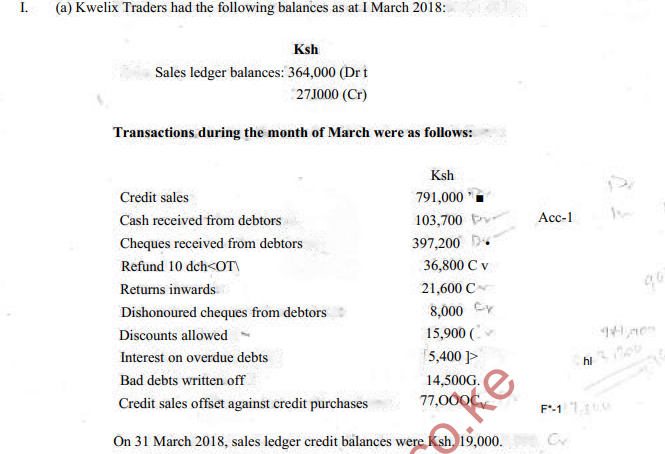

Prepare:

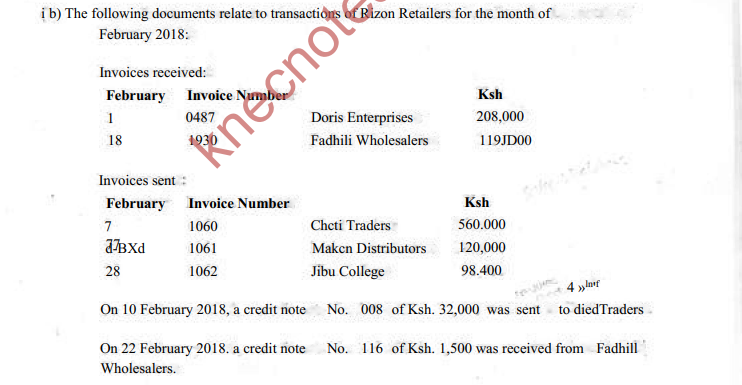

I. Sales journal;

II. Purchases journal;

III. Returns inwards journal;

IV. Retums outwards journal.

Post the totals of the journals prepared in (i) above to the respective ledger accounts. (12 marks’

2. ( a) Explain the meaning of each of the following terms as used in accounting:

(i) non-current assets;

(ii) current liabilities;

(iii) capital;

(iv) drawings. (8 marks>

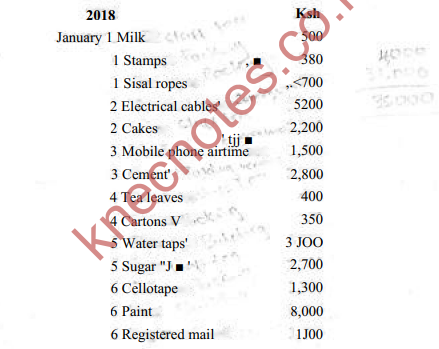

(b) On I January 2018, rhe petty cashier of I’rcsha Enterprises had a cash balance of Ksh. 4,000. On the same date, the petty cashier was given Ksh, 31,000 by die cashier in order to reimburse the amount spent.

The petty cashier made the following payments during the first week ot January: 2018 Ksh January 1 Milk 500

(i) Prepare a petty cash book with the following analysis columns:

I. Packing;

Ii. Staff Lea,

in. Communication;

IV. Building repairs.

On 6 January 2018, the petty cashier had Ksh. 3,300 cash in ha nd. Adv-u the petty cashier un the possible cause of the dtffcrenue between ihc petty cash book balance and the cash in hand. f 12 marks)

3 fol Explain lour types of errors that do not affect the agreement of a trial balance.

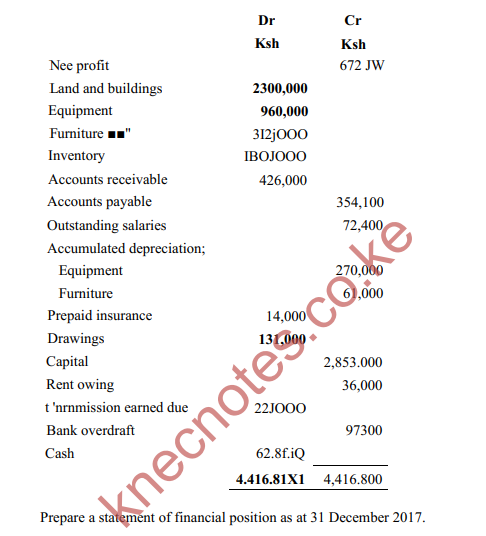

(b) The following is the trial balance efSupuah Traders as at 31 December 2017.

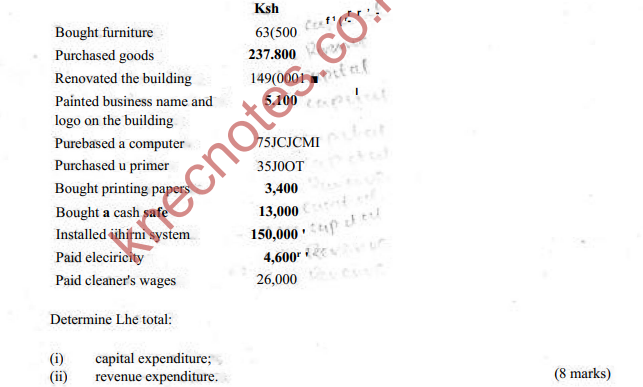

<bl Oil ] January 201 IS, Farida started a business with Ksh, 6(M) 000 in cash The fulluwing transactions took place during the month of January:

20 IS

January I Opened a business bank account and deposited

Ksh. 400^000 of the cash in hand.

3 Brought m personal furmlure valued at Ksh. 45,000 to be used in the business.

10 Paid rent for Ksh. 30JQ00 tn cash.

17 Purchased goods for Ksh. 87,000 from Sila Limited on credit,

25 Sold goods for Ksh 32,400 and received a cheque.

29 Sold goods for Ksh. 72,100 to Batrix Enterprises on credit.

J J Paid the amount due to Sita Limited by cheque.

i i Prepare ledger accounts to record the transactions above.

(ii) Balance tiff the accounts prepared in (i) above. (12. marks)

(a) Explain the meaning of each of the following accounting concepts:

(i) going concern;

(ii)

ill Jleriii lily;

ii) consistency;

iv prudence, (8 marks)

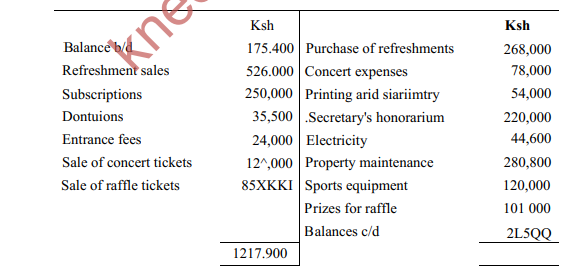

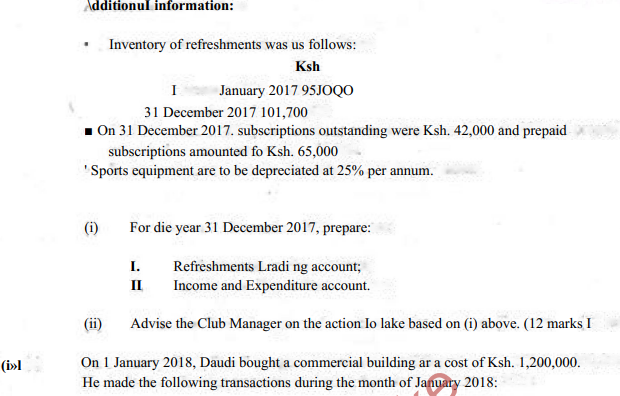

(b) The following is the receipts and payments account of Salam u Social Club for the year ended 31 December 2017:

(b) On 1 March 2018. Braita Retailers had Ksh. 20,500 cash in hand and a bank overdraft of Ksh 16,000.

The following transactions took plate during the month of March. 2018

March 3 Sold goods for Ksh. 117.000 and received cash.

5 Paid Ksh. 3,400 for electricity in cash after deducting a 10% cash discount:

7 Received the following cheques from debtors after deducting a 10% cash discount: Ksh

Lewis 18,000

Baraka 50,000

12 Settled the following creditors’ accounts by cheque after deducting a 5% cash discount:

Ksh

Karani 140000

Masika 15000

20 Paid Ksh. 37000 to Joby Limited by cheque.

21 Paid Ksh, 40000 for insurance by cheque.

22 The proprietor took Ksh. 38000 cash for personal use,

25 The proprietor look Ksh. 50.000 from tire cash till and deposited into the business bank account

29 Repaid a loan of Ksh. 200000 by cheque.

.30 Purchased goods for Ksh, 13,000 in cash.

.31 Received a commission of Ksh, 2,600 by cheque.

Prepare a three-column cash book for the month of March 2018. (12 marks)

On 4 February 2018, Machi Enterprises sold the following items to Danix College on credit,

20 bags of Mazo meal at Ksh, 700 per bag.

50 packets of Tasti biscuits at Ksh. 450 per packet.

40 litres of Sary cooking oil at Ksh. 120 per litre.

Danix College was allowed a 10% trade discount.

Prepare an invoice for the sale.

On 31 January 2018 the cash bock (bank cotunui) of Raptor Traders had a balance of Ksh. 53,400 while the bank statement had an overdraft of Ksh. 77.400 on (he same dale,

On investigation, the following discrepancies were revealed:

J. A cheque of Ksh. 45,000 from a customer was returned as unpaid due in insufficient funds.

H. The firm had issued cheques to suppliers amounting to Ksh. 2HO.OOO but only cheques totaling Ksh. 154.000 had been presented.

III Bank charges amounting to Ksh. 3,100 were reflected in the bank statement only.

IV Cheques deposited and not yet credited amounted to Ksh. 237,800.

V. A standing order payment of Ksh, 100,000 for rent was reflected in the bank statement only,

VI. Direct deposits by customers amounting to Ksh. 147,100 appeared on the bank statement only.

V A cheque of Ksh 68,000 received from the debtor was recorded in ibe cash book as Ksh. 86,000.

Prepare;

(ii all updated cash book;

11 i) a bank reconciliation statement. i 12 marks I