MONDAY: 21 August 2023. Afternoon Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Explain THREE financing decisions made by the Board and management in an organisation. (6 marks)

2. Describe THREE benefits that may accrue to a firm from preparing a cash flow statement. (6 marks)

3. Texa Limited practices a strict residual dividend policy. It maintains a capital structure of 60% debt and 40% equity. Earnings for the year are Sh.10,000,000.

Required:

Using the debt ratio, determine the maximum amount of capital expenditure possible without selling new equity. (3 marks)

Suppose that the planned investment outlay for the coming year is Sh.20,000,000, evaluate whether the

company will pay a dividend. (5 marks)

(Total: 20 marks)

QUESTION TWO

1. Summarise FOUR users of financial statements, citing the information need. (4 marks)

2. Describe THREE internal factors that could influence financing decisions in an organisation. (6 marks)

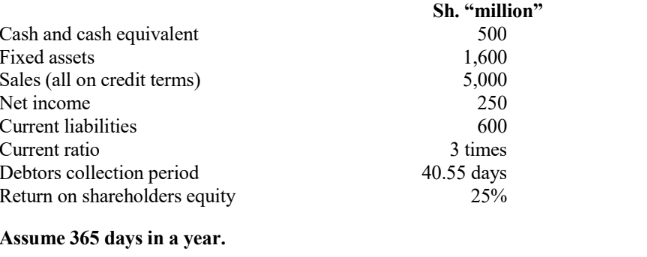

3. The following information was extracted from the financial statements of Kwekwe Ltd. for the year ended 31 December 2022:

Required:

Calculate the following for the year ended 30 December 2022:

Accounts receivable. (2 marks)

Current assets. (2 marks)

Return on total assets as a percentage. (2 marks)

Total shareholders equity. (2 marks)

Quick ratio. (2 marks)

(Total: 20 marks)

QUESTION THREE

1. Highlight FOUR objectives of accounting. (4 marks)

2. The following trial balance was extracted from the books of Sunlight Ltd. as at 31 March 2023:

Additional information:

1. A building whose net book value was Sh.20 million as at 31 March 2023 was to be revalued to Sh.36

million.

2. The corporation tax for the year is estimated at Sh.10 million.

3. The directors have proposed a final dividend of 20% on the ordinary shares.

4. The directors have agreed to transfer Sh.2 million to capital redemption reserve fund.

Required:

Prepare statement of profit or loss for the year ended 31 March 2023. (6 marks)

Statement of financial position as at 31 March 2023. (10 marks)

(Total: 20 marks)

QUESTION FOUR

1. Enumerate FOUR causes of soft capital rationing as used in capital budgeting. (4 marks)

2. A company is considering undertaking a capital investment project that is expected to generate annual cash flows of Sh.1 million for 5 years. The cash flows shall grow at a rate of 5% per year. The cost of capital for the company is 10%.

Required:

Compute the present value of cash flows. (4 marks)

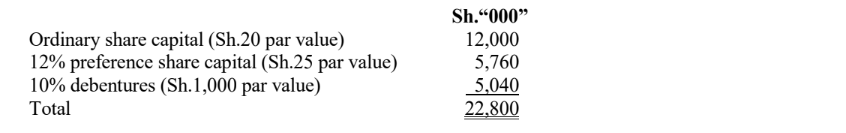

3. The following was the capital structure of Ushindi Ltd. as at 31 December 2022:

Additional information:

1. The current market prices per share is Sh.25. The most recent dividend paid by the company is Sh.2.50. Dividends are expected to grow at an annual rate of 10% per year.

2. New preference shares will be issued at Sh.35 per share subject to a floatation cost of Sh.5 per share.

3. New debentures will be issued at Sh.1,200 per debenture with a discount of Sh.30 and floatation cost of Sh.30 per debenture.

4. Corporation tax rate is 30%.

Required:

The cost of ordinary share capital. (2 marks)

The cost of preference share capital. (2 marks)

The cost of debenture capital. (2 marks)

The weighted average cost of capital (WACC) using market value weights. (6 marks)

(Total: 20 marks)

QUESTION FIVE

1. Describe THREE red flags that could indicate that financial statements are of poor quality. (6 marks)

2. Explain the following theories of dividend:

Information signalling theory. (2 marks)

Tax differential theory. (2 marks)

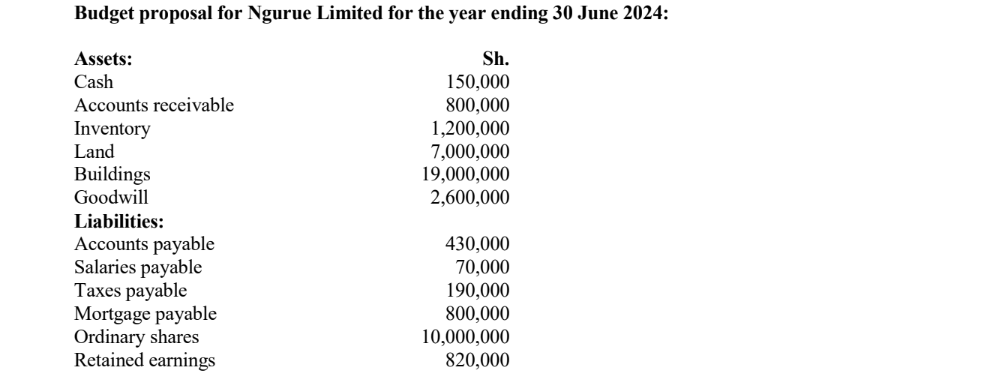

3. The following are the forecasted assets and liabilities of Ngurue Limited as at 30 June 2024:

Required:

Determine the company’s budgeted net working capital requirement. (4 marks)

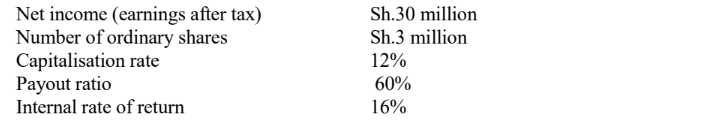

4. The following information was extracted from the financial statement of Usawa Ltd.:

Required:

Calculate the intrinsic value of a share under:

Gordon’s growth model. (3 marks)

Walter’s model. (3 marks)

(Total: 20 marks)