MONDAY: 1 August 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Highlight five limitations of profit maximisation objective of a firm. (5 marks)

2. Explain five assumptions of cost volume profit analysis. (5 marks)

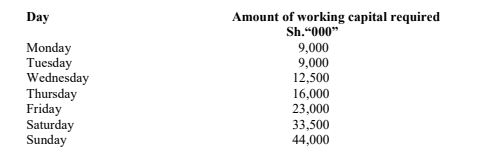

3. The projected weekly working capital requirements for Uwezo Ltd. for the second week of August 2022 is as follows:

The expected cost of short term funds is 20% while that of long term funds is 25%.

Ignore taxation.

Required:

A schedule showing the amount of permanent and seasonal working capital requirement for each day. (4 marks)

The average amount of long term and short term finance that would be required daily. (2 marks)

The total cost of working capital finance if the firm adopted an aggressive financing strategy. (2 marks)

The total cost of working capital finance, if the firm adopted a conservative financing strategy. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain the following terms as used in valuation:

Book value. (2 marks)

Replacement value. (2 marks)

2. Discuss three importance of capital investment decisions. (6 marks)

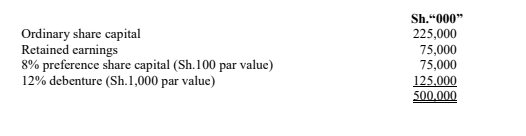

3. The capital structure of Maziwa Ltd. which is considered optimal as at 31 May 2022 was as follows:

The company intends to raise additional funds for investing in a new project which is estimated to cost Sh.150

million.

Additional information:

1. Any new ordinary shares issued will incur a 15% floatation cost per share.

2. The most recent ordinary dividend paid by the company was Sh.5 per share. Dividend is expected to grow at the rate of 8% per annum.

3. The current dividend yield is 6.25%.

4. The company expects to raise a maximum of Sh.22,500,000 from retained earnings to finance the project.

5. Additional 8% preference shares can be issued at the current market price of Sh.120 per share.

6. A new 12% debenture can be issued at Sh.960 per debenture.

7. Corporation tax rate is 30%.

Required:

The current market price per ordinary share. ( 2 marks)

The number of ordinary shares that should be issued to finance the project. (2 marks)

The cost of retained earnings. (1 mark)

The cost of ordinary shares. (1 mark)

The cost of preference shares. (1 mark)

The cost of debenture capital. (1 mark)

The company’s weighted marginal cost of capital. (2 marks)

(Total: 20 marks)

QUESTION THREE

1. Cyrus Mwavuli borrowed Sh.1,000,000 from Hakika Bank at an annual interest rate of 12% on reducing balance. The loan was repayable in annual instalments over a period of four years. The instalments were payable at the end of the year.

Required:

A loan amortisation schedule. (4 marks)

2. Discuss three factors that could influence a firm’s capital structure decisions. (6 marks)

3. The following data was extracted from the books of Banda Ltd. for the year ended 31 December 2021:

Required:

Banda Ltd.’s statement of financial position as at 31 December 2021. (10 marks)

(Total: 20 marks)

QUESTION FOUR

1. Explain each of the following dividend policies:

Stable dividend. (2 marks)

Constant dividend payout ratio. (2 marks)

Residual dividend. (2 marks)

2. Discuss three causes of conflict between shareholders and creditors. (6 marks)

3. The shares of Ukweli Limited are currently trading at Sh.60 each at the securities exchange. Ukweli Limited’s

price earning (P/E) ratio is 6 times. The company adopts 50% payout ratio as its dividend policy. It is predicted

that the company’s dividends will grow at an annual rate of 25% for the first three years, 20% for the next 2 years and thereafter at a constant rate of 10% per annum in perpetuity. The investor’s minimum required rate of return is 16%.

Required:

Current intrinsic value of the shares of Ukweli Limited. (6 marks)

Advise a prospective investor whether or not to buy the shares of Ukweli Limited. (2 marks)

(Total: 20 marks)

QUESTION FIVE

1. Summarise two differences between “master budget” and “cash budget”. (4 marks)

2. Argue four cases in favour of factoring as a source of finance. (4 marks)

3. The directors of Sports Wear Ltd. is considering the selection of a project from two mutually exclusive projects

each with an estimated productive life of five years.

Project Alpha will cost Sh.4,960,000 and is expected to generate annual cash flows of Sh.1,200,000 with an estimated residual value of Sh.1,180,000.

Project Beta will cost Sh.2,400,000 and is expected to generate annual cash flows of Sh.600,000 with an estimated residual value of Sh.405,000.

The company employs a straight line depreciation policy. The company’s cost of capital is 12% per annum.

Required:

Pay back period for each project. (4 marks)

Net present value (NPV) of each project. (6 marks)

Advise the board of Sports Wear Ltd. on which project to undertake under each of the investment evaluation method in 3 (i) and (ii) above. (2 marks)

(Total: 20 marks)