TUESDAY: 5 April 2022. Morning paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Discuss three functions of anew issue market. (6 marks)

2. Highlight four principle weaknesses of equity market in your country. (4 marks)

3. Examine four advantages of secondary securities market to investors. (4 marks)

4. Explain the meaning of the following terms used in time-in-force designations:

Fill or kill. (1 mark)

All or nothing. (1 mark)

Good till cancelled. (1 mark)

5. The following information relates to Bora Limited:

- The company forecasts to earn Sh.2 per share in perpetuity.

- The company pays out all its earnings and dividends.

- The book value per share is Sh.12,00.

- The required rate of return on equity is 10%.

Required:

The level amount per share residual income that will be earned each year. (1 mark)

The value of the share using residual income model. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Describe five external factors that could affect an industry’s growth, profitability and risk. (5 marks)

2. Benson Mwembea has gathered the following data for a private company:

Current revenues Sh.40,000,000

Revenue growth 6%

Gross profit margin 30%

Depreciation expense as a percentage of sales 2%

Working capital as a percentage of sales 10%

Selling, general and administration expenses 3,000,000

Tax rate 30%

The earnings and expenses are normalised and that the capital expenditures are expected to cover depreciation plus 5% of the firm’s incremental revenues.

Required:

The firm’s free cash flow to firm (FCFF) (6 marks)

3. A firm has a justified price to sales ratio of 2 times, a net profit margin of 5% and a long term growth rate of 4%.

Required:

Calculate the justified leading price to earnings (P/E) ratio based on the Gordon ,growth model. (3 marks)

4. The shares of Bidii Ltd. are currently trading at Sh.60 each at the securities exchange. The company has paid a dividend of Sh.4.0. It is predicted that the company’s dividend’s will grow at an annual rate of 20% for the first three years, 15% for the next two years and thereafter at a constant rate of 10% per annum in perpetuity. The investor’s minimum required rate of return is 12%.

Required:

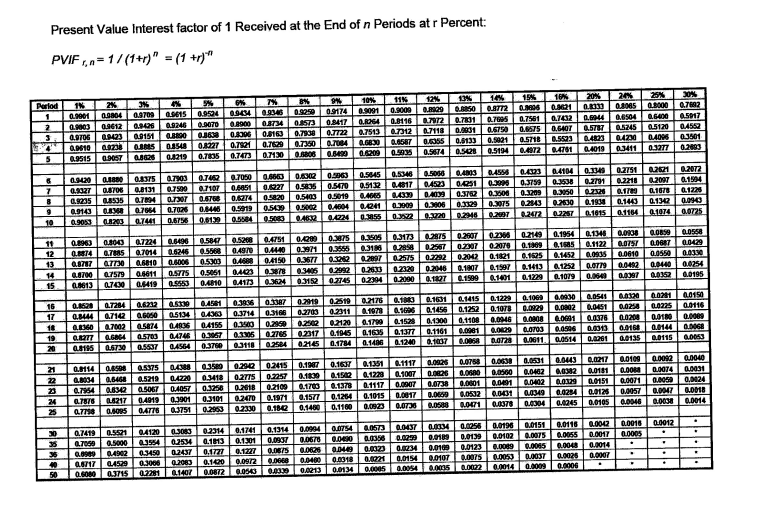

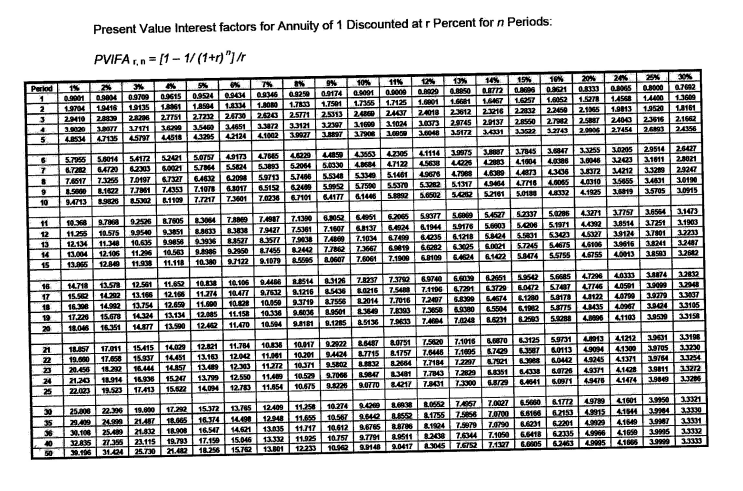

The intrinsic value of the shares’of Bidii Ltd. (4 marks)

Advise a prospective investor whether or not to buy shares of Bidii Ltd. (2 marks)

(Total: 20 marks)

QUESTION THREE

1. Equity research analysts pays close attention to a firm’s competitive advantage.

Citing relevant examples, describe three sources of competitive advantages enjoyed by a firm. (6 marks)

2. Highlight the three factors that could determine the sensitivity of a firm’s earnings to the business cycle. (3 marks)

3. Martin Kivuva, a CIFA practitioner is researching the relative valuation of two companies in the financial services industry, Maji Mazuri Ltd. (MML) and Relax Group International (RGI).

The following applicable information on the companies has been provided:

Earnings Before Interest, Taxes, Depreciation and Amortisation (EBITDA) comparisons (in Sh. millions except for per-share)

Company RGI MML

Price per share 150 100

Shares outstanding 5 million 2 million

Market value of debt 50 100

Book value of debt 52 112

Cash and investments 5 2

Net income 49.5 12

Net income from continuing operations 49.5 8

Interest expense 3 5

Depreciation and amortisation 8 4

Taxes 2 3

Required:

Evaluate the Price/EBITDA for both RGI and MML. (4 marks)

Evaluate the Enterprise Value/EBITDA for both RGI and MML. (4 marks)

Advise on the relatively undervalued company. (3 marks)

(Total: 20 marks)

QUESTION FOUR

1. In relation to factors affecting market efficiency, explain how the following factors could contribute to and impend a market’s efficiency:

Market participants. (2 marks)

Information availability and financial disclosure. (2 marks)

Limits to trading. (2 marks)

2. Charts are an essential component of the technical analyst’s toolkit. Charts provide information about past price behaviour and provide a basis for informing likely future price behaviour.

In relation to technical analysis tools, describe the following features of charts:

Volume. (2 marks)

Time intervals. (2 marks)

Relative strength analysis. (2 marks)

3. Meta Lab Ltd. earns a book rate of return (ROE) of 12%. It reinvests half of its earnings and pays out the other half as cash dividends. The nominal cost of capital is 12%.

Required:

Given this ROE and dividend payout ratio, determine the growth rate of Meta Lab earnings and dividend. (2 marks)

The growth rate in part (c) (i) above is expected to continue in perpetuity. Calculate the present value of Meta .Lab shares. (2 marks)

4. Horizons Company Ltd. is currently in a mature industry. Over the last three years, it has averaged a profit margin of 10%, a total asset turnover of 1.8 and a leverage ratio of 1.25. The firm distributes 40% of its earnings as dividends.

Required:

Calculate the firm’s long-term sustainable growth rate using’the PRAT model. (4 marks)

(Total: 20 marks)

QUESTION FIVE

1. Examine four reasons why equity analysts could be engaged to value a business. (4 marks)

2. The equity share of ABL Limited offers dividend of Sh.4.00 at present. The present dividend growth rate is 40%. Analysts predict that the dividend growth rate will decline linearly over a period of 12 years after which it will stabilise at 15%.

An investor requires a return of 18% for his investment in the equity share of the company.

Required:

The intrinsic value of the equity share using the H- model. (4 marks)

3. General Power Limited is expecting a return on equity (ROE) of 15% over each of the next five years. Its current book value is Sh.5.00 per share, it pays no dividend and all earnings are reinvested. The required return on equity is 10%. Forecasted earnings in years 1 through year 5 are equal to ROE times beginning book value. At the end of year 5, the ROE falls to long run average level and the price-to-book value ratio falls to 1.2.

Required:

The firm’s intrinsic value using residual income model, (6 marks)

4. Dan’s Limited minority shareholders hold 15% of firm’s equity and the Chief Executive Officer (CEO) holds other 85%. There are two’possible scenarios.

In scenario 1: The CEO will likely sell the firm very soon. In this case, valuation discounts will be very small. A Discount for Lack of Marketability (DLOM) of 5% will be applied and a Discount for Lack of Control (DLOC) will not be applied under the assumption that all selling shareholders will receive the same price. The value of the firm’s equity is estimated at Sh.1.15 Billion.

In Scenario 2: The CEO has no plans to sell the firm, and the minority shareholders cannot sell their interest easily. A DLOC will be estimated by using reported earnings instead of normalised earnings to provide an estimated firm equity value of Sh.1.035 Billion.

Required:

Evaluate the value of minority share’s equity interest under both scenarios.