An exchange rate is the rate at which a unit of one currency can be exchanged for another- for any currency there is an exchange rate for each currency it can be traded with.

Exchange Rate Concepts

There are three concepts involved in the way in which exchange rates are expressed which must be understood at the outset.

a) Buying and selling prices

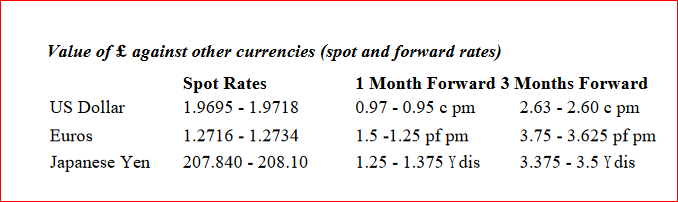

Two prices are always quoted for any currency -a buying and a selling price. Thus, a UK bank would quote its exchange rates as follows:

Value of £ against other currencies

- US Dollar1.9695 –1.9718

- Euro1.2716 –1.2734

- Japanese yen 207.840 –208.10

(Note that these rates vary on a daily basis and the figures given here are for illustration only.)

The lower of the two rates is the price at which the bank will buy sterling (for example, sell dollars in return for sterling) and the higher figure is the rate the bank will buy the exchange currency (for example, sell pounds for dollars). The wider the spread between these two quotes the larger the profit margin. Note that the terms “bid” and “offer” rates are often used as an alternative to buy and sell rates, but here we shall stick to the latter terminology throughout.

b) Spot and forward rates

This is an important distinction.

The spot rate is the current rate of exchange for a unit of currency for immediate transactions and quotations for which no previous arrangements have been made, delivery to the buyer being made two days later.

The forward rate refers to a rate of exchange fixed today for delivery at a defined date in the future -for example, one month forward and three months forward being for one month and three months in the future respectively. Thus, for example, a German company which is contracted to receive $1 million in three months’ time could either:

- Wait for three months and then sell the dollars for Euros at the (then) spot rate; or

- Enter into a contract now to sell the dollars for Euros in three months’ time at the month forward rate.

Whilst the company may expect that the spot rate in three months’ time may be higher than the current forward rate, there is an element of risk. By waiting and seeing what the spot rate is on the day of receipt of the dollars, the company stands to possibly gain or lose on the exchange at the prevailing spot rate in relation to the forward rate. On the other hand, the company can buy certainty about the exchange rate by selling the dollars forward at the (possibly) lower forward rate. It is important to note that forward rates are not statements of what spot rates will be at the future date implied by the forward rate, (e.g. three months in the future for a three month forward rate), but are merely indications of the direction in which spot prices will move. Depending on the risk assessment, the forward rate can be expected to be higher or lower than the expected future spot rate. This is because a forward price comprises the spot price on the date of the contract plus (or minus) the interest differential reflecting the expected relative changes in interest rates. Thus, for example, if the forward rate of Euros against sterling is expected to fall it is because interest rates in Germany are expected to be higher than those in the UK. (We consider the impact of interest rates on exchange rates in more detail below.)

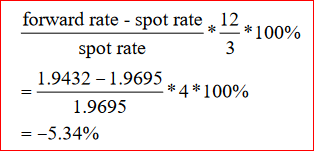

c)Discount and premium

These refer to the strength of the forward rate in respect of the current spot rate. They identify whether the market considers the currency to be, respectively, weaker or stronger in the future, in relation to the exchange currency.

A currency with a forward discount implies that it is becoming weaker in relation to the exchange currency and will buy less of that exchange currency in the future. A forward premium would have the opposite effect. The rates for one and three, or more, months in advance are often quoted in terms of the discount or premium applying. For example:

- Income and expenditure in a country on both domestic goods (which would otherwise have been exported) and imports.

- Differential interest rates between countries.

- Differential inflation rates between countries.

- The balance of payments position between the countries concerned.

- Government economic policy, particularly in regard to influencing exchange rate levels.

- Speculators and the general view as to the economic prospects of a country.