The following is the statement of financial position of Rexen I ratters as at 1 June 2015:

Non-current Assets Ksh. Katu

Fumirure and fittings 530.000

Motor vehicles 750.000

1,280,000

Current Assets

Inventory 85.000

Accounts receivable 214.000

Cash in hand 39.400 .138.402

Capital

Non-current liability 987,000

Loan from Sifa Bank 300.000

Current Liabilities

Accounts payable 260,100

Bank overdraft 71,300

J1L4W 1.618.400

The following transactions took place during the first week of June 2015:

• Received cheques totalling Ksh 135,000 from debtors.

• Bought goods for Ksh. 40,000 and paid by cheque. — f’

• Sold excess furniture at a cost of Ksh. 207,000 and received the payment in fa icfc form of a cheque.

• The proprietor brought in additional cash of Ksh. 60.000 to be used in the

business.

• Repaid Ksh. 100,000 of the loan from Sifa Bunk by cheque,

• Paid a creditor Ksh. 50,000 by cheque.

Prepare a statement of financial position after taking into account the above transactions.

(li) The petty cashier of Panda Enterprises was gi ven a cash float of Ksh. 20,000 by the main cashier During the first week nl” March 2015. the petty cashier made the following payments;

2015 Ksh.

March 2 Air lime for cellphone 1,800

3 Tea leaves 300

4 Telephone 3.400

4 Petrol 4.000

4 Bread and cakes 600

5 Printing papers 1.500

5 Bus fare 500

5 Pens 200

6 Milk 1,700

6 Envelop 400

7 Taxi 900

7 Tea girl’s wages 2,700

Prepare a petty cash book with the following analysis columns:

transport;

stationery;

staff tea;

telephone.The following mformntion relates to tomia Retailers for toe month of January 2015:

Ha Janet Ji as at I January 2015;

Sales ledger

Purchases ledger

Ksh.

67,400 DR

81,300 CR

rraes Mtions during the month of January Hire as follows;

Ksh.

Credit sales 713,200

Had debts written off 22 500

Di scoun ts received 5 j

Credit purchases 590,000

Rctund ta debtors 4 999

Cheques received from debtors 461 .KQO

Returns inwards 35 ggy

Cheques paid to creditors 392,700

Returns outwards 14 jgg

Cash paid to creditors 60,1)01)

Dishonoured cheque from a debtor 25,000

Discounts allowed 55 ggg

BmInnccs as nt 31 January 2GJ5;

Sales ledger

Purchases ledger

Prepare:

(i) Sales ledger control account;

(ii) Purchases ledger conlang] account.

Un i February 2(d 5, Rudisha Traders had Ksh 37,300 cash in hand and Ksh. 136.400 cash at bank,

The following transactions took place during the month:

2015

February 2 Paid salaries amounting to Ksh. 77,400 from die bank account

4 Sold goods for Ksh. 55,000 mid received cash

10 Received a cheque of Ksh. 114,000 from Mose, a debtor, after deducting a cash discount of Ksh 6,000

15 Paid Ksh. 3,500 for electricity by cheque

I Withdrew Ksh. 30,000 from the bank for office use

19 Purchased goods worth Ksh. 68,000 and paid by cheque

22 Paid Ksh. 95,000 by cheque tu Rehetna Wholesalers after deducting Ksh. 5,000 lls discount

25 (Tie proprietor took Ksh, 25,000 cash for personal use

27 Received Ksh. 4,20(1 as refund for rates

28 Received d commission of Ksh. 18,000 in form of a cheque

28 Paid Mom, a creditor, Ksh. 28,000 by cheque, in lull settlement of her

account of Ksh 30,000

28 Paid wages amounting to Ksh. 78,000 in cash

Prepare a three-column cadtbook tor the month of February 2015. (11 marks)

Explain four types of errors that may not affect the agreement of a trial balance, (8 marks)

On 1 ApriI 2015, Nyota started a business with Ksh. 340.000 in cash. the following transactions took place during the month:

2015

April 2 Opened a business hank account and deposited Ksh. 280,000 of the cash

7 Bought goods for Ksh. 270,000 from Kisa Wholesalers on credit

12 Sold goods for Ksh. 32,500 and received cash

15 Obtained a loan of Ksh. 120,000 from Delta Finance in form of a cheque

20 Paid Ksh. 29,000 for general expenses in cash

22 The proprietor withdrew Ksh 12,500 from the bank for personal use

30 Paid Kisa Wholesalers the amount due to them by cheque

(i) Prepare ledger accounts to record the transactions above.

(ii) Balance off the ledger accounts as at 30 April 2015, (12 marks)

The following transactions relate to Faulu Traders for the month of January 2015.

2906/102 6

Credit sales:

2015 Ksh.

January 2 Abdalla 190,000

7 Zoe Enterprises 370,000

12 Dkoth 82.000

25 Kate 56,500

C redit Purchases:

I 2015 Ksh.

January 1 Bora Wholesalers 101,600

10 Chema Enterprises 97,000

22 Sify Manufacturers 69,400′

31 Keh Traders 43,000

Purchases returns:

2015 Ksh.

January 15 Chema Enterprises 16,200

28 Sify Manufacturers 4,300

Sales returns:

2015 Ksh.

January 19 Abdalla 7,200

12 Kale 3,500

Prepare:

(i) purchase* journal;

(ii) sales journal;

(i i i) purchases returns j<u tmal;

(iv) sales reruns journal.

(8 marks)

The following is the summarized cash book (bank column) of Tawala h’nicrpriscs fur the month of May 2015.

Cash hook

2015

May I Balance tyf

Receipts

Ksh.

156,500

S142ffi

2015

Payment

May 31 Balance c/f

Ksh.

698,100

3.32.600

On 31 May 2015, the bank statement had a balance of Ksh, 414200. investigation, the following discrepancies were revealed:

A cheque of Ksh. 69,500 received from n customer had been returned by rhe bank unpaid.

I Ji vidends received amounting Lo Ksh. 12,800 appeared on die bank statement only.

Bank changes nt Ksh, 5,100 appeared on lhe bank statement only.

Cheques amounting to Ksh. 150,000 issued to suppliers had not been presented to die bank for payment

Cheques received totaling: Ksh, 314,000 had been entered in the cashbook but iiad not been credited by the bank..

A cheque of Ksh, 89JOOO received from a customer had been incorrectly entered as Ksh 9JJOOO in the cash book.

Direct bankings by customers amounted to Ksh. 35 6,400.

Prepare:

(i) updated cash book

(it) bank reconciliation statement. (12 marks)

5. (a) Explain the use of each of the following source documents in a business.

(i) Invoice;

(ii) Credit note;

(iii) Statement of account;

(iv) Cash receipt {8 marks)

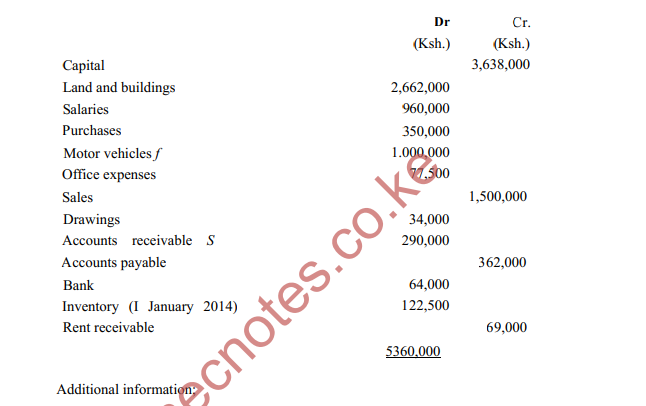

The following is the trial balance of Tayari Wholesaler? ax at 31 December 2014

■ Inventory as at 31 December 2014 was valued al Ksh. 60,000.

• Motor vehicles are depreciated at a rate of 20% per annum.

* On 31 December 2014, accrued office expenses amounted to Ksh. 12.500.

(i) Prepare;

(I) an income statement fur the year eitded 31 December 2014.

(II) a statement of financial position as at 31 December 2014,

(ii) Advise the proprietor cm the action to take regarding the pcrfbrm Hence of the business as obtained in (i) above.

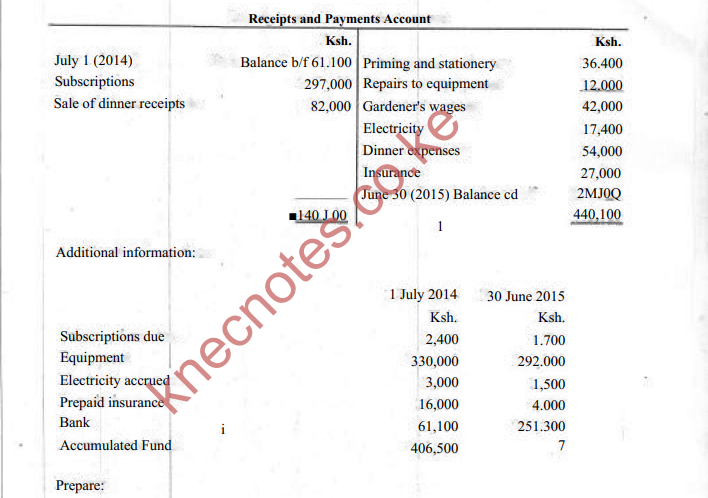

Prepare:

(i) income and expenditure account for the year ended 30 June 2015.

(ii) statement of financial position as at 30 June 2015.Scwna Retailers incurred the fol lowing expenses during Lhc year ended

31 December 2014:

(Ksh,)

Purchase® of goods 360,000

Payments of rent 120,000

Payments of wages 60,000

Purchase of office furniture 72.000

Repainting df shop 17,500

Purchase of a motor vehicle 850,000

Payment of insurance for motor vehicle 22,000

Payments of office expenses 247, EDO

Extension of warehouse 119,000

Purchase of computer 75.000

Installation of alami system 37,000

Installation of an ait conditioner in the office 95,000

(i) Classify the expenses above as either capital expenditure or revenue expenditure.

(ii) Determine the;

(I) total capita] expenditure;

(I!) mtal revenue expenditure,

Rosa Limited had the following transactions relating to its equipment.

2012

January I Bought Equipment A and Equipment B for Ksh. I80,000 each

2013

January 1 Bought Equipment C forKsh. 400,000

July 1 Bought Equipment D for Ksh. 200.000

2014

January 1 Sold Equipment A. for Ksh. 95,000

The firm depreciates equipment at die rate of 20% per annum on cost

(i) Far each of Ihc years ended 3 L Decern her 2012,2013 and 2014. prepare-

(1) equipment account,

(LI) provision for depreciation on equipment account;

(iii For the year 2014, prepare equipment disposal account. (12 marks’)