SECTION A (40 marks)

Answer ALL questions in this section in the spaces provided.

1. List four users of accounting information. (2 marks)

2. An amount paid for machinery repairs was debited to machinery account. State the type of

error made. (1 mark)

3. List two types of cash book. (2 marks)

4. Mati Limited depreciates its furniture using the straight line method, which is applied from one

year to another. State the accounting concept being applied. (1 miyk)

5. For each expenditure stated below, indicate whether it is a capital or a revenue expenditure.

(2 marks)

(i) Repainting of classroom

(ii) Purchase of stationery

(iii) Renovation of hostel

(iv) Payment of electricity

The following information relates to Meta Traders for the year ended 31 December:

2011- 2012

Ksh Ksh

Gross profit 342,000 517,000

Expenses 186,000 493,000

(a) For each of the years ended 31 December, 2011 and 2012, compute the net profit.

(b) Advise the proprietor on the possible cause of the change in net profit. (3 marks)

7. Highlight the purpose of a sales journal. (1 mark)

8. Bei Traders operates a petty cash book on an imprest system. Reimbursement is done at the

beginning of each week. The following information is available.

Ksh.

I April, 2013 Petty Cash balance 2,740

1 April, 2013 Cash given to Petty cashier 5,760

Determine the petty cash float. (2 marks)

State the meaning of each of the following terms:

(a) Asset;

(b) Liability, (2 marks)

10. State one reason that may cause a cheque to be dishonoured by a bank. (1 mark)

11. Molan Retailers had the following balances as at 31 March, 2013;

Capital 100,000

Bank 15,000

Inventory 32,000

Creditors 13,000

Debtors 66,000

Prepare atrial balance as at 31 March, 2013

12. Pembe Traders bought goods on credit from Safi Wholesalers for Ksh. 150,000. Pembe Traders was allowed a 10% trade discount. State the:

(a) source document received by Pembe Traders;

(b) amount due from Pembe Traders.

(2 marks)

13. Highlight the purpose of a bank reconciliation statement. (2 marks)

14. Genl Limited bought an equipment for Ksh. 200,000 on 1 January. 2011. The film depreciates its equipment at 20% per annum on cost. On 31 December, 2012, the equipment was disposed off for Ksh. 140,000.

Prepare an equipment disposal account

15. Explain the meaning of the term ‘Control Account’. (2 marks)

16. On 1 January, 2012, Boza paid Ksh. 44,000 for rent. The rent for the year ended 31 December, 2012 was Ksh. 40,000. Prepare the rent account (2 marks) 17. The following information relates to Kofi Social Club:

Ksh.

Bar sales 850,000

Bar inventory’: 1 January; 2012 440,000

31 December, 2012 139.000

Bar purchases 650,000

(a) Prepare a bar trading account for the year ended 31 December, 2012.

(b) Advise the manager of the club on the action to take on the performance of the bar. (3 marks)

18. Charo Enterprises returned goods to Mega Traders. State the journal used to record the above transaction in the books of Mega Traders. (1 mark.)

19. Amani intends to buy goods for Ksh. 20,000 from cither supplier A or supplier B. Supplier A is offering a 20% trade discount and a 5% cash discount. Supplier B is offering a 25 % cash discount.

(a) Determine the net amount payable by Amani to each of the suppliers.

(b) Advise Amani on the supplier to select if he is to pay promptly. (3 marks)

20. Kula does not keep proper books of account. The following information is available for the year ended 31 Decmber, 2012.

Capital: 1 January, 2012

Ksh. 120,000

Assets: 31 December, 2012 192,000

Liabilities: 31 December, 2012 45,000

Determine the profit for the year ended 31 December, 2012.

SECTION B (60 marks)

Answer any FOUR questions from this section in the spaces provided.

21. (a) Explain three qualities of good accounting information. (6 marks)

(b) On April, 2013, the petty cashier of Raba Dealers had a balance of Kshs. 1,650 cash in hand. On the same date, the cashier gave the petty cashier Kshs. 3,350. During the week ended 5th April, 2013, the petty cashier made the following payments:

2013 Ksh.

1 Milk 300

1 Pens 280

1 Bus fare 290

2 Sugar 120

2 Sambo-Creditors 520

3 Taxi 600

4 Tea leaves 160

5 Photocopying papers 1000

5 Milk 150

Prepare a petty cash book with the following analysis columns:

– Stationery;

– Travelling;

– Office tea;

– Ledger.

22. (a) The following errors were revealed in the books of Choda Traders during the month of April. 2013.

(i) A purchase of motor van on credit from Mazela Motors for Ksh. 3.500.000 was omitted from the books of account;

(ii) A credit sale of Ksh. 15,000 to J. Mwangi was entered in J. Munga’s account;

(iii) Furniture purchased for Ksh. 45,000 was debited to the purchases account.

Prepare Journal entries to correct the errors above. (6 marks)

(b) Tahidi Enterprises had the following balances as at I March, 2013.

Mali – Debtor 106,000

Turi – Creditor 62.500

Bank 144,000

Furniture 92.500

During the month of March, the following transactions took place: 2013 March 1 Withdrew Ksh. 30,000 from the bank for office use;

6 Received a cheque of Ksh. 86,000 from Mali;

12 Cash sale Ksh. 37,000;

20 Bought goods on credit from Turi Ksh. 150,000;

25 Returned goods worth Ksh 2,000 to Turi;

27 Paid Tun Ksh 210,000 by cheque.

Prepare ledger accounts to record the transactions above.

(ii) Balance off the bank account.

(iii) Comment on the bank balance obtained in (ii) above

a) Explain three causes of depreciation on non-current assets.

(b) Tima Traders does not keep proper books of account.

The following information was obtained from the records of the business:

Ksh.

Receipts from debtors 302,000

Payment to creditors 93,300

Rent paid 15,000

Insurance paid 10,000

Salaries and wages paid 85,000

Assets and Liabilities as at:

1 January 31 December

2012 2012

Ksh . Ksh.

Debtors 59,000 36,000

Creditors 48,000 33,000

Inventory 21,500 11,600

Furniture 52,000 44,000

Insurance prepaid 3,000 4,000

Prepare an income statement for the year ended 31 December, 2012.

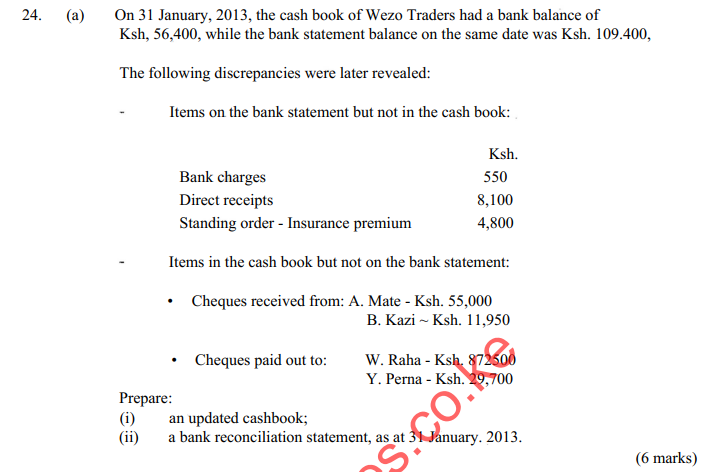

Prepare:

(i) Sales ledger control account;

(ii) Purchases ledger control account.

25. (a) Jirani Traders had the following balances as at 1 July, 2013:

Ksh.

Cash in hand 16,000

-Cash at bank 58,(XX)

The following transactions took place during the month of July, 2013. July 1 Paid Ksh . 12,000 for rent by cheque;

2 Cash sales amounted to Ksh. 18,000;

4 Purchased goods worth Ksh. 15,000 and paid by cheque;

10 Received a cheque of Ksh. 28,900 from Suhel in settlement of his account;

15 Took Ksh 13,200 from the cash till and deposited it into the bank account;

24 Paid Sela Traders Ksh. 9,000 by cheque;

31 Proprietor withdrew Ksh 5,000 from the cash till for personal use.

Prepare a cash book for the month of July, 2013

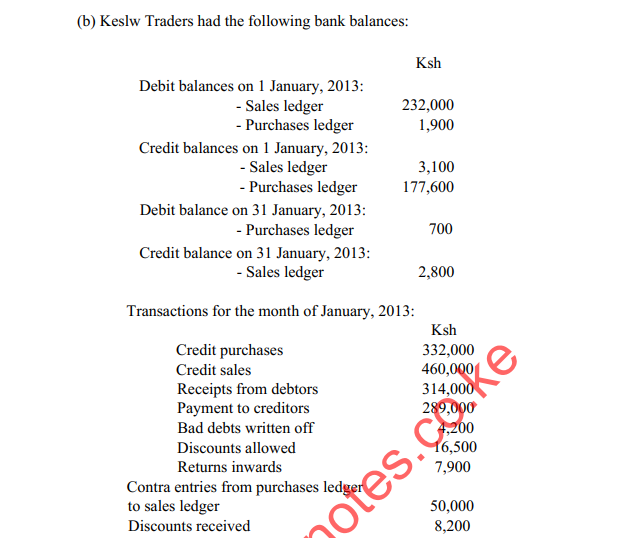

Additional information:

• Inventory as at 31 December 2012 was valued at Ksh. 43,900.

• The motor vehicle is depreciated at 25% per annum.

• On 31 December 2012:

– outstanding telephone was Ksh 500;

– prepaid insurance amounted to Ksh. 1,800

(i) Prepare an income statement for the year ended 31 December, 2012;

(ii) Advise the proprietor on the action to take on the performance of the firm. (9 marks)

26. (a) Soscii Retailers had the following transactions during the month of March, 2013.

March 1 Credit sales to Bosi Ksh. 30,000;

5 Credit purchases from Wale Ksh. 14,700;

7 Credit sales to Chama Ksh. 11,500;

12 Goods returned by Bosi Ksh. 2,000;

15 Credit purchases from Laki, Ksh 20,000; less

5% trade discounts;

21 Credit sales to Saba Ksh 41,600;

27 Goods returned to Wale Ksh. 1,200;

31 Goods returned by Saba Ksh. 4,500

Prepare:

(i) Sales Journal;

(si) Purchases Journal;

(iii) Returns inwards Journal;

(iv) Returns outwards Journal.

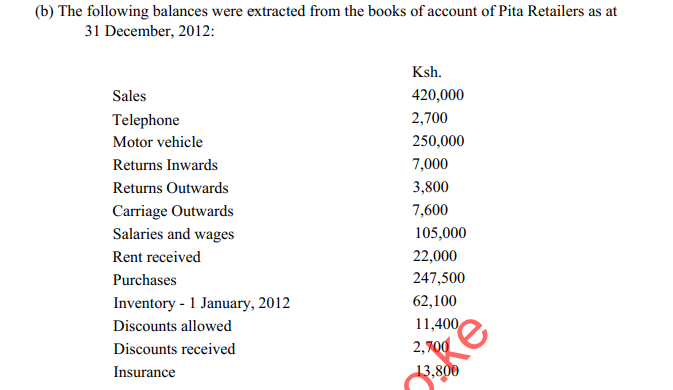

Additional information:

• Subscription prepaid on 1 January, 2012 and 31 December, 2012 amounted to Ksh’. 15.000 and Ksh 32,000, respectively;

• Outstanding electricity as at 31 December, 2012 was Ksh. 400:

• On I January, 2012, the club had premises with a cost of Ksh. 1,500,000;

• Games equipment to be depreciated at 10% per annum;

• Accummulated fund as at 1 January, 2012 was Ksh. 1,562,500.

Prepare:

(i) income and expenditure account for the year ended 31 December, 2012;

(ii) statement of financial position as at 31 December 2012.