SECTION A (32 marks)

Answer ALL the questions in this section in the spaces provided.

1. Highlight two uses of the petty cash book. (2 marks)

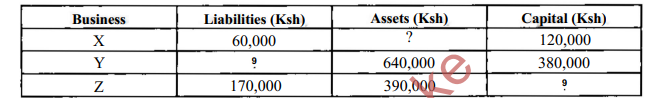

2. The following table shows the liabilities, assets and capital of three businesses.

Determine the value of the missing items. (3 marks)

3. Explain each of the following accounting concepts:

(i) Going concern;

(ii) Accruals. (4 marks)

4. Classify each of the following expenses as either revenue expenditure or capital expenditure:

(i) purchase of stock

(ii) purchase of office furniture

(iii) repainting of an old building

(iv) partitioning of an office block

On 1 January, 2009, Juma bought equipment for K.sh.400,000. The equipment was expected to depreciated at a rate of 15% per annum using reducing balance method.

For the three years ended 31 December, 2009, 2010 and 2011, prepare the provision for depreciation account. (4 marks)

6. State the source document issued by a firm in each of the following transactions:

(i) Sale of goods on credit

(ii) Goods returned to the firm by a customer (2 marks)

7. The following information relates to Jaribu supermarket as at 30 June, 2012:

Ksh

Creditors 68,000

Inventory 193,000

Bank 32,400

Prepare a statement of affairs as at 30 June, 2012.

9. The following errors were discovered in the books of Jambo Traders.

(i) Ksh 5,000 spent on furniture repairs was recorded in the furniture account

(ii) A credit sale to B. Malik was entered in B. Mailaka’s account

(iii) A cash payment of Ksh 2,900 was not recorded in the books

State the type of error in each of the cases above. (3 marks)

10. Jamii social club received the following amounts for subscriptions during the year ended 31

December:

2010 120,000

2011 145,000

Included in the amount received in 2010 was Ksh 15,000 relating to 2009 and Ksh 35,000 relating to 2011.

Included in the amount received in 2011, was Ksh 18,000 relating to 2010.

Prepare a statement to ascertain the subscriptions for the year 2010

SECTION B (68 marks)

Answer ALL the questions in this section in the spaces provided.

11. (a) Zawadi started business on 1 June, 2012 with Ksh 200,000 cash. The following transactions took place during the month:

June 2 Opened a business bank account and deposited Ksh 140,000;

3 Paid rent of Ksh 25,000 by cheque;

5 Bought goods on credit from Tala wholesalers worth Ksh 185,000;

9 Bought stationery for Ksh 2,700 cash;

11 Purchased furniture worth Ksh 56,000 by cheque;

20 Sold goods on credit to B. Diwa for Ksh 68,000;

25 Obtained a loan of Ksh 300,000 from Mengi finance inform of a cheque;

27 Made cash sales of Ksh 77,000;

30 Received Ksh 50,000 in form of a cheque from B. Diwa.

Prepare ledger accounts to record the above transactions. (10 marks)

(b) On 31 May, 2012, the totals of the trial balance extracted from the books of Mapato Enterprises failed to agree. The difference of Ksh 1,000 was entered on the credit side of the suspense account.

The following errors were later discovered:

(i) The debit side of the general expenses account was undercast by Ksh. 1,200;

(ii) A cash sale of Ksh 28,500 was completely omitted from the books;

(iii) Discounts allowed of Ksh 3,400 had been credited in the discounts received account;

(iv) Equipment purchased for Ksh 45,000 was debited in error as Ksh 54.000.

Prepare:

(i) journal entries to correct the above errors;

(ii) the suspense account, duly balanced. (7 marks)

12. (a) Explain four uses of the general journal. (8 marks)

(b) The following balances were extracted from the books of Expert Traders as at

31 December, 2011;

Sales

Ksh

439,800

Premises 580,000

Purchases 292,800

Drawings 80,500

Carriage outwards 17,500

Capital 620.000

Debtors 170,800

Creditors 267,500

Bank 37,600

Salaries and wages 61,100

Rent 87,000

Additional information;

• Inventory was valued at Ksh 71,400 on ? 1 December, 2011.

• On 31 December, 2011, outstanding wages amounted to Ksh 4,200 while prepaid rent was Ksh 15,000.

(i) Prepare:

I. an income statement (trading, profit and loss account) for the year ended 31 December, 2011.

II. a statement of financial position (balance sheet), as at 31 December, 2011.

(ii) Advise the owner on the measures he can take in general, to improve the capital. (9 marks)

13. (a) Explain four causes of depreciation of fixed assets.

(b) On 1 March, 2012, the cash book of Nadir Enterprise had a balance of Ksh.60,100 in cash and Ksh.290,400 at the bank.

The following transactions took place during the month:

March 1 Received cheques from: T. Sambu Ksh.12,000; B. Mali Ksh.36,400;

4 Paid electricity Ksh.4,900 in cash;

7 Made cash sales of Ksh .47,200;

12 Paid die following by cheque: C. Mwanzo Ksh.l 1,000; Mega Ltd

Ksh. 157,500;

15 Withdrew Ksh.22,000 in cash for personal use;

21 Took Ksh.50,000 from the cash till and went and deposited it into the bank account;

27 Received a refund on rates of Ksh.l ,700;

30 Paid salaries Ksh .48,000 by cheque;

31 Purchased goods for Ksh .31,300 by cheque.

Prepare a two column cash book from the transactions given above. (9 marks)

14. (a) The following balances were extracted from the books of Kilo Traders as at

31 December:

2010

Ksh 2011

Ksh

Electricity accrued 12,700 1,200

Insurance prepaid 14,600 16,000

Commission receivable outstanding 1,500 700

During the year ended 31 December, 2011:

(i) Electricity paid amounted to Ksh 64,000;

(ii) Water paid amounted to Ksh 3,000;

(iii) Insurance paid was Ksh 80,000;

(iv) Commission received amounted to Ksh 11,200.

Prepare:

(i) water and electricity account;

(ii) insurance account;

(iii) commission receivable account

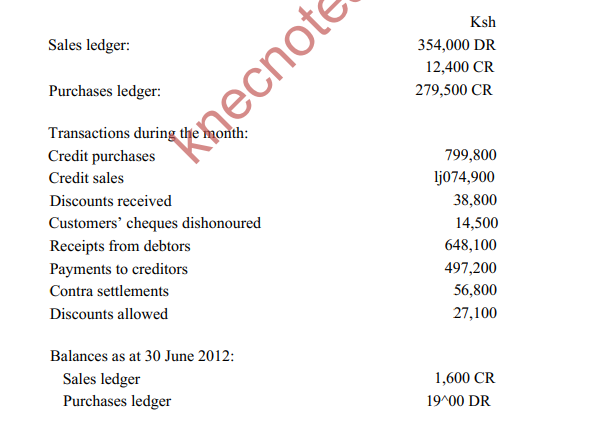

(b) The following balances were obtained from the books of Super Traders as at I June 2012.

Prepare:(i) sale ledger control account;

ii) purchases ledger contra account