WEDNESDAY: 15 December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. In a digital economy, the role of finance manager is pervasive in all activities of the firm.

Required:

In light of the above statement, discuss four main managerial roles played by a finance manager. (8 marks)

2. In relation to working capital management, distinguish between “over-capitalisation” and “under-capitalisation”. (4 marks)

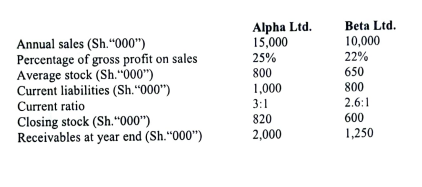

3. The following information relates to two companies: Alpha Ltd. and Beta Ltd. for the year ended 31 December 2020:

Required:

Using the above information calculate the following:

Stock turnover ratio. (2 marks)

Acid test ratio. (2 marks)

Receivables turnover. (2 marks)

Average age of receivables in months. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Highlight five sources of finance in their order of preference according to the pecking order theory (5 marks)

2. The following information relates to profits reported by Donnet Ltd, for the last four years.

Required

The market value of Donnet Limited. (5 marks)

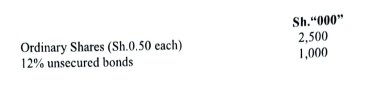

3. The following information was extracted from the statement of financial position of ZAp Limited:

Additional information:

- The ordinary shares are currently quoted at Sh.1.30 each.

- The 12% bonds are trading at Sh.72.

- The ordinary dividend of Sh.0.15 has just been paid with an expected growth rate of I0%

- The corporation tax rate 30%.

Required

The weighted average cost of capital(WACC) for the company.

QUESTION THREE

1. Mathew Wakili intends to start a small business enterprise.

Advise Mathew Wakili on four external sources of finance that may be available to him. (10 marks)

(Total: 20 marks)

2. Pambo Limited Purchased a special machine 1 year ago at a cost of Sh.1,200,000. At that time, the machine was estimated to have a useful life of 6 years and no salvage value. The annual operating costs for the old machine are estimated at Sh.400,000,

A new machine has just been introduced to the market which will do the same job but with an annual operating cost of Sh.340,000. The new machine costs Sh.2,100,000 and has an estimated useful life of 5 years with zero salvage value.

The old machine can be sold for Sh.1,000,000.

Additional information:

- The company uses straight line method of depreciation.

- The corporation tax rate is 30%.

- The company’s cost of capital is 10%.

Required:

The initial investment for new machine. (2 marks)

The incremental cash inflow after tax. (2 marks)

The Net Present Value (NPV) of the new machine. (2 marks)

Advise the management whether to invest in the new machine. (2 marks)

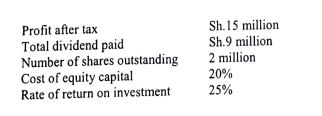

3. The following information has been extracted from the books of Kawaida Ltd. for the year ended 31 December 2020:

Required:

The current theoretical market value of the company’s share using the Walters Model. (4 marks)

(Total: 20 marks)

QUESTION FOUR

1. With respect to working capital management, describe four possible methods of easing cash shortages in an organization (4 marks)

2. XYZ Ltd. has a dividend capitalisation rate of 12% on its investment of Sh.600,000 in assets. The company has 600,000 outstanding ordinary shares at Sh.10 per share each, The company’s rate of return is 10% and it has a policy of retaining 40% of the earnings.

Required:

Using Gordon’s model, determine the price of the company’s share. (3 marks)

Critique Gordon’s Model as a method of valuing securities. (3 marks)

3. Fred Onyango visited his local bank in search for additional working capital and proposes to borrow Sh.120,000 repayable in six months. The credit analyst at the bank upon interviewing Fred Onyango discovers that although the customer’s cash inflows have been averagely steady over the last few years, his business experiences a boom twice a year at intervals of’ six months. The end of the next six months coincides with the end of the proposed loan’s tenure. A partially amortising loan with Sh.60,000 being paid at the end of the sixth month is recommended.

Required:

Prepare a loan amortisation schedule for the two options to assist Fred Onyango in understanding the repayments.

Note: The bank charges an interest rate of 14.40% per annum. (10 marks)

(Total: 20 marks)

QUESTION FIVE

1. Budgets are not prepared in isolation and then filed away but are the fundamental components of what is known as the budgetary planning and control system. In line with this statement:

Explain the meaning of the term “budgetary planning and control system”. (I mark)

State five objectives of a budgetary planning and control system. (5 marks)

2. JNS Manufacturers Limited manufactures two products namely; “Skyline” and “Digitex The company is in the process of preparing the year 2022 budgets. Both products are made by the same grade of labo ur grade C. The company currently holds 800 units of Skyline and 1,200 units of Digitex in inventory but 250 units of Digitexts have been discovered by auditors to have deteriorated in quality and must therefore be scrapped. Budgeted annual sales of Skyline are 3,000 units and of Digitex are 4,000 units, provided that the company maintains finished goods inventories at a level equal to three months sales.

Grade C labour was originally expected to produce one unit of Skyline in two hours and one unit of Digitex in three hours at an hourly rate of Sh.250 per hour. However, in discussions with Wafanyikazi trade union negotiators, it has been agreed that the hourly wage rate should be raised by Sh.50 per hour provided that the times to produce Skyline and Digitex are reduced by 20%.

Required:

Production budget for the year 2022. (6 marks)

Direct labour budget for the year 2022 indicating the direct labour cost per hour. (4 marks)

3. Summarise four assumptions of the Walter’s dividend relevance model. (4 marks)

(Total: 20 marks)