MONDAY: 5 December 2022. Afternoon Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

Do NOT write anything on this paper.

QUESTION ONE

1. Highlight THREE advantages of issuing shares through private placement. (3 marks)

2. Describe THREE circumstances under which a firm might find it appropriate to use retained earnings as a source of finance. (6 marks)

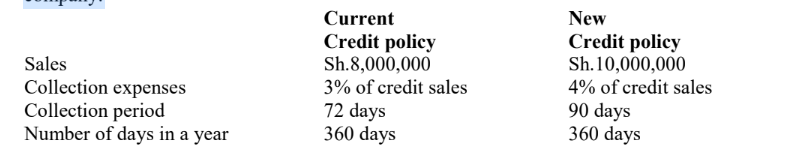

3. Magharibi limited is evaluating a change in its credit policy.

Presently, 70% of sales are on credit. The gross profit margin is 20%. The following information relates to the company:

Required:

Change in gross profit. (3 marks)

Change in collection expenses. (3 marks)

Change in average accounts receivable. (3 marks)

Using the results in 3 above, advise the management whether or not to change the current credit policy if the borrowing rate is 16% per annum. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Examine THREE ethical issues facing financial managers. (6 marks)

2. Highlight FOUR arguments in favour of wealth maximisation objective. (4 marks)

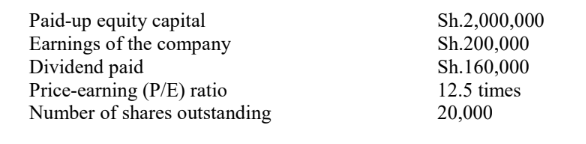

3. The following information relates to Upendo Technologies Ltd:

Required:

Determine the following:

Earnings per share (EPS). (2 marks)

Dividend per share (DPS). (2 marks)

The intrinsic value of a share using Walter’s model. (3 marks)

Whether the company’s dividend pay-out ratio is optimal using Walter’s model. (3 marks)

(Total: 20 marks)

QUESTION THREE

1. Outline FOUR reasons for time preference for money. (4 marks)

2. Explain THREE characteristics of capital investment decisions. (6 marks)

3. Arthur Kiplangat holds a 5-year, 12%, Sh.1,000 debenture par value.

Determine the value of the above debenture. (4 marks)

4. The following details relate to a capital project in Furaha Ltd:

Initial cash outlay Sh.104,000,000

Annual net operating cash flow (after tax) Sh.33,600,000

Useful life of project 6 years

Minimum required rate of return 16%

Required:

Assess the suitability of the capital project using the following methods:

Net present value (NPV). (2 marks)

Internal rate of return (IRR). (4 marks)

(Total: 20 marks)

QUESTION FOUR

1. Describe FOUR benefits that might accrue to a company by having its shares quoted in the securities exchange. (4 marks)

2. Explain TWO ways in which a company could issue new shares to its existing shareholders. (4 marks)

3. Describe TWO costs associated with disclosure of financial statements information. (4 marks)

4. The management of Makadilio Ltd. has decided to prepare a cash budget.

The following projections and other information are drawn from their balances:

1. The opening cash balance on 1 February 2023 is expected to be Sh.30,000,000.

2. The projected sales are as follows:

Sh. “000”

December 2022 80,000

January 2023 90,000

February 2023 75,000

March 2023 75,000

April 2023 80,000

3. Analysis of books shows that accounts receivables are settled as follows:

60% within the month of sale

25% the month following

15% the month following (second month after the month of sale)

4. Projected purchases were as follows:

Sh. “000”

January 2023 60,000

February 2023 55,000

March 2023 45,000

April 2023 55,000

5. All purchases are on credit and past experience shows that 90% are settled on the month of purchase and the balance settled the month after.

6. Wages are Sh.15 million per month and overhead of Sh.20 million per month (including Sh.5 million depreciation) are settled monthly.

7. Taxation of Sh.8 million has to be settled in March 2023 and the company will receive settlement of an assurance claim of Sh.25 million in April 2023.

Required

Prepare a cash budget for the month of February, March and April 2023. (8 marks)

(Total: 20 marks)

QUESTION FIVE

1. Examine TWO reasons why a company may prefer debt capital to equity capital. (4 marks)

2. Discuss THREE importance of capital budgeting to a company. (6 marks)

3. Simon Nyaga intends to save a certain amount of money every year for five years in a bank paying 10% interest annually in order to raise college fee of Sh.5,000,000 for his daughter.

Required:

Determine the annual deposit that Simon Nyaga makes. (3 marks)

Janet Pendo has acquired a 20-month auto loan of Sh.6,000,000 at an annual interest rate of 12%.

Required:

Determine the amount of monthly loan repayments that Janet Pendo makes. (3 marks)

4. The following information relates to product K produced and sold by Poka Limited.

Sh.

Selling price 12,000

Variable cost per unit 8,000

Fixed costs per annum 20,000,000

Required:

Determine the following:

Break-even point in shillings. (2 marks)

Number of units to be produced and sold in order to achieve a profit of Sh.30,000,000. (2 marks)

(Total: 20 marks)