December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. The functions of a finance manager have evolved due to the dynamic nature of the business environment. Highlight some of the emerging roles of finance management. (4 marks)

2. Outline the practical difficulties faced by small scale enterprises wishing to obtain finance to expand production. (4 marks)

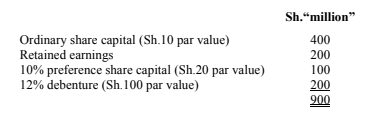

3. ABC Ltd. is in the agricultural industry. The company’s balance extract as at 31 March 2020 is as below:

Additional information:

- Corporate tax rate is 30%.

- Preference shares were issued 10 years ago and are still selling at par value (MPS = Par value).

- The debenture has a 10 year maturity period. It is currently selling at Sh.90 in the market.

- Currently the firm has been paying dividend per share at Sh.5. The DPS is expected to grow at 5% p.a. in future. The current MPS is Sh.40.

Required:

Calculate the market weighted cost of capital for this firm. (8 marks)

Outline the weaknesses of using the weighted average cost of capital as a discounting rate. (4 marks)

(Total: 20 marks)

QUESTION TWO

1. Distinguish between convertible debentures and non-convertible debentures. (2 marks)

2. Company XYZ Ltd. has sold 10,000 ordinary shares of Sh.30 (partly called up) plus 20,000 Sh.45 preference shares, which are convertible. Compute the total number of ordinary shares after conversion. (4 marks)

3. Outline the constraints to the growth of Venture Capital in Kenya. (6 marks)

4. For each of the companies described below, advice the company on the most appropriate dividend policy to be adopted by the company.

A company with a large proportion of inside ownership, all of whom are high income individuals. (2 marks)

A growth company with an abundance of good investment opportunities. (2 marks)

A company experiencing ordinary growth, has high liquidity and much unused borrowing capacity. (2 marks)

A dividend-paying company that experiences an unexpected drop in earnings from the trend. (2 marks)

(Total: 20 marks)

QUESTION THREE

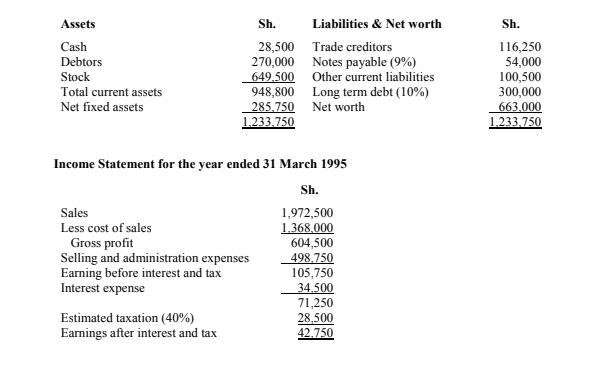

The following financial statements relate to the ABC Company:

Required:

1. Calculate:

Inventory turnover ratio. (2 marks)

Times interest earned ratio. (2 marks)

Total assets turnover. (2 marks)

Net profit margin. (2 marks)

(Note: Round your ratios to one decimal place)

2. The ABC Company operates in an industry whose norms are as follows:

Ratio Industry Norm

Inventory turnover 6.2 times

Times interest earned ratio 5.3 times

Total assets turnover 2.2 times

Net profit margin 3%

Required:

Comment on the revelation made by the ratios you have computed in part (a) above when compared with the industry average. (4 marks)

Explain the limitations of using financial ratios in decision making. (8 marks)

(Total: 20 marks)

QUESTION FOUR

1. Distinguish between Capital structure and financial structure of a firm. (4 marks)

2. Roca Real Estate Developers purchased a machine five years ago at a cost of Sh.7,500. The machine had an expected economic life of 15 years at the time of purchase and a zero estimated salvage value at the end of 15 years. It is being depreciated on a straight line basis and currently has a book value of Sh.5,000. The Financial Manager has conducted a feasibility study aimed at acquiring a new machine for Sh.12,000 and is depreciated over its 10 years useful life. The new machine will expand sales from Sh.10,000 to Sh.11,000 per annum and will reduce labour and materials usage sufficiently to cut operating cost from Sh.7,000 to Sh.5,000. The salvage value of the new machine is Sh.2,000 at the end of useful life. The current market value of the old machine is Sh.1,000 and tax is 40%. The firms cost of capital is 10%. The financial manager wishes to make a decision on whether to replace the old machine with a new one and he seeks your held.

Required:

Compute the NPV of incremental cash flows and advice the company on whether to replace the old machine with a new machine. (10 marks)

Discuss the advantages of using NPV techniques in evaluating investments. (6 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain the concept of crowdfunding and highlight relevant examples. (4 marks)

2. Explain the significance of valuation securities. (4 marks)

3. XYZ Ltd is expected to pay a DPS of Sh.6 in one year’s time. The dividend payout ratio is 60% and the Return on Equity is 15%. Determine whether the share is overvalued if the MPS is Sh.40. (4 marks)

4. Highlight the defensive tactics against a hostile takeover bid. (8 marks)

(Total: 20 marks)