SECTION A

Answer ALL the questions in this section.

1. Explain the term discount received as used in accounting.

3. Give an example for each of the following items

(i) None current assets;

(ii) Current liabilities.

(2 marks)

4. The closing stock of Tena Traders was overstated by Ksh 7,000 and the computed gross profit was Ksh 142,000 for the period. Determine the corrected gross profit.

5. State the book of original entry used to record each of the following transactions:

(i) Bought equipment on credit;

(ii) Bought goods and paid by cheque.

(2 marks)

6. Explain the purpose of a bank statement to a business organization. (1 mark)

7. Classify each of the following items into either assets or liabilities:

(i) Prepaid rent;

(ii) Accrued electricity.

(2 marks)

8. The petty cashier paid out weekly expenses amounting to Ksh 6,462 and remained with Ksh 973 at the end of the week.

Determine the amount the petty cashier was given at the beginning of the week. (1 mark)

9. State whether each of the following items of expenditure are capital or revenue.

(i) Purchase of stock of goods;

(ii) Repairs to motor vehicle;

(iii) Renovation of the stores department.

10. State one advantage of the straight-line method of depreciation. (I mark)

11. Explain the purpose of each of the following source documents:

(i) Invoice;

(ii) Credit note. (2 marks)

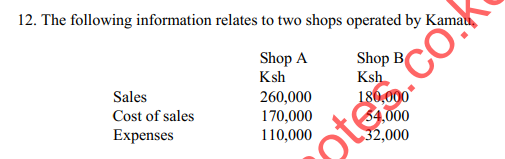

Advise Kamau on the profitability of his business. (3 marks)

13. The business of Kawaida Traders has been experiencing trading difficulties and has already closed three of its six branches in the city.

State the accounting concept to be assessed when final accounts are prepared. (2 marks)

14. Kobe Enterprises bought a machine for Ksh 200,000 on 1 January 2008. The machine was to be depreciated at a rate of 20% per annum on reducing balance.

Determine the book value as at 31 December 2010.

15. State the type of balance in each of the following accounts (either debit or credit).

(i) Returns inwards.

(ii) Carriage outwards.

(iii) Returns outwards.

(3 marks)

16. Explain the term “subscription in arrears”. (1 mark)

17. Sarah does not keep proper set of books of accounts for her business. After an year of trading 2011, creditors amounted to Ksh 22,000, stock of goods Ksh 11,000, cash Ksh 51,000 and a loan of Ksh 10,000 from her uncle. She had an initial capital of Ksh 20,000. Advise Sarah on her business performance for the year. (3 marks)

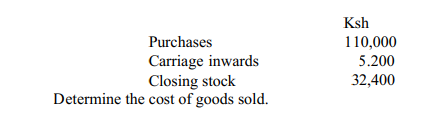

18. The following information relates to Zaidi Traders for the year ended 31 December 2010.

(2 marks)

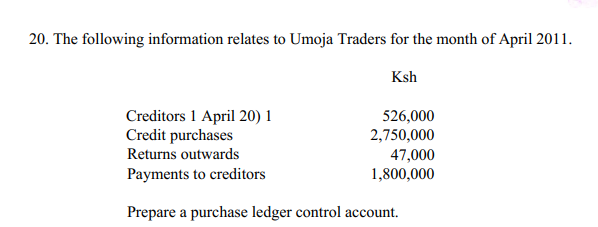

19. Differentiate between bad debts and provision for doubtful debts.

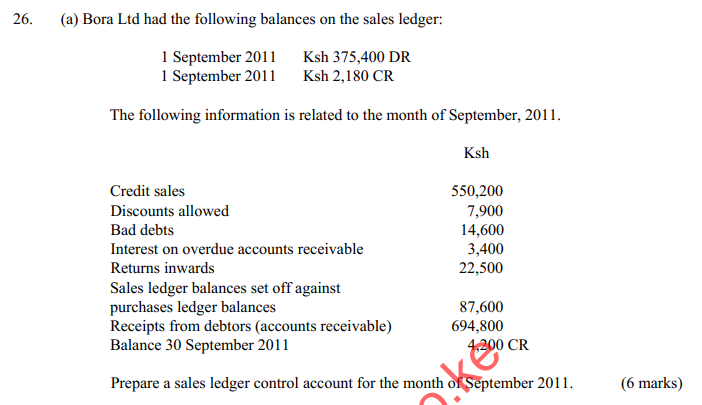

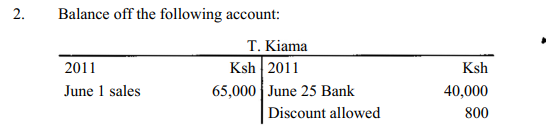

SECTION B

Answer any FOUR questions from this section.

21. (a) Explain three uses of the general journal. (6 marks)

(b) On 1 September 2011, the cash book of M wala Traders had the following balances:

Cash in hand ksh 16,400

Cash at bank Ksh 57,200

The following transactions took place during the month of September: 2011

September 2: Received a cheque for Ksh 11,300 from C. Jonah after deducting

a cash discount of Ksh 2(X).

4: Paid Ksh 6,500 for insurance by cheque.

12: Received Ksh 800 as a commission by cheque.

14: Cash sales amounted to ksh 2.200.

20: Withdrew Ksh 15,000 from the bank for office use.

21: Paid ksh 7,600 for wages.

22: Proprietor took Ksh 3,500 in cash for personal use.

28: Paid Ksh 21,700 to B. Owino by cheque.

30: Paid Ksh 18,900 to T. Robi by cheque.

Prepared a three column cash book for the month of September 2011

22. (a) Explain each of the following accounting concepts:

(i) Prudence;

(ii) Dual aspect;

(iii) Matching.

(6 marks)

(b) The Petty Cashier of Waziri Traders was given a cash float of Ksh 7,000 by the main cashier on 1 August 2011.

She paid out cash for each of the following items during the month.

2011 Ksh

August 1 Telephone bill 1,200

2 Envelopes 400

4 Mobile air time credit 1,500

5 Printing papers 2,000

15 Bus fare 250

17 Brooms 520

22 Creditor S. Juma 160

25 Soap 90

31 Petrol 800

(i) Prepare a petty cash book for the month of August 2011 with the following analysis columns:

• Cleaning

• Stationery

• Travelling

• Telephone

• Ledger accounts

(ii) On 31 August 2011 after the last transaction, the main cashier sent creditor – Mbithi to the petty cashier for payment of Ksh 550. Advise the petty cashier on the action to take.

23. (a) Explain three reasons for making provision for depreciation on fixed assets. (6 marks)

(b) On 1 July 2011, Amani started business with Ksh 60,000 in cash out of which

Ksh 40,000 was deposited into a business bank account.

The following transactions took place during the month of July. 2011

July 1 Purchased furniture for Ksh 14,000 in cash.

2. Bought goods for Ksh 50,000 from W. Mwanza on credit.

4. Sold goods for Ksh 11,600 to R. Kola and 22,800 to J. Fatuma, all on credit.

9. J. Fatuma returned goods worth Ksh 500.

21 Paid Ksh 9,400 for office expenses by cheque.

31 Paid W. Mwanza half of the amount due to him.

Prepare ledger accounts to record the transactions above.

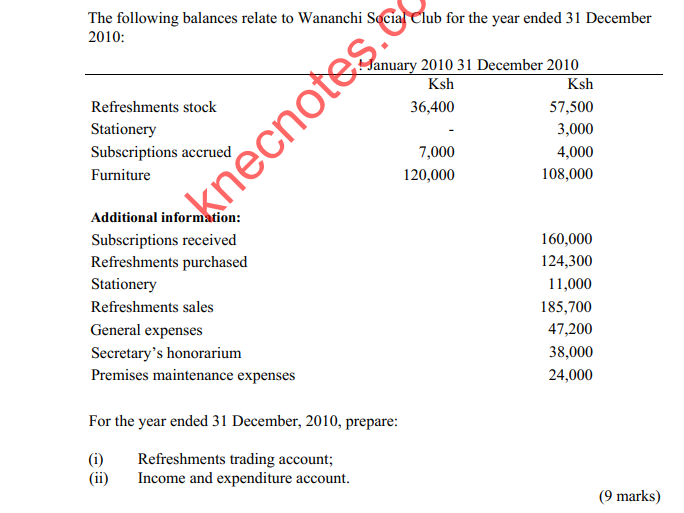

24. (a) Explain each of the following terms as used in non-profit making organizations.

(i) Donations;

(ii) Accumulated fund;

(iii) Deficit.

(6 marks)

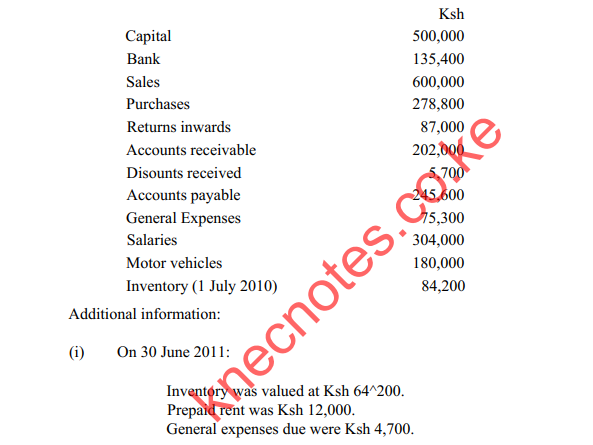

(b) The following balances were extracted from the books of Swapo Enterprises as at 30 June 2011.

Additional information:

(i) On 30 June 2011:

Inventory was valued at Ksh 64^200.

Prepaid rent was Ksh 12,000.

General expenses due were Ksh 4,700.

(ii) Depreciation on motor vehicles was to be provided at 25% per annum.

(iii) A provision for doubtful debts was to be created at 5% of accounts receivable.

I. Prepare an income statement for the year ended 30 June 2011.

IL Advise the management on the profitability of the business.

25. (a) The trial balance of Bibu Traders did not balance and the difference was entered in the suspense account.

On investigation, the following errors were revealed:

(i) The sales day book was undercast by Ksh 2,500.

(ii) A cash purchase for Ksh 3,650 was entered in the cash book as Ksh 3,560.

(iii) Motor expenses of Ksh 1,700 were recorded in motor vehicles account.

(iv) The purchase day book was undercast by Ksh 1300.

Prepare:

I. Journal entries to correct the errors above.

II. Suspense account showing the original difference in the trial balance.

(6 marks)

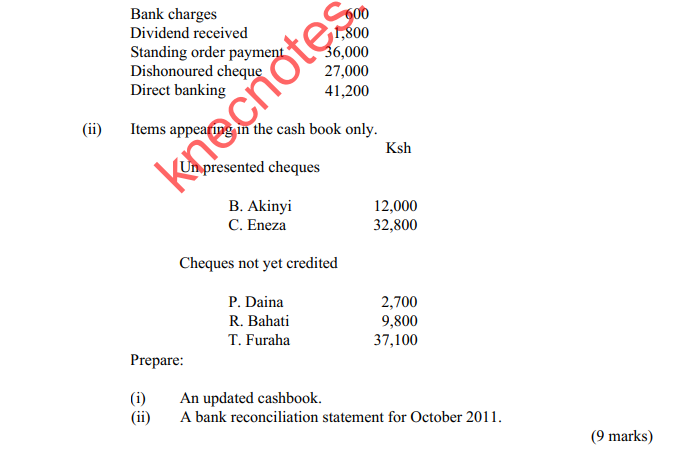

(b) On 1 October 2011 the cash book (Bank Column) of Sura Traders had a debit balance of Ksh 65,900 while on the same date the bank statement showed a credit balance of Ksh 40,500.

On investigation, the following discrepancies were revealed.

(i) Items appearing on the bank statement only: