1. (a) Explain five users of accounting information. (10 marks)

(b) The trial balance of Benda Traders prepared on 31 October 2017 failed to agree. The following errors were subsequently revealed.

• Credit sales of Ksh 10,720 to Victoria was omitted from the books.

• Discount received of Ksh 15,160 was debited to the discount received account.

• Rent expense of Ksh 10,800 was credited in the rent received account.

• A credit balance of Ksh 12,400 in the bank account was recorded as Ksh 14,200.

• A machine bought for Ksh 200,000 in cash was entered in the purchases account.

• A cash sale of Ksh 20,000 was entered only in the cash book.

• A credit sale of Ksh 400,000 to Grace had been entered in Tracy’s account.

Prepare:

(i) journal entries to correct the errors above.

(ii) a suspense account to determine the difference in the trial balance.

(10 marks)

2. (a) Soja Enterprises had the following transactions for the month of April 2017: 2017

April I Bought goods for Ksh 63,000 on credit from Cha Io Wholesalers.

15 Sold goods for Ksh 40,000 in cash.

20 Bought a motor vehicle for Ksh 2,660,000 from Mambo Motors

Limited on credit.

30 Paid salaries of Ksh 72,000 by cheque.

Enter the transactions above in the relevant accounts and balance off the accounts.

(b) The following information was extracted from the books of accounts .if Chanzo Traders for the month of June 2016:

June 1 Balances

• Cash Ksh 101,000

• Bank Ksh 27,000 (credit)

4 Received cheques from the following debtors after deducting a

5% discount:

Maiyo Ksh 95.000

Karoki Ksh 190,000

7 Issued the following cheques to creditors after deducting a 10% discount:

Wamba Ksh 36,000

Waren Ksh 54,000

12 Cash sales amounted to Ksh 85,000

12 Bought furniture for Ksh 60,000 and paid by cheque

15 Sold extra equipment worth 25,000 and received cash.

18 Deposited Ksh 200,000 of cash in hand into the bank.

21 Paif Kiko Traders Ksh 18,000 by cheque.

24 Received cheques from the following debtors after deducting a

5% discount in each case:

Magu Ksh 80,000

Milton Ksh 120,000

Prepare a three-column cash book for the month of June 2016 (12 marks)

(a) The following information was extracted from the records of Sika Traders for the week ended 26 March 2016:

March 1 Sold goods for Ksh 20,000 to Odipo Traders on credit.

4 Bought goods for Ksh 80,000 from Chanzo Enterprises on credit.

5 Sold goods for Ksh 56,000 to Jeko Wholesalers on credit.

5 Sold goods for Ksh 68,000 to Alexander and Company on credit.

15 Odipo Traders returned goods worth Ksh 4,000.

16 Jeko Traders returned goods worth Ksh 16,000.

26 Bought goods worth Ksh 5,(XX) from Wasik Wholesalers on credit.

27 Returned goods to:

• Chanzo Enterprises worth Ksh 20,000.

• Wasik Traders worth Ksh 2,000.

30 Bought goods from the following on credit:

• Bitak Wholesalers Ksh 12,000.

• Diko Sellers Ksh 7,800.

30 Sold goods to Paba Enterprises worth Ksh 24,000 on credit.

Enter the transactions above in the relevant journals and show the total amount of each journal. (8 marks)

(b) Seko Trades operates a petty cash book on ‘imprest system’. On 1 May 2016, the petty cashier received Ksh 5,500. The following transactions took place during the month of May 2016:

May 4 Bought stamps of Ksh 340.

4 Paid Ksh 850 for printing papers.

5 Paid Ksh 300 for bus fare.

5 Bought printing papers for Ksh 250.

6 Paid Ksh 560 for taxi.

16 Bought cleaning soap for Ksh 440.

27 Registered mail for Ksh 600.

31 Bought ball pens for Ksh 450.

(i) Enter the transactions above in a petty cash book with the following analysis

columns:

• Postage

• Stationery

• Travelling

• Miscellaneous

(ii) Show the balance to be carried forward at the end of the month. (12 marks)

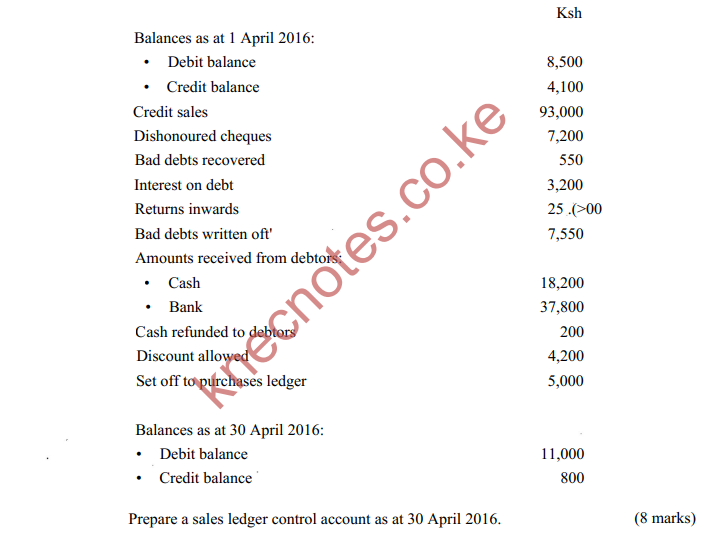

4. (a) Rafat Limited sells goods on credit terms. The following information relates to the month of April 2016:

Additional information:

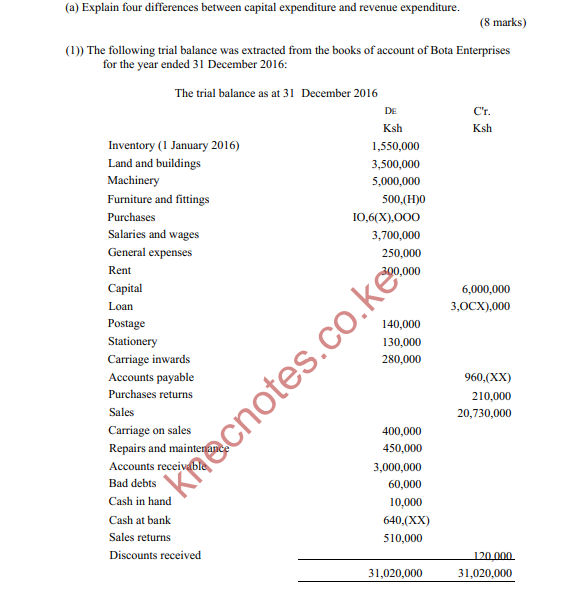

• Wages amounting to Ksh 210,000 was outstanding on 31 December 2016.

• Included in the general expenses is insurance premium of Ksh 60,000 paid for the year 2017.

• A provision for doubtful debts at the rate of 5% is to be created.

• Depreciation is to be provided for as follows:

– Land and building at 2% per annum on cost.

– Machinery at 10% per annum on cost.

– Furniture and fittings at 15% per annum on cost.

• Interest on loan is at the rate of 9% per annum.

• The value of inventory as at 31 December 2016 was Kshs 1,490,000.

(i) Prepare the income statement for the year ended 31 December 2016.

(ii) Advise the management on two ways in which the firm can improve the performance in (i) above. (12 marks)

(a) Explain each of the following accounting concepts:

(i) Realization concept

(ii) Dual aspect concept

(iii) Materiality concept

(iv) Objectivity concept.

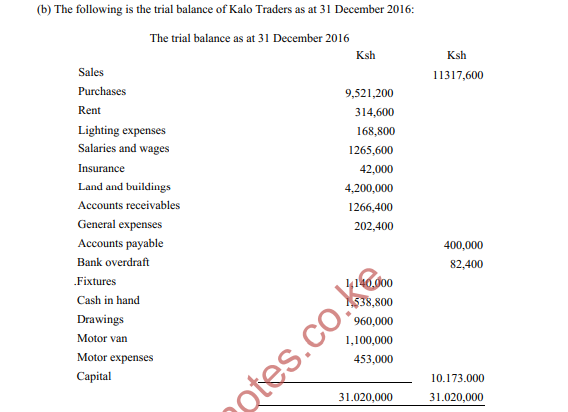

• Inventory as at 31 December 2016 was Ksh 1,666,400.

• Depreciation is provided for as follows:

– Motor van at Ksh 275,000

– Fixtures at Ksh 13,680

(i) Prepare:

I. an income statement for the year ended 31 December 2016.

II. a statement of financial position as at 31 December 2016.

(ii) Advise the management on the action to take based on the cash position of the firm.

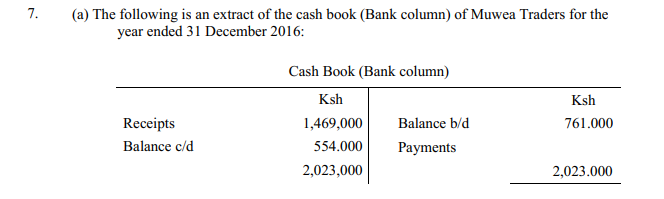

Additional information:

• All payments and receipts are made through the bank.

• Bank charges amounted to Ksh 111,000.

• Cheques drawn amounting to Ksh 267,000 had not been presented to the bank for payment.

• Cheques received amounting to Ksh 762,000 had been entered in the cash book only.

• A payment of Ksh 12,000 by cheque had been entered as a receipt.

• A cheque of Ksh 40,000 had been returned by the bank unpaid.

• Dividends of Ksh 62,000 had been credited directly by the bank.

• The bank statement on 31 December 2016 showed an overdraft of Ksh 1,162,000.

Prepare:

(i) an updated cashbook as at 31 December 2016.

(ii) a bank reconciliation statement as at 31 December 2016.

(8 marks)

(b) The following information relates to Ruka Traders for the year ended

31 December 2016:

(i) Balances as at 1 January 2016:

Motor vehicles

Depreciation for motor vehicles

(ii) Transactions during the year were as follows:

• Bought two new motor vehicles at a cost of Ksh 1750,000 each on 1 July 2016.

• Two motor vehicles were sold on 1 July 2016. One had been bought for

Ksh 800,000 on 1 July 2014 and was sold for Ksh 400,000. The other motor vehicle had been bought for Ksh 900,000 on 1 July 2014 and was sold for Ksh 350,000.

(iii) Ruka Traders depreciates its motor vehicles at the rate of 20% per annum on straight line basis.

For the year ended 31 December 2016, prepare:

I. Motor vehicles account

II. Motor vehicles depreciation account

III. Motor vehicles disposal account.