MONDAY: 4 April 2022. Morning paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

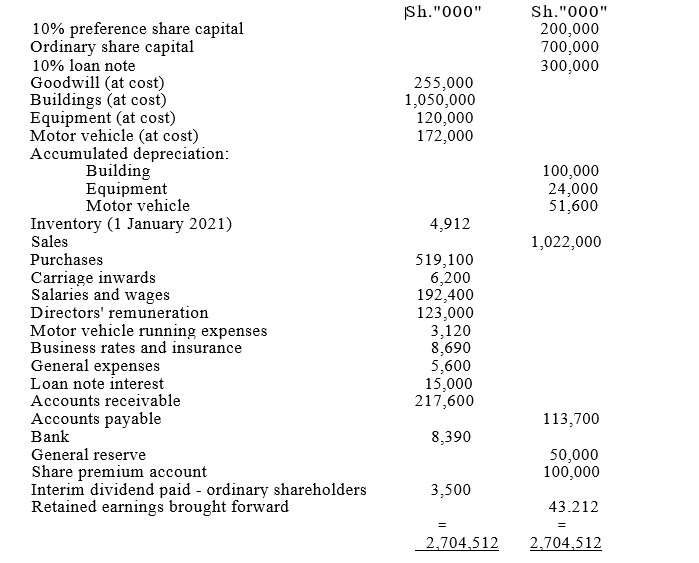

The following trial balance was extracted from the books of Huruma Ltd. 31 December 2021:

Additional information:

- Inventory as at 31 December 2021 was valued at Sh.91,423,000.

- The directors proposed a payment of final dividends to the ordinary shareholders of Sh.2,000,000 to the preference shareholders.

- Depreciation is to be provided per annum as follows:

Asset Basis

Motor vehicle 10% on reducing balance

Building 2.5% on cost

Equipment 15% on reducing balance

- The directors also proposed that Sh.10,000,000 be transferred to the general reserve.

- During the year ended 31 December 2021, an allowance of Sh.45,000,000 was made for corporate tax.

- During the year end_ed 31 December 2021, an impairment review was undertaken in respect of the goodwill. It was discovered that the goodwill had been impaired by Sh.5,000,000.

- A difference in the books of Sh.1,200,000 that had been written off to general expenses during the year was later found to have been due to the following errors:

- Sales returns of Sh.1,800,000 had been debited to sales, but was omitted from the customers account.

- The purchase journal had been undercast by Sh.3,000,000.

Required:

- Statement of profit or loss for the year ended 31 December 2021. (12 marks)

- Statement of financial position as at 31 December 2021. (8 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain the function of each of the following organs in the management of government finances:

Public accounts committee. (2 marks)

Committee of ways and means. (2 marks)

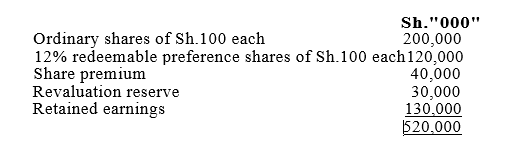

2. An extract from the statement of financial position of Left Ltd. as at 31 October 2021 was as follows:

Additional information:

On 1 November 2021, a resolution was passed by the directors to redeem half of the redeemable preference shares at a premium of 15%. The premium on redemption is to be financed from the existing share premium account, while the nominal account was financed as follows:

1. 250,000 ordinary shares of Sh.100 each at a premium of Sh.20 per share payable for in full on application. The shares were issued to the public and 280,000 applications were received. Any excess monies received were returned to the applicants.

2. The difference in the nominal amount was drawn from the retained earnings.

Required:

1. Journal entries to record the above transactions. (5 marks)

2. An extract of the amended statement of financial position as at 30 November 2021. (1 mark)

3. You are the accountant of Tayari Ltd. In preparing the company accounts for the year ended 31 December 2021, you are faced with the following problems due to Covid-19 pandemic:

The company owns some shares in a quoted company which the shareholders think are worthless.

A debtor who owes a large amount to the company is rumoured to be going into liquidation.

The company had a poor trading year and the owners believe that a more balanced result could be presented if a last-in-first-out (LIFO) inventory valuation method was adopted instead of the present first- in-first-out (FIFO) method.

4. During the year the company purchased Sh.100,000 worth of face masks for the employees use. These were still in use as at year end.

5. All the non-current assets of the company might now cost more than they did at the time they were purchased.

Required:

Explain how you would treat each of the above cases and justify each treatment with an accounting concept. (10 marks)

(Total: 20 marks)

QUESTION THREE

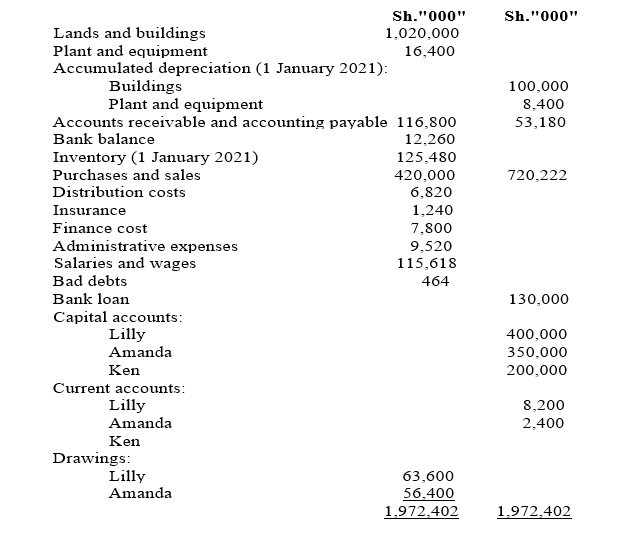

Lilly, Amanda and Ken are in partnership sharing profits and losses in the ratio 2:2:1.

The following is their trial balance as at 31 December 2021:

Additional information:

- Inventory as at 31 December 2021 was valued at Sh.148,420,000.

- Land and buildings were acquired a few years ago. The buildings were valued at Sh.420,000,000.

- Depreciation is to be charged per annum as follows:

Asset Rate

Buildings 2V2% per annum on cost

Plant and equipment – 15% per annum on reducing balance basis

- No entries have been made in the books for sales on credit amounting to Sh.6,000,000 on 20 December 2021. Payment for the goods was received on 3 January 2022.

- The partners agreed to the following:

- Lilly is to be paid a salary of Sh.5,000,000 per month.

- . Interest on drawings to be charged as follows: Lilly Sh.1,800,000 and Amanda Sh.1,200,000.

- To allow interest on capital account balances at 5% per annum.

Required:

- Statement of profit or loss and appropriation account for the year ended 31 December 2021. (10 marks)

- Partners’ current accounts. (4 marks

- Statement of financial position as at 31 December 2021. (6 marks)

(Total: 20 marks)

QUESTION FOUR

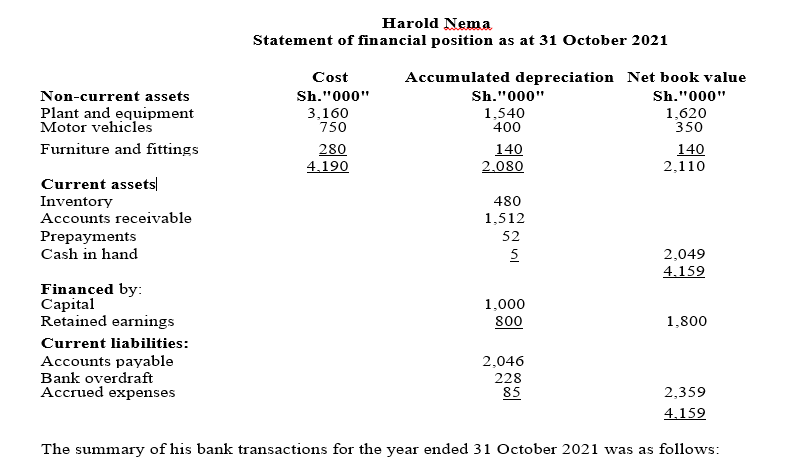

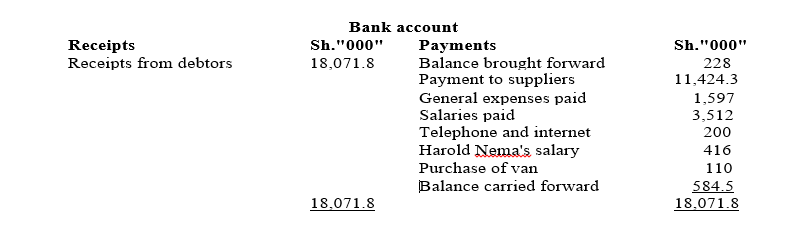

Harold Nema does not employ a full time accountant to maintain his books of account. He has appointed you as his accountant to extract his financial statements for the year ended 31 October 2021. The following information has been availed to you:

Additional information:

- Accounts receivable and accounts payable as at 31 October 2021 were Sh.1,842,300 and Sh.2,391,800 respectively.

- As at 31 October 2021, accrued expenses amounted to Sh.63,300 and pre-paid expenses amounted to Sh.31,300.

- The percentage of gross profit margin has remained reasonably static in recent years at 50%.

- Harold Nema drew Sh.2,000 per week from the cash float held by the cashier except during his two-week annual holiday.

- Office expenses amounting to Sh.160,000 and miscellaneous expenses amounting to Sh.15,000 were paid from the cash float during the year.

- Cash in hand as at 31 October 2021 was Sh.9,400.

- Bad debts amounting to Sh.49,000 were written off during the year ended 31 October 2021.

- An allowance of 5% of the accounts receivable is to be maintained for doubtful debts.

- Depreciation is to be provided as follows:

Assets Rate per annum

Plant and equipment 15% on reducing balance

Motor vehicles 20% on straight line

Furniture and fittings 10% on straight line

Required:

- Statement of profit or loss for the year ended 31 October 2021. (12 marks)

- Statement of financial position as at 31 October 2021. (8 marks)

(Total: 20 marks)

QUESTION FIVE

- Outline four types of intangible assets. (4 marks)

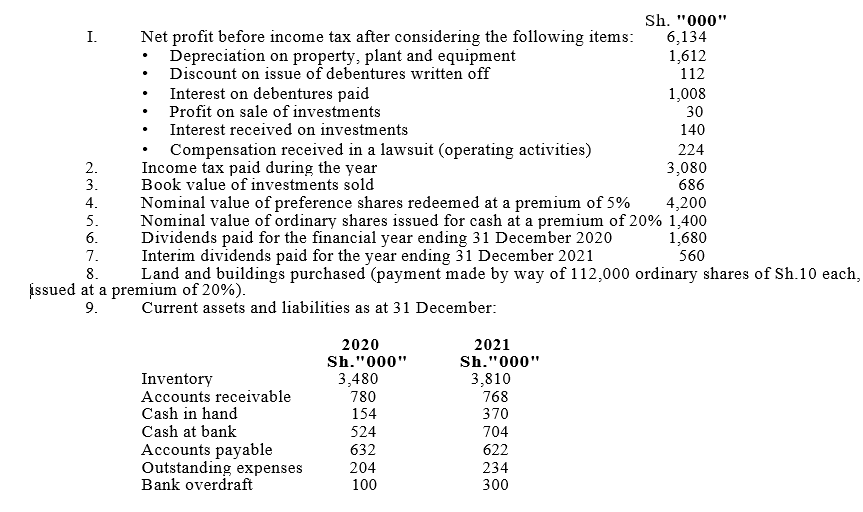

- The following information was extracted from the books of Paulo Ltd. for the year ended 31 December 2021:

Required:

Statement of cash flows for the year ended 31 December 2021, in accordance with the requirements of International Accounting Standards (IAS) 7, “Statement of cash flows”. (16 marks)

(Total: 20 marks)