SECTION A (40 marks)

Answer ALL questions in this section in the spaces provided

1 Highlight the purpose of a returns outwards journal.

3, State two errors that may not affect the agreement of a trial balance.

4. Highlight the use of a credit note. (. I mark )

5. Mwcma paid Ksh. 14,250 for goods purchased. after receiving a cash discount of 5%.

Calculate the list price of the goods. (2 marks)

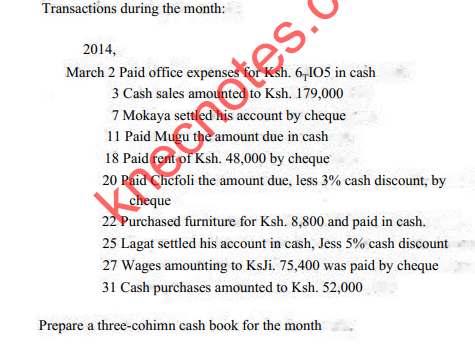

6, The following information was extracted from the records of Tabu Traders for the month of

August 2014. Ksh.

Cross profit 180,000

Wages 64,000

Rent receivable 35,000

Determine the net profit for the month. (2 marks)

7. A computer has a cost of Ksh. 160,000 and an estimated useful life of six years. The computer is depreciated on reducing balance method al the J ate of 10% per annum.

I i) Calculate the value of the computer at the end of the first two years;

(ii) The market price of the computer al the end of the second year is Ksh. 70,000.

Identify one possible cause of the diffrence between the book value and the market value.

(lie following information has been provided by the payroll department of Rango Enterprises for the year 2013:

Wages owing: 1 January 2013

31 December 2013

Wages paid during the year

Ksh.

24,000

27,000

158,000

Calculate the wage expense for the year 2013. (2 marks*

9. The following information has been provided by Viva Traders for the month of June 2014 * Ksh.

Creditors: 1 June 2014 25,000

30 June 2014 30,000

Payments to creditors 192,00G

Calculate the credit purchases for the month. 12 marksj

10, Highlight the use of a cashhook. (1 mark)

11, Highlight the meaning of (he term ‘prudence concept’.

State the account to tie {feinted and rhe account to be credited in each of the following

Transact rons.:

Transaction

f i) Purchase of iumiture by cheque

(i i) Pay men I of rem i n cash

Debit Credit

(2 marks)

Highlight the meaning of ‘subscriptions‘ in a non-profit making organization. 12 marks.)

14, Determine the value of opening inventory from (lie following information:

Cost of sales

Closing inventory

Purchases

Ksh.

280,000

55,000

240,000

(2 marks!

15. Slate the difference between capital expenditure and revenue expenditure.

16. Prepare journal entries to correct the following errors:

(i) Sales were overcast by Ksh. 30,000:

(ii} A receipt from a debtor of Ksh. 180,000 was recorded in the cash book as Ksh, 108,000

(3 marks)

17. The cost of a motor vehicle is Ksh. 375,000. The motor vehicle has a useful life of 5 years.

Depreciation is calculated using the straight line method.

Calculate the book value of the motor vehicle at the end of 3 years. (3 marks)

18. State two advantages of control accounts. (2 marks)

19. Highlight the use of analysis columns in a petty cash book. (1 mark)

20. Stale die treatment of dividends received directly by a bank when updating the cash book balance of a Arm,

(a) Explain each uf the following accounting terms;

(i) Historical cost catLixpk

i’ii) Business entity concept;

I iii} Going concern concept.

(6 marks)

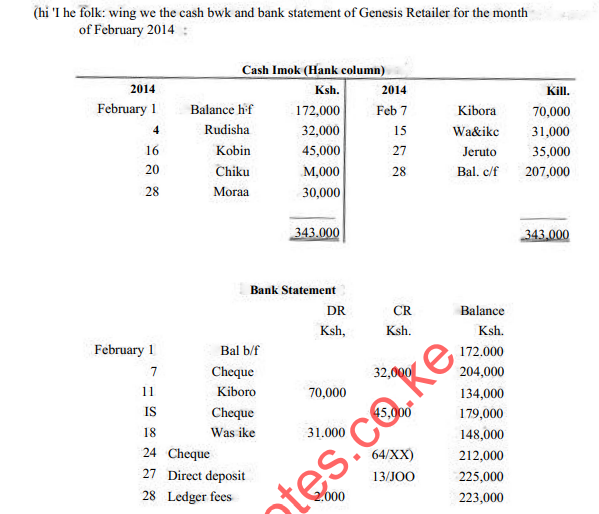

Prepare:

(i) an updated cashbook;

iii) bank reconciliation statement as al 28 February 2014

23. (a) Classify each of the foliowing expenditure as either, revenue or capital:

(i) Legal cost of buying land;

(ii) Carriage inwards on plant purchased:

i i i i) Carriage inwards on purchases;

(iv) Purchase of plant;

(v) Repairs to plant;

(vi) Electricity bills;

(vii) Painting of buildings every year;

(viii) Purchase of a carpet:

I bt) Dril Ling of a bore hole;

(x) Carpet cleaning expenses:

(xi) Purchase of furniture;

(xii) Installation costs of a plant.

24 (a} Feroda Enterprises purchased a machine for Ksh. 1 OOjjOO on 1 January 2011 The machine had an estimated useful Lite of 5 years The machine is depreciated using straight line meihinl.

Fur die years, ended 31 December 2011,2(112 and 201 3. prepare a provision for depreciation on machinery account.

(b) On I July 2014, Upendo started a business with Ksh t OOOflOO which he deposited in a business bank account. The following transactions took place during the month of July 2014:

July 2 Purchased a motor van for Ksh. 1,500t

000, paying by cheque

5 Withdrew Ksh, 220.000 from the bank for business use

8 Paid rent of Ksh. 24.000 by cheque

IQ Bought goods on credit from Sarah for Ksh. 72.000

12 Cash purchases amounted to Ksh. 40,000

25 Paid wages totalling Ksh 64,000 in cash

31 Settled Sarah’s account in cash

31 Withdrew Ksh. 12,000 from the bank for personal use Prepare ledger accounts to record die transactions above