Examiners in this paper raised a number of concerns concerning how candidates approached and attempted to solve certain questions.

Some candidates did not perform well in the following questions:

Question No. 1 (a) in which candidates were required to cite FOUR reasons to justify why not-for-profit entities should be subject to regulation.

Despite this question being rather straight forward, most candidates did not give convincing responses. On a general level, the question centred on entities that are not driven by the profit motive, such as some classes of public entities, charitable

organisations and NGOs.

The following were among the expected responses.

Reasons why not-for-profit entities should be subject to regulation:

- Public sector bodies, such as local government organisations, spend tax payers’ money and should be required to account for it.

- The chief executives of public sector bodies are often highly rewarded and their performance should be verified.

- Charities are big business. In addition to regular public donation, they receive large donations from high-profile donors.

- NGOs and charities employ staff and executives at market rates and have heavy administrative costs. Supporters/donors are entitled to know how much of their donation has gone into administration.

- Any misappropriation of funds from supporters/donors is serious in two ways. It is taking money from the donating public, who thought they were donating to a good cause, and it is diverting resources from the people who should have been helped.

- Not all charities are bona fide and some could be connected to activities that are generally frowned upon.

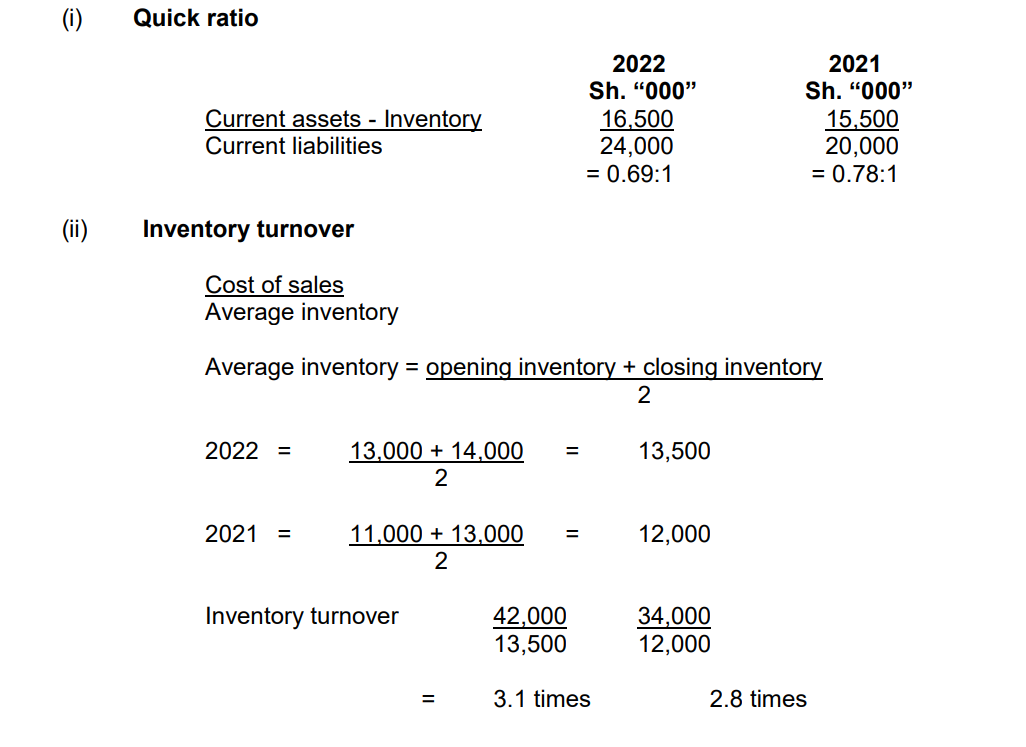

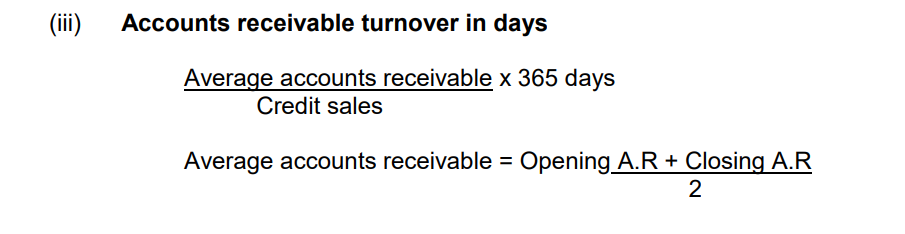

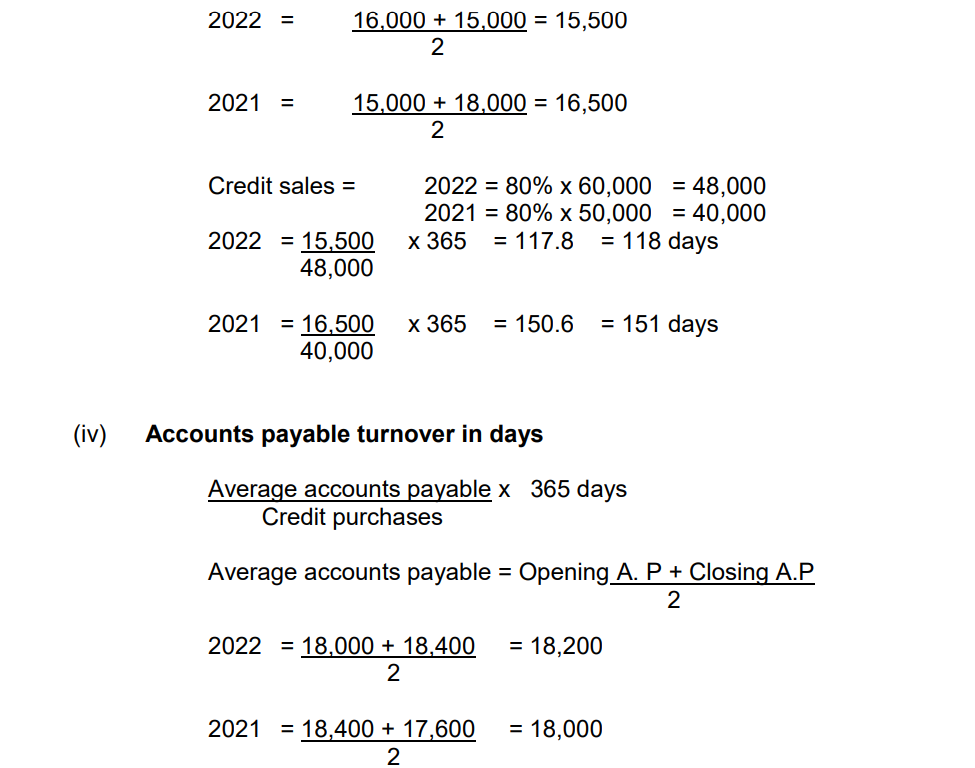

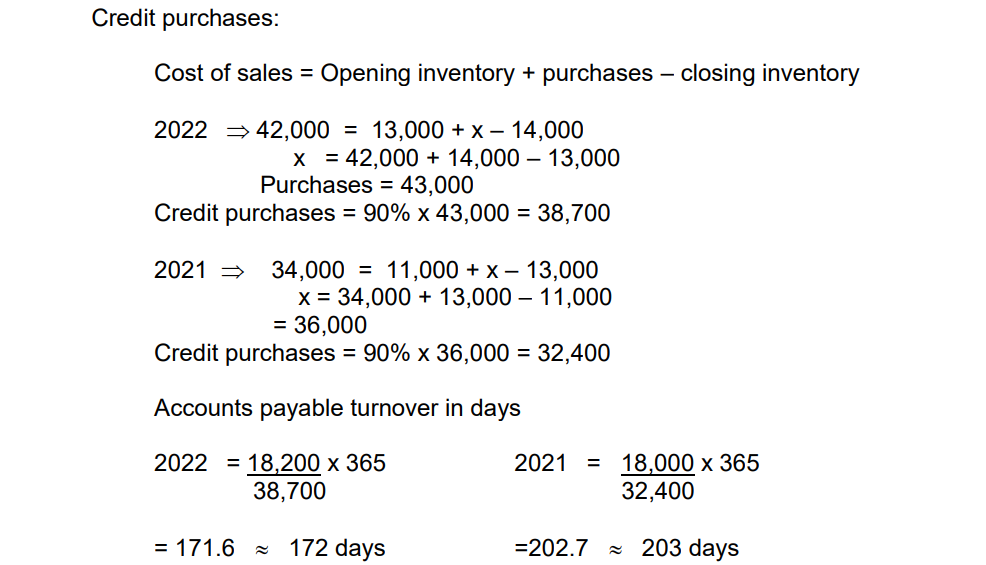

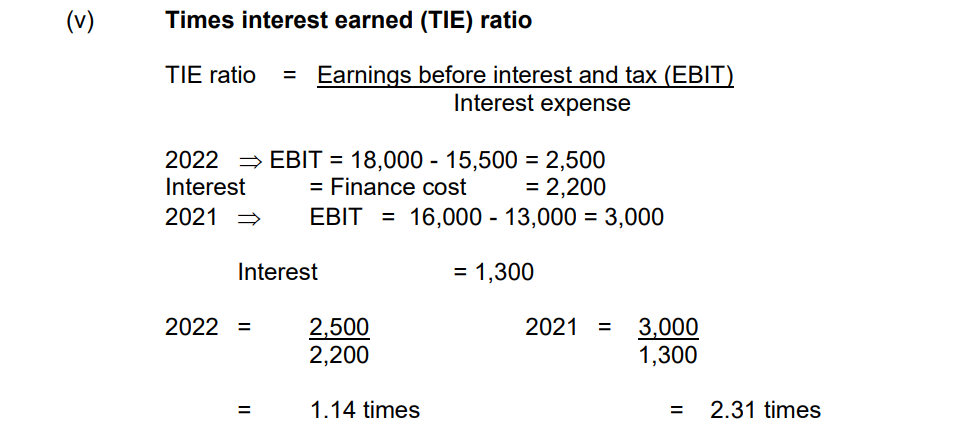

Question No. 2 (a) in which candidates were provided with information about a certain company (Tazama Ltd.) and required to compute some ratios. Some candidates were unable to compute the ratios referred to.

These ratios should have been computed as follows:

In this part of the question, it was important for the candidate to know where to express figures as ratios, percentages, number of times or even in days.

Question No. 2 (b) in which candidates were also unable to highlight THREE risks that might arise due to each of the following situations:

- Low inventory turnover.

- High debtors’ turnover.

The following were among the expected responses:

Risks that might arise due to:

1. Low inventory turnover

- High risk of stock spoilage.

- High risk of increased cost of storage.

- High opportunity cost of tied up capital.

- High risk of obsolescence.

2. High debtors’ turnover

- High risk of bad debts.

- High cost of managing debts.

- High risk of increased allowance for doubtful debts.

- High risk of bad debts

Question No. 5 (a) in which candidates were required to state FOUR elements of financial statements.

These elements are to be found in the Conceptual Framework for Financial Accounting issued by the International Accounting Standards Board (IASB). The following was the expected response.

1. Elements of financial statements:

- Income.

- Expenses.

- Assets.

- Liabilities.

- Equity.

Question No. 5 (b) in which candidates were required to explain TWO reasons for and TWO reasons against the use of the accrual method of accounting in the public sector.

The following were the responses expected by the examiner.

Reasons for and against the accrual method of accounting in the public sector:

Reasons for:

- The accrual method of accounting measures all the income earned for a particular period regardless of the cash receipts. This gives the true total income earned.

- The method ensures that all costs are considered for the period to which they relate regardless of cash payments.

- The method measures and matches the revenue with related cost/expenditure to the period to which they relate.

Reasons against:

- The method can be misleading on the income reported when the funds/cash are yet to be collected.

- The measure of profit will not match the cash received.

- The method may not be suitable for government accounting since the government uses a budget period where expenditure and income are allocated.