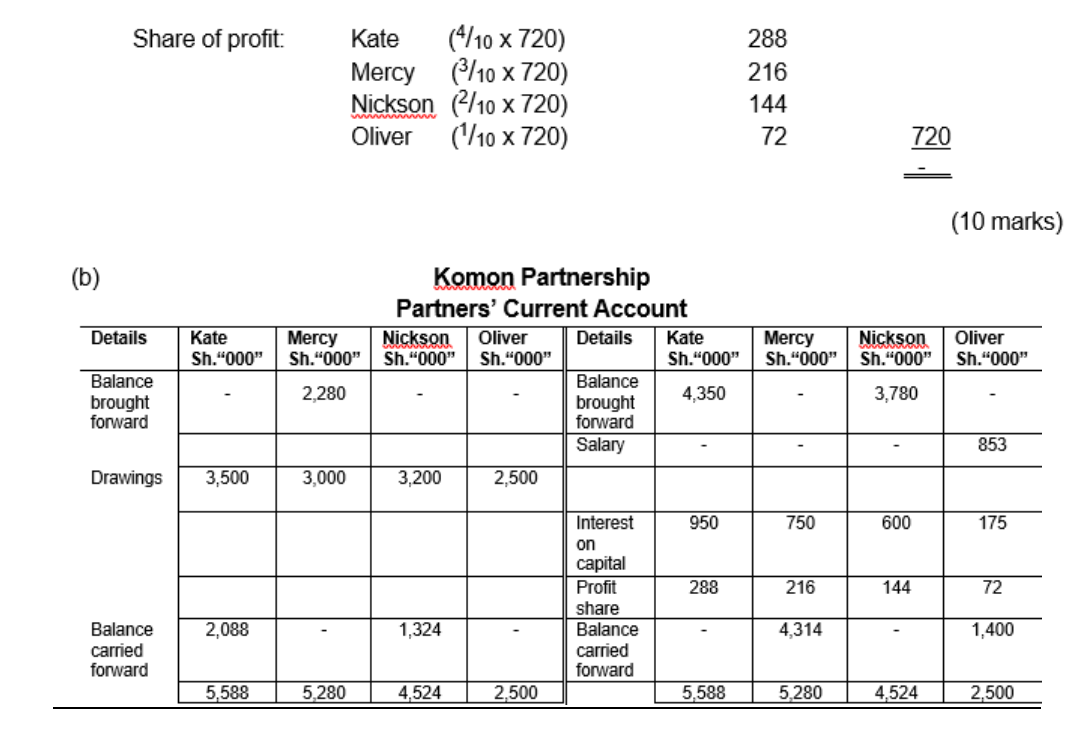

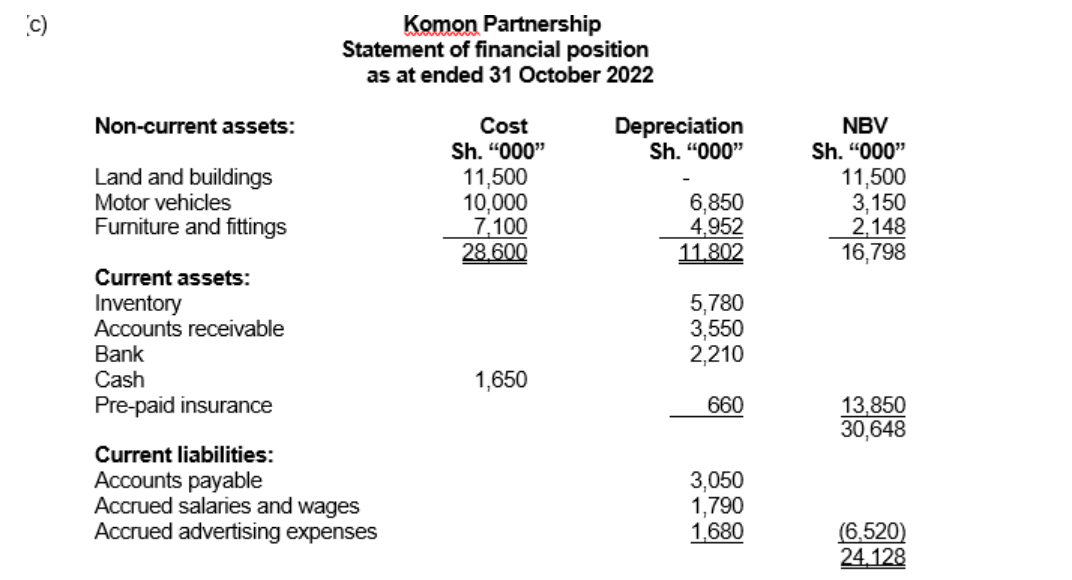

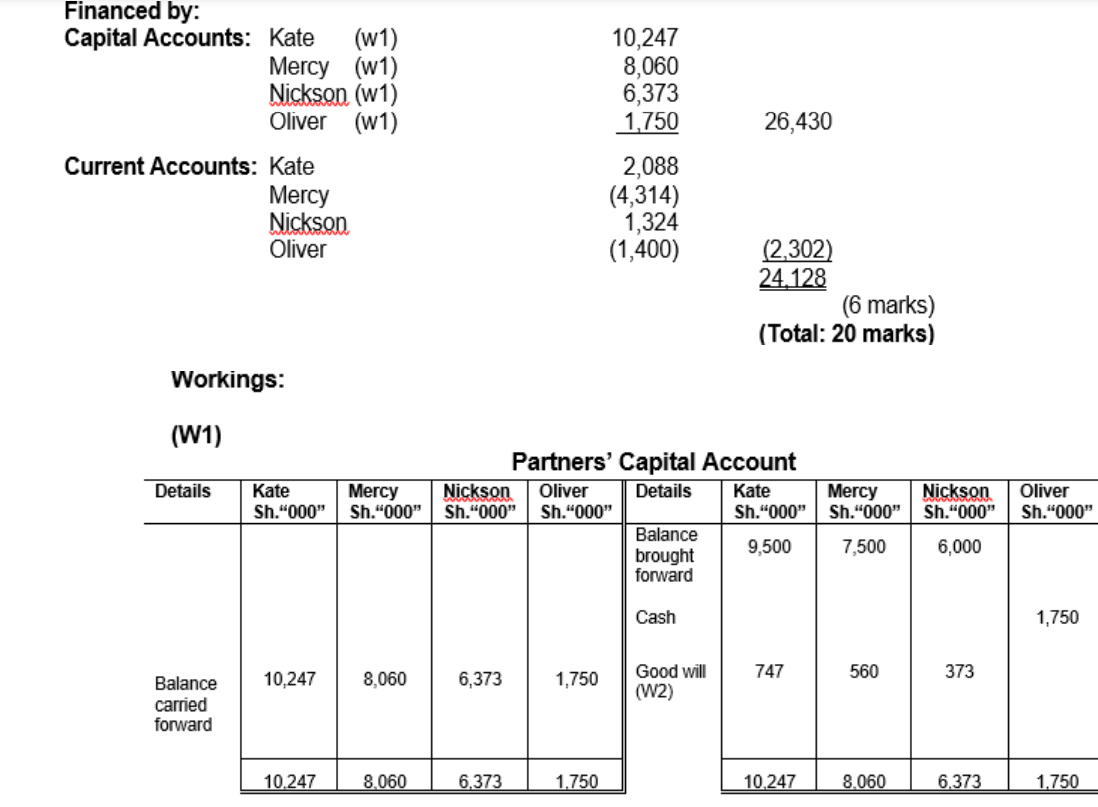

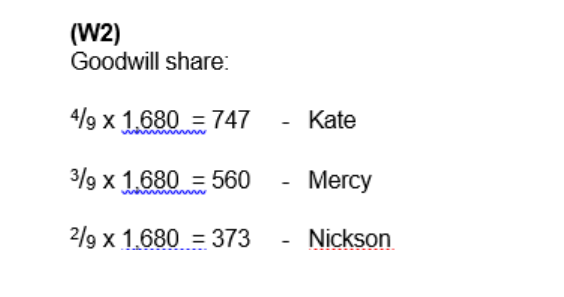

Question 3(b) and (c)

Candidates were provided with details in relation to a partnership business where there was an admission of a new partner. The treatment of goodwill posed challenges to most of the candidates.

The candidates were expected to prepare the required statements as follows:

Question 5(b)

Candidates had challenges in explaining the following in relations to manufacturing accounts:

- Meaning of the term “unrealised profit”.

- Describing the treatment of unrealised profits in the books of a manufacturing firm.

The expected responses were as follows:

1. Unrealised profit

Unrealised profit arises when manufactured goods are transferred at a profit over and above the cost of manufacture to the sales and distribution warehouse. If at the end of the year some of such goods are not sold, then there is an unrealised

profit.

2. Treatment of unrealised profits in the books of a manufacturing firm:

A provision for unrealised profit should be created equal to the percentage profit on the closing inventory of finished goods. During the subsequent year, an adjustment is made. If it is an increase, it is treated as an expense and if it is a decrease, it is treated as income.

Question 5(c)

Candidates had challenges in explaining the following types of funds in the context of public sector accounting:

- Revolving funds

- Fiduciary funds

The expected response was as follows:

1. Revolving fund:

A revolving fund is a fund that is set up for a specified purpose with provision that repayments will be made for future benefit of others with a similar need. The government may use a revolving fund to support non-profit government functions or operations.

2. Fiduciary fund:

This is a fund that is used to account for transactions related to assets held by a governmental unit as a trustee or agent. They are held on behalf of others and therefore they cannot be used to fund the government’s own expenses.