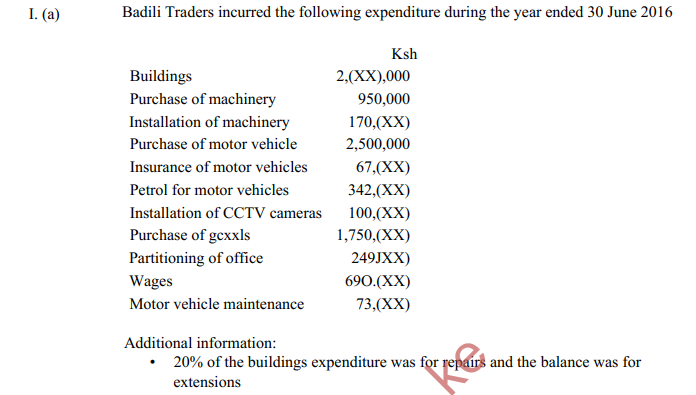

Determine:

(i) total capital expenditure,

(ii) total revenue expenditure (8 marks)

On 1 May 2016, Jona started a business with Ksh 190,000 in cash The following transactions took place during the month:

2016

May 1 Opened a business bank account and deposited Ksh. 120,000 of the cash

7 Brought his personal motor vehicle valued at Ksh. 350,000 to be used in the business.

9 Purchased goods for Ksh. 85,(XX) on credit from Tele Wholesalers.

10 Sold gcxxJs for Ksh. 22,300 and received cash.

15 Paid general expenses amounting to Ksh. 9,700 in cash.

19 Sold goods for Ksh. 35,100 on credit to Pakc Restaurant.

22 The proprietor took Ksh. 5,(XX) from the cash till and paid for his personal insurance.

27 Paid Tele Wholesalers Ksh. 65,0(X) by cheque.

29 Bought furniture on credit for Ksh. 55,(XX) from Chanzo Furnitures.

30 Received rent for Ksh. 20,(XX) from subletting premises.

31 Returned broken furniture worth Ksh. 2,(XX) to Chanzo Furnitures.

Prepare ledger accounts to record the transactions above.

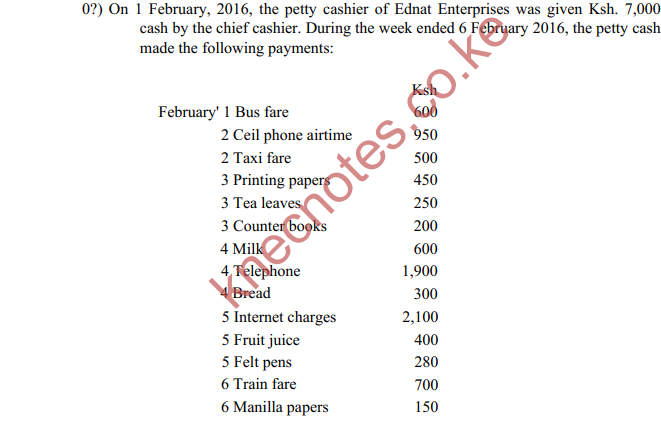

Oh 4 February 2016, the chief cashier gave the petty cashier an additional cash of Ksh. 4,000.

(i) Prepare a petty cash book with the following analysis columns:

• Communication;

• Travelling;

• Stationery;

• Refreshments

(ii) At the end of the week, the actual cash held by the petty cashier was Ksh. 1,500

. Advise the petty cashier on the action to take based on the results in (i) above. (12 marks)

3. (a) Explain each of the following source documents:

(i) Invoice;

(ii) Credit note;

(iii) Payment voucher;

(iv) Cash receipt. (8 marks)

(b) The following balances were extracted from the books of Herrin Retailers as at 31

December 2016:

Ksh,

Sales 1,340,000

Carriage inwards 14,800

Insurance 37,000

Inventory (1 January 2016) 447,200

Returns inwards .27,000

Returns outwards 11,300

Purchases 960,100

Rent received 744,OCX)

Rates 12,4(X)

Accounts receivable 860,(XX)

Salaries and wages 569,000

Discounts allowed 38,600

Discounts received 67,000

General expenses 22,400

Buildings 2,710,000

Additional information:

• On 31 December, 2016:

– Inventory was valued at Ksh. 279,500,

– Rates amounting to Ksh. 4,500 were outstanding;

– Insurance of Ksh. 7,000 was prepaid.

• A provision for doubtful debts of 5% is to be created on accounts receivable.

• Buildings are to be depreciated at 2% per annum on cost

(i) Prepare income statement for the year ended 31 December 2016.

(i) Advise the proprietor on the action to take based on trading operations results obtained in (i) above. (12 marks)Kilimo Traders had the following transactions during the month of April 2016. 2016 . Ksh

April 1 Purchased goods on credit from Safi Wholesalers. 139,400

4 Sold foods on credit to Ziada Enterprises 67,500

7 Sold foods on credit to Wenax College. 25,600

12 Purchased goods on credit from Yato Manufacturers. 86,(XX)

15 Returned goods to Safi Wholesalers 1300

19 Sold goods on credit to Rono Hotel. 191,700

22 Sold goods on credit to Excel Hotel. 37,200

25 Bought an equipment on credit from Golden Machines limited. 300,000

30 Sold goods on credit to I.ait Enterprises. 16,800

30 Purchased goods on credit from Dilla Manufacturers. 75,000

Prepare

(i) purchases journal;

(ii) sales journal;

(iii) returns inwards j oumal;

(iv) general journal. (8 marks) On 31 July 2016, the cash book of Wasili Traders showed a bank overdraft of

Ksh. 61,000 while the bank statement on the same date showed a credit balance of Ksh. 73,700.

On comparisons, the following discrepancies were revealed:

1. Dividends received amounting to Ksh 4,800 were reflected in the bank statement only.

11 Cheques totaling Ksh. 142,100, received and deposited, were not reflected in

the bank statement.

III. Bank charges amounting to Ksh. 3,400 were shown on the bank statement only.

IV. The bank had made a standing order payment of Ksh. 39,000 on behalf of the firm which was reflected on the bank statement only.

V. A customer had made a direct deposit of Ksh. 228,500 into the firm’s bank account.

VI A cheque from a customer of Ksh. 8,200 was returned as unpaid by the bank.

VII A cheque received for commission of Ksh. 950 was credited in the cash book.

VIII. The bank had erroneously credited the firm’s account with Ksh. 3,000

IX. Cheques issued to suppliers amounting to Ksh 89,200 had not been presented for payment.

Prepare:

(i) an updated cash book;

(ii) a bank reconciliation statement

5. (a) Explain each of the following accounting concepts:

(i) Going concern.

(ii) Money measurement.

(iii) Dual aspect

(iv) Business entity. (8 marks)

(b) The following information relates to Fahari Traders for the month of June 2016.

Transactions during the month of June:

Balances as at: Ksh.

1 June 2016 Sales ledger – Debit 394,000

– Credit 55,100

Purchases ledger – Debit 38,000

– Credit 247,100

Balances as at:

30 June 2016 Sales ledger – Credit 38,500

Purchases ledger – Debit 29,600 Ksh

Credit purchases 949,600

Credit sales 1,520,000

Cheques paid to creditor 512,800

Cash received from debtors 293,000

Returns outwards 42,500

Discounts received 87,600

Bad debts 49,800

Cash paid to creditors 107,900

Interest on overdue accounts of debtors 67,500

Refunds form creditors 11,000

Cheques received form debtors 956,400

Return inwards 59,100

Dishonoured cheques 23,400

Discounts allowed 123,000

Prepare:

(i) sales ledger control account;

(ii) purchases ledger control account (12 marks)

The trial balance of Vissa Retailers failed to agree by Ksh. 5,000. The difference was placed on the debit side of the suspense account. Later, the following errors were discovered

I Repairs to equipment of Ksh 8,000 had been recorded in the equipment account

II Rent paid of Ksh. 43,000 had been entered in the rent account as Ksh. 34,000.

HI. Cash drawings amounting to Ksh. 25,000 had been completely omitted from the books.

IV Discounts received of Ksh 2,000 had been entered in the discounts allowed account

Prepare

(i) journal entries to correct the errors above;

(ii) suspense account duly balanced. (8 marks)

On I May 2016, Teta Enterprises had Ksh. 36,000 in cash and a bank overdraft of

Ksh 14,200. The following transactions took place during the month of May: 2016

May Obtained a bank loan of Ksh. 200,(XX) which was deposited into the business

1 bank account.

3 Settled Jami Wholesalers’ account of Ksh. 15,(XX) by cheque, alter deducting

a cash discount of 10%.

5 Paid rent for Ksh. 30,(XX) by cheque.

12 Received a cheque of Ksh. 19,OCX) from Peter Traders, alter deducting a cash discount oi 5%.

15 Paid electricity for Ksh. 12,400 in cash.

22 Bought equipment lor Ksh. 41,500 and paid by cheque.

25 Withdrew’ Ksh, 50,(XX) from the bank for office use.

28 The proprietor Uxrk Ksh. 29,000 of the cash for personal use.

29 Paid Benda Manufacturers their account of Ksh. 18,000 by cheque, after

deducting a cash discount of 5%.

30 Sera Enterprises settled their account of Ksh. 25,000 by cheque, aftet deducting a cash discount of 10%.

31 Paid wages of Ksh. 33,000 in cash.

Prepare a three-column cash book for the month of May 2016