SECTION A (40 marks)

Answer ALL the questions in this section.

1. State two uses of accounting information. (2 marks)

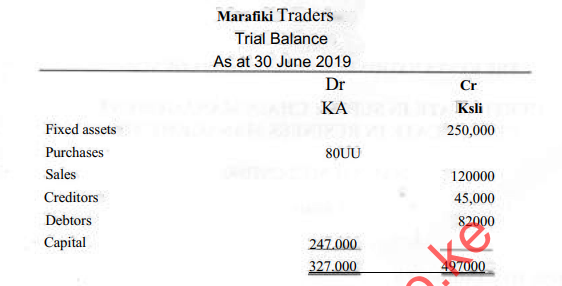

The following trial balance of Marafiki Traders prepared on 30 June 2019 failed to balance.

Prepare a corrected trial balance as at 30 June 2019. (3 marks)

3. Outline two advantages of using a petty cash book in a business organization. (2 marks)

4 The following information relates to Kaka Traders:

Capital 455.111

Liabilities 342,912

Determine the value of assets. (I mark)

5. State the book of original entry prepared from each of the following source documents:

Source document Book of original entry

(i) Incoming invoice

(ii) Outgoing debit note

(2 marks

6. State two errors that do not affect the agreement of a trial balance, (2 marks)

7. On ] January 2019, Neru Traders. hud cash in hand of Ksb 8,000 and cash al bank of

Ksli 60,000. During rhe month, the following transactions took place. 2019 January IB 31

Settled Lire account of Shuma rmdersof Ksh 17,(MX) by cheque, less Ksh 2,000 cash discount.

Received Ksh 22,800 in cash from Jane, after allowing a 5% cash discount.

Prepare a three column cash book far the month of January 2019, (3 marks)

8. The following information was obtained from the books of accoimi of Mbmra Traders as at

30 June 2019.

Ksb

Cash book balance (Dr ) 734 JOOO

Unpresented cheques 256 JOOO

Cheques received by Ltre bunk but not yet credited in the account of Mbara Traders. 115,000

Balance as per bank statement (Dr) 875,000

Prepare a bank reconciliation statement as at 30 June 2019. (2 marks)

9. Highlight three items that appear on the credit side of sales ledger control account,

(3 marks)

10. Classify each of the following expenses as either, revenue expenditure or capital expenditure:

(i) Purchase of machinery

(ii) Petrol cost for motor vehicle,

(ii i) Painting of ft new building;

(iy) Repairs to motor vehicle. (2 marks)

11. Stare two accounting concepts, (2 marks}

12. State the difference between straight line method and reducing balance method of depreciation. (2 marks)

13. The opening capital of a business was Ksh 16,588 while the drawings during the year were Ksh 3,400. Determine the amount of capital as at the end of the year (2 marks)

14. State the meaning of the term, ‘accitied expense’ as used in accounting, (I mark)

15. The Fallowing balances were exlraclwl from the books of account of Sila Traders as at 31 December 2018. Ksh

Gross profit 400000

Salaries I60JOOO

Discounts received 16JOOO

Discounts allowed 30JOOO

Determine the net profit for die year ended 31 December 2018. (2 marks)

16. From the following transactions, state lhe account to be debited and lhe account to be credited.

(i) Started a bustness with cash in the bank, Ksh 1 million.

(ii) look cash. Ksh 20,000 from the business to pay hospital bill for his family.

(2 macks)

17. Differentiate between the terms ‘surplus’ and “deficit, as used in income and expenditure account (2 marks)

18. Slate two uses of control accounts in a business organization. (2 marks)

J. Classify each of the following accounts as either, real account Or nominal account,

(i) Delivery van.account.

(ii) ihirchases account.

(2 marks)

20. -Stale the use of a debit note-

22. (a) On I January 2019, Chaka Traders had Ksh 100,000 cash in hand and Ksh at bank. The following transactions took place during the month: January 2

Bought goods for Ksh. 15,000 in cash.

Paid salaries amounting to Ksh 75,000 in cash.

Received a cheque of Ksh 9,800 from Mark, after allowing a 2%

cash discount,

Settled Jcra Traders account of Ksh 30,000, less Ksh 1,500 cash discount.

12 Bought machinery for Ksh 50,(X)0, paying by cheque.

20 Took Ksh 10,000 from the cash till for personal use.

31 Cash sales amounted io Ksh 70JOOO.

Prepare a three-column cash book for the monih of January 2019. (9 marks)

(b) A motor van was bought on 1 January 2017 for Ksh 1.000,000. Depreciation is provided for at the rare of 10% pet annum, on reducing balance method. Determine, the amount of depreciation expense for each of the years: 2017 and 2018. (6 marks)

23. (a) Mambo Traders has not been keeping proper business records. However, the following information has been made available for the year ended 31 December 2018.

(ii) Receipts from debtors during the year amounted to Ksh 317,450

(iii) Payments to creditors during the year amounted to 172,700.

(iv) Cash sales for the year amounted to Ksh 96300.

(i) Balances as at:

1 January 2018 31 December 2018

Ksh Ksh

Debtors 142.780 123,330

Creditors 56,240 76330

(i) Assess credit:

(I) sales, by preparing total debtors control account.

(II) purchases, hy preparing total creditors control account.

(ii) Determine the amount of sales to he recorded in die income statement for the year ended 31 I December 2018. (9 marks)

The following information was obtained From the books of account of Wanda Traders for foe month of January 2019.

January 1, sales ledger balance

Ksh

48.490 (Dr)

Credit sales for foe month 490POO

Returns inwards

Cheques received from debtors 450,000

Discounts allowed 14,000

January 31. sales ledger balance 61,930 (Dr.)

Prepare sales ledger control account. (6 marks)

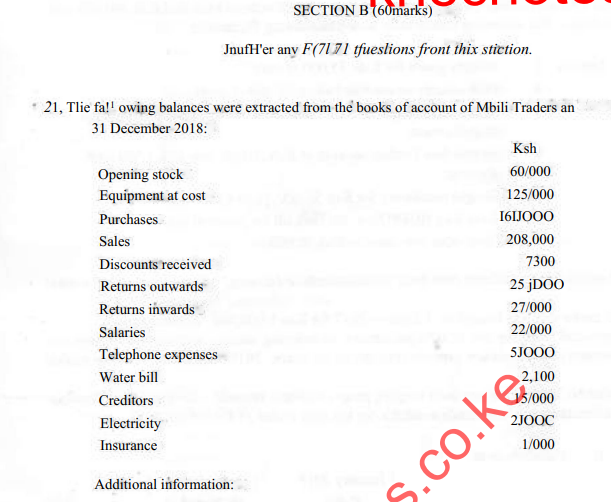

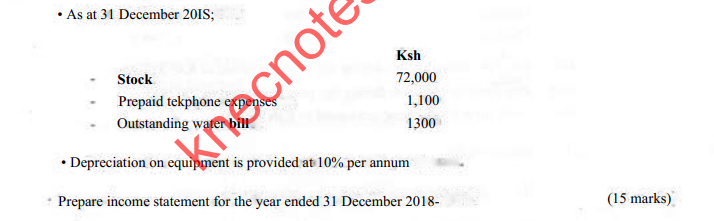

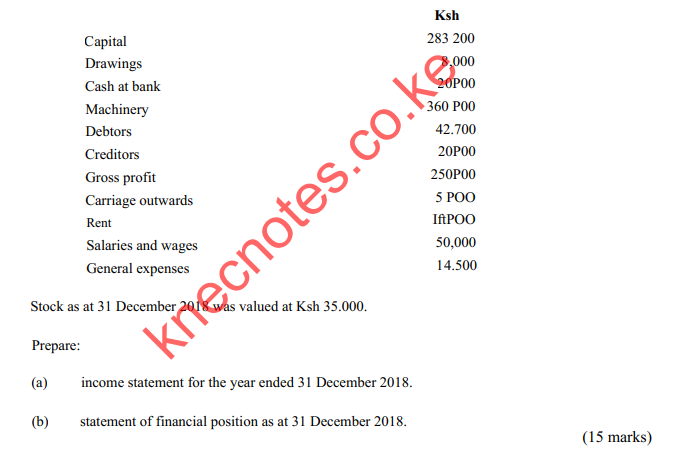

24 The following balances were extracted from the books of account of Karama Enterprises for the year ended 31 December 2018

Timu Traders maintains a petty cash book on an imprest system, with a float of Ksh 25,000. Reimbursement is made on the first day of each week.

The following payments were made during the first week of April 2018: April 1 Envelopes Ksh 800

i Rulers 700

3 Sugar 2,500

4 Tea leaves 1,800

4 Printing papers 2JOOO

5 Postage stamps

Prepare a petty cash book, using the following analysts columns:

– StafT tea

– Stationery

– Postage.

(9 marks)

(b) Explain three qualities of a good financial statement. (6 marks)

26.

(a) The following transactions relate to Apax Traders for the month of May 2019: May 3 Sold goods for Ksh 60,000 to Ayimba on credit.

22 Sold goods for Ksh 150JOOO to Malala Retailers on credit.

24 Ayimba returned goods worth Ksh 10JOOO.

30 Sold goods for Ksh 9,000 to Ramba Stores on credit.

Prepare;

(i) sales journal:

(ii) returns inwards journal.

(7 marks)

Additional information:

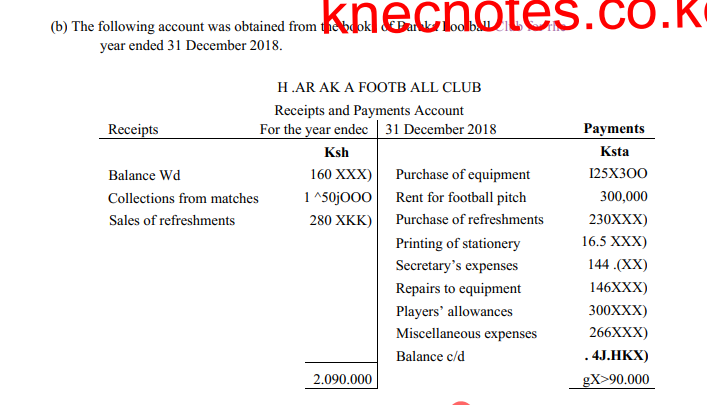

Receipts For the year endec 31 December 2018 Payments

Ksh Ksh

Balance Wd 160 XXX) Purchase of equipment I25X3OO

Collections from matches 1 ^50jOOO Rent for football pitch 300,000

Sales of refreshments 280 XKK) Purchase of refreshments 230XXX)

Printing of stationery 16.5 XXX)

Secretary’s expenses 144 .(XX)

Repairs to equipment 146XXX)

Players’ allowances 300XXX)

Miscellaneous expenses 266XXX)

Balance c/d . 4J.HKX)

2.090.000 gX>90.000

• As at I January 2018, the equipment was valued at Ksh 1,000,(XX).

• Equipment is depreciated at 20% per annum on cost,

(i) Prepare income and expenditure account for the year ended 31 December 2018.

(ii) Based on the results in (i) above, advise the management on whether to continue running the cluh or nut