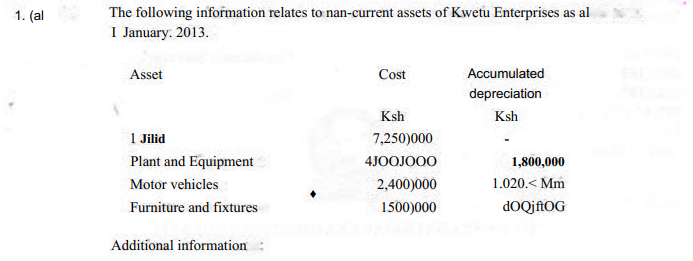

(i l Equipment costing Ksh 7 JOO was acquired during the year.

(ii) A motor vehicle bought for Ksh 500JOOO tn the year 2011 was disposed of for Ksh 300,000, during the year 2013.

I mi Land was revalued at Ks.it B00.000 during the year

(iv) Furniture costing Ksh 120,000 is fully depreciated and diercfore is no longer in use.

(vi Depredation is provided on straight line basis as follows:

– Plant and equipmeni 20%

– Motor vehicles 25%

Furniture and Fixtures 10%

(vi) Depreciation is charged in full in the year of acquisition but none in the year nf disposal.

Prepare a non-current assets movement schedule Ide die year ended 31 December 201 1

Kimis Traders operates a petty cash hook on die imprest system, with a float of

Ksh 45.000 per week. On 3 June 2013, the petty cashier had Ksh 6500 in hand

Rcimtnirsenitmi is made cts the lirst day of every week.

The following transactions took place in lhai week:

2013

June 3 Reimbursement was received from die main cashier,

4 Purchased office stationery for Ksh BJJOO.

5 Paid cleaners’ wages totalling to Ksh 8,6OO

6 Bought photocopying, papers for Ksh 2.40(1

h Purchased airtime vouchers for Ksh 4500.

6 Paid Ksh 3.000 fur taxi services.

7 Bought cleaning detergents for Ksh 3,450 and postage stamps for Ksh 3,100.

8 Paid Ksh 2,700 for bus fare.

Prepare a petty cash book with the following analysis columns;

• Travelling

* Stationery

■ Postage and telephone

■ Cleaning

(a) Explain the use of each of the following documents;

(J) Invoice;

(ii.i Payment voucher;

(iii) Credit note;

(iv) Cash receipts. (8 marks)

The following balances relate to Shama Traders for the year ended 31 December. 2013;

Ksh.

Capital 2,507,750

Motor vehicles at cost 3 250,000

Furniture at cost 950JOOO

Accounts payable 490 JOCK!

Accounts receivable 53OJDO

Bank 790X100

Inventory 86 p00

Insurance I75JJ00

Salaries and wages 292.000

Electricity 127000

Provision for depreciation: Motor vehicles 312.500

– Furniture 118,750

Bad debts 67JD00

General expenses 182.000

Gross profit 3j000,000

Additional information:

* Accrued salaries and wages as al 31 December was Ksh 68,000

• Insurance paid in advance its at 31 December 2013 j mounted to Ksh 17.600,

■ Depreciation is to be provided on the reducing balance basis as follows.

Motor vehicles 25<A

– Furniture UK#

Prepare income statement for the year ended 31 December 2013.

suiL-nient of financial position as at 31 December 2013

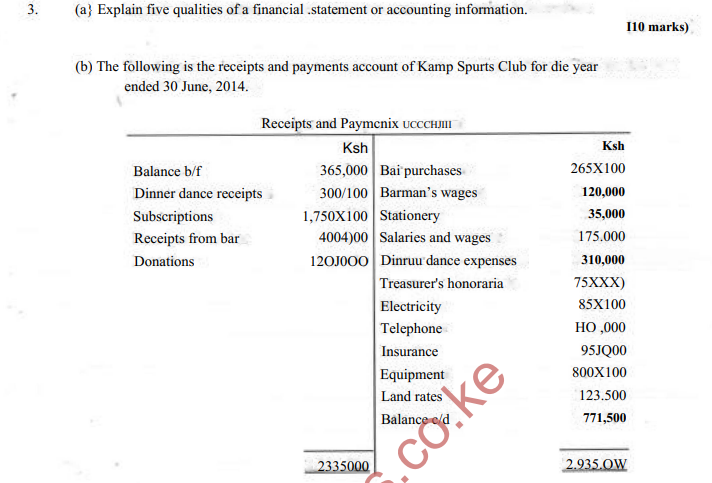

• The opening and closing inventory for the bar was valued at K$h 117,(XMi and

Ksh 150.000. respectively.

■ As at 30 June 2014:

Subscriptions received m advance amounted to Ksh 75X100;

– Subscriptions in arrears amounted u> Ksh 128000;

Salaries and wages in arrears amounted to Ksh 18XXXI

Depreciation on equipment is provided ftt 10 per cent per annum on cost

i) Prepare an income and expenditure account for the year ended 30 June 2014.

(ii) Advise the management on ibe action to take on the annual dinner dance

4, (a) Explain four differences between capital expenditure and revenue expenditure. (8 marks)

(b) Bongo Traders started business on 1 March 2014 with cash at bank of Ksh 300 XXX).

The following transactions took place during the month of March 2014,

March I Withdrew Ksh 80JD00 for office use.

2 Bought equipment worth Ksh 120,000 by cheque.

7 Purchased goods worth Ksh 6.CKK) by cheque.

12 Paid wages Ksh 12500 by cheque.

15 Made cash sales of Ksh 40j000.

16 Credit sales to Wemba amounted to Ksh 22,000,

18 Purchased goods on credit worth Ksh 4()JOOO from Mashi Traders.

22 Sold goods worth Ksh 32XXX) and received a cheque.

26 Wemba settled his account in full in cash.

28 Paid general expenses Ksh 35,000 in cash.

31 The proprietor took Ksh 21,000 from the cash till for personal use.

Record the transactions above in the relevant ledger accounts. (12 marks)

5 (a) The trial balance of Saku Traders prepared on 30 April 2013 did not agree. The credit side exceeded the debit side by Ksh 56JOOO, On investigation, the following errors were revealed:

(i) Discounts allowed totalling to Ksh 15,000 had been credited to the discounts received account,

(ii) Sales day book had been undercast by Ksh 12,450,

(hi) Salaries paid of Ksh 65.(XK) had been recorded tn tlie salaries account as

Ksh 56.000.

i v Payment for electricity of Ksh 19 JOO had been recorded in the cash book only.

(v) A credit sale to John amounting to Ksh 12,400 had been correctly posted to his account bur posted to the wrong side of the sales account,

(vi) A returns inwards of Ksh.7 JOO was recorded as returns outwards.

(vii) Purchases were undercast by Ksh 19,850.

Prepare a suspense account. (10 marks)

(b) Mapema Enterprise had cash in had of Ksh 35,700 ami a hank overdraft of Ksh 25 JOO on I June, 2013.

The following transactions took place during live month of June. 2013

June 2 Sold goods for Ksh 80 JOO in cash

3 Deposited Ksh 70.000 of the office cash into the bank account.

5 Paid rent of Ksh 33 JOO by cheque.

8 The customers settled their accounts by cheque, after deducting a

5% cash discount, as follows:

– Maseke Ksh 58200

– Jernes Ksh 34200

10 Bought goods on credit for Ksh 56,000 from Jijo suppliers.

21 Withdrew Ksh 45,000 from the bank for office use.

24 Settled the account of Jijo supplier by cheque and received a cash discount of 554-.

26 Withdrew Ksh 24,000 from the bank for personal use.

30 Paid wages of Ksh 26,000 in cash.

(i) Prepare a three column cash book for die month of June 2013.

(ii) Advise the management on (he action to take on the closing balances. (10 marks)

The following information relates to die aceounLs receivable of Necter Enterprises for [lie month of April 2013:

Balance as at 31 March 2013

Ksh

125,000

Total credit sale s 825XXX)

Receipts froiri debtors 475jO(X)

Interest charged to credit customers on overdue debts 75,000

Discounts allowed 92 WO

Bud debts written off 60 WO

Returns inwards 58.125

Dishonoured cheques 20 W0

Purchases ledger balances set off against sales ledger balances 17250

Prepare a sales ledger control account for the month of April 2013. (JO marks)

The cash book i.bank column) of Soko Traders on 31 May. 2013 had a debit balance

of Ksh. 78, 250 while ihc bank statement showed a credit balance of Ksh 74500.

The following information revealed the causes of the differences:

* A cheque for Ksh 14.900 was dishonoured ,

‘ Direct deposits by cuslomcTs amounted to Ksh 12500

* A standing nrrlcr of Ksh 8500 was honoured by the bank.

• The bank made a credit error entry of Ksh 7500 into the account of Seiko Traders.

• Opening balance in the cash btK>k was undercast by Ksh 6200.

■ Cheques amounting to Ksh I12,400 recorded m the cash book had nut yei been

credited by the bank.

■ Payments in form of cheques to suppliers amounting to Ksh 105,850 had riot been presented to the bank for payment.

Prepare

fi) an updated cash book.

(ii) a bunk reconciliation statement as at 31 May 2013, (10 marks)

7, (*) Explain the following accounting concepts!

(i) Money measurement concept;

(it) Historical cost concept;

(iii) Realisation concept;

(iv) Dual aspect concept. (8 marie*I

The following transactions were extracted from the books of account of Chau Traders for the month of May 2013.

May 1 Sold goods worth Ksh 12,500 to Ngau on credit.

2 Sold goods worth Ksh 5j000 to Akinyi on credit.

5 Bought goods on credit from Popee Traders worth 25JOOO.

6 Bought goods on credit Inim Bitii worth Ksh 17JMJ0.

8 Akinyi returned goods which had cost Ksh 800,

9 Sold goods worth Ksh I JOO on credit to Main#,

12 Bought goods on credit worth Ksh 32.000 from Kajuluu. Traders.

14 Returned goods which had cost 3 .(MM) to Popcc Traders

20 Mama returned goods worth Ksh 7 JOO.

26 Remmed goods which hud cost Ksh 1,800 to Kujuluu Traders.

30 Sold goods worth Ksh 5.000 to Wiki on credit.

31 Bought goods tor Ksh 10,000 from Mu moo traders on credit.

Prepare ihe relevant day books to record the transaction* above.